The hidden factor experts say proves the Aussie property boom is a lie

The Australian property market is skyrocketing. But experts fear there’s one factor that is masking the real truth.

Since the pandemic arrived on our shores a little over a year ago, the Australian property market has been on quite the rollercoaster of highs and lows.

This time last year, sellers were often accepting 10 per cent below their asking price and predictions of prices falling almost a third were coming from some of the big four banks.

But with record-low interest rates and government stimulus starting to flow into housing, the broader market bottomed out and began its climb to current heights.

Rather than crashing, property prices are currently growing at the fastest rate since the late 1980s.

But there is another side to this story, without which the current housing boom may be far less strong — or perhaps not even happening at all.

The Bank of Mum and Dad.

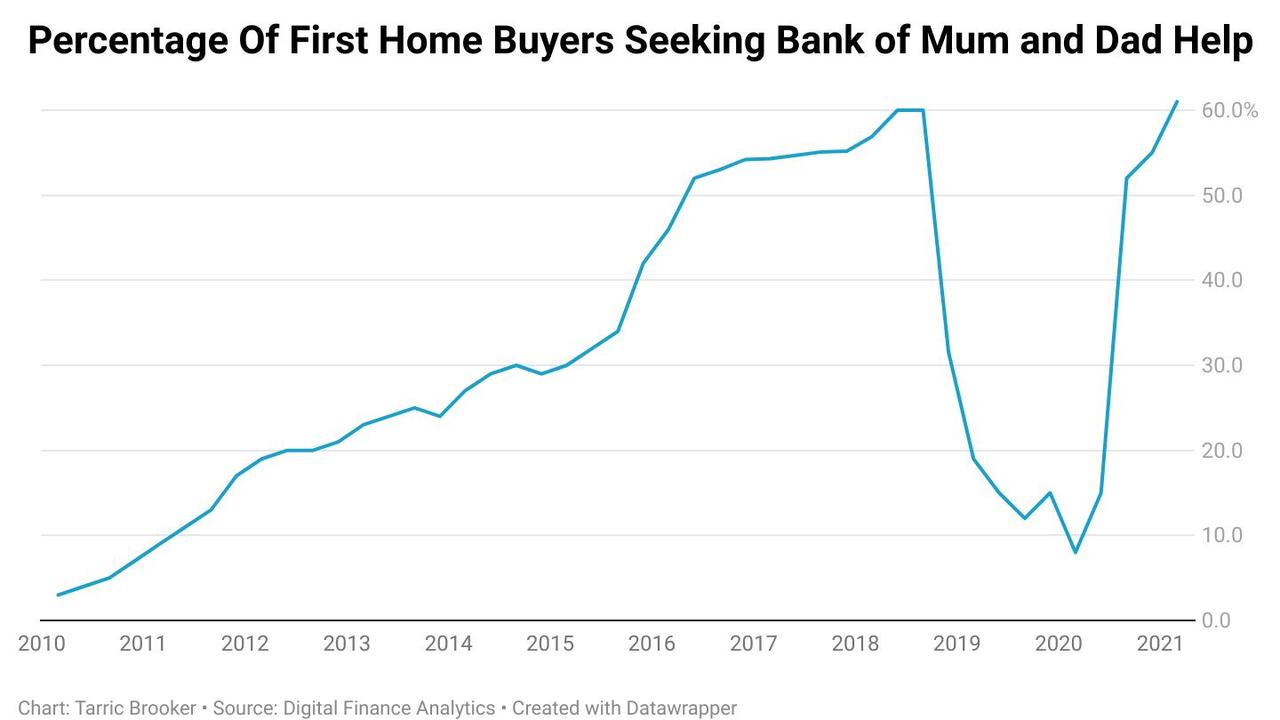

According to Digital Finance Analytics (DFA) data, in March last year, just 8 per cent of first homebuyers were receiving support from their parents.

This was before the rate cuts and the pandemic began to significantly impact the housing market.

RELATED: Two factors that could halt Aussie house price boom

This was the lowest proportion of first homebuyers receiving support from parents since 2011.

Just six months later more than half of all first homebuyers were relying on help from the Bank of Mum and Dad in order to achieve their dream of home ownership.

