Aussie mortgage holders face interest rate Armageddon

The hits keep coming for Australian mortgage holders, with the Reserve Bank of Australia’s latest hike hitting homeowners harder than ever.

The hits keep coming for Australian mortgage holders, with the Reserve Bank of Australia (RBA) on Tuesday hiking the official cash rate (OCR) another 0.25 per cent – the seventh consecutive monthly increase.

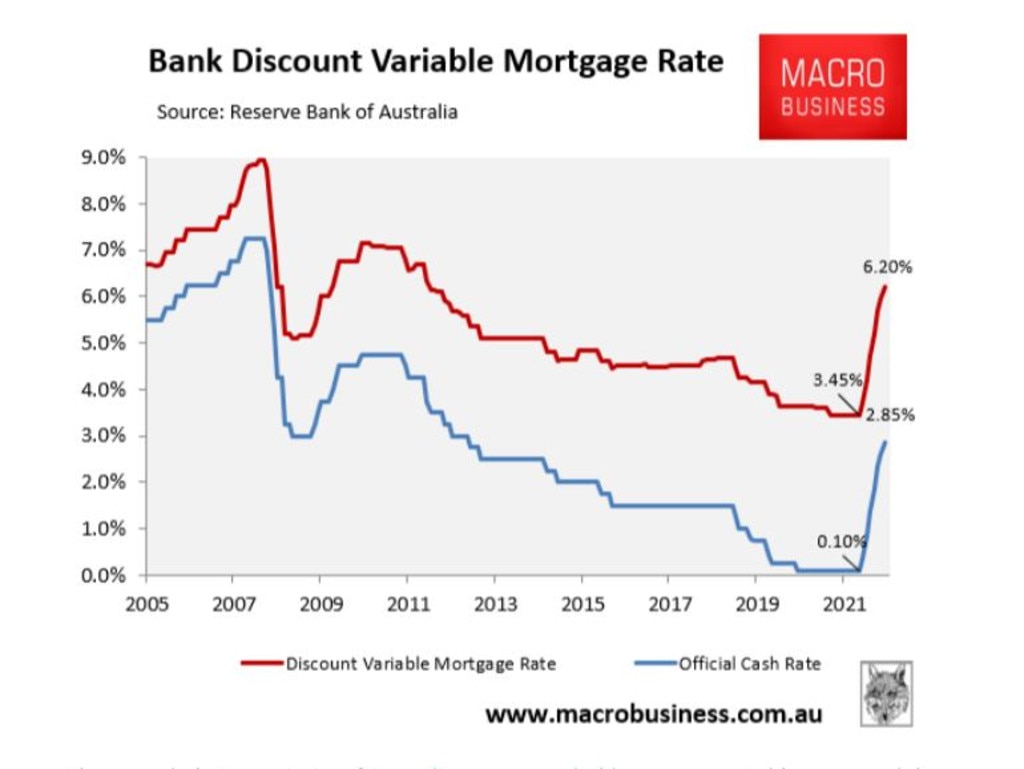

The increase has sent the OCR to 2.85 per cent, which is the highest level since April 2013. Once the increase is passed onto mortgage holders, Australia’s average discount variable mortgage rate will climb to 6.20 per cent, which will be the highest level since May 2012:

The overwhelming majority of Australian mortgage holders are on variable rates, and they are experiencing the sharpest lift in monthly mortgage repayments on record.

As illustrated in the next table, Tuesday’s OCR increase will lift average monthly mortgage repayments by 37 per cent above their level in April before the RBA’s first hike. For a borrower with a $500,000 mortgage, this will represent an $831 increase in monthly mortgage repayments.

In its commentary accompanying Tuesday’s monetary policy decision, the RBA governor Phil Lowe explicitly stated that “a further increase in inflation is expected over the months ahead” and that “the Board expects to increase interest rates further”. Lowe also concluded by stating that “the Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that”.

Therefore, it is inevitable that the RBA will lift the OCR higher. The only question is how far?

The major banks last week lifted their OCR forecasts in response to the shock inflation print, which saw the Consumer Price Index (CPI) rise by 7.3 per cent in the year to September. Specifically:

— CBA predicts a 3.1 per cent OCR by December, after which the RBA will pause.

— Westpac and NAB forecast a 3.6 per cent OCR by March 2023.

— ANZ predicts the OCR to peak at 3.85 per cent by May 2023.

The bond market remains even more hawkish, tipping a peak OCR of 3.95 per cent by August 2023.

The below table shows how much variable mortgage repayments would rise if the above interest rate forecasts were to come to fruition:

Under the best-case scenario of the CBA, the RBA will only increase the OCR another 0.25 per cent in December, which would lift monthly mortgage repayment 41 per cent above their April pre-tightening level.

Westpac’s and NAB’s 3.6 per cent peak OCR forecast would see mortgage repayments rise to 48 per cent above their pre-tightening level, whereas ANZ’s and the bond market’s 3.85 per cent and 3.95 per cent peak OCRs would increase mortgage repayments to 52 per cent and 54 per cent respectively above April’s level.

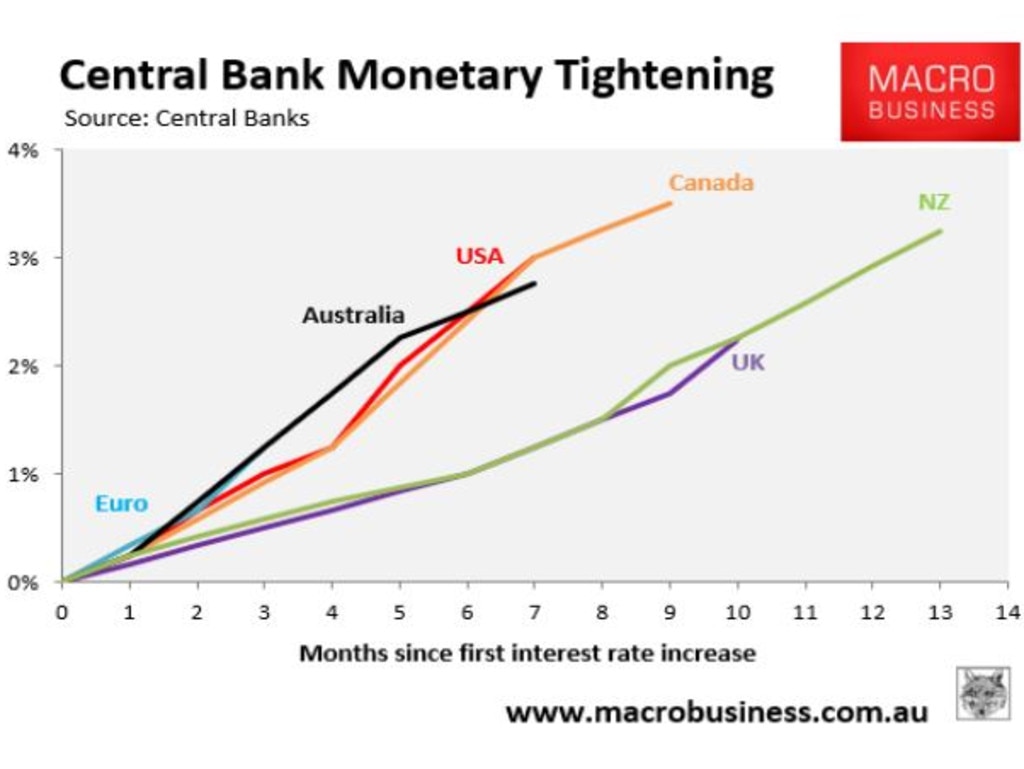

The next chart plots the RBA’s OCR increases against a selection of advanced nations:

As you can see, the RBA’s 2.75 per cent increase in the OCR in only seven months is among the fastest rate of tightening in the world. Although, it lags behind Canada (3.50 per cent) and New Zealand (3.25 per cent) in terms of magnitude.

There are three key differences between Australia and these nations that argues against the RBA hiking rates so aggressively.

First, Australian households are the second most indebted in the world, making them more sensitive to rate hikes:

Second, unlike other nations, most Australian mortgage holders are on variable rates. This makes monetary transmission faster, meaning changes in interest rates flow through quicker to borrowers in Australia than elsewhere and the RBA doesn’t need to hike rates as aggressively to slow demand.

Finally, Australia’s wage growth – the key measure of domestically driven inflation – is rising far more slowly than elsewhere:

Indeed, the 2.6 per cent wage growth recorded in Australia over the June quarter is well below the circa 3.5 per cent level the RBA previously stated was consistent with inflation within the target band over the medium term. It also means that Australian wages are falling sharply in real inflation-adjusted terms.

This last point around wage growth is paramount to the debate around inflation and interest rates.

Most of Australia’s inflationary pressures are imported or weather related. These supply factors have driven up the cost of goods, which accounted for over three quarters of Australia’s CPI growth in the year to September:

By contrast, services (which comprise around 80 per cent of the economy) continued to experience only moderate inflation precisely because they are most tightly linked to wage growth, which remains soft.

Given the broadest measure of demand-driven inflation – wages – remains well in check, hiking the OCR into the stratosphere won’t solve Australia’s inflationary troubles, which are primarily supply-driven.

Doing so will merely exacerbate cost-of-living pressures and drain household disposable income, thereby cratering consumption. It risks plunging the Australian economy into a consumer-led recession without relieving the very forces driving the inflation in the first place.

The RBA must tread carefully on further rate hikes. If it tightens as aggressively as ANZ, Westpac, NAB or the bond market are predicting, then it risks driving the Australian economy off a cliff into an unnecessary recession.

Blindly following other central banks and hiking rates until the economy breaks is not a sound strategy.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.