House prices to plummet by as much as 22.3 per cent by 2023: NAB

House prices are already plunging but are set to take an even bigger hit next year, knocking hundreds of thousands off home values.

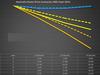

House prices are set to plummet even further next year with an overall drop of 23 per cent in some states between 2022 and 2023, according to the National Australia Bank.

Across Australia, most capital cities apart from Sydney will experience a brutal hit to house prices in 2023 after they shot up during the pandemic, the bank forecasts.

Surprisingly, Hobart will suffer the biggest drop in house prices next year with prices set to plunge by 16.6 per cent, after falling this year by 6.4 per cent, NAB found.

This will result in Hobart house prices dropping by a huge 23 per cent in the space of just two years – meaning as much as $174,000 could be slashed from a median price home worth $758,000.

Wondering what can cause falling house prices? Check out Compare Money's guide >

However, Melbourne house prices were expected to plummet even further at 23.2 per cent in the next two years, the bank’s quarterly survey of the residential property market found.

This would include 9.1 per cent in 2022 before accelerating to 14.1 per cent next year, slashing close to $220,000 off the price of a median three-bedroom home worth $947,000 in the city.

Sydney is expected to suffer the biggest drop in house prices this year at 12.9 per cent, set to be followed by an extra 9.4 per cent in 2023.

This will see house prices plummet by 22.3 per cent overall in one of Australia’s most expensive housing markets, knocking off a whopping $345,000 for a house that costs $1.55 million.

Despite a smaller than expected rate rise this month of 0.25 per cent taking interest rates up to 2.6 per cent in October, higher interest rates are slashing buyers’ borrowing power and are the key driver for falls in property prices, NAB noted in its quarterly survey.

It predicted rates will go as high as 3.1 per cent before being paused.

“Indeed, the two capital cities most bound by affordability constraints – Sydney and Melbourne – have fallen the most,” the report noted.

“To date, Sydney and Melbourne have led the declines, but prices in other capital cities now appear to have also peaked. And the decline in Brisbane has accelerated.”

Brisbane house prices were expected to start gently falling by 0.8 per cent his year before accelerating to 9.4 per cent in 2023.

Both Adelaide and Perth were still expected to make house price gains this year at 9.9 per cent and 1.5 per cent respectively, before plummeting next year.

Adelaide house prices will drop by 16.3 per cent, while Perth will suffer a 13.9 per cent fall in 2023.

Buyers have also been spooked by the rising cost of renovation which is having a “quite

significant” influence and instead means people are looking to buy fully renovated properties, the survey also found.

“Property professionals believe the three most important considerations for homebuyers when deciding to buy a property are the amount they are prepared to borrow to buy (82 per cent), good local amenities (60 per cent) and the size of the house (57 per cent),” the report said.

There continued to be grim news for renters though with little availability and rising rents skyrocketing well above house price growth.

Rents will rise by 3.5 per cent in the next 12 months and 3.8 per cent in two years’ time nationally, according to the survey.

“With rents growing faster than house prices, gross yields should improve, with rents outstripping prices in all states,” the report said.

More Coverage

Rental growth in two years’ time is expected to be fastest in Western Australia at 5.1 per cent, revised up sharply from 2 per cent earlier this year, and by 5 per cent in the Northern Territory, followed by 4.1 per cent in Victoria.

Property professionals in NSW were a little more bullish and now expect rents to grow 3.7 per cent in two years’ time, the survey added.

“Apartment rents are growing most strongly in Sydney and Melbourne – where declines were largest, but are also up well over 10 per cent year-on-year in Brisbane and Adelaide,” it said.