‘They don’t live in reality’: Truth behind Sydney street as federal government declares war on black market tobacco trade

The federal government has declared war on the black market tobacco trade as hundreds of tobacconists pop up in Sydney and Melbourne.

Lobby groups have renewed their calls to legalise vaping as a way to tackle a $32 billion hole in the federal budget created by illegal tobacco operators.

Federal budget papers have revealed tobacco excise will bring in about $7.4 billion this year – an almost 50 per cent drop from what was predicted in the 2021-22 budget.

Just three years ago, tobacco excise was the federal government’s fourth-largest source of revenue. This year, it is now only the seventh largest, with alcohol duty beating out cigarettes.

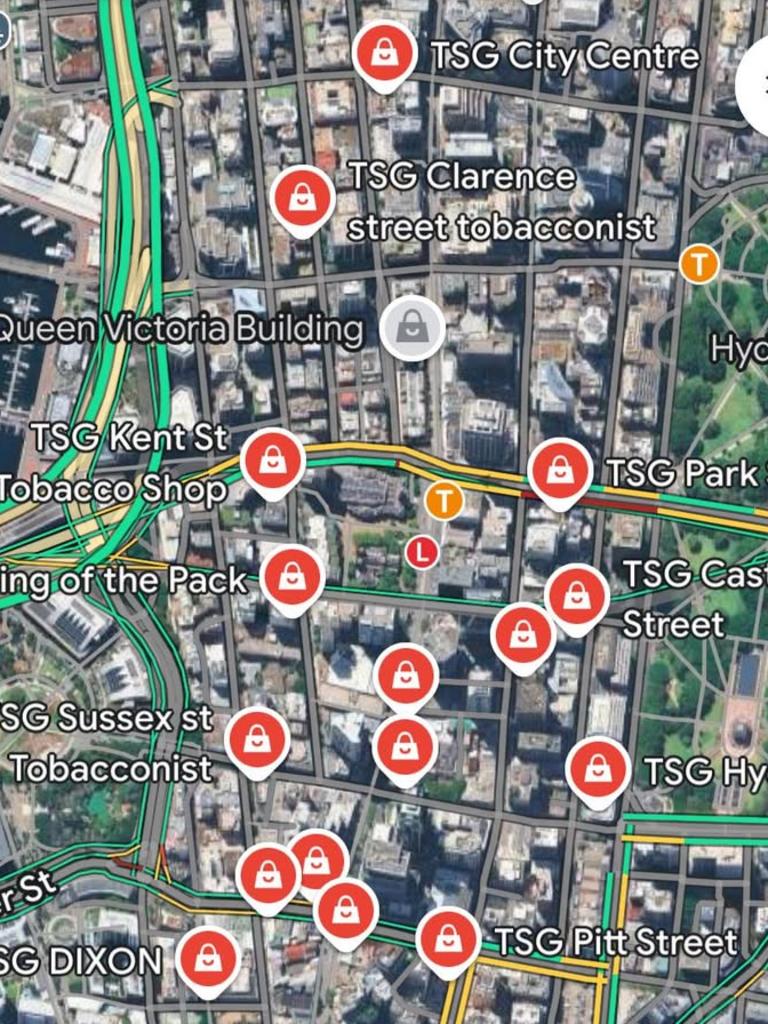

This is despite the number of tobacco shops across Australia exploding – with the “vast majority” selling untaxed cigarettes and vapes.

Now, the federal government has unveiled a $156 million, two-year plan to crack down on the black market tobacco trade as it threatens to spiral out of control.

The bulk of the cash ($49.4 million) will go to an AFP task force dedicated to investigating organise crime groups, budget papers have revealed.

A further $40 million will be divvied up between the states and territories to tackle their own unique challenges, while $31.6 million will go towards strengthening monitoring and enforcement under the existing laws.

On average, a packet of cigarettes obtained legally is now $50, while illegal operators are selling packets for around $15.

The government’s failure to predict the scale of the explosion of the cigarette black market – which has led to a vicious gang war in Victoria – means the predicted forecast shortfall is now at $32 billion since 2019.

Legalise Vaping director Brian Marlow said one solution to the government’s overestimation of tobacco excise was to sell and tax legal vapes to adults.

“It is very simple. If you tax something too high, it will actually reduce the revenue you generate because people will find other means to purchase the thing,” he said.

“This way, you could actually fund health programs, and get to quit smoking or vaping. Instead of just pushing people to buy products illegally.”

Federal governments have continually increased the tobacco excise by almost 300 per cent since 2013.

James Martin, a senior lecturer in criminology at Deakin University, told news.com.au that the government’s continued policy to increase the tax on cigarettes was putting money “into the hands of crooks”.

“(Increasing tobacco taxes) – along with the ongoing ban on consumer vaping products – is precisely the worst thing that the government can do and plays straight into the hands of organised crime,” Mr Martin said.

“Further expanding the black market is also bad for public health as it ensures the market is flooded with extraordinarily cheap cigarettes. It’s bad news all around.”

Tobacco shops numbers explode

In just four years, the number of tobacconists in NSW has gone from 14,500 to 19,500.

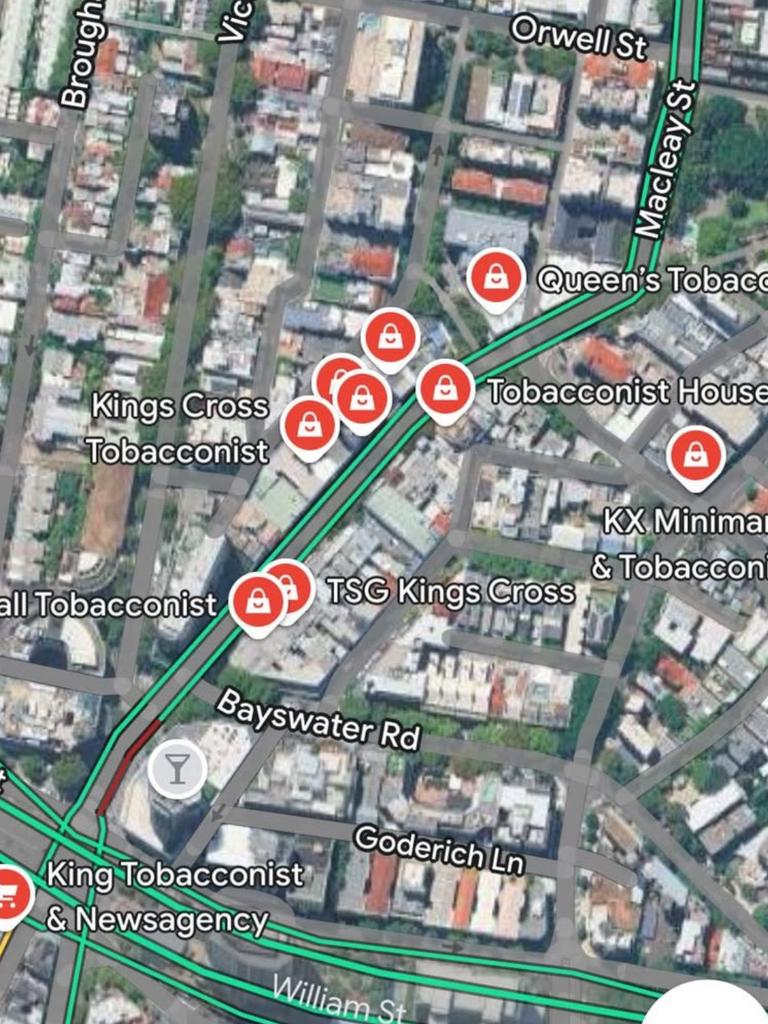

On just Darlinghurst Road in Kings Cross alone, there are 10 tobacconists within a 200-metre radius.

“I would say the vast majority are now illegal operations,” Mr Marlow from Legalise Vaping said.

“(The government) don’t live in reality. They look at excel spreadsheets and don’t walk outside and see there are tobacco shops everywhere operating illegally.”

Beer tax freeze

At a minimum, experts everywhere are calling on the government to freeze any further increase to tobacco excise as the black market explodes.

The calls come after Prime Minister Anthony Albanese promised a two-year freeze on the biannual indexation of the draught beer excise.

The excise on beer and spirits currently increases twice a year, in February and August, in line with inflation.

However, the prime minister said that a “common sense measure” would be introduced if Labor was re-elected to help take pressure off beer drinkers, breweries, and bars.

“My government is building Australia’s future and to do that we need to support our small and medium local businesses to thrive,” Mr Albanese said.