‘Scared’: Bank’s chilling phone call to Aussie

An Aussie man who had to access hardship arrangements when he couldn’t pay his mortgage has revealed the stressful outcome.

An Australian dad has slammed a bank for pestering his wife about overdue mortgage repayments when he had already set up a repayment plan, claiming it was “predatory” behaviour.

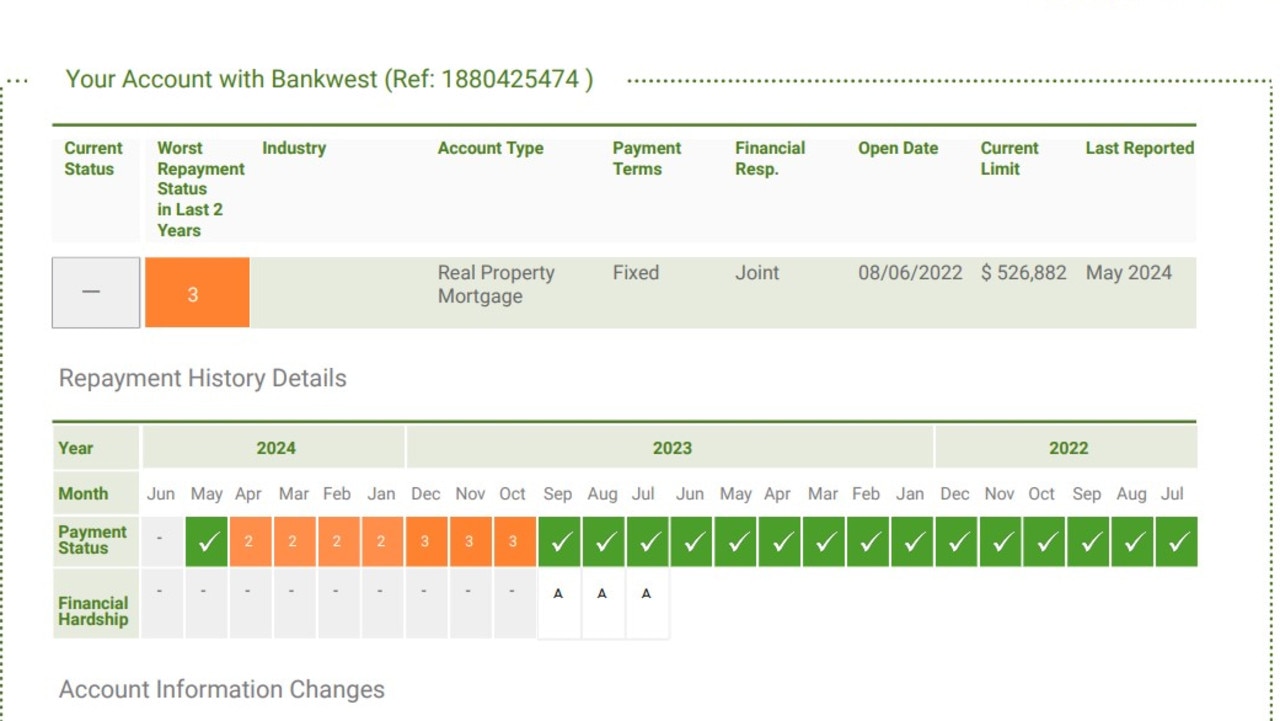

Jacob* has also been left upset that his credit score has been seriously impacted, leaving him unable to refinance.

He entered into a plan to pay an extra $1100 a month on top of his normal repayments to make up for the missed mortgage debt while he was experiencing hardship.

But Bankwest continued to report that he had missed making his mortgage repayments despite the payment plan, negatively impacting his credit score, he said.

As a result, he added it has left it impossible for him to refinance any time soon.

“I believe this issue reflects a wider practice of predatory banking, where banks like Bankwest make it difficult for consumers to move to better options with lower rates,” he claimed.

He said he entered into similar hardship arrangements and a payment plan for an investment property he has mortgaged through HSBC and the bank had never reported his repayments as missing.

