Terrifying new reality for mortgage payers after latest cash rate rise

The hits keep coming for Australian mortgage holders, with the Reserve Bank of Australia’s latest hike hitting homeowners hard.

ANALYSIS

The hits keep coming for Australian mortgage holders, with the Reserve Bank of Australia (RBA) on Tuesday hiking the official cash rate (OCR) another 0.25 per cent – the eighth consecutive monthly increase.

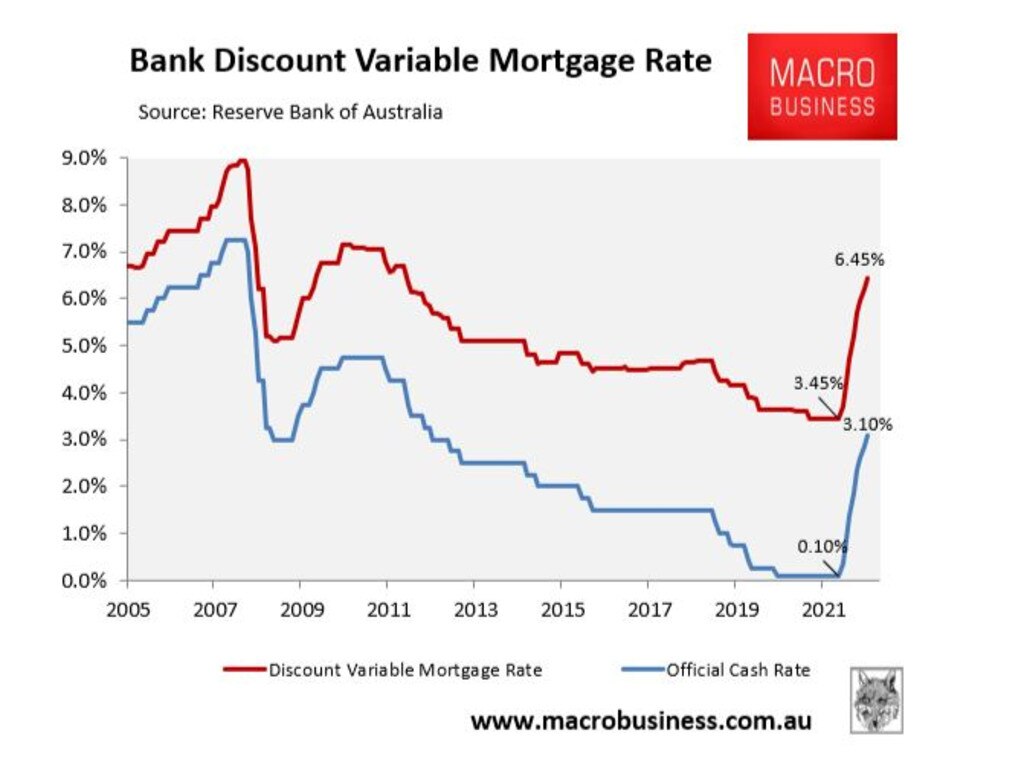

The decision sent the OCR to 3.10 per cent, which is the highest level since November 2012. Once the increase is passed onto mortgage holders, Australia’s average discount variable mortgage rate will climb to 6.45 per cent, which will be the highest level since April 2012:

Most Australian mortgage holders are on variable rates, and they are experiencing the sharpest lift in monthly mortgage repayments on record.

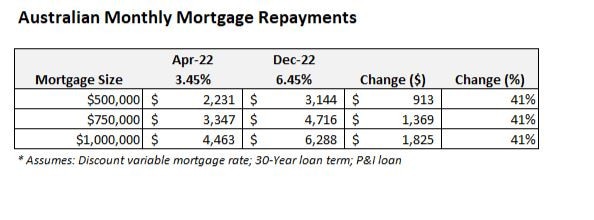

As illustrated in the next table, Tuesday’s OCR increase will lift average monthly mortgage repayments by 41 per cent above their level in April before the RBA’s first hike. For a borrower with a $500,000 mortgage, this will represent an increase of more than $900 in monthly mortgage repayments.

More rate rises, but endgame nears

In its commentary accompanying Tuesday’s monetary policy decision, RBA governor Phil Lowe explicitly stated that “Inflation in Australia is too high” and that “the Board expects to increase interest rates further over the period ahead, but it is not on a pre-set course”.

At the same time, Lowe acknowledged “there has been a substantial cumulative increase in interest rates since May” and “monetary policy operates with a lag and the full effect of the increase in interest rates is yet to be felt in mortgage payments”.

At the time of writing, the big four banks’ OCR forecasts were as follows:

- CBA: 3.35 per cent by February 2023, then dropping to 2.85 per cent by December 2023.

- NAB: 3.60 per cent by March 2023, remaining steady into 2024.

- Westpac: 3.85 per cent by May 2023, then dropping to 2.85 per cent by November 2024.

- ANZ: 3.85 per cent by May 2023, then dropping to 3.50 per cent by November 2024.

Financial markets had also tipped a peak OCR of 3.60 per cent by November 2023.

Therefore, the OCR will rise a further 0.25 per cent to 0.75 per cent, depending on which forecast comes to fruition.

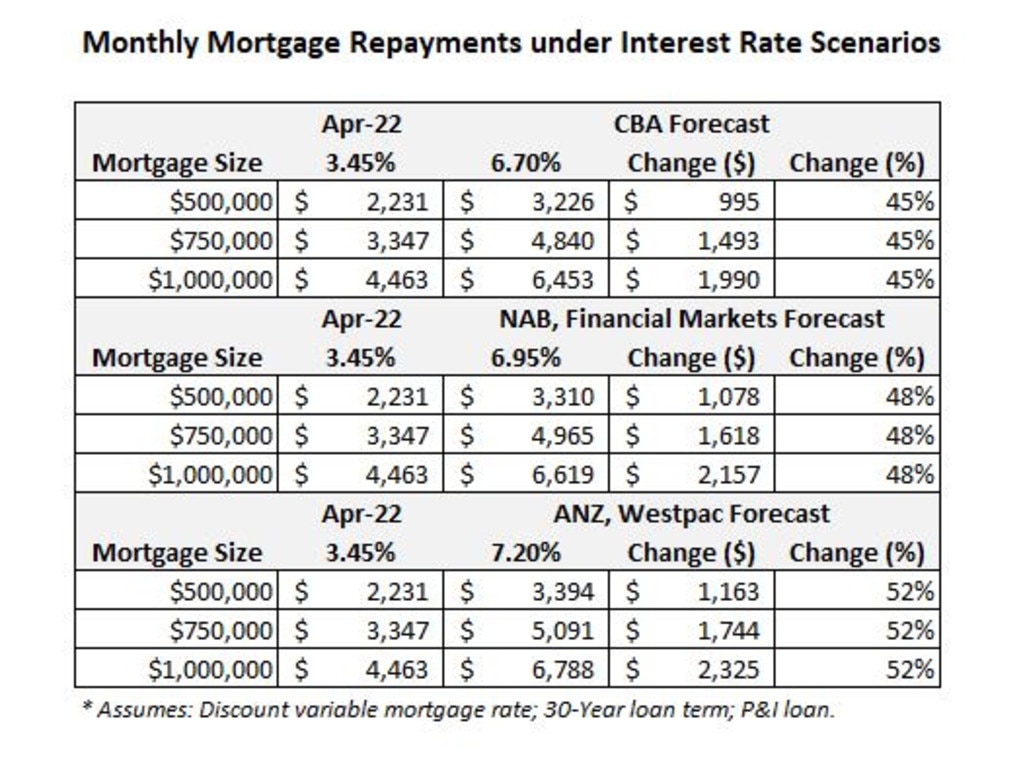

The impact on Australian mortgage holders from the above forecasts is illustrated below:

Under the best-case scenario of the CBA, the RBA will only increase the OCR another 0.25 per cent in February, which would lift monthly mortgage repayment 45 per cent above their April pre-tightening level.

