‘Something is going to need to change’: Truth behind Australia’s negative gearing ‘insanity’

This divisive Australian policy is costing us billions – and grim data has revealed just how nightmarish the situation has truly become.

In recent weeks, the issue of negative gearing has once again shot back into the headlines, after it was revealed that the Albanese government instructed Treasury to model a range of proposals for potential changes to the policy.

So far, Labor has been very coy on the possibility of a change, with the Prime Minister declaring that there were no plans to introduce negative gearing policy changes before the next election.

Meanwhile, a Labor official confirmed to Nine newspapers that the ALP was considering its options on the issue, but warned the government could still choose to walk away from any change.

As the battle over negative gearing’s future continues to be waged by politicians and on social media, it raises an interesting question – who are Australia’s negatively geared property investors?

A grain of salt

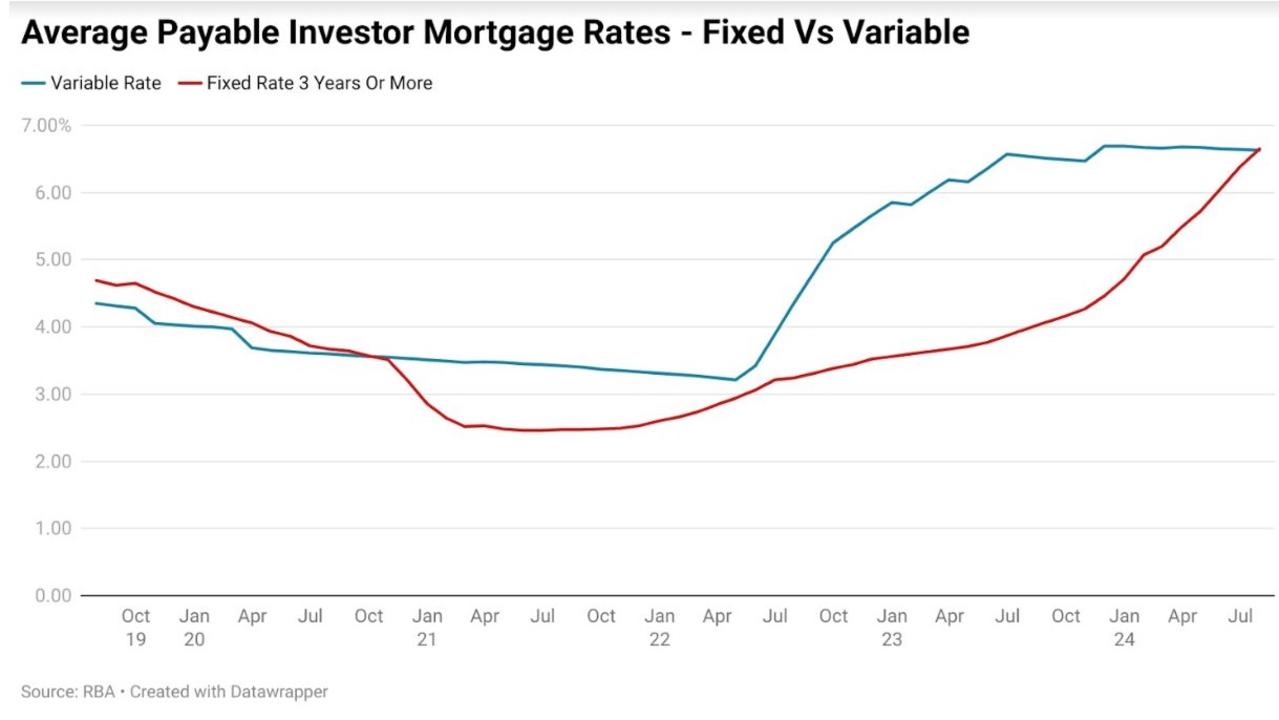

Before we get into the numbers from the Australian Taxation Office (ATO), it’s worth noting that the figures cited are based on data from the 2021-22 financial year, which delivered the lowest interest rates for investors in Australian history, with variable rates hitting an average of 3.2 per cent and fixed rates 2.5 per cent.

