‘Struggling to keep afloat’: Grim sign mortgage chaos is here

New data has revealed just how many Australian households are “struggling to keep afloat” – and sadly, something is going to have to give.

In the world of economics and finance, Australian households’ relationship with debt is almost legendary.

While the United States and a long list of other advanced economies have each been forced to confront their extremely high household debt levels and pay them down relative to incomes, Australia is one of a handful that has not seen its households meaningfully de-leverage in recent decades.

But despite the pile of mortgage debt held by households spending the overwhelming majority of the last 30 years growing strongly, there are several avenues of consumer credit where Australians had pulled back dramatically – credit card debt and personal loans.

According to figures from the Reserve Bank, the level of outstanding credit card debt accruing interest peaked at a little over $37 billion in October 2011.

While the level of overall credit card debt would not peak until March 2018, this does not provide an entirely accurate picture of the debt load faced by households, since it includes purchases made with the intention of being paid off before they start accruing interest.

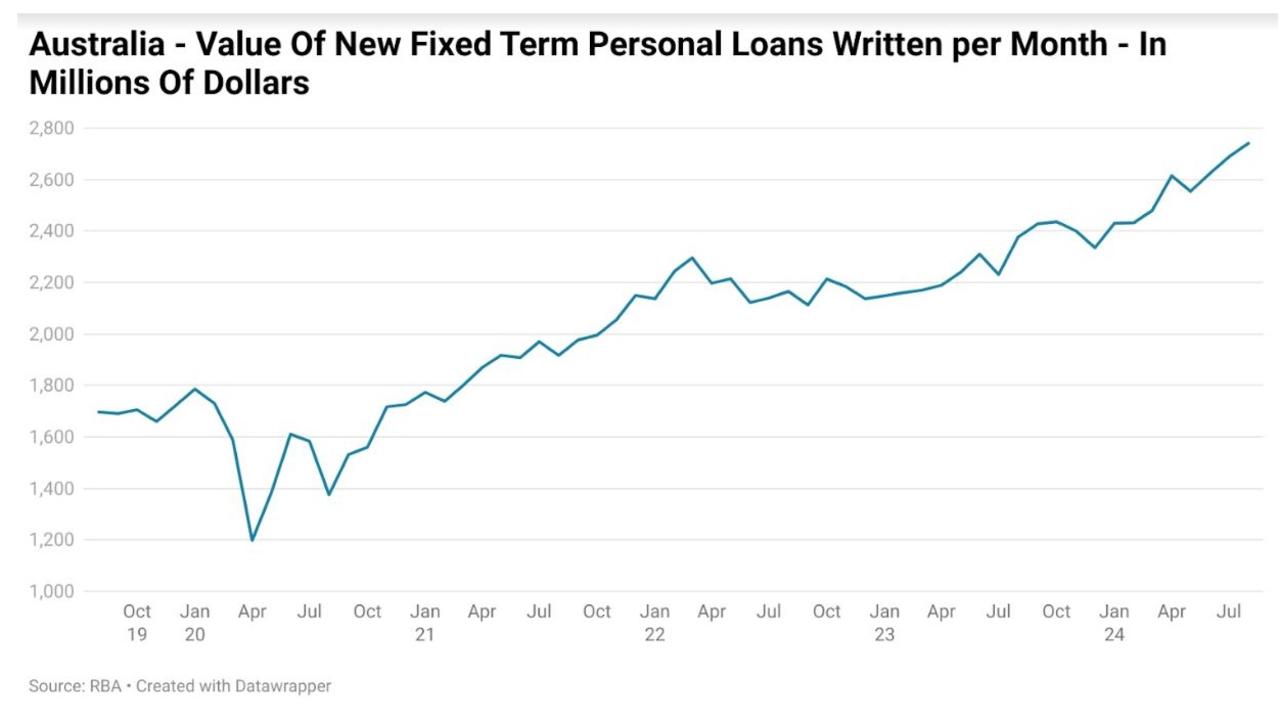

Meanwhile, the overall aggregate monthly value of personal loans being written peaked in April 2016 at a total of $2.46 billion. This figure would not be eclipsed until March of this year.

But recently, something changed.

Credit card debt growth began to surge, based on the growth in the level of outstanding debt accruing interest. At the same time, the value of new personal loans being written each month hit a new all time high on a seasonally adjusted basis.

A sizeable proportion of households finding themselves in significant financial stress is not a new thing, with the number of households in mortgage and rental stress rising strongly since the pandemic began.

According to figures from research firm Digital Finance Analytics (DFA), as of August, 76.9 per cent of households who rent were in stress, along with 50.1 per cent of those with mortgages.

DFA defines mortgage and rental stress in cashflow terms, whereby a household is in stress if its spending exceeds its income. DFA Principal Martin North recently noted that despite the implementation of the stage 3 tax cuts and other government support programs (electricity subsidies, various Queensland government subsidies) mortgage stress continues to hover near all-time highs.

When broken down by state and territory, the highest level of mortgage stress is in South Australia, where 54.0 per cent of borrowing households are in stress, followed by 51.5 per cent of households in Tasmania.

At the lower end of things, the ACT has the lowest level of mortgage stress at 39.9 per cent, followed by the Northern Territory at 42.6 per cent.

In terms of rental stress, New South Wales holds the highest level with 82.9 per cent of renters in stress, followed by the ACT with 80.7 per cent.

At the more positive end, 30.5 per cent of renting households in the Northern Territory are in stress, followed by 66.5 per cent of those in South Australia.

Credit card debt

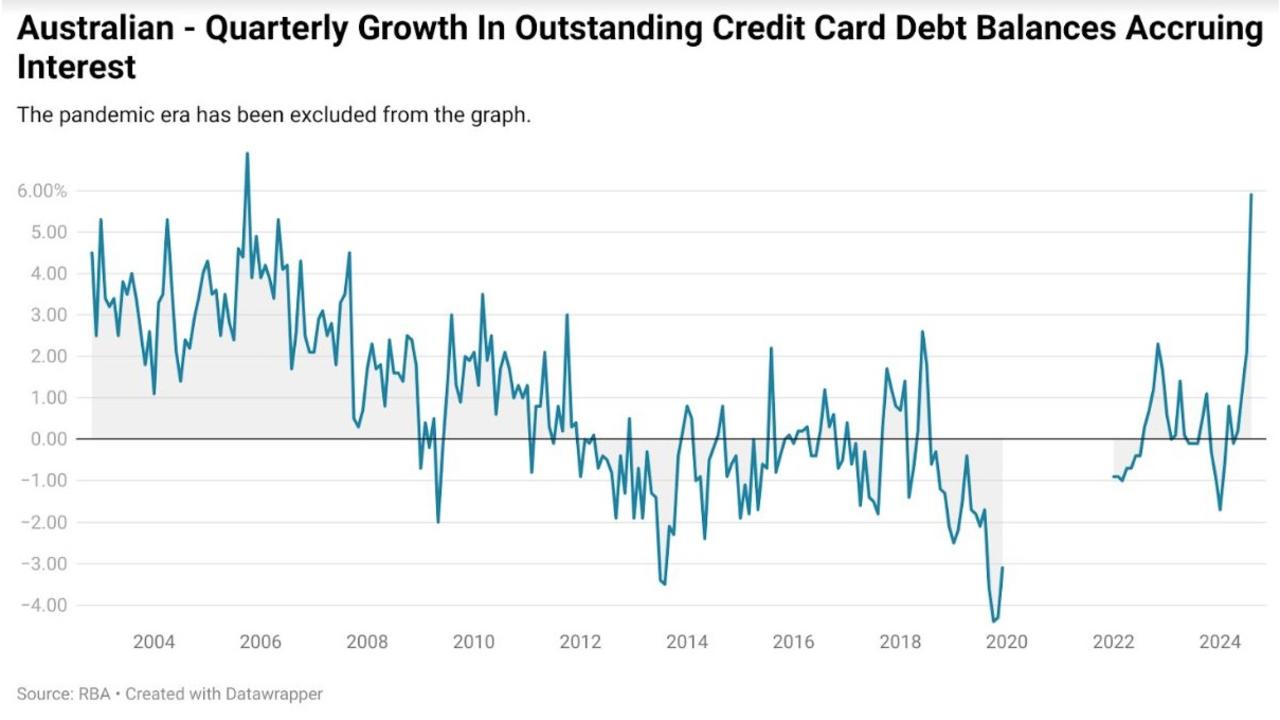

On a rolling quarterly basis, the level of growth in credit card balances accruing interest recently hit its highest level since October 2005, growing by 5.9 per cent in the quarter through to the end of August.

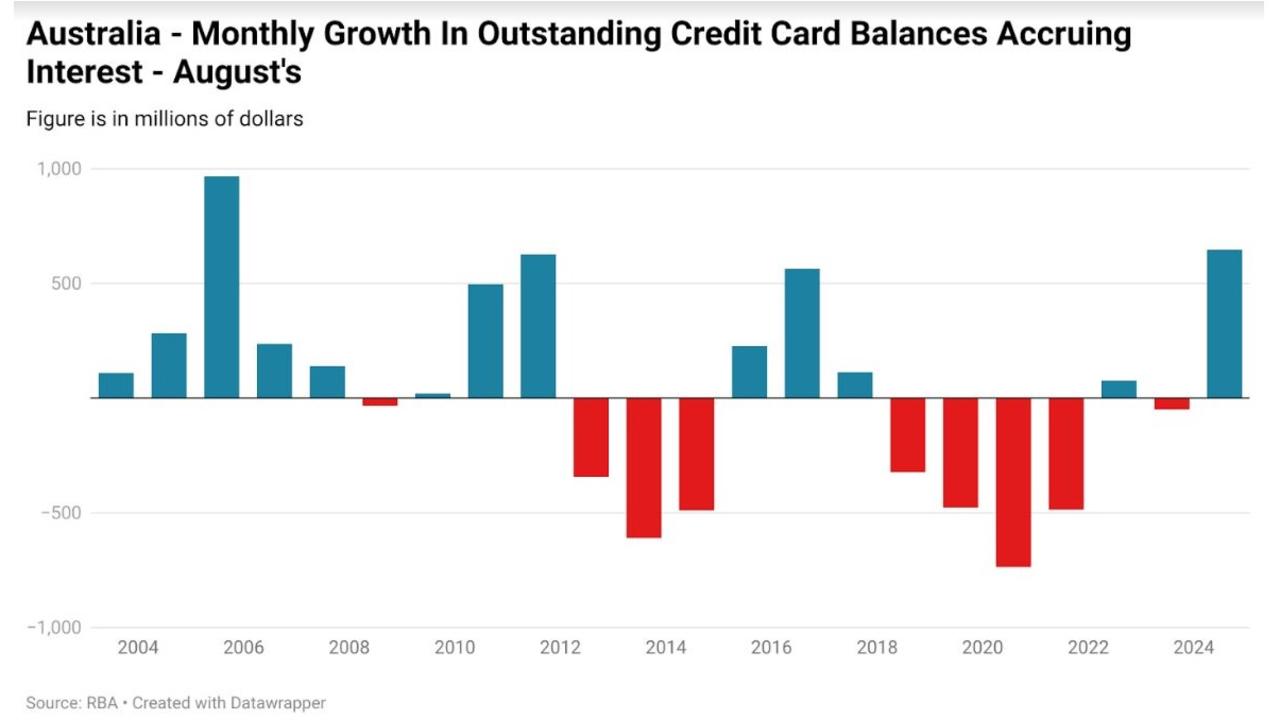

Much of the growth in outstanding balances occurred in August, during which Australians expanded their credit card debt by over $640 million for the month.

While there can be a high degree of seasonality to credit card data, when comparing August with the same month of previous years, August 2024 marked the strongest growth in balances since the heyday of credit card debt growth in 2005.

Personal loans

According to figures from the ABS, in August, households took out a record high of $2.74 billion in new fixed term personal loans.

This figure represents a 61.6 per cent increase on the same period in 2019 and a 76.7 per cent increase on the monthly average during the first year of the pandemic.

This surge in lending arguably represents the largest and most significant change in the course of personal loan lending since records began in 2002.

With new personal lending hitting new record highs in five of the last six months worth of data, it appears clear that a further expansion in this type of lending may be on the cards.

