‘Disconcerting news’: Damning line found in RBA report

It’s just 14 words in the RBA’s 80-page quarterly report – but it represents really good news for homeowners and bad news for everyone else.

The RBA just admitted it didn’t realise how important housing is to the Australian economy, in a sign that it could push back hard against any further fall in house prices.

This looks, once again, like good news for homeowners and bad news for everyone else.

Australia’s central bank just released its major quarterly report, the statement on Monetary Policy. In it was this gem of a line:

“Recent developments have shown that dynamics in the housing market can have more pervasive effects than we had expected.”

Basically, when house prices fell, it hurt the economy more than the RBA expected. House price falls reduced consumption, reduced construction activity, and the decline in prices and trades also whacked the many people who work in real estate and related sectors.

This adds to comments from a senior RBA official who admitted that before house prices fell the RBA had not understood how important the housing industry was to GDP.

“We had not fully taken account of this in our forecasts of GDP and it is part of the explanation of why GDP growth has turned out to be slower than we had expected,” said Deputy Governor Guy Debelle in October.

HOUSES AND HOLES

There’s a meme that our economy is just houses and holes – i.e. real estate and mining.

I’ve always thought that was unfair to a lot of good businesses in our economy – we do food manufacturing brilliantly, pharmaceuticals are a booming export category, we have a huge healthcare sector and education is one of our biggest export earners.

But the latest admission from the RBA is there’s more truth to that meme than they thought. And they should know. Real estate really is a major component of our economy.

And that’s disconcerting news for anyone hoping we can find a sweet spot where the economy grows healthily but house prices stay sane.

WILL THE RBA EVER LET HOUSE PRICES SLIDE AGAIN?

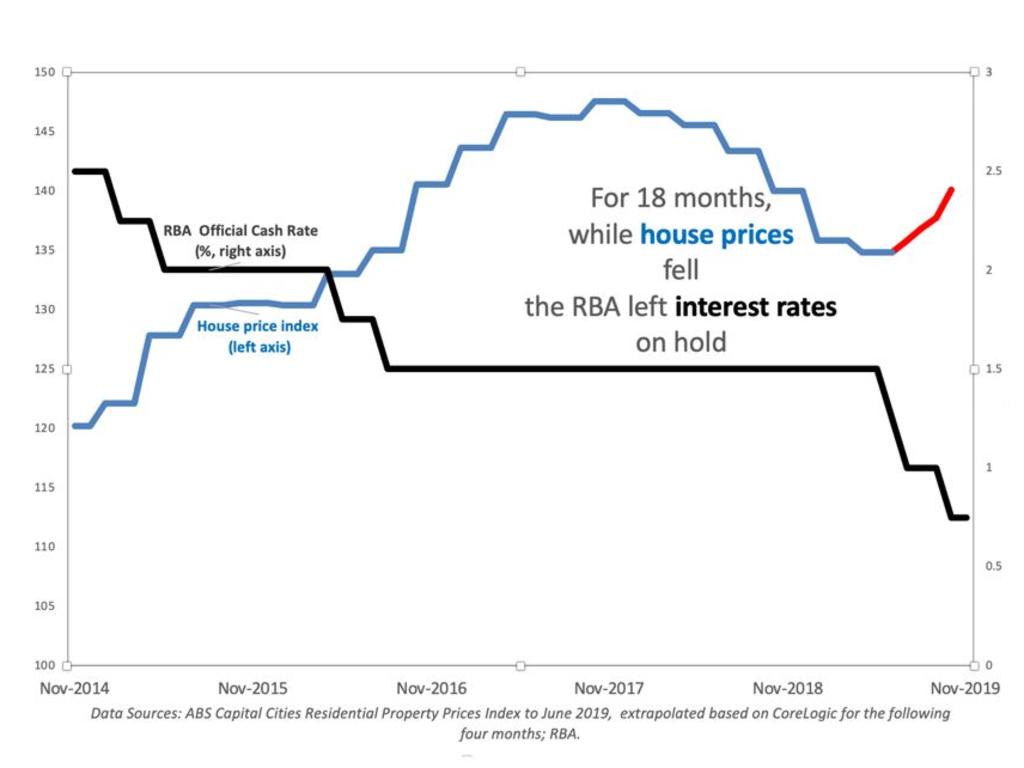

Back in December 2017, Australia’s property price index started falling. Falls had already been going for a while in Perth, and Sydney had turned down by that point. But By December 2017 price falls were big enough for the national index to tip over.

When this happened, the RBA did not react. It left interest rates on hold, as the next graph shows.

It believed this was the right move. I tended to agree. Our housing market was frothy and debt levels were dangerously high. It was helpful for the market to come off a bit, that was the consensus. The risk would develop mostly only if it fell too far and too fast.

The RBA during this period focused on its role in securing Australia’s financial stability, and saw the house price fall as “a welcome development”.

“There was concern in the community about rapidly rising housing prices and debt and declining housing affordability,” said RBA Governor Philip Lowe. “These earlier trends were not sustainable and were posing a medium-term risk to our economy. So a pullback is a welcome development and can put the market on a more sustainable footing.”

The RBA could have cut rates to stop house prices falling. They didn’t. Presumably they saw leaving rates on hold as important in preventing a dangerous housing bubble. We all know Australia’s household debt is at record highs – nearly double disposable income.

Indeed the minutes of an RBA board meeting in 2018 show them considering arguments about “the risks to longer-term sustainable growth from further increases in household debt”. At that meeting they chose to leave rates on hold.

“The Bank has highlighted the issue of household debt as a potential threat to financial stability many times over the past few years,” said Assistant Governor Michele Bullock in early 2019.

All this background is why their current statement arrives with such impact. They were for some time quite sure that a house price fall was worth it. Now, well, it is not so clear. Because now they understand better how deeply woven into the Australian economy housing is. That raises serious questions about whether, next time there is a natural downturn in Australian housing prices, the RBA might try to fight it.

Jason Murphy is an economist @jasemurphy. He is the author of the new book Incentivology.