‘Just isn’t enough’: Grim new stats prove there’s never been a worse time to be a young Aussie

We now have cold, hard proof that young Aussies are making a “rare level of sacrifice” – but it’s still not enough for them to get ahead.

When following the stream of data and figures emerging on the topic of housing affordability, the news is generally quite poor, with report after report concluding that there has scarcely been a worse time to purchase a home in the last 30 years.

Yet in conversations around dining tables and barbecues across the nation, as well as on social media, there is a common retort to the conclusions shared by the various property data providers, banks and academics: “If housing is so expensive, how are people still buying homes?”

Considering the clear difficulty illustrated in buying a home in the various data releases, it’s a fair question.

The short answer is people aren’t buying homes in anything like the numbers they once did.

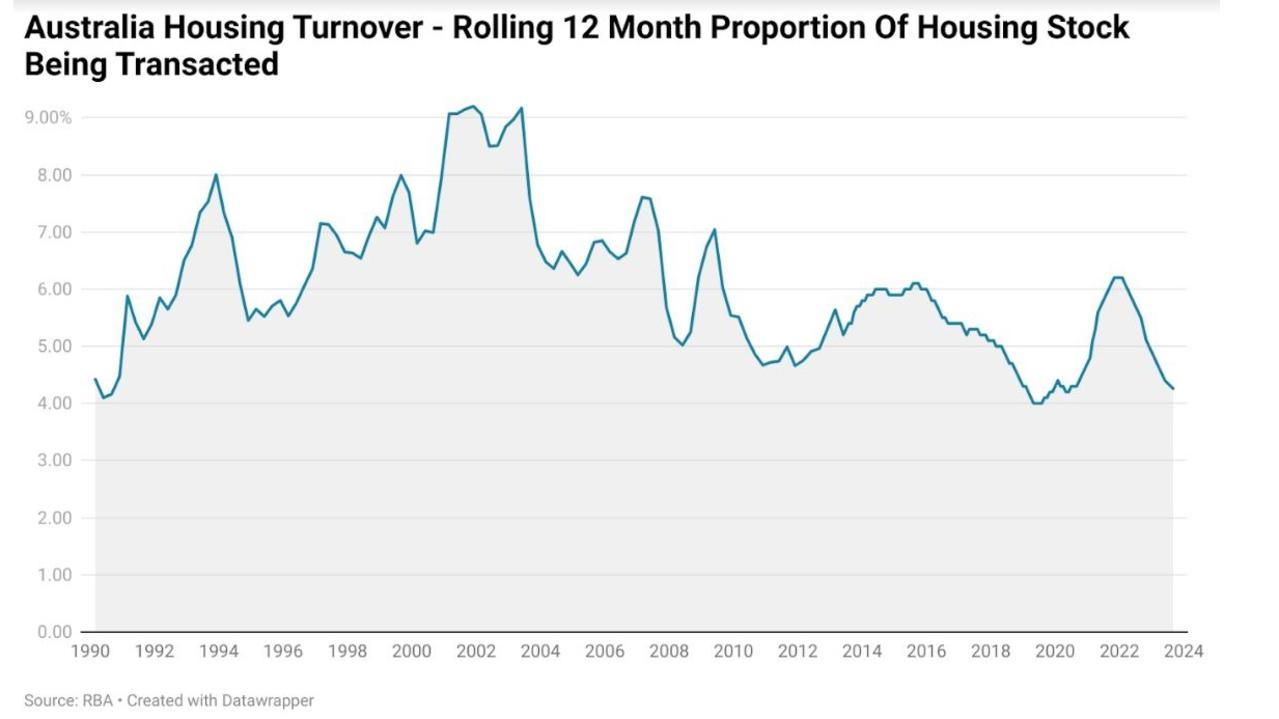

Today, the proportion of overall housing stock being transacted upon each year is roughly equivalent to where it was during the absolute height of the early 1990s recession, when interest rates were in double digits and unemployment was on track to hit the highest level since the Great Depression.

As of the latest figures, annual housing turnover is roughly 4.6 per cent, compared with a peak of 9.1 per cent recorded in 2001.

The lucky few

In decades past, purchasing a home was an experience generally embarked upon by a single person or a couple, with only a lucky few enjoying the support of parents, other relatives or friends.

But in 2024, help from family and/or friends to purchase a first home has not just become commonplace, it has become the means through which a majority of prospective first home buyers get into the market.

According to investment and advisory group Jarden Australia, 15 per cent of borrowers are receiving an average of $92,000 from parents.

“If we assume the majority are first home buyers, it would imply about 75 per cent of first home buyers were receiving some form of family assistance,” said Jarden Australia chief economist Carlos Cacho.

It’s a huge jump from the $23,500 average data from research firm Digital Finance Analytics (DFA) cited back in 2010, when an average of 6 per cent of first home buyers sought help from the Bank of Mum and Dad.

Government gets involved

While some form of government intervention ostensibly intended to get more people into the housing market has been a feature of government policy for more than six decades, the level of intervention over a protracted period is arguably greater today than it was during any previous era.

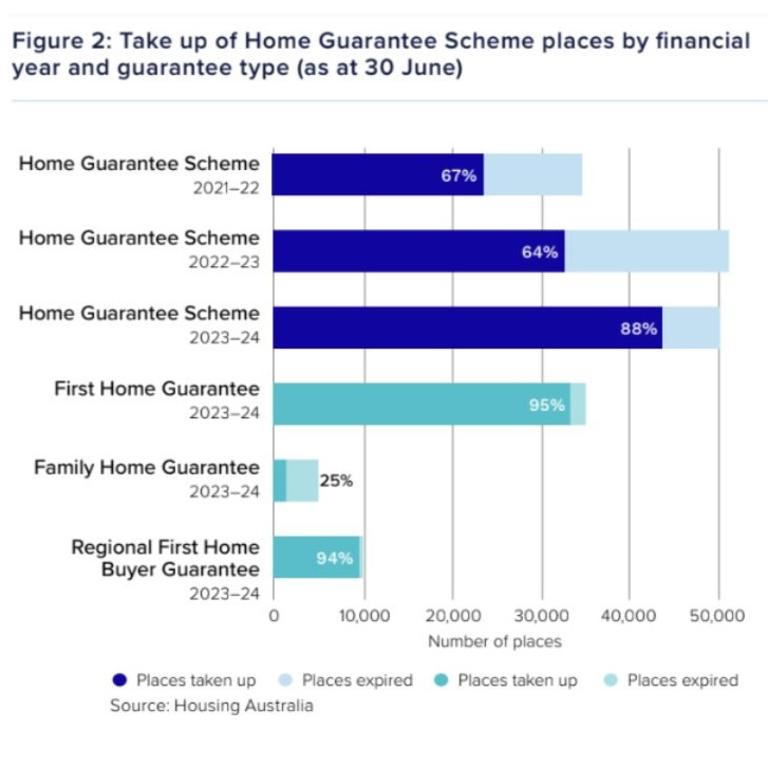

Government body Housing Australia provides backing for mortgage loans for first home buyers with as little as a 2 per cent to 5 per cent deposit, depending on a household’s individual circumstances.

When first introduced in October 2019 by the Morrison government, the scheme provided 10,000 places annually.

Over time, the scheme has grown increasingly larger, with the First Home Guarantee providing 35,000 places in 2023-24 and the Regional First Home Guarantee providing a further 10,000 places.

According to the most recent figures from Housing Australia, more than one in three first home buyers who purchased a home in the last 12 months did so with support from one of the aforementioned programs.

Assistance falls flat

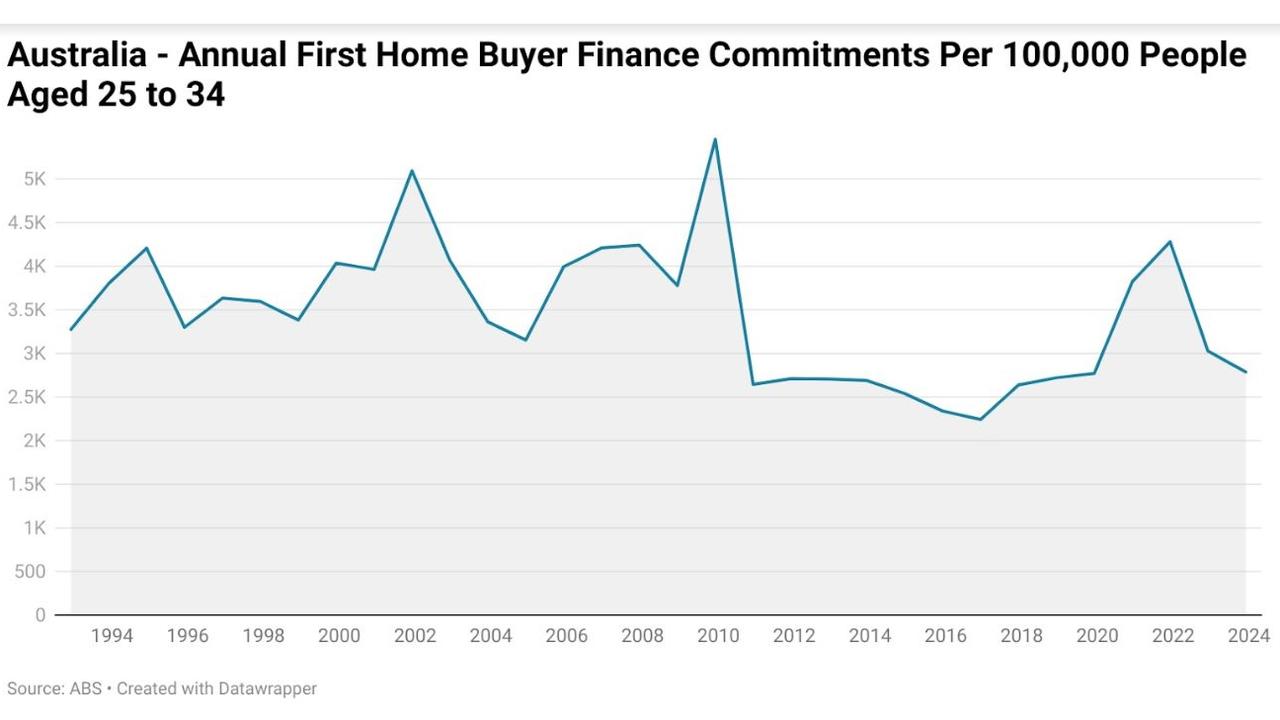

Despite a majority of first home buyers receiving some form of assistance to purchase a home, data from the Australian Bureau of Statistics shows that the number of first homebuyer finance commitments per capita (based on the population aged 25 to 34) is well below the long run average.

Between 1992 and 2023, there was an average of 3453 finance commitments per 100,000 people aged 25 to 34, compared with 2787 in the 2023 calendar year.

The averages per 100,000 people aged 25 to 34 over previous decades were as follows:

• 1990s (1992 to 1999): 3655

• 2000s: 4133

• 2010s: 2602

While the current performance is better than the decade average for the 2010s, it is 24.1 per cent below the average performance of the 1990s and 32.9 per cent below the performance of the 2000s.

The takeaway

For a long time, housing has been an issue where the federal government has largely tinkered around the edges. Each new government comes to power loudly proclaiming that it wants more affordable housing, but when push comes to shove, leaders from both sides of politics have supported policies that put varying degrees of upward pressure on housing prices.

But in 2024, it is increasingly becoming clear that simply tinkering around the edges may no longer be enough, as the Albanese government considers changes to negative gearing and the capital gains tax discount, at least partially due to their perceived impact on the housing market.

