‘Jobs will be lost’: Construction slowdown to leave thousands unemployed

The Reserve Bank has sounded a rare warning about “huge falls” in a vital sector of the Australian economy — here’s who has the most to fear.

The Reserve Bank has sounded a rare double warning that feels like it could only happen in Australia. A slowdown in building is hurting the economy badly, the central bank says. Yet, paradoxically, another price boom could be set to explode.

The first and most urgent warning is about the construction slowdown. It is more intense than the Reserve Bank (RBA) expected, the deputy governor admitted on Thursday.

“(We) had expected construction activity to remain at a pretty high level for most of this year, but it turned down sooner and by more than we had expected,” Guy Debelle said.

Many, many households in this country depend on someone who works in construction or a related industry. As construction slows down, jobs will be lost.

TOOLS DOWN

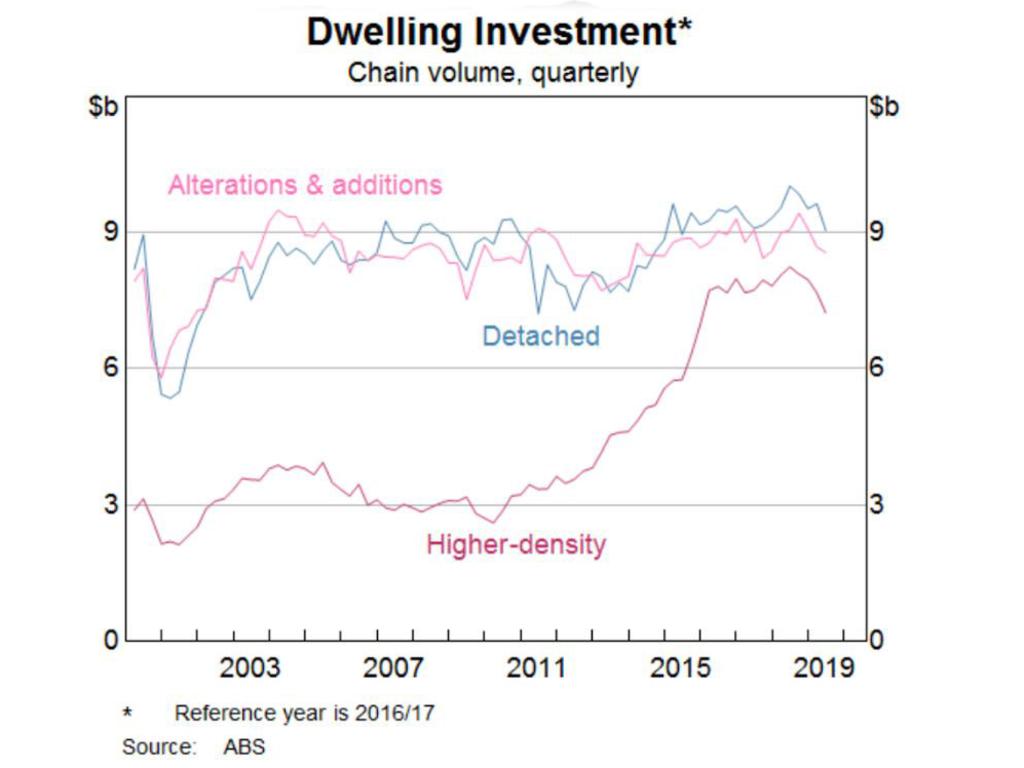

The housing downturn is already biting. We are building less already. As the next graph shows, investment in new high and low-density housing has fallen as well as alterations and additions (renovations).

