New property boom looks imminent with a range of indicators pointing to price growth

There’s a lot of uncertainty around Australia’s economy, but there’s huge activity in one area – real estate. A boom is now here.

Uncertainty surrounding the national economy has done little to impact the rapidly growing confidence that another property boom is imminent, new data suggests.

Almost 18 months of declines in median house prices in Australia’s two largest markets – Sydney and Melbourne – ended in June after prices fell more than 10 per cent from their peaks.

But consecutive monthly increases in dwelling values since, coupled with exceptionally high auction clearance rates and a lift in home loan approvals paint a picture of a rebound in real estate fortunes.

Data house CoreLogic said the national home value index recorded its third month of growth in September, up 0.9 per cent across all capital cities.

Sydney is up a cumulative 3.3 per cent and Melbourne up 3.2 per cent in August and September.

With spring in full swing, a traditionally busy time in real estate, industry pundits say the storm clouds look to have cleared and a new period of growth is here.

AUSSIES MORE CONFIDENT

Consumer comparison website finder.com.au has been tracking property sentiment for the past six months and has found the proportion of Australians who think now is the time to buy has lifted since May.

“More and more Aussies are feeling confident about the property market, we’ve found,” money expert Bessie Hassan told news.com.au.

“When we ask whether now is a good time to buy, 59 per cent currently believe that it is, which is up from 54 per cent in May. And 52 per cent think property in their area will increase somewhat or significantly in the next 12 months.”

In Sydney, 53 per cent of those surveyed expected prices to rise in the next year, while 61 per cent in Melbourne also believed values would rise, she said.

This time last year, Saturday auctions in most capital cities were ghost towns where you’d be hard-pressed to find many bidders.

Clearance rates were flat and prices continued a downward trend, with the average time a property spent on the market also higher than it had been for several years.

Since then, Ramon Mitchell, director of Gault & Co Property Advisory, said competition had strengthened among buyers, with bigger offers made and sales completed faster.

“There’s been increased traffic through open house inspections and there seems to have been much higher conversion of these to registered bidders on auction days,” Mr Mitchell said.

“You can see how this has played out in consistent improvement in auction clearance rates – including sales prior to auction.

“There’s no doubt this is having an effect on value – they’re increasing across most of the markets we monitor – particularly in the capital cities.”

Despite high prices making it difficult for first-home buyers to crack the market, research by lenders’ mortgage insurance provider Genworth has found that Millennials remain determined to buy their own home.

RELATED: Sign that property markets are in recovery mode, with investors getting their mojo back

It found 94 per cent of young people consider homeownership a high priority, with 66 per cent of those surveyed hopeful of buying in the next five years.

More than half are working to save a deposit and three-in-four think now is the right time to act.

Genworth’s research also found young Aussies were shifting their expectations in order to meet the market, focusing on different areas or property types.

MORE LISTINGS SHIFTING

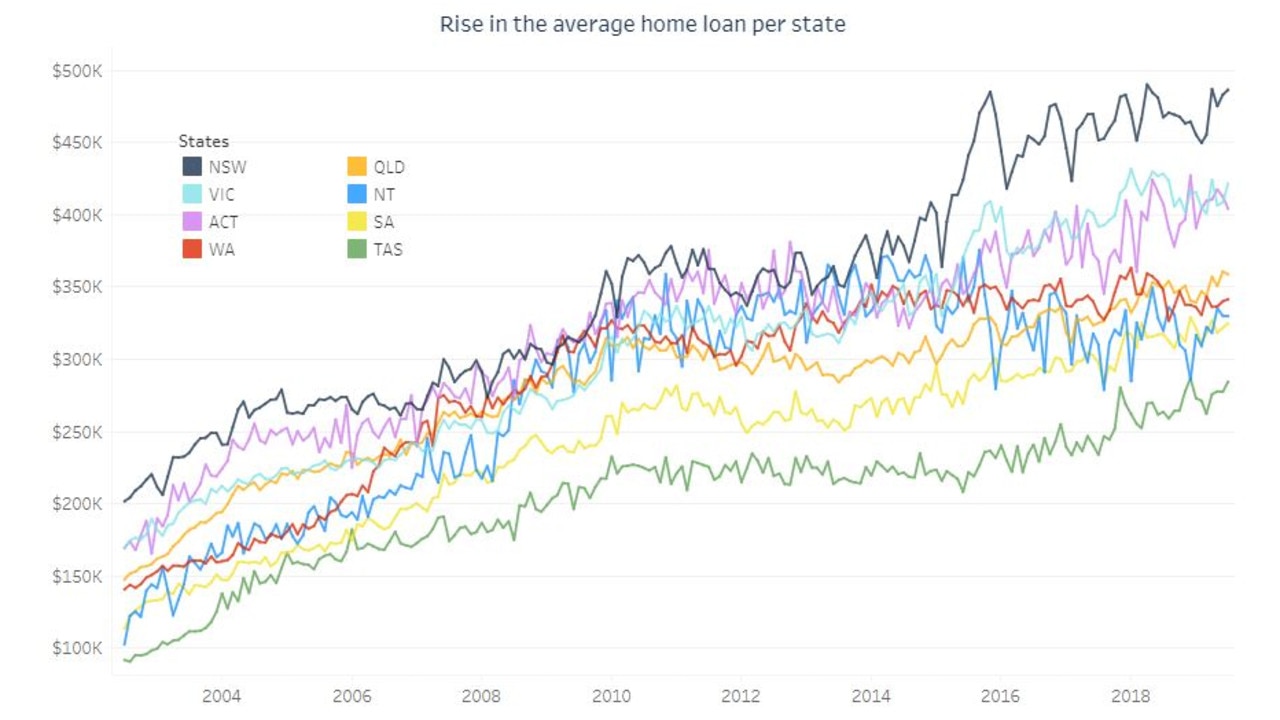

The latest data on monthly home loan approvals from the Australian Bureau of Statistics shows an increase in both the total number of mortgages written in August as well as their value.

There were 32,740 home loans approved in August for owner-occupied homes, up 1.9 per cent on the previous month.

New lending commitments for investment dwellings also rose 5.7 per cent to $4.8 billion in August, with Queensland recording the strongest growth, up 10.4 per cent.

That indicates a renewed confidence among investors, who are historically the first to flee a shaky market and among the last to re-enter a reviving one.

“We’ve seen a bump in house prices in Sydney and Melbourne and the latest ABS figures show a 2.9 per cent increase in the total value of home loans settled in August,” Ms Hassan said.

“That indicates a resurgence in property.

“Auction clearance rates are pushing 70 per cent or more consistently showing strong demand.”

WHAT’S DRIVING GROWTH

Renewed activity from buyers is far outpacing the number of available properties on the market, which is contributing strongly to price increases, Mr Mitchell said.

Stock levels in Sydney and Melbourne, particularly, were historically low, at levels not seen since 2007, he said.

“Many agents are reporting a decline in their listing pipeline by up to 35 per cent from same time last year, which is a substantial drop,” Mr Mitchell said.

“We don’t believe there will be easing of supply (constraints) anytime soon, so buyers can expect more of the same into 2020.”

RELATED: Property upswing set to hit Sydney renters

It seems many would-be sellers were sitting on their hands, hoping to cash in later on a strengthening market, he said.

A sense of certainty after the federal election was combined with the Reserve Bank’s cuts to the official interest rate, Ms Hassan said.

And a number of economists now expect another reduction by the end of the year.

“We don’t yet know if we’re at the bottom of the rates cycle, and there are two more RBA meetings this year,” she said.

Several factors meant buyer groups were set to benefit if they were in a position to act quickly, Mr Mitchell said.

“With the combination of easing of lending restrictions, increased approvals and more foot traffic through a diminished pool of properties, competition is absolutely heating up,” he said.