Since then, the average payable variable rate on an investor mortgage has risen to 6.7 per cent and the three-year fixed rate has risen to 5.5 per cent. The proportion of investors expected to be negatively geared in the data for this financial year is expected to be far, far higher, along with the cost of foregone revenue for the federal Treasury.

We will get into some estimates from the Parliamentary Budget Office on this shortly.

Their income

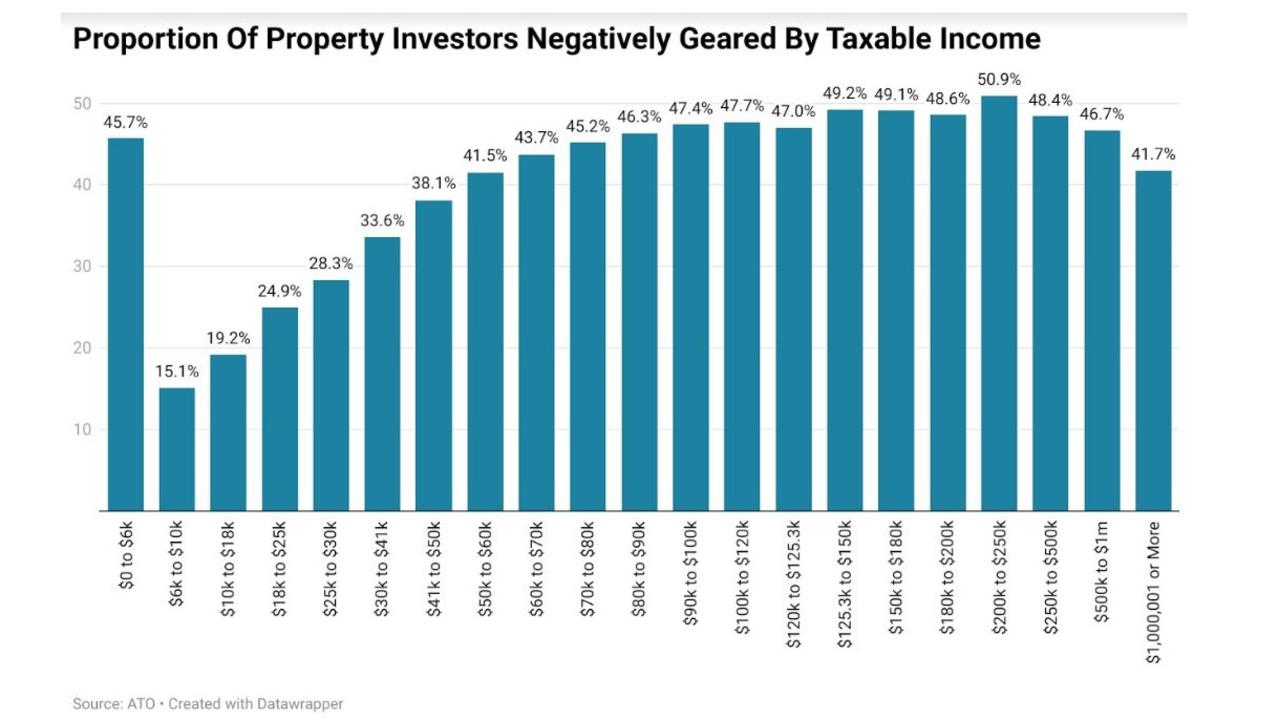

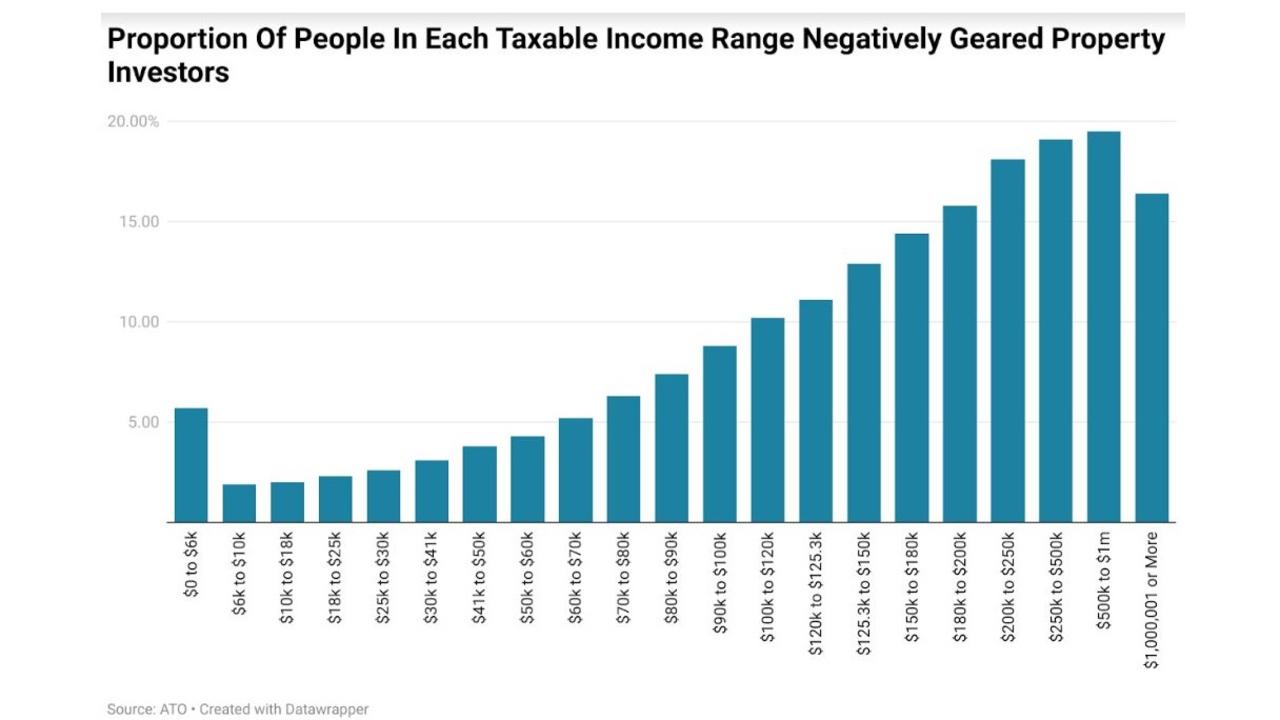

Across the various income demographics, the most likely group to have a negatively geared property was individuals with a taxable income of $500,000 to $1,000,000, with 19.5 per cent of people negatively gearing property portfolios and 41.8 per cent holding an investment property.

For individuals with a taxable income consistent with that of the median full time wage earner ($88,900 and assuming no deductions), 7.3 per cent were negatively geared property investors and 15.8 per cent were property investors overall.

Based on the median personal income ($67,600 and assuming no deductions), 5.6 per cent were negatively geared property investors, with 12.6 per cent property investors overall.