According to DFA’s latest figures, more than 60 per cent of first homebuyers are now receiving help from their parents to put down a deposit on a property.

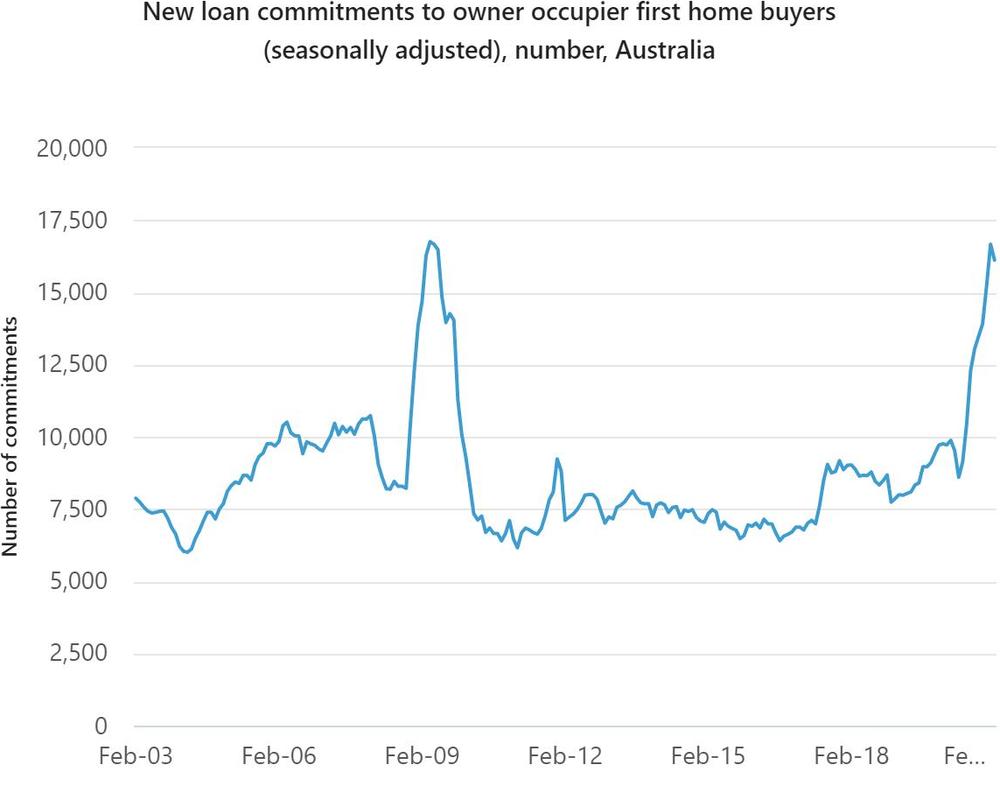

As parents increasingly come to the aid of their adult children, the number of first homebuyers purchasing properties has risen by 93.8 per cent, according to figures from the Australian Bureau of Statistics.

RELATED: Australian industry heading for apocalypse

Only during the height of the property mania driven by the Rudd government’s first homeowner grants was the number of first homebuyers greater than it is now.

