The two factors that could halt Aussie house price boom

House prices are soaring at unprecedented levels, but a strange combination could soon see the Aussie house market go haywire.

This time last year there were fears from economists and the major banks that Aussie housing prices could crash, with predictions of up to 32 per cent price falls coming from even the most mainstream of forecasters.

Now 12 months later you’d be hard pressed to find any forecaster expecting lower housing prices in the short term, let alone a historic housing crash.

According to figures from housing price data provider CoreLogic, housing prices are currently rising at the fastest rate since 1988, a time when the average Aussie home could be purchased for around $100,000.

But as the global economy continues down the long path to recovery from the coronavirus pandemic, there is a threat on the horizon that grows more concerning for the Aussie housing market with each passing day, inflation or in some cases the expectation of future inflation.

RELATED: The suburbs set for big price hikes

How does inflation impact house prices?

Inflation is an issue for the property market for two main reasons. Once inflation exceeds the upper limit of the RBA’s 2 per cent to 3 per cent target band, historically pressure rises on the RBA to raise interest rates.

Then there is the ultimate arbiter of global interest rates, the bond market. As inflation and expectations of future inflation rise, bond market participants generally begin to demand higher interest rates to offset the inflation eating away at their returns.

With inflation expectations continuing to rise globally and particularly in the United States, the bond market has already started demanding higher interest rates.

Since hitting their crisis lows, the effective cost of the US government borrowing for 10 years has risen by up to 250 per cent, with speculation continuing to grow that it could go even higher.

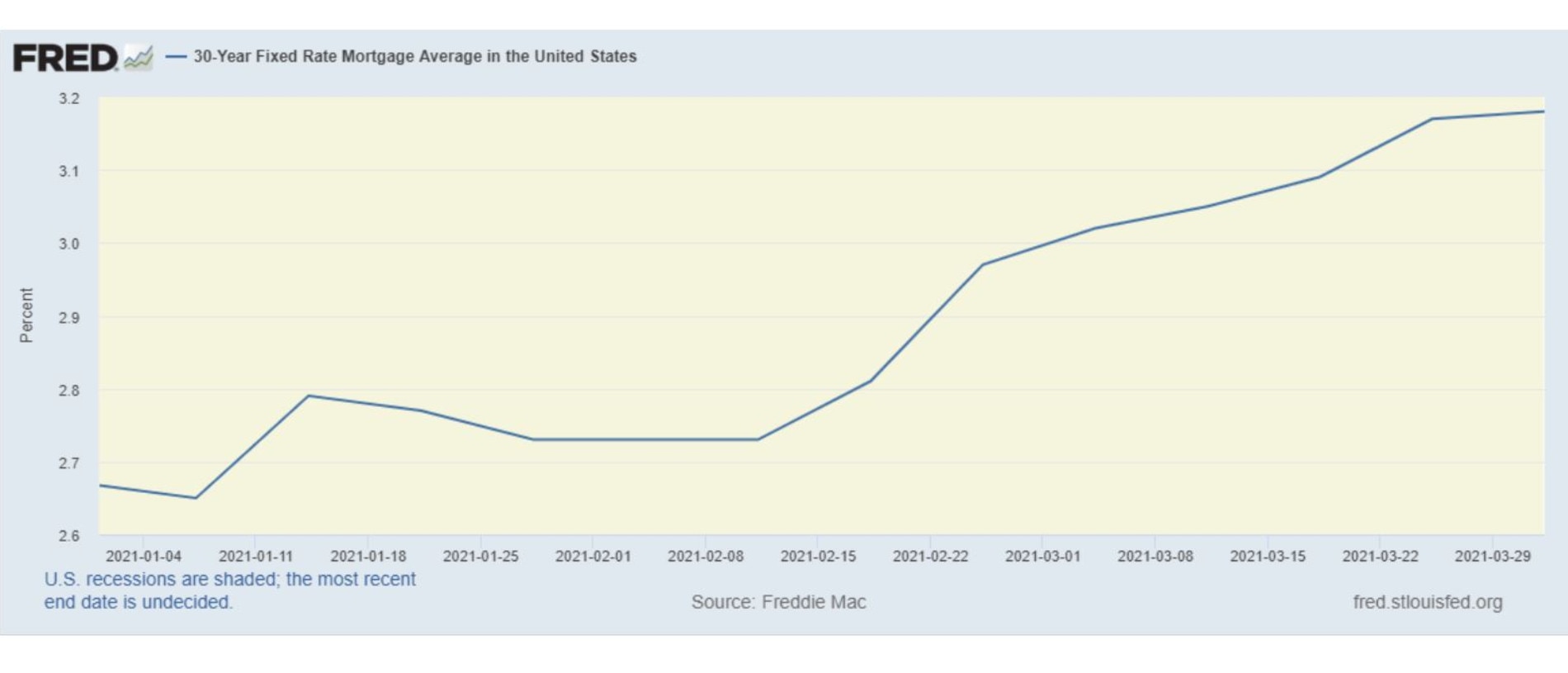

As a result, the standard 30-year US mortgage rate has already risen by 0.53 per cent in less than three months.

RELATED: Warning on booming house prices

But the expectations of higher inflation and rising interest rates may be just beginning.

Global supply chain disruptions, material shortages and rising shipping costs are already putting significant pressure on manufacturers to raise their prices.

According to data from the Philadelphia branch of the US Federal Reserve, prices paid by manufacturers have risen to the highest level since March 1980.

The Suez Canal effect

Now, enter everyone’s favourite green 200,000 tonne container ship, the MV Ever Given and its temporary home wedged in the Eastern bank of the Suez Canal.

After delaying traffic through one of the most vital waterways in the world for almost a week, many major European ports are already feeling the stress from the backlog of ships delayed by the Ever Given’s now infamous adventure.

RELATED: Why you should keep renting

Caroline Becquart, senior Vice President at Mediterranean Shipping Company recently shared her thoughts on the issue with shipping news website Splash.

“We envisage the second quarter of 2021 being more disrupted than the first three months, and perhaps even more challenging than it was at the end of last year. Companies should expect the Suez blockage to lead to a constriction in shipping capacity and equipment, and consequently, some deterioration in supply chain reliability issues over the coming months.” Becquart said

Joe Biden’s $2 trillion stimulus package

There is also another major potential driver of inflation that the bond market is very concerned with, US President Joe Biden’s stimulus packages.

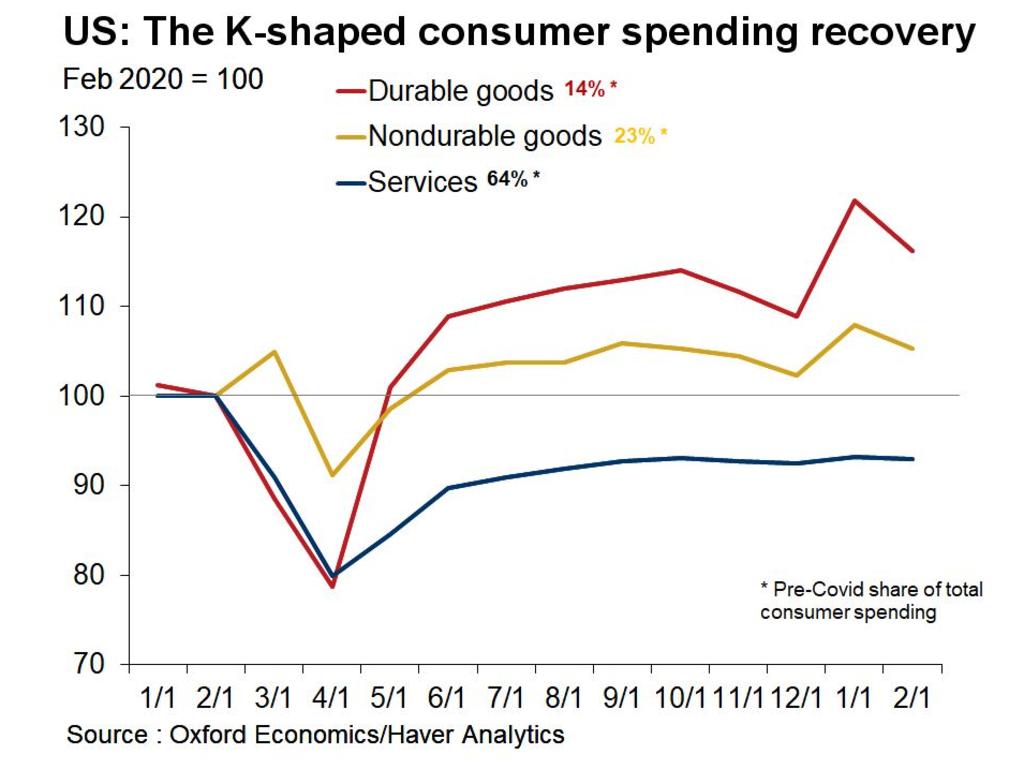

Even as things sit today there has been a pandemic driven push toward consumers focusing their spending on goods, rather than services. This has placed increased demand on manufacturers and importers already struggling to get the stock they need, due to global supply chain issues.

RELATED: Big myth about housing boom

With trillions of dollars more stimulus still expected from the Biden administrations infrastructure plan and yet another stimulus package to potentially come after that, there are concerns this wash of cash could place upward pressure on inflation.

But as the Democratic Party continues to settle into its new position of power holding the White House and a majority in Congress and the Senate, there are number of Democrats who want to do their best impersonation of a daytime TV infomercial with an impromptu “but wait there’s more”.

A group of 21 Democrat Senators (a little over one fifth the US Senate) asked President Biden to include recurring stimulus checks in his upcoming “Build Back Better” recovery proposal.

Prominent Congresswoman and left wing standard bearer Rep. Alexandria Ocasio-Cortez has urged the Biden administration to go even further. Stating that Biden’s more than $2 trillion infrastructure stimulus plan should go “way higher”.

Ocasio-Cortez suggested in a recent interview that the ideal number was “realistically $10 trillion over 10 years”.

With supply chain issues expected to continue for the foreseeable future in one hand and the possibility of trillions more stimulus from the Biden administration in the other, concern continues to mount that inflation could drive government borrowing costs significantly higher.

While the US Federal Reserve, European Central Bank and a long list of economists believe the current supply chain disruption and stimulus driven inflation will be “transitory”, it’s ultimately the opinion of the broader bond market that will decide the direction of global rates in the short term.

But how does this all affect Aussie house prices?

This brings us back to many Australians favourite topic, housing prices.

If the inflation that results from US stimulus and global supply chain issues is short lived and less severe than expected, then property investors can sleep soundly in the knowledge that the housing price boom is likely to continue.

However, if the resulting inflation ends up being significantly more sustained and severe than expected, then it could be quite a different story.

There are already warnings from the International Monetary Fund that rising US interest rates could trigger overpriced assets, such as Aussie housing to “unwind in a disorderly manner”.

Whether the property pundits will be as right in predicting a boom this year, as they were wrong about a bust in 2020 remains to be seen. But as one looks out over our nation and the current rate cut driven boom, one has to ask if rate cuts drive higher housing prices, what would higher interest rates do?

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator