Newcastle woman’s buy now, pay later ‘addiction’ racked up $40k debt

The Australian woman got “addicted” to a popular service and despite working three jobs couldn’t keep it turning into an “embarrassing” problem.

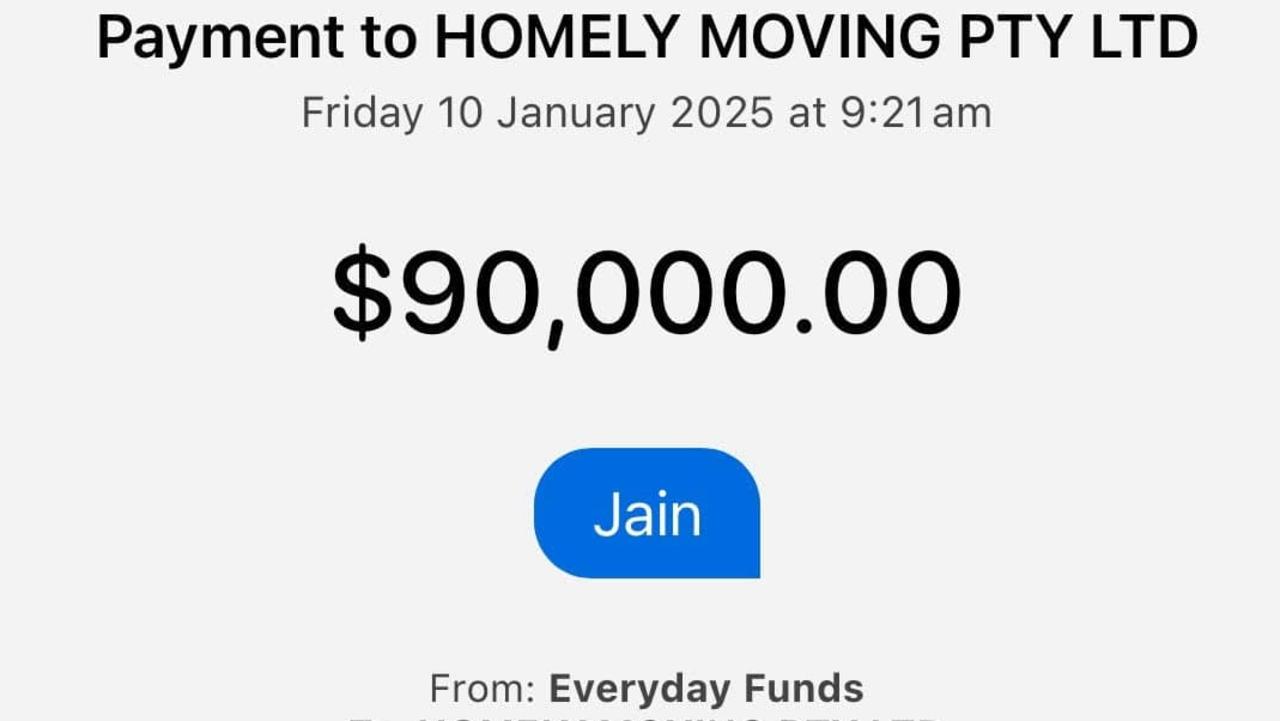

Jacqueline Liddell was “drowning” in $40,000 debt racked up by her “addiction” to buy now, pay later and made worse by taking out a loan and credit cards to try and pay it off, despite working three jobs.

At her lowest point, she said she had around five buy now, pay later accounts with different providers as well as credit cards.

Her love of fashion drew her into the world of buy now, pay later (BNPL), she said.

“I realised I could buy more expensive things that I could never afford and before you used to lay-by things and pay them off slowly and have that long term intrinsic reward system. But then before I knew it I had this enormous debt, it was up to $1000 a fortnight coming out of my account, so it got quite out of control,” she told news.com.au.

Most BNPL providers allow people to purchase an item immediately and then pay if off over four instalments every two weeks.

“Because it goes for that eight weeks by the time you have paid off an item of clothing you bought previously, you want the next thing,” Jacqueline added.

“It was an addiction and then … I was struggling so much to pay it off and used the credit card to pay off the buy now, pay later. It all built up and before I knew it I was drowning.”

Deciding between buy-now-pay-later or a credit card? Read Compare Money's credit card vs BNPL guide >

The 32-year-old said her biggest regret was spending $1000 on a pair of leather pants, which she put a hole in the first night she wore them.

“I was buying cat food, shoes, clothes and anything. I guess I was well and truly addicted to buying clothes. I was literally like Carrie Bradshaw from Sex and the City … and then it just continued,” she explained.

“It started with clothes and make up and then I think I was realising how bad it was when it swapped to buying more day to day things and it wasn’t as fun.

“Even like going to the hairdresser or your facial and all these things I used to be able to pay upfront and then before you know it you’re completely reliant on the system and it’s hard to get out.”

The high school teacher is convinced the BNPL system completely transformed her attitude towards money, saying prior to getting it she always had paid off her bills and never had debt.

“It literally just changed my brain. When I was 20 I would never have dreamt of going overseas on a credit card but the whole idea of buy now, pay later transformed my ideas with money and I just thought I could go overseas on a credit card and pay it back later,” she said.

“It was fun and easy and it’s also so intrinsically linked to fashion.”

Have a similar story? Continue the conversation | sarah.sharples@news.com.au

The Newcastle woman said she knew things were really bad when she was using BNPL to purchase vouchers for food and fuel, as well as pet food.