Who they are

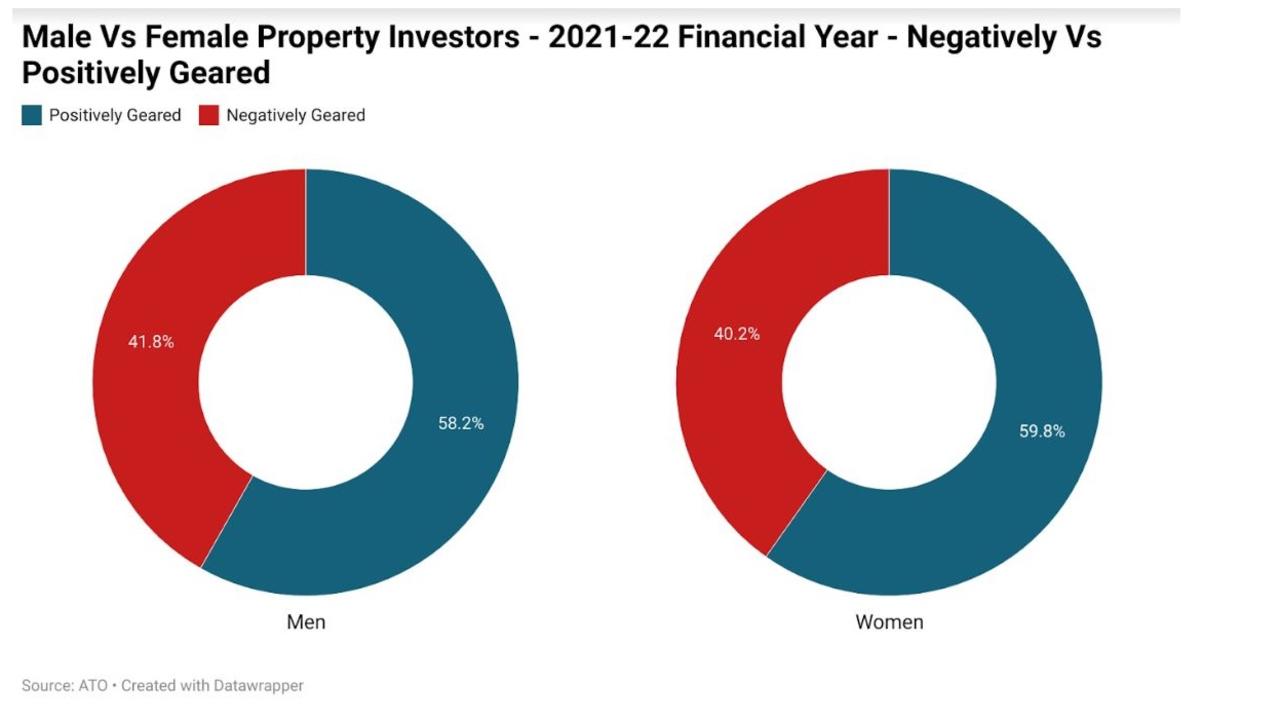

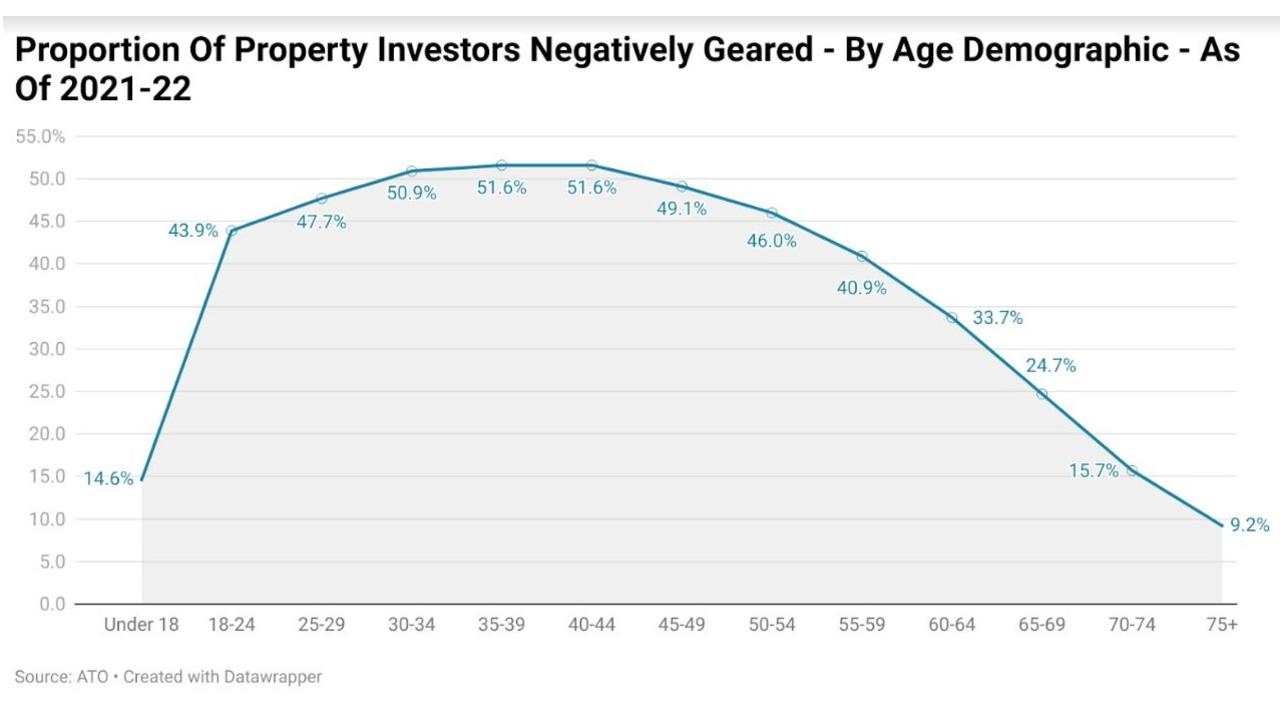

The age and gender demographic which includes the most negatively geared property investors is men aged 40 to 44, with a total of 77,800. This demographic also includes the highest proportion of investors who are negatively geared, with 53.5 per cent reporting a net loss on their property portfolio.

