Finance news you need to know today

THE US government says it is sanctioning two Middle Eastern exchange houses and an individual accused of helping to funnel cash to the Islamic State group.

THE US government says it is sanctioning two Middle Eastern exchange houses and an individual accused of helping to funnel cash to the Islamic State group.

DONALD Trump has criticised Lockheed Martin’s F-35 fighter jet program as too expensive, his latest attack on large defence contractors.

DOCTORS and health professionals have called on London Mayor Sadiq Khan to ban all diesel cars from the UK capital.

A LEADER of Italy’s populist 5-Star Movement is pressing for a vote on whether the country should keep the euro as its official currency.

IKEA’S full-year net profit rose 19.6 per cent to $6 billion, the group says, citing growth in both mature and emerging markets.

GENERAL Mills, which has been struggling with weaker sales for its cereal and yoghurt, plans to cut between 400 and 600 jobs around the world.

IRAN has proposed a state budget of $134 billion, loosening the purse strings as Donald Trump threatens to put renewed pressure on Tehran.

FRENCH President Francois Hollande says he will not seek a second term in office in the presidential election in 2017, an unprecedented move.

THE Pittsburgh-area McDonald’s franchisee who created the Big Mac nearly 50 years ago has died at the age of 98.

FOR the first time in eight years, cartel representatives have agreed to cut oil output by 1.2 million barrels a day.

BRITAIN’S new plastic five-pound note, bearing the portrait of wartime Prime Minister Winston Churchill, has fallen foul of thousands of people.

THOUSANDS of people are demonstrating across India to protest the government’s decision to withdraw large-denomination currency from circulation.

A MEXICAN cement maker is ready to lend its services to Donald Trump to build the wall he wants to erect on the southern border of the US.

THE Swiss are the richest people in the world, with an average wealth of $759,015 per adult, Credit Suisse says in its annual global wealth report.

UK PM Theresa May has pledged to address business concerns that Britain could fall off a “cliff edge” into uncertain trading conditions after leaving the EU.

ANGELA Merkel has confirmed she wants to run for a fourth term as German chancellor in next year’s election.

PRESIDENT-ELECT Donald Trump has wrapped up a meeting with former Secretary of State Henry Kissinger in Trump Tower.

GERMANY has opposed calls for debt relief for Greece after Barack Obama offered support for such a mechanism during a trip to Athens.

THE Dow Jones has opened at a record high after the index capped off its best week since 2011 following Donald Trump’s surprise election win.

US SHARES have surged to levels not seen since the 2008 financial crisis as Wall Street reassessed Donald Trump’s presidency.

PAYPAL users can now send money to friends and family using just their voice, after the payment service announced it was to integrate into Apple’s Siri.

FINANCIAL forecasters are wiping egg off their faces after Donald Trump market meltdown warnings didn’t materialise, but experts caution there could be more volatility ahead.

STOCKS are moving solidly higher in midday trading on Wall Street following Donald Trump’s upset victory over Hillary Clinton in the US presidential election.

SCOTLAND will intervene against the UK’s central government in the legal battle over its formal divorce from the EU.

GLOBAL stock markets remain subdued ahead of the US election result, as investors prepare for the most turbulent trading session since Brexit.

THE British government is preparing legislation to trigger the procedure to leave the EU, despite a push to overturn a court decision that may delay Brexit.

US AUTHORITIES are recalling nearly three million Samsung washing machines following several reports of injuries, including a broken jaw.

HILLARY Clinton is holding onto her narrow lead over Donald Trump in the US presidential race just days ahead of the election.

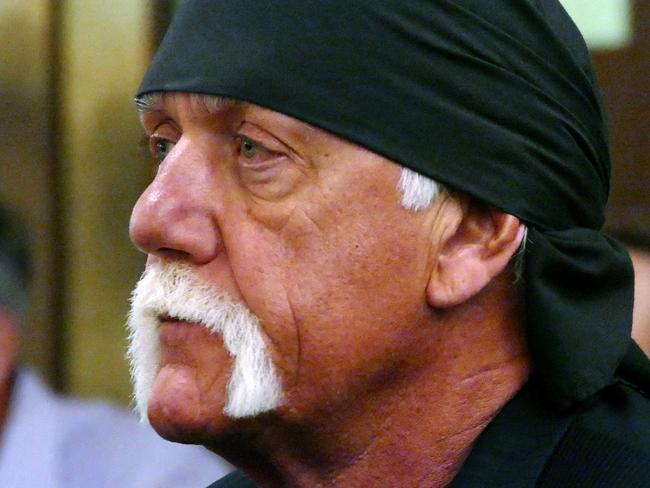

SHUTTERED news website Gawker has reached a $40 million cash settlement with former wrestler Hulk Hogan over a leaked sex tape.

DONALD Trump’s odds are narrowing, and markets around the world are panicking. Strap yourselves in for Brexit 2.0.

Original URL: https://www.news.com.au/finance/markets/world-markets/page/37