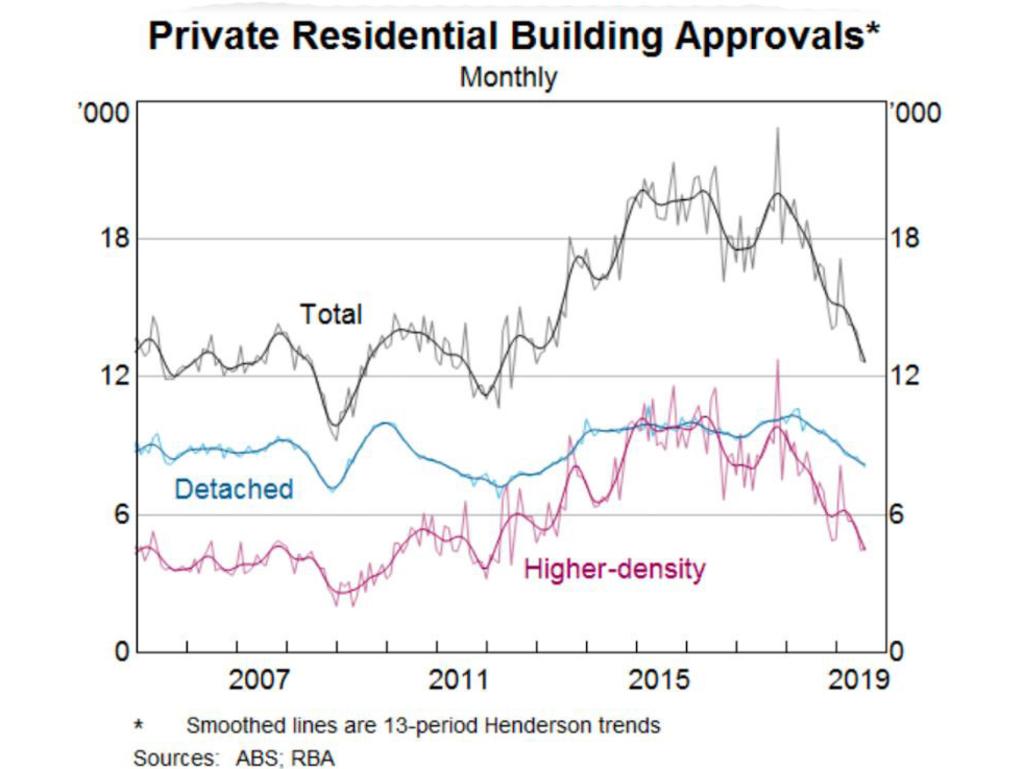

But there is still a long way to fall for higher-density projects if they are going to return to their old levels. And if you look at building approvals, they suggest high-density construction will fall hard when it falls. As the next graph shows, higher-density building approvals are back at 2012 levels.

Building approvals are like a crystal ball for the construction market — they let us see the future because you have to get a project approved before you build it. And what we see in the crystal ball is a distinct absence of activity.

BIG FALLS AND SOON

“We are forecasting a further 7 per cent decline in dwelling investment over the next year, and there is some risk the decline could be even larger,” Dr Debelle said.

That is a huge fall for a vital sector in the Australian economy. Six per cent of Australians work in a construction-related industry, the RBA says.

“The residential construction sector has linkages to the business services sector through architects, draftspeople and construction engineers and to the manufacturing sector through steel, bricks, etc.”

Construction workers who are self-employed or work in smaller firms have the most to fear.

“The outlook for smaller contractors, which are quite prevalent in the housing sector, is not so great in the period ahead,” Dr Debelle said.

If I ran a crane hire business, for example, I’d be worried. The cranes on the horizon of our capital cities are getting higher and higher as the buildings they are constructing are getting taller and taller and closer to being finished. When they pack up, there won’t be much to come for quite some time.

Of course, many construction industry workers have a good set of skills, and they can go into other work on infrastructure projects or other industries. The question is how many of those jobs will there be? The RBA has admitted we are a long way from full employment.

PRICE RISES ARE BACK

There is still more bad news about this economic downturn. The RBA is forecasting it won’t come with any relief on house prices. Quite the opposite, in fact.

The RBA’s second warning is this: House prices are going to bounce back because the fall in construction is going to lead to a shortfall in housing.

“Demand is still continuing to increase given population growth. Prices have turned in Melbourne and Sydney (though not Perth or Darwin), which probably brings the investor back into the market,” Dr Debelle said.

Rising demand in an environment of low building activity sows the seeds of the next boom. “The growth in demand without a meaningful supply response will lead to a larger price response,” he said.

This is a paradoxical situation. It feels like it could only happen in Australia.

House prices surging while the economy slowly dwindles away? It’s like the smell of eucalypts in the morning breeze or the surf crashing on Bondi Beach. It’s quintessentially Australian. Tim Winton should write a book about it.

But how long can it go on for? For how long can we have these two lines on the graph moving apart from each other? And if they do eventually come back together, which one moves? Does the economy catch up or do house prices collapse back?

Jason Murphy is an economist. He is the author of the new book Incentivology. Follow him on Twitter @jasemurphy