‘Like a punishment’: 35-year-old’s tax bill leaves her with $0

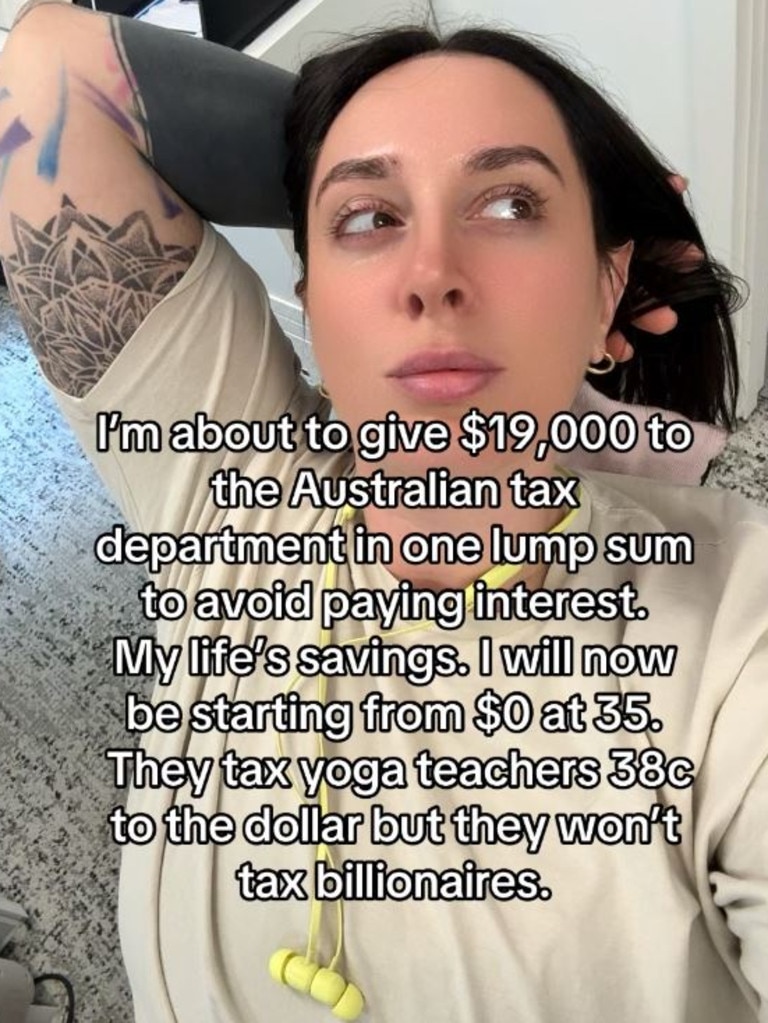

A hardworking Aussie has taken to social media to share her fury over an eye-watering tax bill that has left her feeling “punished”.

When Eve Gindein received a $19,000 tax bill, she felt “defeated” and like working two jobs was pointless.

Ms Gindein has an office job and is also a yoga instructor; she had a studio but sold her business during Covid because it was “impossible to deal with the tax situations” and the pandemic all at once.

The 35-year-old teaches yoga part-time in Perth now because she’s very passionate about it, but financially, it barely feels worth it.

“The industry is messed up because we’re treated like employees and expected to turn up for the same shift every week, but we’re sole traders and have to pay our own tax,” she told news.com.au.

“Unless you’re charging people $50 for a yoga class it isn’t viable.”

MORE: Australia’s fastest growing salaries

Ms Gindein’s $19,000 bill came about because the tax she’s paying is for the last seven years. She had some issues getting her tax sorted and originally planned to lodge her returns as a company but needed to do it as a sole trader.

The fact that she ended up needing to do her taxes as a sole trader meant she paid “three times as much” – a reality she found hard to swallow because she’d already been taxed the standard amount through her office job.

“I claimed everything I could claim but (the tax bill) was an excessive amount,” she explained.

“There’s inequity in Australia on how we are taxed. There are bigger tax breaks for bigger companies.”

Ms Gindein said the system feels unfair because the tax office counts everything as income, even though half the time after she’s paid for her overheads, she’s not left with anything.

“I might earn $1,000, but by the time I paid my overheads, there was nothing. It is so unrealistic, and that’s why so many small businesses can’t survive,” she said.

MORE: Aussie jobs over $150,000 revealed

The 35-year-old said getting the $19,000 bill meant she had to use all her savings to pay it off.

“I will now be starting from $0 at 35,” she explained.

When the yoga instructor shared her distress over the bill online, she was met with a mixed reaction, particularly because she claimed “billionaires don’t get taxed,” whereas, in comparison, she’s getting taxed $38 cents for every dollar she earns.

Some people offered her their sympathy.

One commented that it was “rough,” another said it sounded like an “absolute nightmare,” and others just poked fun at her financial woes.

Someone told her to become a billionaire instead of doing yoga, another said, “welcome to adulthood,” and one commented, “Wahh! I don’t like tax because I’m not an adult”.

Despite the mixed reaction, Ms Gindein explained that it didn’t change her from feeling completely disheartened.

“I felt like me following my dreams was this lie sold to me as a working-class person,” she said.

The yoga instructor was also frustrated because she’s never tried to cut corners or not declare any of her earnings, and she feels like her transparency simply caused her financial stress.

People online were also telling her she should accept cash and not declare everything, implying that was what stopped them from getting hit with a tax bill.

“It was like a punishment for being super honest with what I could deduct and my income,” she said.

According to the Financial Comparison Finder, one in 10 people admit to knowledge of or involvement in tax fraud and evasion.

More Coverage

One in 10 Aussies have deliberately committed tax fraud or dobbed in a tax dodger, according to new research by Finder.

The ATO also received more than 47,000 tip-offs from the community about tax avoidance and other dishonest behaviours in the 2023–24 financial year.

The whole experience has left Ms Gindein feeling like the tax office is a “ corporate enforcer,” and she has no hope of ever making a living as a yoga teacher.