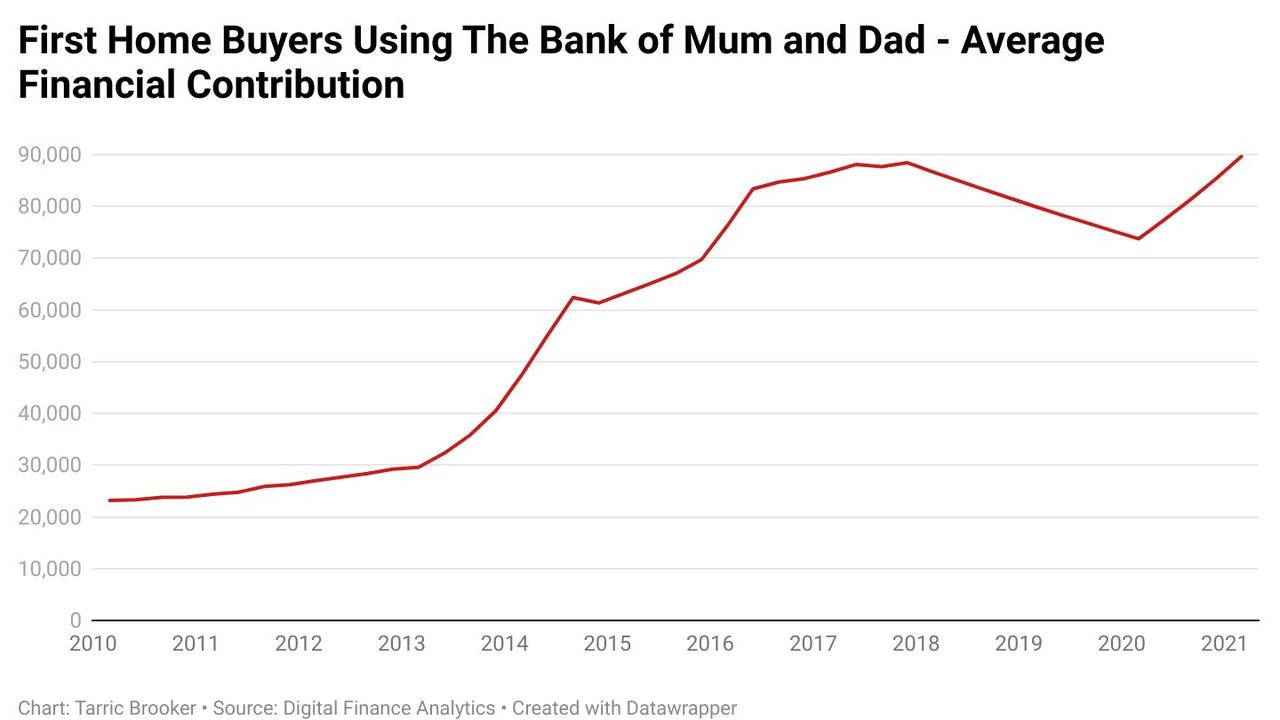

Parents generally aren’t exactly just chipping in a little bit of extra cash to top up a deposit either.

As of March, the average amount of assistance parents were providing their first homebuyer children for their deposits was almost $90,000.

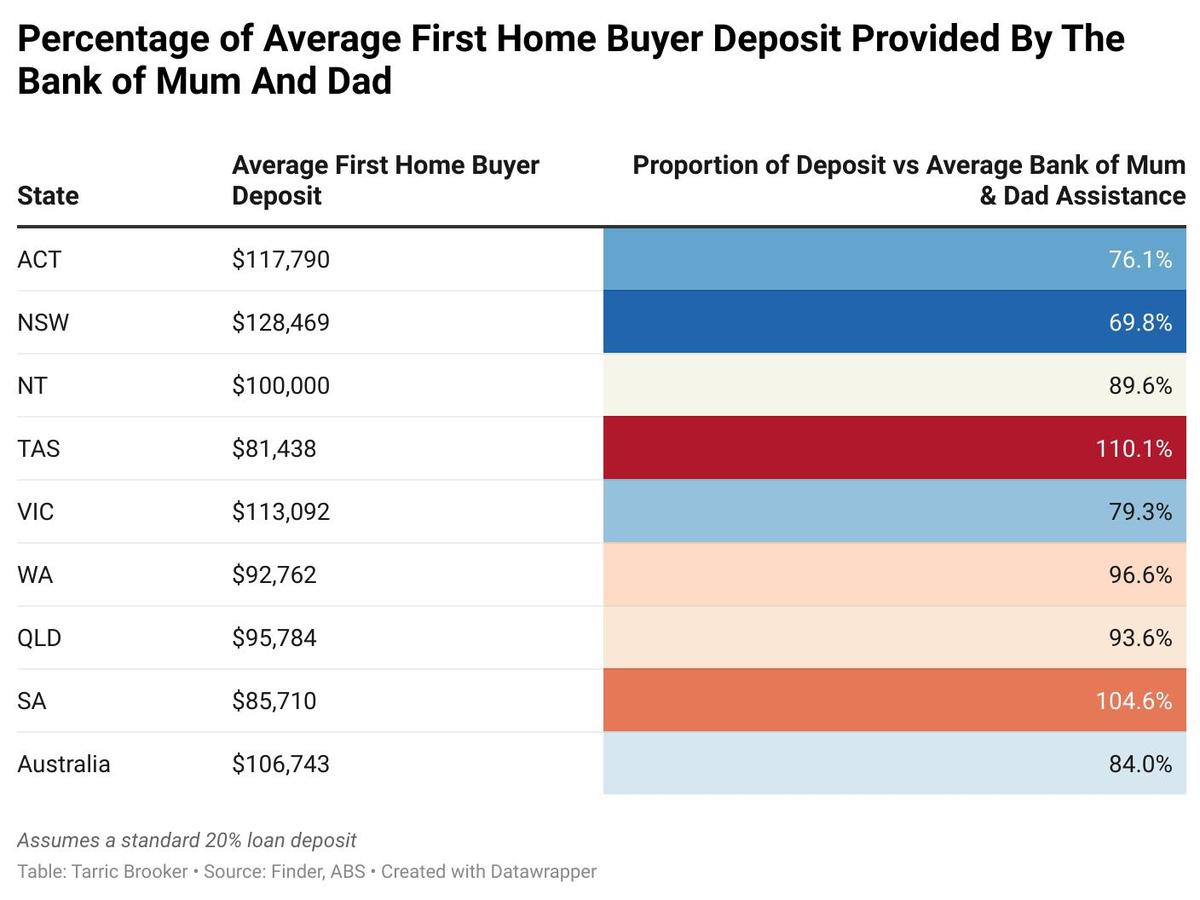

Based on the average first homebuyer deposit amount of $106,743, the Bank of Mum and Dad is providing an average of 84 per cent of the total required deposit for the more 60 per cent of first homebuyers that are receiving parental assistance.

The averages are no doubt skewed by some parents providing their children with very large sums of money for deposits on more expensive homes, particularly in Sydney and Melbourne.

Overall the data presents a picture of a first homebuyer cohort increasingly supported by the Bank of Mum and Dad to get into the market, despite the fact interest rates are at record lows.

The data also suggests they were seemingly doing OK without them a little over a year ago.

In fact, funds for a first home from the Bank of Mum and Dad has become the nation’s ninth largest lender, with Aussie mums and dads collectively loaning or gifting more than $33.6 billion to their children for home deposits.

For a first homebuyer receiving the average amount of assistance from their parents and getting the average loan, they would only need to come up with a little over $17,000 – a far cry from the more than $106,000 they would need to come up with if they were on their own.

Just a few years of saving, or a few cheeky rounds of superannuation withdrawals (as many did), and hey presto, with the help of the Bank of Mum and Dad you’ve got yourself a newly minted homeowner.

For higher income earning prospective first homebuyers, the assistance of parents can have even greater impacts on house prices.

With a standard loan requiring a 20 per cent deposit, every $1 a parent provides in assistance is another $4 a prospective first homebuyer can borrow, provided they earn enough to satisfy their lender.

Arguably at least partially as a result of the increased support by parents, the average loan size of first homebuyers has risen by around 20 per cent.

According to DFA principal Martin North, the Bank of Mum and Dad has provided a huge boost to the housing market.

“Around 60 per cent of first homebuyers currently getting into the market are doing so with the help of the Bank of Mum and Dad,” Mr North said.

“Without this factor the property market wouldn’t be nearly as strong.”

But it’s not all good news for the first homebuyers who use parental assistance to leapfrog their rivals.

“There is a three times greater probability of a Bank of Mum and Dad-enabled purchaser defaulting on their loan within five years compared with a more normal first homebuyer,” Mr North said.

“It’s because some haven’t had the long-term experience of saving.”

With the high proportion of first homebuyers receiving parental assistance enabling near record numbers of purchasers to get into the market, it’s clear this demographic is a major driving force of the current price boom.

Without the tens of thousands of mums and dads who played bank manager for their adult children, the current property boom would likely be significantly weaker – or perhaps not even a boom at all.

But this raises an important question for first homebuyers and the broader property market going forward.

How many more parents are going to be willing and able to provide each of their children with an average of around $90,000 to buy a home?

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator