How much extra Aussies could be forced to pay with interest rate rises

Looming interest rate rises would cost homeowners thousands a year, while the rising cost of living has 11 million worried.

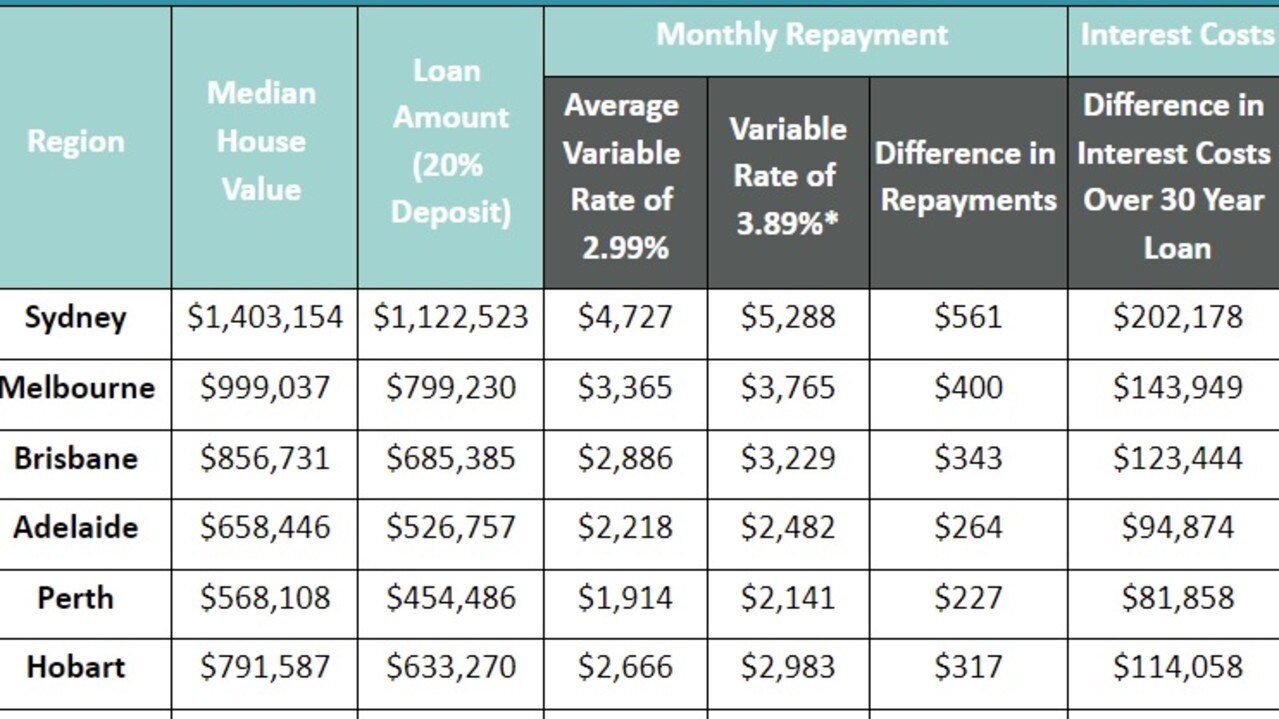

Aussie homeowners face having to find an extra $332 on average a month to pay their mortgage if interest rates rise, but people in Sydney will be forced to fork out a whopping $561.

New research from Canstar found that if interest rates rise in line with some of the major bank forecasts — with some predicting it to hit 1 per cent by the end of the year — close to three-quarters of borrowers would need to forgo certain expenses to afford home loan repayments.

The official interest rate currently sits at 0.1 per cent and the last time it was increased was in November 2010.

Canstar’s research revealed that if the average variable rate of 2.99 per cent soared to 3.89 per cent for a typical home loan of $644,497 nationally, it would mean Aussies would need to find almost $4000 more a year to pay their home loan.

It would also cost them $116,000 more in interest over the life of their loan, the analysis found.

For a homeowner in Sydney with a typical mortgage of $1.12 million, they would be scrambling to find an extra $6700 a year to pay off their mortgage and would also be forking out $202,000 more in interest over the life of their loan.

In Melbourne, homeowners with a typical mortgage of $799,230 would need to pay an extra $400 a month with the interest rate rise.

Meanwhile, people in Canberra also face some of the biggest hikes with $422 added to their monthly loan.

Canstar’s group executive of financial services, Steve Mickenbecker, said Aussies are set to feel financial pain.

“Costs keep rising for households with petrol prices reaching an eight-year high and supermarket shoppers reporting higher grocery bills, but the sting is about to get worse for some,” he said.

“Anyone with a mortgage will likely feel financial pain when the Reserve Bank raises the cash rate this year as predicted by some of the major banks.

“With demand in the economy driven by government spending rather than wages growth, the federal budget leaves the Reserve Bank in a conundrum. If the Reserve Bank lifts the cash rate in response to inflation before wages take off, widespread household stress will follow.”

Canstar’s research found the top three expenses borrowers would need to give up to afford higher home loan repayments include restaurant meals and dining out, holidays and entertainment.

But Mr Mickenbecker said the hospitality, tourism and entertainment sectors were critical to Australia’s economic recovery and had been hit hard by Covid-19 lockdowns and restrictions. “Borrowers spending less in these areas is hard news following a tough two years for these industries,” he said.

“There is little doubt that the banks will fully pass on the cash rate increases to borrowers, and it’s expected that multiple increases will follow.

“Home loan interest rates are likely to be close to 2 per cent higher in a couple of years.”

Brisbane homeowners with a mortgage of $685,385 would need to find an extra $343 a month with interest rate rises, while those in Hobart with a $633,720 mortgage would be facing an extra $317 for repayments.

Darwin homeowners faced the smallest increase with a mortgage of $455,718 upping their repayments by $217 a month, while those in Adelaide with a $526,757 mortgage would need to find $264 a month.

In Perth, homeowners with a typical mortgage of $454,486 are facing repayment hikes of $227 a month.

An alarming number of people were also concerned about their ability to afford household bills as a result of the rising cost of living.

Canstary’s survey found 56 per cent of Aussies – equivalent to more than 11 million people – are worried they will be unable to afford household bills amid skyrocketing living costs.

When asked about the household bills they are most concerned about, nearly one-third said their biggest worry was housing costs including rent or mortgage repayments, followed by petrol and groceries.