Federal Budget 2020: Why Australia’s record-breaking debt isn’t as bad as it seems

Australians may be worried about the sheer amount of debt the country is taking on but one figure shows it’s actually not as bad as it looks.

The Morrison Government’s response to the coronavirus pandemic will put Australia into a historic amount of debt but the news is not as bad as it seems.

Tuesday night’s Budget revealed a monster deficit of $213 billion this year and a record net debt of $966 billion by 2024.

So how much is this exactly?

Sydney Morning Herald political editor Peter Hartcher put it into some context.

“(Gough) Whitlam’s biggest budget deficit was equal to 1.8 per cent of GDP. Paul Keating’s was 4.1, during Australia’s last recession,” he wrote in an opinion piece.

“This budget expects to be in deficit by 11 per cent of GDP, or $213 billion. It is an extraordinary deficit and it will usher in an era of extraordinary debt.”

Yes, it is a staggering amount of debt.

Hartcher noted, and many others agree, the debt is necessary to kickstart the economy and create jobs.

But many might be worried about the eye-watering amounts involved, and how much it will cost to pay back.

RELATED: Will you spend or save the extra cash from the Budget? Have your say

Interestingly though, it’s not going to be as bad as you might think. In fact, it will actually be better.

Despite having a lot more debt than before, Australia will actually be paying less interest each year than it was prior to the pandemic thanks to historically low interest rates.

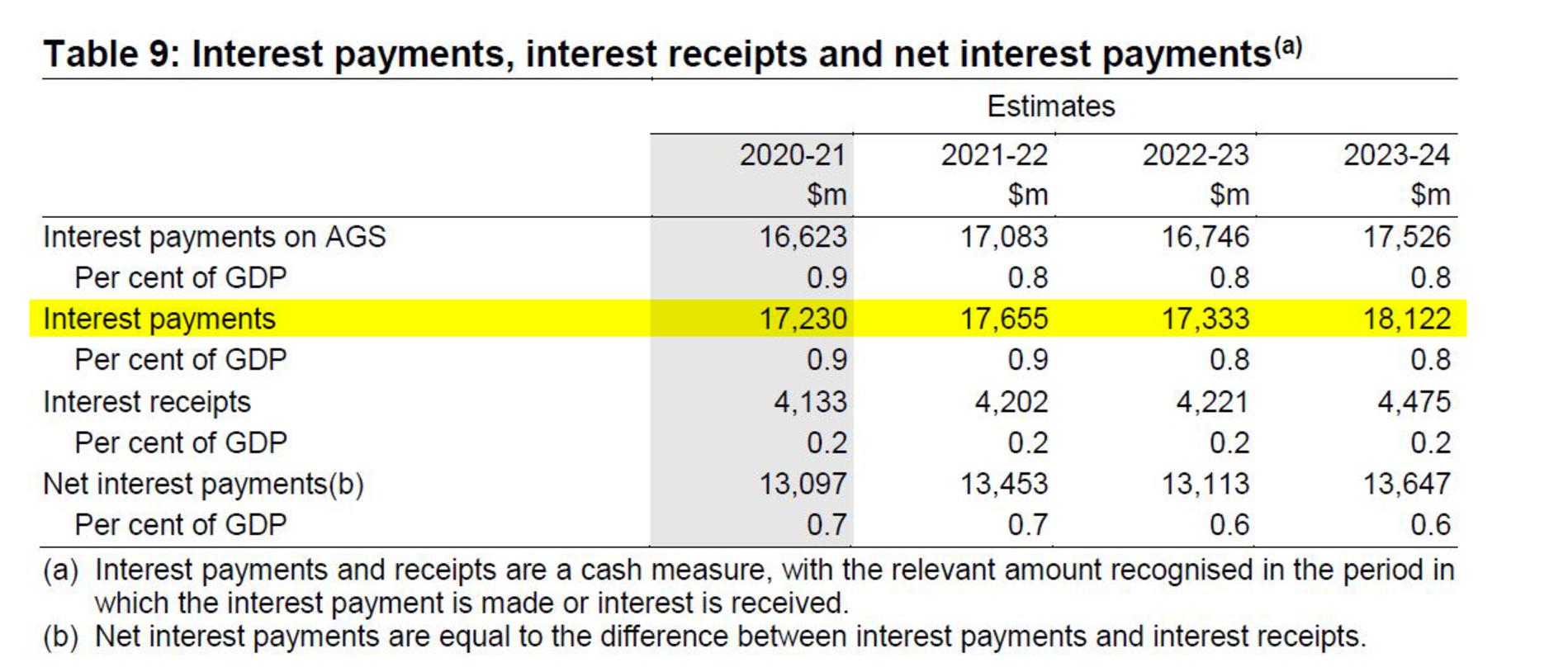

Deloitte Access Economics partner Chris Richardson told news.com.au that Australia’s interest payments before the pandemic were $19.0 billion in 2018/19. In the next four years they are expected to be lower — around $17 billion or $18 billion a year — according to Budget forecasts.

“People might be thinking ‘what the hell?’ surely they would be higher? But it’s the cost of debt that’s the important thing,” Mr Richardson said.

“While the amount of debt has gone up, interest has gone way down.”

He said new debt would benefit from interest rates that were “cheap as chips”, and as Australia’s old debt matures, it can also be rolled over to these bargain basement interest rates.

“I worry that people worry too much, they see the really big numbers and assume we’re buggered, that the future is buggered and spending will have to be chopped,” Mr Richardson said.

“There’s lots of things to be worried about due to the pandemic but debt isn’t one of them.

“The cost of defending our lives and livelihoods has been much cheaper than people realise.”

RELATED: What the Budget means for you

RELATED: How to get your backdated tax cut

Mr Richardson said in some cases the money had been borrowed at low rates for 10 years or even 30 years, but he also believes, like many other economists, that interest rates will remain low for years to come.

He says the high level of spending has been necessary and the alternative was much worse unemployment.

“This has been the right thing to do,” he said.

“It’s been a very big war for our health and the main beneficiaries have been older Australians. Now we are swinging into a war for jobs and the main beneficiaries will be young Australians.

“We have not been perfect but we have been brilliant,” Mr Richardson said, referring to Australia’s coronavirus response.

“When you compare Australia’s response on the virus and economy, the outcomes on both so far have been absolutely world class.”

However, Cian Hussey, a research fellow at conservative think tank, the Institute of Public Affairs told news.com.au that many Australians will be dead by the time the debt is paid off.

“On very optimistic projections, we don’t think Australia will be debt-free until the early 2080s,” Mr Hussey said.

The IPA has modelled two scenarios, one in which gross debt peaks at $1.92 trillion in 2037, the budget returns to surplus the following year, and the debt is paid off by 2063.

The second scenario has debt peaking at $2.05 trillion in 2042, a return to surplus in 2046, and the debt paid off by 2080.

In the first scenario, GDP stabilises at 5 per cent, whereas in the second it settles at 3 per cent.

Australian Financial Review political editor Phillip Coorey pointed out that net debt is expected to peak at $966 billion in 2024 and will still be 40 per cent of GDP in a decade.

But he noted that most of the Budget initiatives, such as wage subsidies and the business investment allowance, could be turned off when unemployment falls below 6 per cent, forecast to be 2023-24.

“The huge deficit will decline quickly, again something the budget demonstrates with the deficit falling from $213.7 billion this financial year to a still hefty $66.9 billion by the end of the forward estimates (in four years),” he wrote.

RELATED: Winners and losers in the Budget

Providing further context on the spending, Prime Minister Scott Morrison noted that the infrastructure spending far exceeded what was spent on the Sydney Opera House, which he said would have cost about $800 million to build today.

“We’ve got $7.5 billion extra in infrastructure investment that’s been brought forward,” he told 4BC this morning.

Not everyone is happy with the government’s cash splash, with Labor shadow treasurer Jim Chalmers telling SBS some important areas had been missed.

“I think it’s a rare feat to rack up more than a trillion dollars in debt and still leave so many people behind,” Mr Chalmers said.

“No plan for the future, doesn’t make enough inroads into unemployment which is still too high for too long.

“In terms of what’s not in the budget; a trillion dollars in debt and nothing for the care economy, nothing meaningful for climate change, no local jobs programs. All of these sorts of things missed out.”