Interest rate rises: One in four Aussie mortgage holders could face financial stress

With another super-sized interest rate rise expected this week, Aussies are facing the worst financial hit in almost 10 years.

There were 942,000 Aussies at risk of mortgage stress after five months of super-sized interest rate hikes, and this figure is only set to rise with another rate hike expected in October.

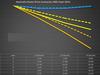

The research from Roy Morgan found that 20.8 per cent of mortgage holders – or one in five – were currently facing mortgage stress, after a series of interest rate rises saw the official cash rate go from a record low of 0.1 per cent in April to 2.35 per cent in September.

This is the highest number of mortgage holders classified as at risk for over three years since May 2019.

However, if the rate is hiked in October and November as predicted, that number will rise again to one in four mortgage holders under financial stress.

It also comes amid warnings house prices could plummet by as much as 43.5 per cent in 2025 in a “worst-case scenario” if super-sized rate hikes continue to be pushed through to tackle the country’s worst inflation in three decades, new analysis found.

This could mean Sydney’s median house price would fall from its 2022 peak of $1.41 million to $796,650 – a $613,350 drop in just three years.

The number of households in mortgage stress jumped by 88,000 from July to September.

Now, if interest rates increase again as predicted by 0.5 per cent in October, the official rate would skyrocket to 2.85 per cent. It would be the highest the rate had been since May 2013.

And, if the Reserve Bank of Australia (RBA) increases interest rates by 0.5 per cent for the next two months, this would mean close to one in four of mortgage holders would be at risk of mortgage stress, the equivalent of 1.1 million people, Roy Morgan research found.

This would be the most mortgage holders classified as at risk since July 2013, just over nine years ago.

Roy Morgan defines mortgage stress as having repayments greater than between 25 per cent and 45 per cent of household income.

Roy Morgan CEO Michele Levine said mortgage stress is on the rise during 2022 as the RBA embarks on its first interest rate increasing cycle in over a decade, but still remains below long-term averages in September despite five straight monthly increases.

“Official interest rates are at 2.35 per cent the highest they have been for over seven years since early 2015,” she said.

“Even so, with just over one in five mortgage holders considered at risk in September 2022 at 20.8 per cent, the level of mortgage stress is still below the long-term average over the last 15 years of 22.7 per cent of mortgage holders considered at risk since October 2007.

“Looking forward, RBA Governor Philip Lowe has stated there will be further interest rate increases to come in the next few months.”

Modelling by Roy Morgan shows that with two additional interest rates increases of 0.5 per cent in both October and November the number of mortgage holders considered at risk would rise by 158,000 to 1.1 million – the highest since July 2013, she said.

“Of more concern is the rise in those mortgage holders considered extremely at risk, now estimated at 620,000 in September 2022 – the highest since May 2019, before anyone had even heard of the coronavirus or Covid-19,” she said.

Borrowers on fixed interest home loans that are due to expire in coming months could be put under mortgage stress by Christmas, experts warn.

Finder analysed Australian Bureau of Statistics data and found $158 billion of fixed rate mortgages set to expire by the end of 2023 could increase repayments by as much as $10,872 per year on average.

But Ms Levine added it was important to consider that interest rates are one factor that determines whether a mortgage holder is considered at risk.

More Coverage

“The variable that has the largest impact on whether a borrower falls into the at risk category is related to household income – which is directly related to employment,” she said.

“These figures suggest that as long as employment levels remain strong the number of mortgage holders considered at risk will not increase to anywhere near the levels experienced during the Global Financial Crisis in 2007-2009 when well over 30 per cent of mortgage holders were considered at risk – including a peak of 35.6 per cent in May 2008.”

However, economists fear that Australia could be headed towards recession as world markets face a meltdown.