“It was pretty embarrassing … I would go to the counter and use the voucher and this was when I started realising I was ignoring the problem and buying stuff to make myself feel better as a bandaid,” she said.

“I just thought I was in too deep and then when I went to buy something with a voucher I would say ‘I got this for Christmas and someone gave me this’ and literally the people at the counter didn’t react. I think it’s a lot more common then we know but I thought why am I lying to these people?

“I was realising it’s not good and it was just this real struggle and when you’re got to stay no to social situations – it was something really silly and embarrassing.”

Jacqueline said she got her first BNPL account at 25 and closed her final one at the end of last year – marking a tough six year journey.

She said it wasn’t easy though as she felt “trapped by the cycle” and was “very reliant” on BNPL and had a few “relapses” despite deleting the apps from her phone and giving her brother the passwords to her accounts.

“It can be laughed about if you’re buying clothes that it’s a silly woman thing, but people have a lot of addictions to spending money, and you do get that adrenaline rush,” she said.

She was forced to delve into the psychology behind her spending and how her shopping was based on her emotions.

To tackle her debt, her strategy was to pay off her smallest debts first and work her way up to the larger one, admitting she had some hard months where she had no money, but she would cross off the dates on her calendar to when her loans would be gone.

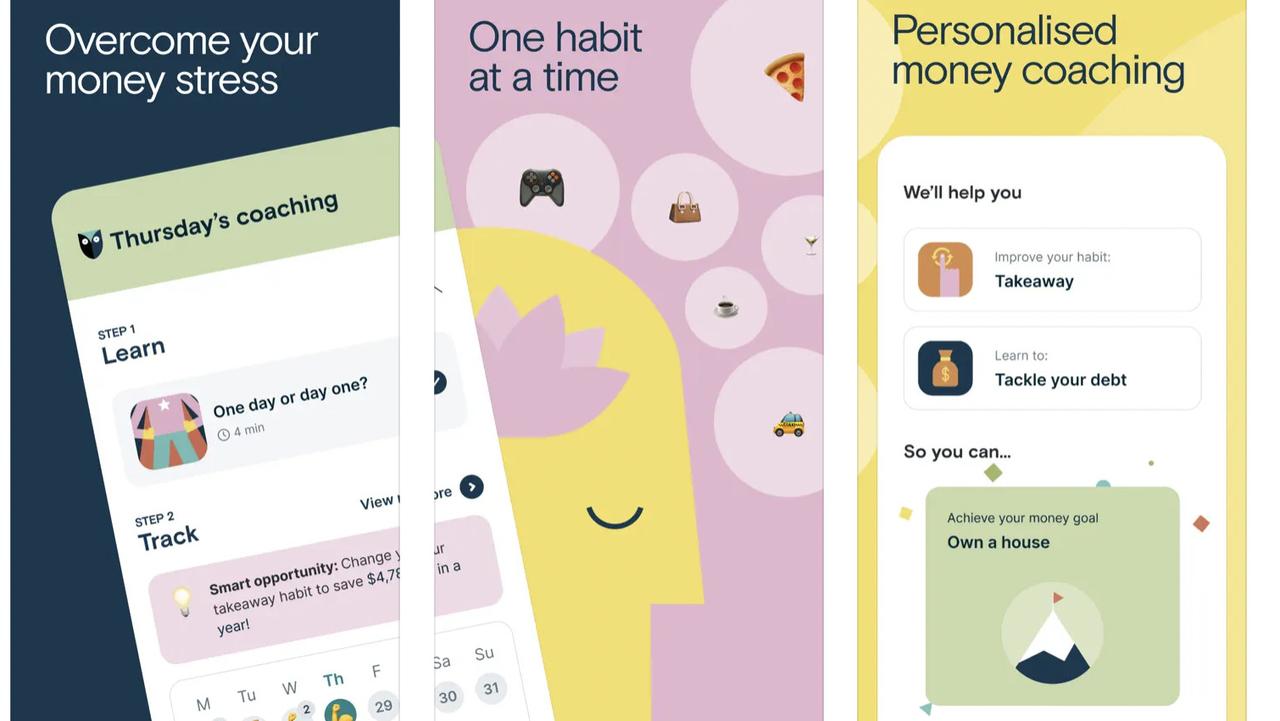

Jacqueline was part of a trial of new money coaching app from non-bank lender Wisr that uses psychology to help users build smarter habits and reduce financial stress.

She said it not only taught her why she fell into debt and how to save but also not to judge herself so “harshly”.

Created with clinical psychology advisers and behaviour science consultants using interventions such as Cognitive Behavioural Therapy (CBT) and Acceptance and Commitment Therapy, the app called Wisr Today aims to create lasting habits and behaviour change.

Over 47 weeks of testing, users saved an average of $377 a week by understanding spending triggers, changing their money habits and resisting mindless spending.

“The stress of finances permeates everybody’s life. It is more than how much or how little you have in the bank. Money is emotional, and it affects each of us differently, and it’s constantly changing,” said Wisr Chief Strategy Officer Dr Lili Sussman.

“Building good money habits is more than sticking to a budget; If it was easy, then we’d all have brilliant habits. Money and genuine financial health are about your behaviour, values, goals, and routine habits. The secret to financial health starts with healthy habits and psychology with science-based intervention.

“Technology has enabled us to digitise and make affordable proven interventions. It’s never been done before, and amid a global financial crisis, the timing has never been so crucial to empower and support Aussies to get smarter with their money habits.”