In a generation, a first home has gone from something that was largely done as a couple or alone, to a task where the overwhelming majority of buyers are receiving help from friends, family or various levels of government.

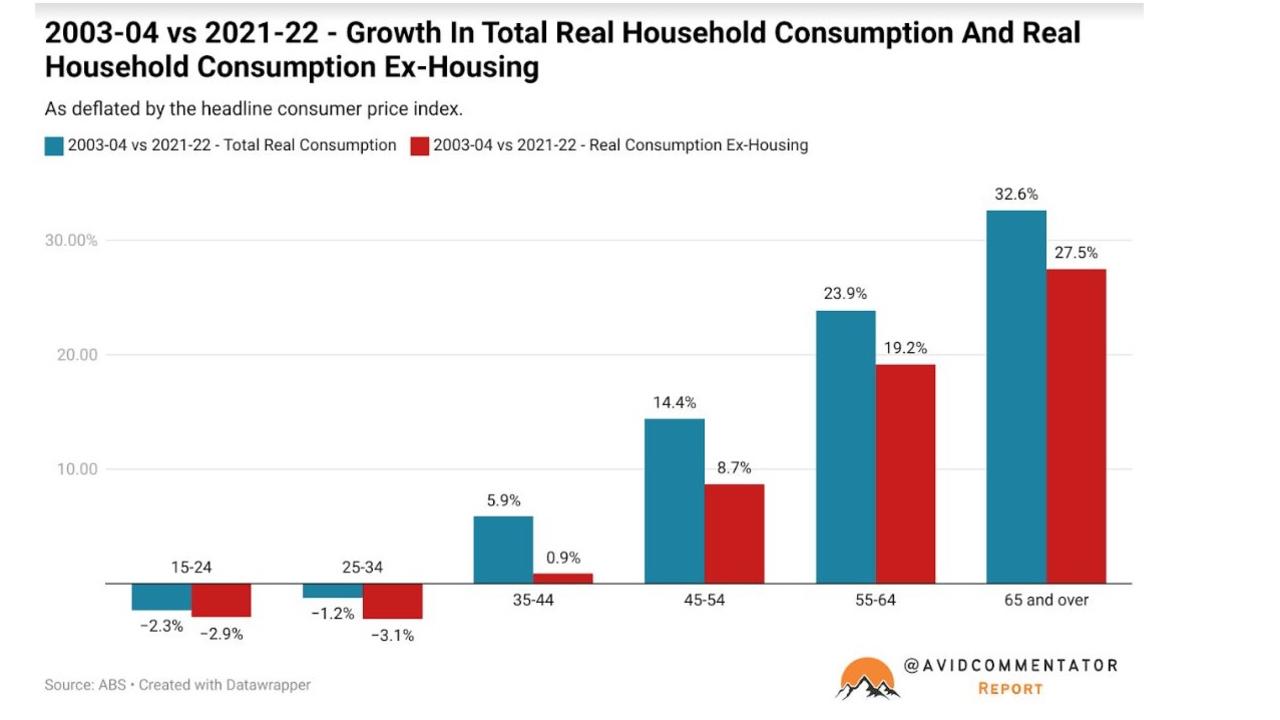

While there is a great deal of debate over to what degree younger demographics prioritise home ownership amid narratives of wasteful spending on gadgets and holidays, the data doesn’t support these assertions.

According to figures from the ABS, households aged under 35 are spending less in inflation adjusted terms excluding their housing costs than they were way back in 2002-2003. For households aged 35 to 44, they are spending just 0.9 per cent more in inflation adjusted terms (ex-housing) as almost two decades ago.

Ultimately, the data shows that even with government intervention and the support of the Bank of Mum and Dad, significantly fewer young people per capita are getting into the property market compared to decades long past.

While non-existent real household consumption growth for under 35s outside of their housing costs should prove to be a major tailwind for the home ownership dreams of this demographic, the simple reality is the hurdles to market entrance are so high this rare level of sacrifice just isn’t enough.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator