Dark sign recession is ‘definitely’ coming amid sharp interest rate hikes and global market chaos

There are ominous clouds hanging over the global economy, as spooked markets prepare for the inevitable recession on the horizon.

The global economy is spooked right now, as ominous clouds hang on the horizon amid warnings we are now “definitely” headed for a recession.

Markets have tumbled globally in the past few days – and Australia’s stock exchange looks to be next in line – because of the latest inflation figures stemming from the US.

Released on Friday, they showed that the cost of everyday goods has risen to a 41-year high.

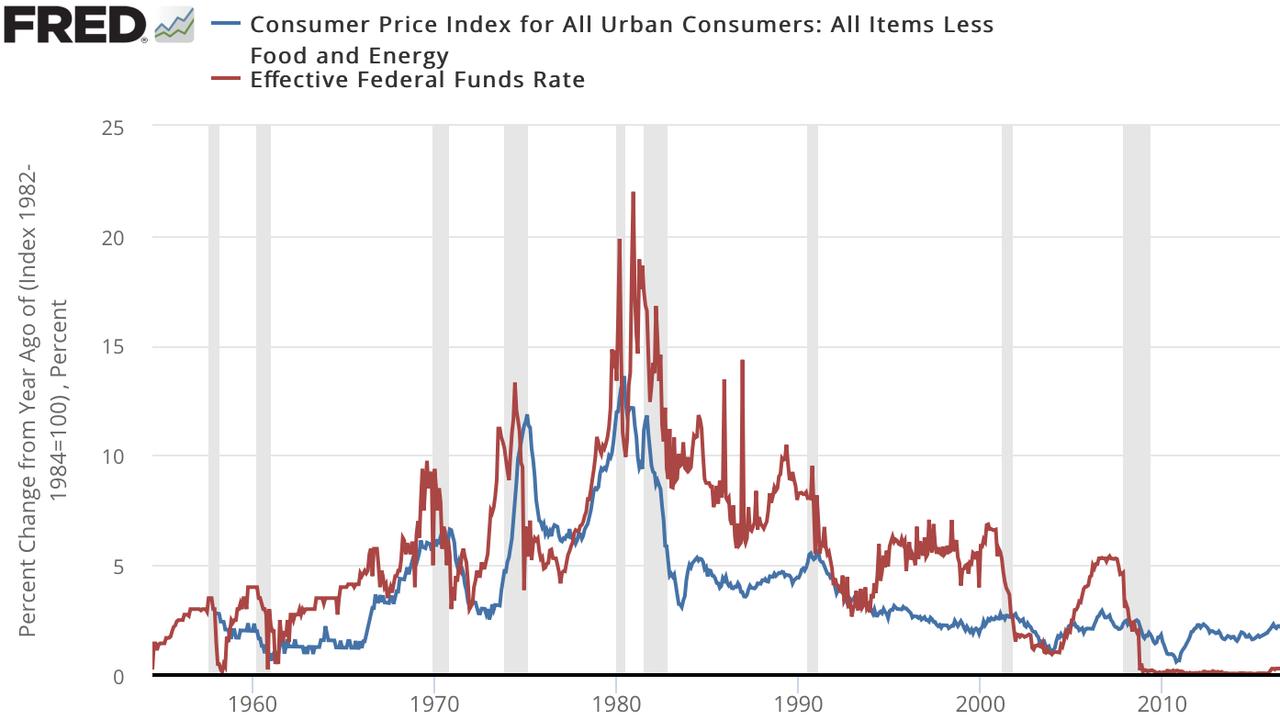

Much like here in Australia, but far more far more serious in America, the US Federal Reserve is bumping up interest rates to take a little heat out of the economy.

The idea is to do this delicately without causing a crash. But it is a balancing act that has many worried that the Federal Reserve may go too hard and send the global economy into a recession.

Adam Dawes, a senior investment adviser in Australia, said Aussies will “really begin to feel the bite” from the economic turmoil gripping the world right now.

Speaking to Sunrise today he said the signs for the global economy were not good from previous rate hikes in the US – saying he believes there will “definitely be a recession in the US”.

“Since 1950, the US has had 15 rate cycle rises,” he said. “Out of those, 11 have ended in recession. They do not have a great track record.”

However, he said that Australia’s commodities like iron ore and gas, as well as its low unemployment might insulate us from the pain felt in other nations.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

“We have 400,000 vacant jobs here. That will provide a safety net,” he said. “But it is the wage price inflation or wage growth that is the key to keeping inflation in check.

“People then have to go and find a new job. The employer has to pay more. That is more difficult as well.”

Meanwhile, the chief investment officer of the country’s largest pool of capital, AustralianSuper’s Mark Delaney, says Australia is heading for a “material downturn”.

His prediction is backed by leading economists, who expect there will be a sharp slowdown in the economy from next year, amid headwinds from rising interest rates and falling real wages.

The former Treasury economist said the global economy had “run out of capacity” after years of strong employment growth, and it would be difficult to avoid a “material downturn” as central banks raise rates to control inflation.

“High wages growth, high inflation, labour shortages are the classic preconditions for an end of the cycle,” Mr Delaney told the Australian Financial Review.

The Australian Government doesn’t seem very positive about what’s coming our way either warning of a “dire” budget situation with a deficit that could blow out further due to soaring inflation.

The Australian stock market meanwhile has been closed for three days because of the long weekend. But it is expected to feel the bite today in a big way – with it tipped to plunge more than 4 per cent.

Why is the economic situation so bad?

Markets around the world were hammered on Monday as global equities, oil prices and bitcoin went into freefall amid heightened recession fears triggered by runaway inflation.

“The hangover from a higher-than-expected US inflation reading is continuing to cause scissoring pain throughout the markets, as it extinguishes the hope the US Federal Reserve might be able to take its foot off the pedal on interest rate rises,” AJ Bell investment director Russ Mould said.

US and European stocks had already tumbled on Friday following the inflation data, with Asia following suit on Monday.

European stock markets extended pre-weekend losses with drops of over 2 per cent, while London took a hit also from data showing the UK economy contracted in April for a second month in a row.

Wall Street also tumbled, with the blue-chip Dow down around 2.3 per cent in late morning trading and the tech-heavy Nasdaq falling nearly 4 per cent.

World oil prices, whose surge has contributed massively to soaring inflation, slid around 1.5 per cent as the high cost of living increased recession expectations.

The possibility of more Covid restrictions in China’s biggest cities also weighed on crude futures as the country is a major oil consumer.

Fresh coronavirus outbreaks in Shanghai and Beijing have seen authorities reimpose containment measures.

“This has fed into a narrative that the global economy will slow even further at a time when prices are showing little sign of doing the same,” CMC Markets UK chief market analyst Michael Hewson said.

On Friday, investors were left surprised when data showed US inflation jumped to 8.6 per cent in May, the fastest increase in more than 40 years, as the Ukraine war further fuelled energy and food price rises.

It has led to speculation that the Federal Reserve will now be contemplating a single interest-rate lift of 75 basis points at its meeting this week.

With the central bank forced to be more aggressive, there is heightened concern that the US economy could be sent into recession next year. If that were to happen, it would have worldwide repercussions.

“The market is now thinking much more about the Fed driving rates sharply higher to get on top of inflation and then having to cut back as growth drops,” SPI Asset Management head of trading and market strategy Stephen Innes said.

– with AFP