Australian suburbs most at risk of defaulting on their mortgage

With interest rates predicted to jump even higher and the cost of living skyrocketing, these are the areas in Australia struggling the most.

Aussies are set to be slammed by further interest rate hikes and the skyrocketing cost of living with new analysis revealing the suburbs across the country that could be most at risk of losing their homes.

Falling house prices are also predicted to impact homeowners in financial trouble, with international credit agency Moody’s Investors Service revealing the postcodes where borrowers are 30 days or more behind on their mortgage repayments.

It comes as Westpac made a chilling prediction that interest rates will increase to 3.1 per cent in November and keep rising to 3.85 per cent.

Moody’s Investors Service has mapped out the suburbs where borrowers have fallen behind on their payments at triple the rate of the national average.

Troubled suburbs that feature in its analysis include Bidwill in western Sydney, Burnside in Melbourne, Burpengary in Brisbane, Mawson Lakes in Adelaide and Alexander Heights in Perth.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Interest rates, which have risen six times this year to 2.6 per cent already, have hit a nine year high and have been forecast to continue to climb this year by all the major banks.

Australian’s are also being battered by the highest inflation in 32 years.

But interest rate rises will pose the biggest risk for mortgages with high balances and where payment amounts are close to borrowers’ maximum repayment capacity, said Alena Chen, vice president at Moody’s Investors Service.

“Falling house prices will increase the risk of home loan delinquencies and defaults, because a weakening housing market will make it harder for borrowers in financial trouble to sell their properties at high enough prices to repay their debt,” she added.

“Over the September 2022 quarter, house prices declined 6.1 per cent in Sydney, 3.7 per cent in Melbourne and 4.1 per cent on average across Australia.”

When the Reserve Bank of Australia (RBA) raised rates from a historic low of 0.1 per cent in May for the first time since 2010, 1.2 per cent of Australian residential mortgages were behind in their payments by 30 days or more, Moody’s data showed.

But more than three per cent of borrowers were behind on their repayments in the outer suburbs of major cities.

Homeowners struggling to meet their monthly repayments are particularly at risk in Sydney’s southwest where 1.77 per cent of mortgages are in arrears.

Fairfield was one of the worst affected with 2.55 per cent of borrowers 30 days or more behind in payments.

The western Sydney suburb of Bidwell’s mortgage delinquency rate sits at 3.22 per cent, higher than the broader Blacktown region’s 1.28 per cent.

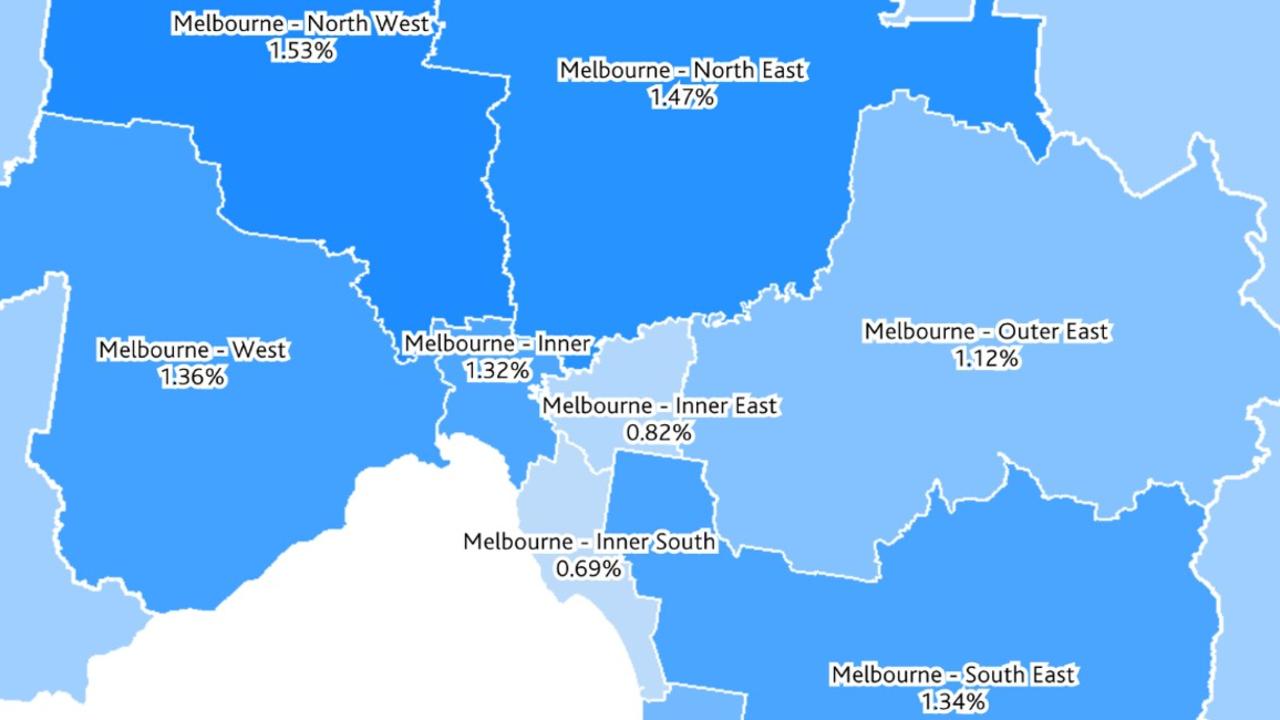

Meanwhile, the Melbourne suburb of Burnside recorded 2.32 per cent of homeowners behind in their payments, well above the 1.53 per cent average in the north west region.

