Aussie’s punishing 7.74 per cent mortgage interest rate

An Australian man is revealing the “ludicrous” situation he is facing when it comes to his mortgage.

A landlord has been forced to hike his tenant’s rent by $100 a week after his bank, which he has been a loyal customer of for 40 years, refused to drop his interest rate after it rolled off its low fixed rate.

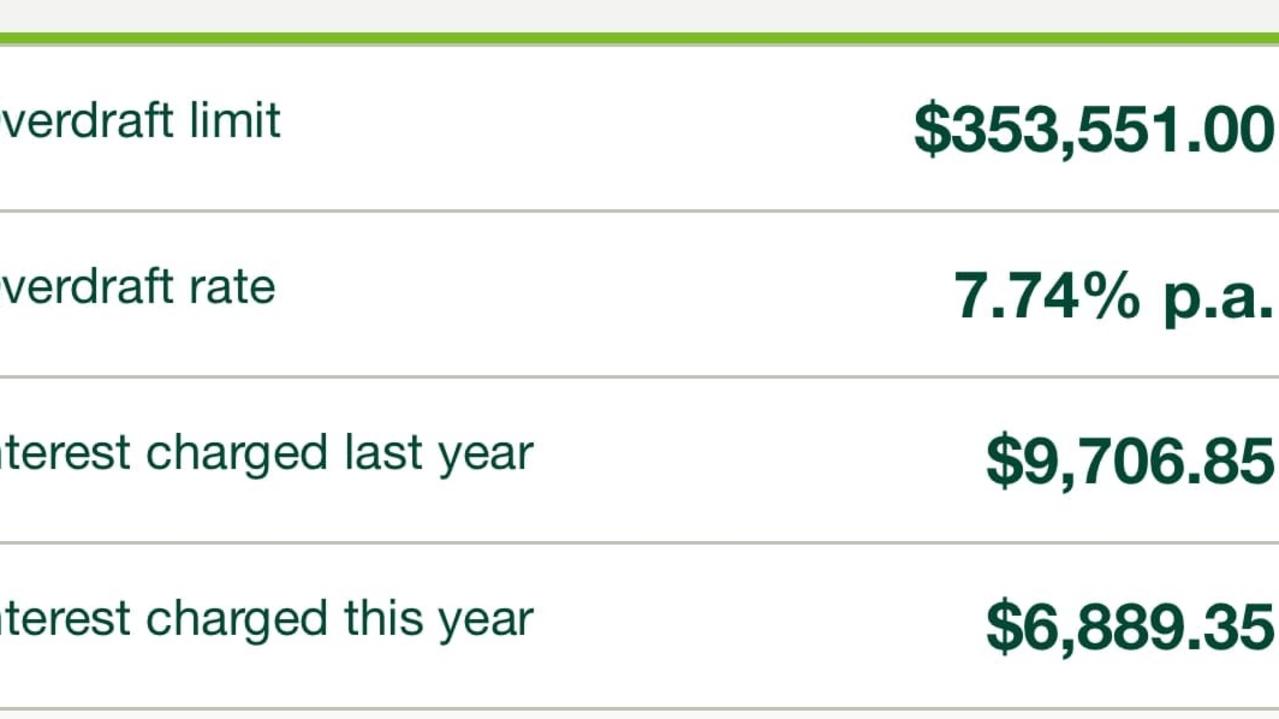

Barney Cservak is now having to pay a punishing 7.74 per cent on his St George loan, although the bank initially suggested another extraordinarily high rate, he said.

The NSW man had an investment loan for $353,000 and when interest rates dropped to record lows during the pandemic, he took up a fixed rate of 2.99 per cent for three years.

“St George sent me an email and said my fixed rate was expiring and offered me an interest rate of just under 10 per cent but said they would bring it down to 7.74 per cent,” he added.

In May, he requested a more competitive rate – conscious his fixed rate was ending in June – adding he was led to believe by St George that he could refinance.

But Mr Cservak attempts to refinance have so far been futile.

St George had initially indicated a standard variable rate of 6.49 per cent would be possible, according to Mr Cservak, so he supplied the relevant documents at the end of May but “things went a bit cold for a few weeks”.

“I got a call from the branch manager advising me that they would not offer a rate less than 7.74 per cent,” he told news.com.au.

The retired project manager said bizarrely he has to prove he can afford to pay the higher mortgage amount for the next three months before the bank will even consider him for the lower rate.

“In the bank’s view, either you are earning an income and can service or you can’t service it – this is crazy. At the end of the day it means the people that are renting my rental property, I had to up the rent nearly $100 a week, but I’m still wearing the balance,” he explained.

“I had to draw off my super to top it off to keep the mortgage going. It seems unreasonable that St George are more than happy for me to fork out nearly $2400 a month and not $2100 a month. At the end of the day, it’s either pass on the increase or absorb it but it just doesn’t make sense.”

Do you have a story? Contact sarah.sharples@news.com.au

Mr Cservak said the lower interest rate had originally saved him around $900 a month and he did the right thing for the tenants in his Blue Mountains’ property.

“I kept their (rent) down low at $255 a week, which is well below market rate, but then I had little choice to pass it on when the interest rate went up,” he said.

“I’m very reluctant to do it, but the problem is St George. They are very reluctant to show me some sort of latitude on the interest rate.”

Complicating matters is the changeover to the higher rate resulted in a shortfall for one payment of about $1300, despite deductions coming out automatically. When he was alerted by St George, he rectified the mistake.

“This shortfall was promptly paid, although I commented that all payments should be automatic,” he said.

However, Mr Cservak believes it has essentially left a black mark against his credit record.

He has been left frustrated and describes the situation as “ludicrous”.

“I’ve got a bit of a sour taste in my mouth with the way the system works. With St George on paper I can’t afford the repayments as I am retired so I can’t afford to renegotiate and refinance,” he said.

“I don’t meet all the current criteria and they are more than happy to continue on as if nothing has happened.”

The lower rate would save him around $60 a week, he estimated.

The 69-year-old added loyalty counts for nothing after being with the bank for decades.

“I think when you get to certain point and you are not in the workforce and you have been loyal they can see it’s going to be difficult for you to switch as you don’t meet current eligibility criteria and as a result you are disadvantaged,” he said.

“Banks in general should have a look at older people and say hang on second just because you can’t afford a 30 year principal and interest loan doesn’t mean, they are going to miss out.

“The property is going to the estate and the banks won’t lose. Banks need reassess the way they test the applications and refinancing in a situation that I’m in at the moment.”

Mr Cservak even engaged Aussie Home Loans and despite a lot of correspondence there has still been no progress.

He was told by their mortgage broker in September that St George will not consider an application to switch until Mr Cservak can demonstrate three months of full repayment of the loan at the new interest rates.

A St George spokesperson said the bank takes multiple factors into account when determining an applicant’s eligibility for banking products.

“We’re unable to comment on individual customer matters,” they added.

sarah.sharples@news.com.au