The take away

The restraint of households surrounding growth in traditional forms of consumer credit exhibited in the years running up to the pandemic appears to have drawn to a close, at least for the time being.

But what is the driving force behind this shift?

While the answer is a challenging one to quantify, the evidence we do have from the likes of DFA, Finder and others suggests that it’s highly plausible that households in financial stress are playing a significant role in the recent surge in consumer credit growth.

In the words of Finder home loans expert Richard Whitten: “Millions of mortgage holders have managed rate hikes so far, but now they’re facing severe financial strain as their savings and emergency funds dry up.

“Housing is increasingly becoming a major source of stress for Australians, with many struggling to keep afloat.”

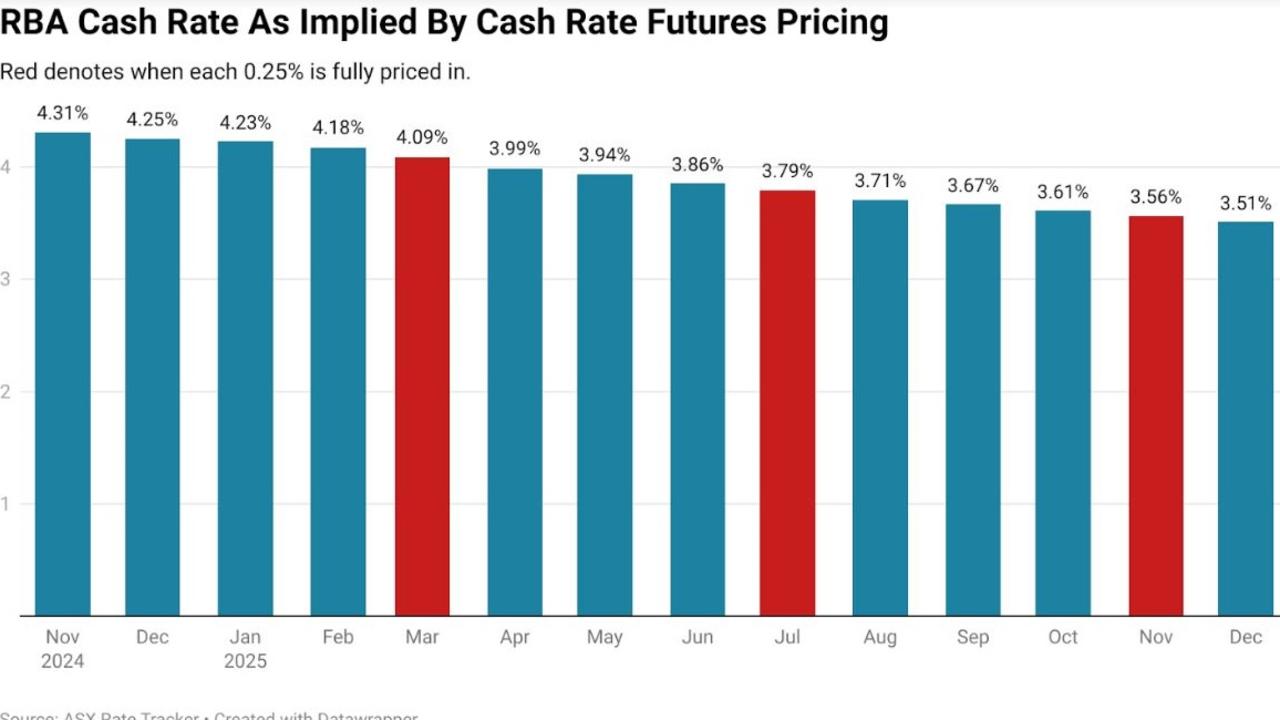

With tight rental markets increasingly tipped to remain for the long term and a full 0.25 per cent rate cut not fully priced in until March 2025, the financial stress households are under appears set to continue.

Taking on consumer credit in the form of personal loans and credit cards provides scope for a household to keep juggling its financial responsibilities for a time, but that does not last forever.

The big question on the minds of many Australian households is what runs out first, the current challenging conditions, or the ability to sustainably endure them?

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator