Insane reason family faced mortgage prison as interest rate ‘exploded’ to 10.6 per cent

With fears interest rates are going to remain higher for longer, one family faced being trapped in mortgage prison for a bizarre reason.

When Mark Davies saw the interest rate on his mortgage “explode” to a whopping 10.62 per cent as rates skyrocketed, he felt “devastated”.

The chef had purchased a home with his wife at the end of December 2022 to live in with their two youngest children, aged 10 and six.

The couple had bought a three-bedroom townhouse near Newcastle for $442,000 and had been forced to go with a lender outside the big four banks as he had previously declared bankruptcy due to a failed business.

“I obviously had a bit of trouble in the past and had to get a mortgage with a higher interest rate, it was around the 8 per cent mark and then over the 12 months that exploded to 10.62 per cent – it went up significantly,” he told news.com.au.

As the interest rate soared, Mr Davies said it was disheartening as it felt like the couple’s monthly mortgage repayments were making no dent on their loan.

The couple had initially put down a $60,000 deposit giving them a loan to value ratio of 91 per cent.

But he thought they would be able to escape the exorbitant interest rate by refinancing.

The dad-of-five was then plunged into the world of valuations with wildly varying figures coming back on their home.

Their initial lender Pepper Money did a desktop valuation and put their Newcastle home as being worth $450,000. The bank wanted them to fork out an extra $15,000 in costs to lower their interest rates, but it wasn’t going to be a “significant” drop, Mr Davis said.

It put a dampener on the thrill of getting back into the property market, he added.

“It was great to buy – just to get that first loan through was huge only because I thought we would struggle being ex-bankrupt. We had brilliant credit and one hiccup in life and people don’t want to touch you, so it was great feeling to get that initial loan but then it felt like we were stuck,” he noted.

The 47-year-old decided to get a second opinion and approached a broker. St George Bank valued the home at $470,000 via a walk through valuation.

However, the bank still required them to pay an extra $15,500 to lower their loan to value ratio below 90 per cent as well as forking out $6300 in lender’s mortgage insurance – which would completely offset any benefit of reducing the interest rate.

“I was a little bit devastated. I thought maybe our property isn’t worth as much and I didn’t understand and thought it was just the way it was,” he said.

“You should always get a second opinion and for that one to come back not great … I thought we were doomed to stay on that interest rate for a while.”

Mr Davies admitting they were “living month to month” as they watched their loan barely drop so the prospect of being trapped in mortgage prison on the extremely high rate was “daunting”.

Yet, a third valuation from Commonwealth Bank came in at $525,000 and the couple were “surprisingly” able to refinance with a big four bank at an interest rate of 6.38 per cent and with no need to pay LMI.

The refinancing has saved the family an incredible $1280 a month.

Mr Davies’ experience saw a staggering $74,000 difference in property valuations between three banks and he thinks greater transparency is needed, particularly as the issue can cost people thousands more in repayments.

“I just think they need to be honest with valuations. I can understand a $5000 to $10,000 difference on valuations because of personal opinion, but $74,000 is a lot of money,” he said.

Many borrowers would be aware that a decent deposit, good credit rating and capacity to service a loan are all important when it comes to a mortgage.

But some may not understand the impact valuations can have on their mortgage repayments.

New findings from Compare Club show a spike in discrepancies in property valuations among lenders assessing the same properties, with the difference as much $120,000.

Compare Club’s head of research and insights Kate Browne said there is a growing concern that Australian homeowners “are falling victim to lowballing tactics employed by some lenders” which can lead to “cost blowouts” that can take years to pay off.

”Consumers should be aware that currently, valuations on the same property can vary by as

much as $120,000,” she explained.

“While this is legal, not all borrowers may be aware that this occurs and a low valuation can cost them far more money than necessary as another lender may value their home much higher.

“This is the ultimate example of why shopping around is worth it, for some of the borrowers we have seen shopping around has saved them over $100,000.”

While all lenders have separate criteria for valuing a property, how that home is valued has

big financial implications for the borrower.

For example, a lower valuation by the lender can lead to higher interest rates. In some cases, that can push the borrower over 80 per cent on their loan-to-value ratio (LVR), which attracts the additional cost of being charged lender’s mortgage insurance (LMI).

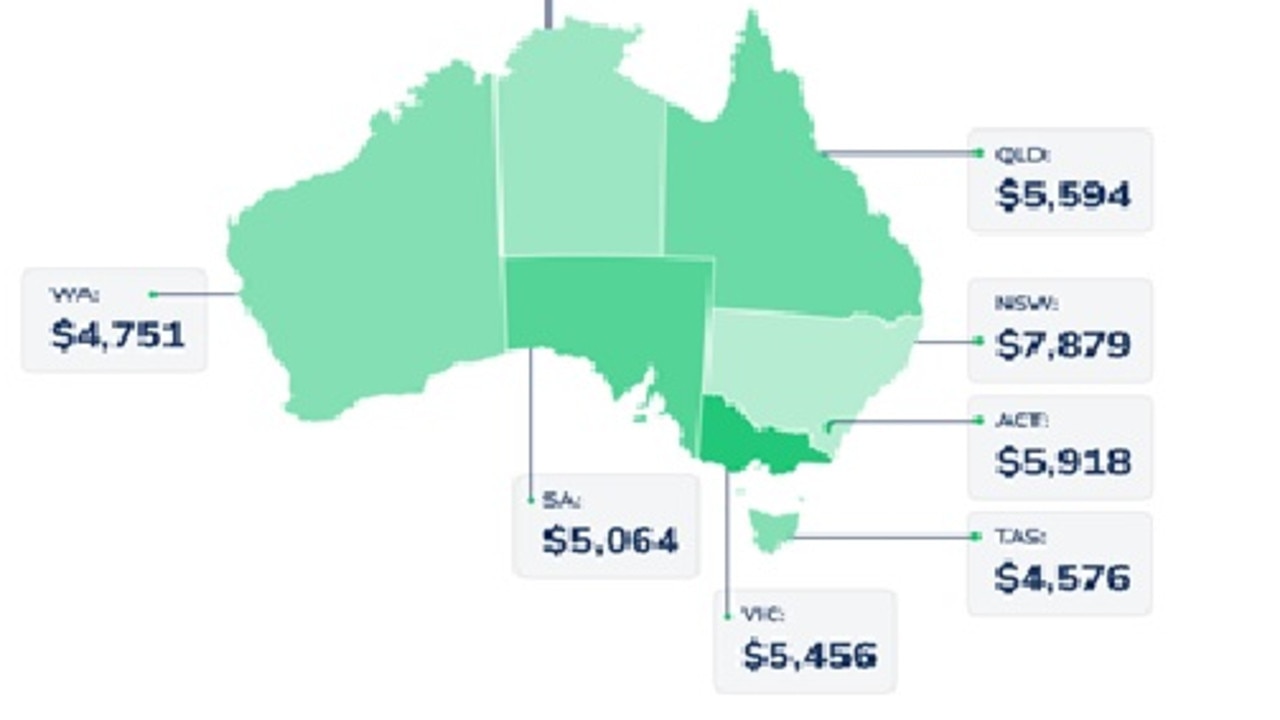

Compare Club’s research showed that borrowers could pay up to $7879 for their mortgage based on a lower valuation.

Ms Browne said a worrying pattern had emerged of properties being valued by different lenders at such a wide variation that borrowers risked paying far more in interest rates and additional borrowing costs if they didn’t shop around.

One Western Australia homeowner was given valuations of $600,000 from ANZ and Commonwealth Bank, while Westpac’s was $610,000 when she went to refinance. Three months later she got a valuation of $720,000 from BankWest.

Lower valuations could mean higher interest rates leading to increased monthly repayments, longer loan repayment periods, reduced affordability for additional expenses, and slower growth of home equity, potentially causing financial strain and limiting future borrowing opportunities, added Ms Browne.

sarah.sharples@news.com.au