For women, the largest number of negatively geared properties is held by those aged 35 to 39, with a total of 69,600. This demographic also includes the highest proportion of property investors who are negatively geared, at 51.6 per cent.

The Boomer factor

For a long time, negatively geared Baby Boomer property investors have been seen as a roadblock to reform surrounding property related tax concessions. But the reality is negative gearing is most effective when there is employment or other forms of income to offset it against at a relatively high tax rate.

As of 2024, the median Baby Boomer is 69 years of age and is on average five years into their retirement. This is illustrated in the ATO’s statistics, with 24.3 per cent of Baby Boomers or older negatively gearing an investment property, compared with 48.1 per cent of those in the age demographics below that.

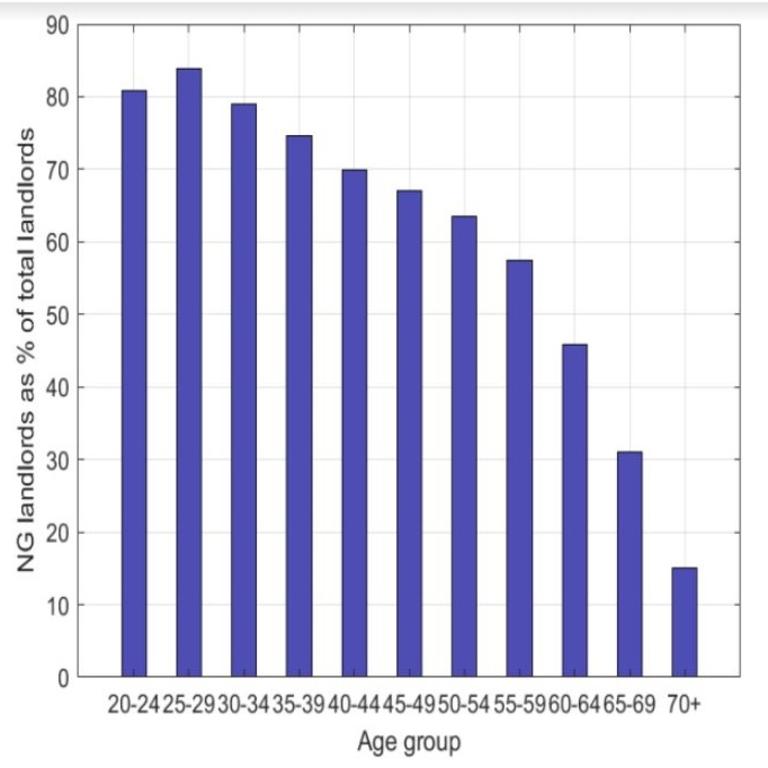

Prior to the large rate cuts seen during the pandemic, the gap between older and younger property investors was even more pronounced. In a 2021 academic paper by Melbourne University’s Professor Shuyun May Li and Dr Lawrence Uren, it was revealed that during the 2014-15 financial year, up to 84 per cent of the property investors in certain age demographics were negatively geared.

How much does negative gearing cost?