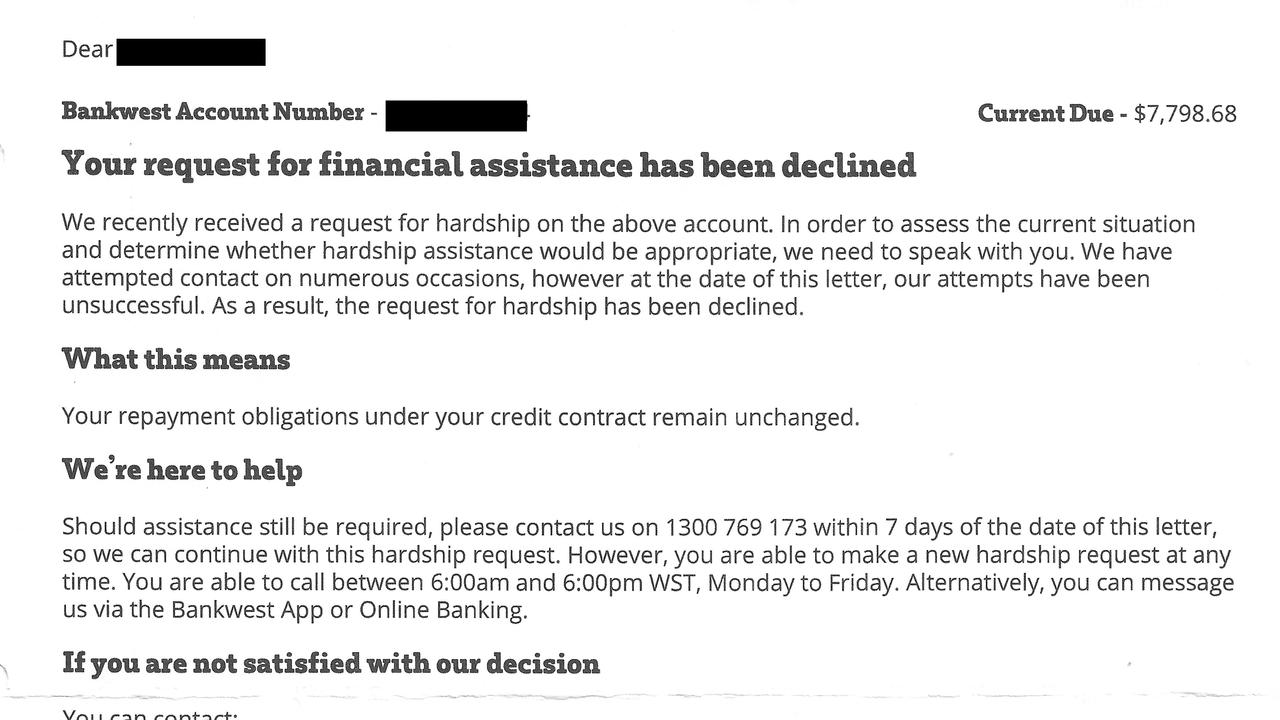

The 37-year-old added a phone call to his wife out of the blue from Bankwest in March this year about the outstanding debt of almost $8000, which left his wife thinking they were “going to lose our home, she was scared”, particularly as he manages the finances for the family.

Later, the family received a letter from Bankwest stating their request for financial assistance was declined — a request they had never made.

Do you have a story? Contact sarah.sharples@news.com.au

For six months, Jacob was making repayments of between $500 and $800 towards his usual $4100 mortgage repayments after he separated with his wife.

Without these hardship arrangements, he said he would have been “homeless”.

However, the Melbourne man later reconciled with his wife and he told Bankwest he no longer needed the financial hardship concessions.

He was given the option of adding the mortgage arrears back into his total loan or paying them off over 12 months.

The IT worker chose the $1100 repayment option over 12 months, but once he realised how “badly” his credit score was being impacted, he borrowed money off a friend in May to pay back the outstanding debt in full.

He said the loan should not have been reported as overdue because he was meeting the terms of the payment arrangement.

“My credit score only came up to 450 which is not sufficient for loan,” he added.

“It’s very hard on me. My little one just started childcare, so we are paying for childcare and not able to get a credit card and it’s really hard. Both my wife and I work hard but we are living hand to mouth.

“If I could refinance I could save $200 to $300 a month which is a lot of money for me.”

He was also critical that Bankwest have shut down their only branch in Melbourne’s CBD, meaning he can only discuss the issue over the phone, rather than in person.

The situation has left the couple in tears at times and he made a complaint with the Australian Financial Complaints Authority (AFCA).

The dispute resolution service ruled that Jacob was given adequate information by Bankwest about how his credit report would be impacted while the loan remained in arrears. He was also given an alternative option which would have taken the loan out of arrears immediately, AFCA said in its assessment.

However, AFCA ruled that the Bankwest call to Jacob’s wife was not reasonable. It proposed that Bankwest pay $1000 in compensation to the couple.

“It is unclear to me why a financial firm would make a collections call to a customer when there was already a payment arrangement in place and the terms of the arrangement were being met,” the AFCA dispute resolution specialist said.

However, Jacob has rejected AFCA’s preliminary assessment and wants to take the matter further.

A Bankwest spokesperson said the financial wellbeing of its customers is a priority and its dedicated team is available 24/7 on the phone or on digital chat to support the individual needs of customers, especially those in vulnerable circumstances.

“Bankwest works with customers in financial hardship to explore a range of repayment options, including arrangements that don’t impact their credit report, so they can make an informed decision on an option they believe best meets their needs,” they said.

“If a customer chooses a repayment arrangement that could impact their credit report, we will explain clearly to them that their credit report may be impacted while their account remains behind in repayments.

“Bankwest aligns with industry requirements on credit reporting of customers in financial hardship and we provide written correspondence to customers on financial hardship matters in accordance with our National Credit Code obligations”, they added.

*Name changed

sarah.sharples@news.com.au