NAB’s and the financial market’s 3.6 per cent peak OCR forecast would see mortgage repayments rise to 48 per cent above their pre-tightening level, whereas ANZ’s and Westpac’s 3.85 per cent peak OCR would increase mortgage repayments to 52 per cent above April’s level.

Under either scenario, Australian mortgage holders face their biggest lift in mortgage repayments in history, which will crush household budgets and ultimately constrain consumer spending – the economy’s biggest growth driver.

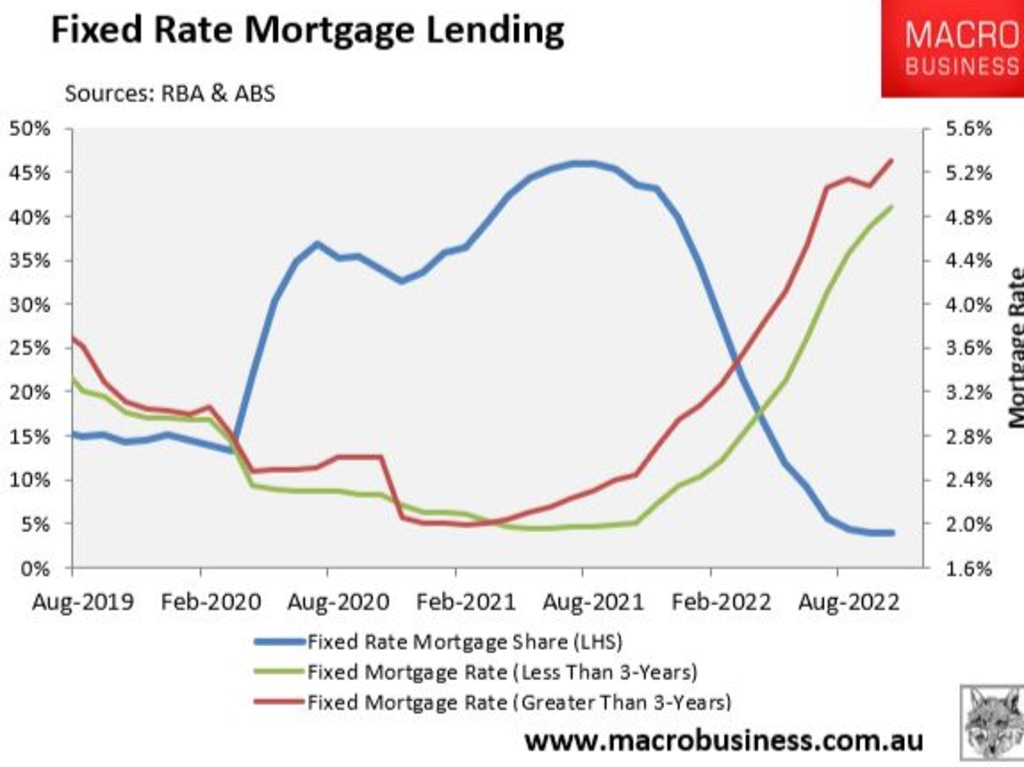

To add insult to injury, the share of Australian home buyers taking out fixed rate mortgages soared over the pandemic from a long-term average of around 15 per cent to an all-time high 46 per cent in mid-2021:

The fly in the ointment here is that nearly one-in-four mortgages (by value) will switch in 2023 from ultra-low fixed rates originated at around 2 per cent to rates that are more than double these levels.

Thus, monetary conditions will tighten even further in 2023 even without additional rate hikes from the RBA.

It is also worth pointing out that the cumulative 3.0 per cent lift in the OCR now matches the 300 basis point buffer on home loan serviceability assessment introduced by APRA in October last year (increased from 250 basis points).

Consequently, many borrowers rolling off cheap fixed mortgage rates could find themselves in extreme financial stress and unable to pay.

RBA has two months to reassess

Thankfully, there is no monetary policy meeting in January, which means Australian mortgage holders will get respite from another rate rise.

Hopefully by February or March there will be enough evidence of slowing domestic growth, the slowing global economy, and slowing inflationary pressures to allow the RBA to stop hiking.

Otherwise, the RBA risks going too far and plunging the economy into recession.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.