It appears even apartment owners are struggling with Central Melbourne’s mortgage arrear rate sitting at 3.53 per cent – more than double the inner Melbourne at 1.32 per cent.

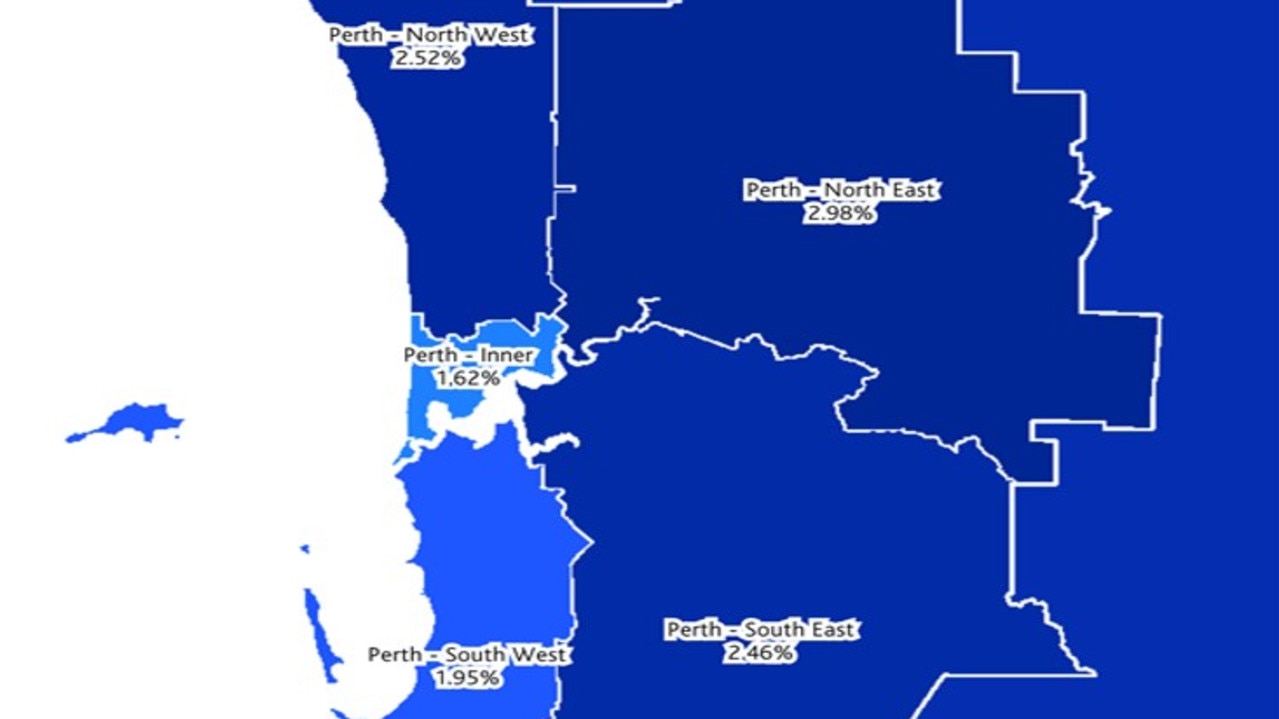

In Perth, the suburb of Bayswater saw 2.78 per cent of borrowers were behind in their repayments, while Alexander Heights it was even higher at 3.12 per cent.

Brisbane’s Morteon Bay north region had the Queensland capital’s highest mortgage delinquency rate of 1.52 per cent overall, although in suburbs such as Burpengary it was more than double that at 3.01 per cent.

In Adelaide’s north, 1.62 per cent of borrowers are behind by at least a month, but suburbs such as Mawson Lakes saw homeowners in more distress with a rate of 2.89 per cent in mortgage arrears.

On a regional basis, the Northern Territory had the highest arrears rate of 2.46 per cent.

Even when it came to the capital cities Darwin had the highest delinquency rate of 2.6 per cent, followed by Perth at 1.7 per cent, then Adelaide with 1.24 per cent and Melbourne at 1.22 per cent.

Mortgage stress was lower in Brisbane at 1.09 per cent, Sydney with 1.01 per cent Hobart at 0.84 per cent and in Canberra just 0.66 per cent.

The data also revealed suburbs where no homeowners were in trouble such as Crows Nest on Sydney’s lower north shore that had a zero arrears rate, as well as North Turramurra on Sydney’s upper north shore.

Commonwealth Bank, NAB and ANZ anticipate the cash rate will be hiked by 0.25 per cent at the RBA’s November and December board meetings.

This would take rates to 3.1 per cent by the end of the year.

ANZ also predicted interest rates will hit 3.85 per cent, which could mean repayments would increase by more than $1000 per month for all mortgages over $500,000 paid off over 25 years.