Dad’s distress over ‘predatory’ $415k loan

A major bank is under fire after two sons discovered an “injustice” after their parent’s death.

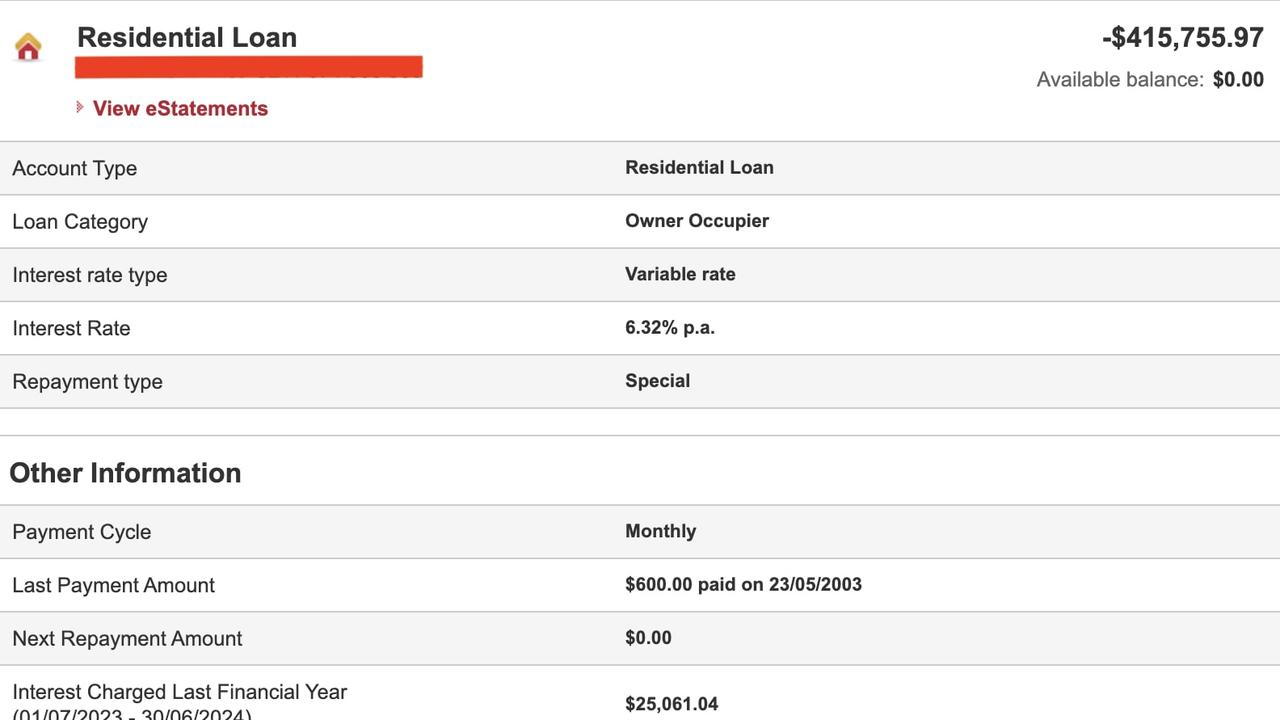

A family is shocked that an $85,000 loan taken out on their parents’ home has skyrocketed to $415,000 with a huge amount of interest slapped on top monthly.

Mark* and his brother lost their 92-year-old dad in May this year, while their mum had already passed away.

Little did they know that their parents had borrowed $85,000 when they were in their 70s and the repayment had jumped to an eye-watering amount.

So “disturbed” was Mark’s dad about the loan that in his final days he asked a trusted granddaughter to find any documentation and destroy it, he said, “thinking that he could make it go away”.

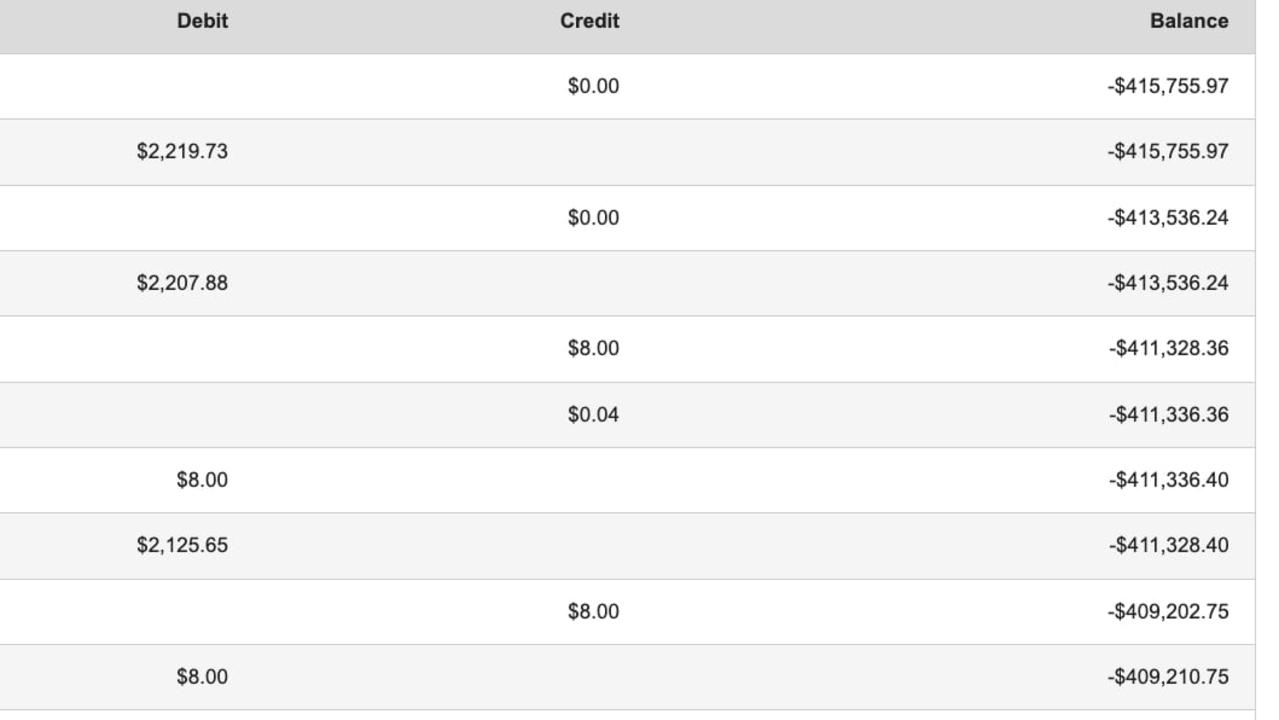

“When dad passed it was $401,000 – so it’s gone up by nearly $15,000 since dad passed and it’s doing over $2500 a month in interest that it’s increasing by,” Mark told news.com.au.

“Neither my brother or I have the capacity to borrow that much at our age to prevent it.”

The 61-year-old said the stress of dealing with the loan and trying to sell the property quickly to stop it wiping out more of the profits is impacting his health.

“It’s just ridiculous that those types of loans were allowed to happen in the first place and they can’t put a stop on it,” he said.

“My brother is not the type of person to agitate whereas that’s in my makeup. I hate injustices and this is an injustice and it just burns at me – not only that it burns me financially.

“We are in awkward position where we trying to sell as we have to rush to find a buyer because if we don’t it’s just eating money.”

Documents show that $25,000 was charged in interest in the last financial year alone – almost a third of the total loan taken out from St George bank.

Do you have a story? Contact sarah.sharples@news.com.au

Mark is also sceptical that his parents really understood how much the loan from St George bank would eventually cost, particularly as it was simply for a car and to do some work around the house.

“They could have bought a Ferrari with the loan amount now,” he added.

“The type of loan they don’t offer it anymore as they know it’s predatory.”

The schoolteacher said he accepts the loan needs to be paid out but can’t understand why St George bank can’t stop the interest accruing – adding it was grotesque to keep billing dead people.

“The smallest goal would be to cease any interest from the date of dad’s death and that way it would go back to about $400,000 and we then know that we don’t need to rush and sell the property,” he said.

“Because the longer the property takes to sell the more impact it having on my brother and I – it’s actually doing my head in.”

He said the best case scenario would be to get some money knocked off the $415,000.

Mark said the brothers also feel powerless to negotiate the interest rate on the loan which sits at 6.32 per cent.

The NSW man said there is a delay in selling the home, which was built by his grandfather 100 years ago, as the family is still waiting for probate to be granted. This is where the court gives permission to the executor to distribute the estate as described in the deceased person’s will, which is a “slow process”, he added.

Mark would love to be able to pay off the loan right now but said it just isn’t possible.

“I don’t have much earning capacity. I’m trying to retire and my brother turns 65 and has even less capacity,” he explained.

“So we are not in a situation where can get a loan from the bank. No one is going to touch us. The only thing would be to take an asset out against our house which we own but that puts us in a situation where we can’t retire.”

Mark has lodged a complaint with the Australian Financial Complaints Authority.

The loan from St George is known as a reverse mortgage and allows homeowners to borrow money using the equity in their home as security.

However, homeowners don’t have to make repayments while living in their house and interest on the loan gets bigger over time and adds to the amount borrowed.

The loan is repayable when the property gets sold but the interest rate is likely to be higher than on a standard home loan, the government website Moneysmart said.

A St George spokesperson did not respond to specific questions about Mark’s parents loan.

But said the bank was always sorry to hear when a customer passes away and it has a team of specialists on hand to support families going through the estates management process.

“Our teams work closely with surviving family members or executers to help them understand the estate’s financial position and what’s required to move forward,” they added.

After news.com.au reached out to St George bank, Mark was told that the interest would be wiped from the date of his dad’s death and put on hold for six months.

*Name changed

sarah.sharples@news.com.au