Should you fix your mortgage rate after RBA interest rate hike?

With today’s cash rate rise, millions of Australians are asking the same question. Here’s what you need to know.

The fix is in – or is it out?

Homeowners on variable mortgages could see their interest rates increase by up to 1.5 per cent by the end of the year, with the Reserve Bank finally forced to raise the official cash rate from its record low of 0.1 per cent to combat soaring inflation.

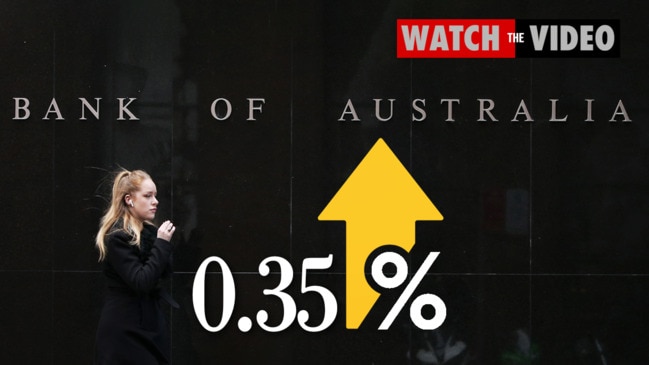

The RBA’s 25 basis point increase on Tuesday to 0.35 per cent is expected to be the start of a series of rate hikes over coming months.

The big question many are asking is, should I move to a fixed-rate mortgage now?

‘Sweet spot has gone’

Unfortunately, you may have already missed the boat.

Fixed-rate mortgages have already doubled from around 2 per cent to around 4 per cent since last year, with a typical three-year rate at a big bank now at 4.59 per cent and up to 4.99 per cent for a five-year loan.

But standard variable rates are still low as 2.19 per cent as of Tuesday morning.

“That’s a heck of a big margin – the sweet spot for switching has definitely gone,” said Steve Mickenbecker from financial comparison website Canstar. “Does it mean you shouldn’t do it? If you’re very, very risk-averse you might still think about doing it.”

Most experts expect the RBA to raise the cash rate by 1.5 to 2 per cent over the next two years.

For a borrower taking a three-year fixed mortgage at the current rate, that means that “I’m going to end up with two years where I’m behind before I sort of start breaking even and one year to make it up”, Mr Mickenbecker said.

When you should still fix

But if the borrower believes rates are going to rise faster than expected, they might still decide it’s better to take out a fixed loan.

“It’s sort of a case of, if I can afford the repayments tomorrow, but I can’t afford it if my loan goes up to 6 per cent, I still might [take a fixed loan],” he said.

“You want to think about a five-year term if you’re going to take that tack, so you’ve got a couple of years at the end. So they’re the sort of choices you’re looking at — none of them are great choices at the moment.”

For those who decide to stay on their current variable loan, Mr Mickenbecker says right now the most important thing is to make sure your rate doesn’t have a three in front of it.

“More like 2.29, 2.19 or lower,” he said.

“The best tip is to look at all the available rates and be prepared to go beyond the obvious big four banks. Sometimes you do have to go to the smaller brands [to get the best rate]. If you’re with one of the big guys, you really have to jump up and down and say, ‘Look, I want to get one of these deals, I can’t afford to be paying you that extra 1 per cent.’”

Fixed rates have doubled

The national property market is slowing, with average capital city dwelling prices rising 0.3 per cent in April and annual growth slowing to 14.6 per cent year on year.

AMP Capital chief economist Dr Shane Oliver says a surge in fixed rate mortgages is the “main driver” of the slowdown.

“Being able to borrow at a fixed rate of 2 per cent or less was a key driver of the boom in prices with fixed rate lending accounting for 40-50 per cent of new lending [compared with around 15 per cent normally] about a year ago,” he said in a note on Monday.

“But with fixed mortgage rates now roughly doubling over the last 12 months combined with an increase in the interest rate serviceability buffer from 2.5 per cent to 3 per cent this has substantially reduced the amount new home buyers can borrow and hence their capacity to pay.”

Dr Oliver is predicting the RBA cash rate to be 1.5 per cent by the end of the year.

“The faster expected initial rise in variable mortgage rates has in turn caused us to bring forward slightly the timing of the fall in prices,” he wrote.

After an eye-watering 22 per cent growth in national average home prices last year, they are expected to remain flat this year before falling by 10 per cent in 2023.

“Top to bottom, the fall in prices into 2024 is still likely to be around 10-15 per cent,” Dr Oliver said.

“But seen in the context of the huge 25 per cent plus surge in prices since their 2020 low this will just take average prices back to the levels of around April last year, so a big rise in negative equity is unlikely.”

Why have fixed rates gone up?

Mr Mickenbecker said the rise in fixed rates compared with variable was due to the different ways banks fund the two types of loans.

“Banks can fund their ‘at-call’ books, their variable rate books, with savings, with wholesale money they’ve raised, all that sort of thing, in a very efficient manner using low-cost funds,” he said. “Retail deposits are in that bucket.”

Short-term finance costs are tied to the RBA cash rate, which is technically known as the “cash rate target”. It’s the interest rate banks charge to lend money to each other overnight.

For longer-term fixed rates, however, banks don’t have that large pool of money on hand from things like customer deposits, for example.

“They’ve really got to go to the wholesale market to get that money because no one’s been prepared, in the environment we’ve had, to lock away a term deposit for three, four, five, six years,” he said.

And those over the past year, interest rates on those foreign funding markets have been on the rise due to a whole range of “global influences”.

“It’s actually been meteoric,” Mr Mickenbecker said.