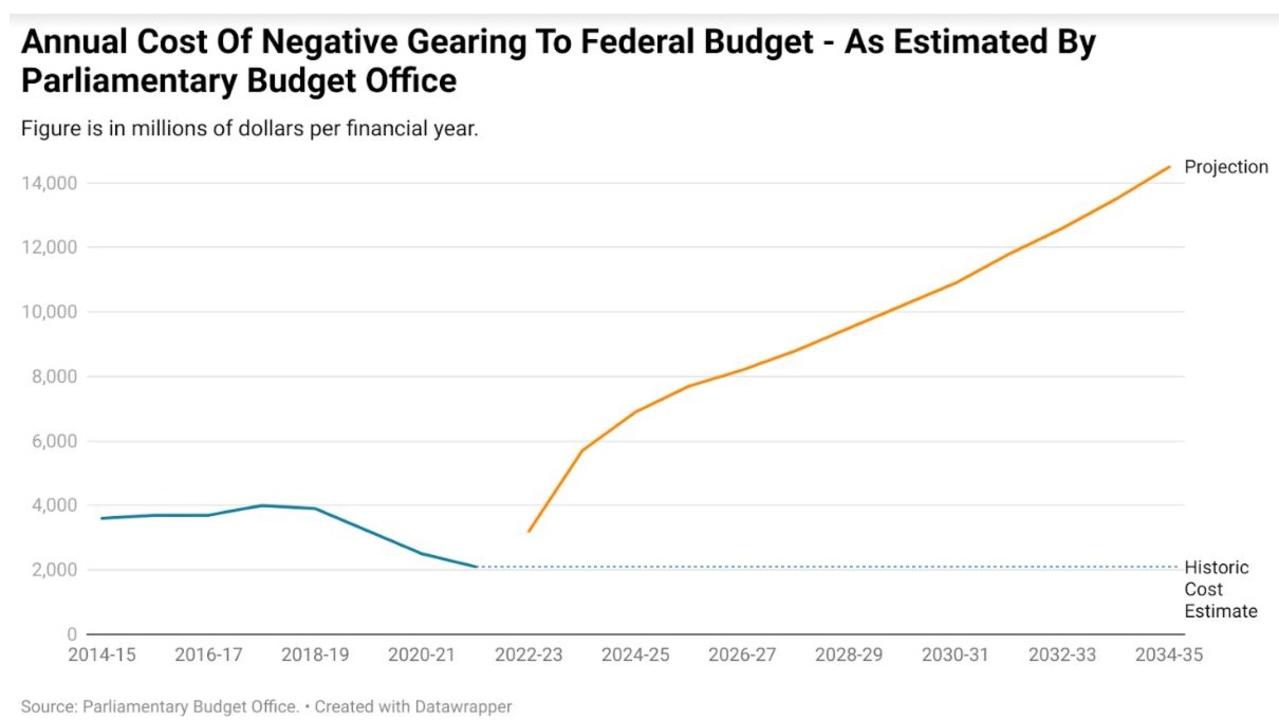

In June, it was estimated by the Parliamentary Budget Office that negative gearing resulted in $2.1 billion in revenue being foregone by the Treasury during the 2021-22 financial year. This is down from a figure of $4 billion in 2017-18.

Amid the expectation of interest rates staying higher than they were prior to the pandemic (PBO pencils in a 2.85 per cent cash rate over the range of estimates), the cost of negative gearing to the budget is expected to rise to $7.7 billion in the upcoming 2025-26 financial year.

The PBO estimates at the end of its forecasts which cover up to 2034-35, negative gearing will result in $14.5 billion per year in revenue being foregone.

The takeaway

In recent years, the issue of housing has gone from one that could largely be left on autopilot by federal policymakers to a potential decider of elections. To what degree negative gearing impacts demand for housing and by extension property prices and home ownership rates is likely to continue to be a source of great debate.

But what is more concrete and crystal clear is falling rates of home ownership and a rising proportion of Australians renting, in some cases well into their golden years.

In 2001, 17.7 per cent of households aged over 55 rented, and by 2021, that figure had risen to 20.6 per cent. For those aged 35 to 54, the increase has been even more significant over the last two decades, with the proportion renting rising from 26.8 per cent to 33.7 per cent.

Given that the latest available snapshot was taken during lockdown, it’s entirely possible that under more normal conditions, the proportion may have been higher.

If the nation’s political class wants more people owning their own homes and having the security and stability that this status provides, something is going to need to change. Simply continuing the same old status quo which has delivered worse and worse outcomes is as a wise man once said, insanity.

Whether the change pursued will be negative gearing reform remains to be seen, but what is clear is that the cost of doing little to address the issue of housing is no longer the easy option for policymakers it once was.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator