Westpac increases interest rates on all fixed rate home loans after RBA announcement

One of Australia’s big four banks has announced a major interest rate hike following last week’s move by the Reserve Bank.

Westpac has announced major increases to its Fixed Rate Home Loan and Investment Property Loan interest rates.

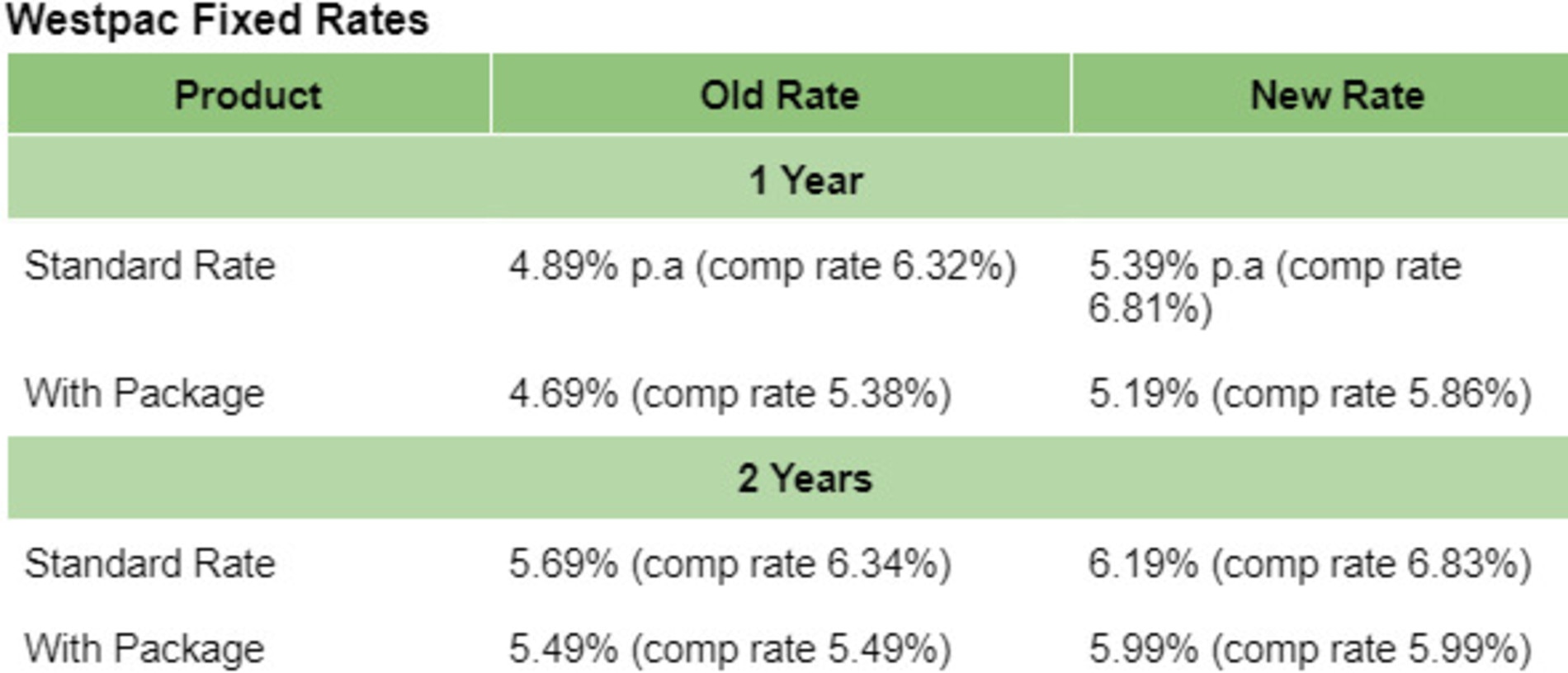

Effective from Tuesday, the big four bank increased the rates on all its fixed rate home loans by 50 basis points for both owner occupiers and investors.

Both new and existing customers have been hit by the change, with the fixed rate on a one-year owner occupier loan going from 4.69 per cent to 5.19 per cent.

Westpac consumer and business banking chief executive Chris de Bruin said they knew the hikes would be tough for some customers.

“We understand that many Australians are carefully managing their household budgets at this time and we’re here to support our customers through the changing interest rate cycle,” he said when the changes were announced last week.

“When we review our interest rates, we seek to balance the needs of multiple stakeholders including home loan and deposit customers.

“We also consider several factors including the increase to the cash rate, competitive environment, and the performance of our business.”

But while home loan customers were impacted by the changes, Westpac did make a move to help savers.

The Westpac Life total variable rate with bonus interest has increased by 0.50 per annum to 2.35 per cent, while the Westpac Bump Savings total variable rate with bonus interest has also risen to 2.35 per cent per annum.

Rate City research director Sally Tindall said Westpac’s move might make other big banks reveal what they were doing for deposit customers.

“There will now be pressure on NAB and ANZ to step up after they notably left savers out of their RBA announcements on Friday,” she said.

“Westpac customers with Life and Bump accounts will see decent rises this month; however, those with eSaver accounts are still only getting an ongoing rate of 0.85 per cent – that’s 1.5 percentage points below the cash rate and 2.75 percentage points behind the market leader.

The increases come after the Reserve Bank of Australia’s (RBA) decision to increase the cash rate by 0.50 per cent at September's board meeting.

Mozo personal finance expert Claire Frawley said lenders were becoming more “unpredictable” with their rate moves.

“While we have seen variable rates rise after all the RBA rate hikes, fixed rates have been more unpredictable, with some lenders moving out of cycle,” she said.

“In August we saw 29 lenders cut some or all of their fixed rates, including two of the big four banks. Commonwealth Bank reduced their 4-year fixed rates by 160 basis points and Westpac their four year rates by 100 basis points.”