‘Think again’: Warning as tax cheats caught

Three people have been jailed over tax fraud as a warning is issued to Aussies preparing to file their tax returns this financial year.

Three people have been jailed over tax fraud as a warning is issued to Aussies preparing to file their tax returns this financial year.

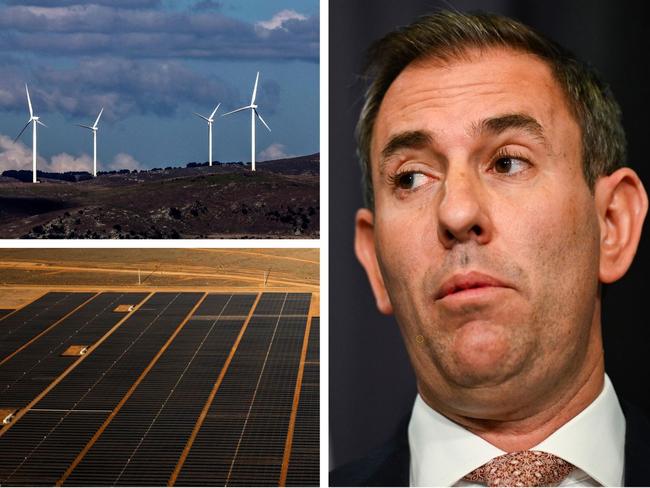

A prominent green energy investor has warned a controversial new tax will hit them in an awkward area.

Hundreds of farmers and volunteer firefighters have gathered to protest a controversial levy that farmers say will cripple them.

Australians are being urged to avoid using TikTok for tax advice this financial year or risk paying major fines or prosecutions, a tax expert warns.

Fireys and farmers have vented their disapproval of proposed “unfair” legislation to hike an emergency service tax.

Aussie taxpayers have tried to sneak some “dubious’ expenses past the taxman, with one expert detailing some of the most outlandish claims.

Jim Chalmers and Angus Taylor have bickered over the cost of Coalition election policies, in a debate before a business audience.

Australian households have picked up the bill for the country as mining companies pay less, a breakdown of the nation’s tax revenue reveals.

Shadow Treasurer Angus Taylor has been questioned on the Coalition’s tax backflip after Peter Dutton ruled out tax cuts over a fortnight ago.

A group of Queensland mayors have proposed a new bed tax for tourists, slugging them an extra levy for staying the night.

Other than the Medicare investment, there is a general consensus the federal budget falls short and leaves a lot of Australians behind.

The federal government has declared war on the black market tobacco trade as hundreds of tobacconists pop up in Sydney and Melbourne.

Jim Chalmers has revealed plans to put pennies back in every Australian’s pocket, in a budget night speech marked as much by what was not said than was.

Aussies struggling with power bills and the cost of medicines should be among the biggest winners from Tuesday’s federal budget.

An Australian economist has sounded the alarm over a proposed change to tax that could end up leaving everyone worse off.

A young Aussie has sparked a debate by sharing the tax horror she’s dealing with now that she works full-time.

The Australian Taxation Office has announced its hit list for businesses ahead of tax time, as it looks to crack down on dodgy practices.

Labor has promised a two-year pause on a much-hated “beer tax”, but that doesn’t mean the price of beer is coming down.

Huge chunks of the cost of building a new home are being eaten up by taxes and red tape, new analysis shows.

An expensive Christian college now in voluntary administration is facing legal action for failing to pay staff on time.

A hardworking Aussie has taken to social media to share her fury over an eye-watering tax bill that has left her feeling “punished”.

The Greens are leading the call to force Australia’s richest people to pay a “billionaires’ tax” that they claim could rake in nearly $25bn in four years.

Industry leaders have taken aim at the government as the latest alcohol price excise kicks in today, with the tax branded “un-Australian”.

The price of a pint will rise again next week, sparking new calls to remove the tax amid concerns it only punishes both producers and pub-goers.

Applications are now open for young Aussies to get a tax-free $1321 cash boost, but there’s a catch.

Peter Dutton has hit back at recent criticism of an Opposition election pledge to give small businesses $20,000 of tax-deductible lunches.

Chances are your tax cut will be even bigger next financial year, it is claimed.

There’s some great news for us struggling with the cost of living as the average Aussie is set to get a big tax break.

As mounting cost of living pressures put more strain on budgets, cash-strapped Aussies are cutting back on little luxuries just to save a bit more.

Struggling Aussie homeowners could get a rate cut sooner rather than later as the Reserve Bank says it is “increasingly confident” about a reduction.

Original URL: https://www.news.com.au/finance/money/tax/page/2