Super withdrawals could see Aussie housing market supercharged

Over 600,000 Aussies made this financial move in the pandemic. Now a proposed change would see it happen even more. The effect would be profound.

There are few things in this world that can get Australians talking as much as property prices. Whether it’s talking negatively geared investment properties at a backyard barbecue or first homebuyers discussing a potential purchase around the dinner table, property is never far from many people’s minds.

And since the pandemic began, avid watchers of Aussie real estate have certainly had a lot to talk about.

But as the property market heats up for what some analysts are predicting will be a boom year, there is one factor playing a role in the ongoing price growth which may have been overlooked. Superannuation withdrawals.

RELATED: Huge change 95 per cent of Aussies want

When the Morrison Government first allowed people to withdraw up to $20,000 from their superannuation from April last year, it was ostensibly intended as a measure to help struggling households through the worst of the pandemic.

During the roughly nine-month life of the program, around 3.5 million people withdrew a cumulative $36 billion, with around 500,000 all but emptying their accounts entirely.

While the Government’s intention may have been for super withdrawals to provide a much-needed boost to household budgets during the pandemic, it didn’t really end up working out that way for many who made one or more withdrawals.

According to figures from analytics firm AlphaBeta, in the two weeks following a superannuation withdrawal, 64 per cent of additional spending was on non-essentials, including clothing, furniture, takeaways, alcohol and gambling.

But some shall we say “enterprising” folks have used their super withdrawals for a very different purpose – a deposit for a home.

RELATED: Dire warning for Aussie house prices

According to figures from research firm Digital Finance Analytics (DFA), 22 per cent of first homebuyers who have purchased a property in the last six months did so with a deposit at least partially made up by withdrawals from their superannuation. A further half of those withdrew the maximum $20,000 from their super over the course of the policy’s two rounds.

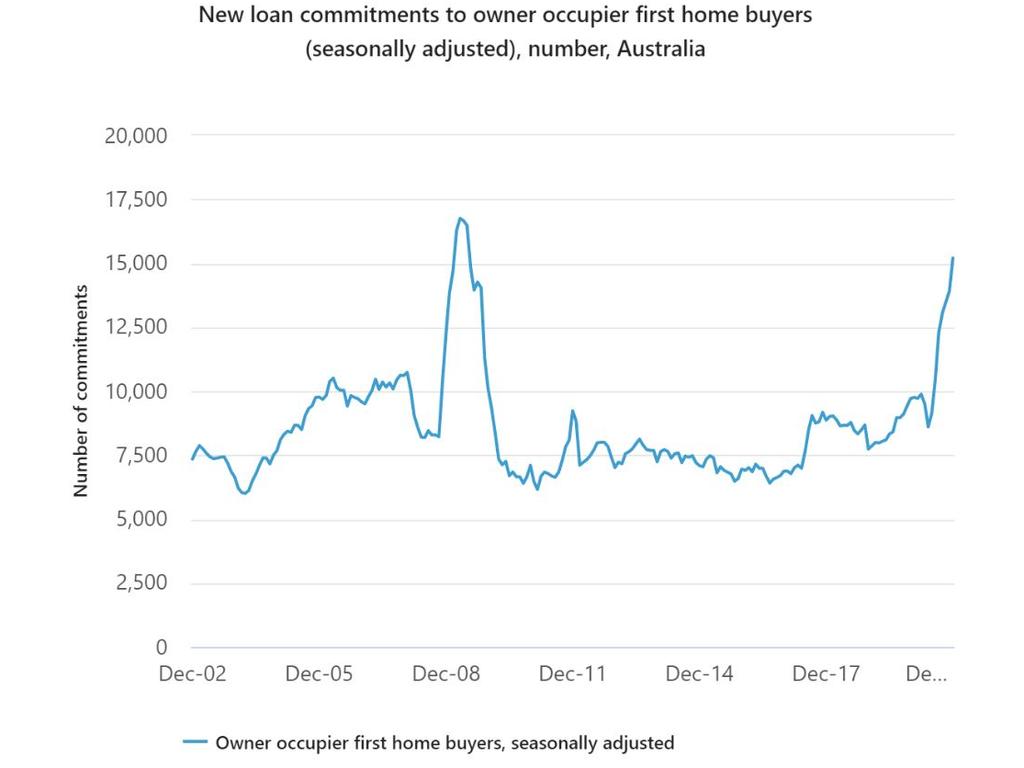

It is true that first homebuyer activity in the market was trending up before the pandemic hit, but since COVID-19 arrived it has become a driving force supporting rising property prices.

According to data from the Australian Bureau of Statistics (ABS), in December 2019, just before the pandemic arrived, there were 9719 first homebuyer finance commitments. For December 2020, the number of first homebuyers making finance commitments had rocketed 56.4 per cent to 15,205.

This explosion in demand has seen the number of first homebuyer finance commitments rise to the highest level in over 11 years and very nearly the highest on record. Only the period dominated by the Rudd government’s first homebuyer grants in 2009 showed a higher level of activity.

Meanwhile, there are reports that some banks will not recognise super withdrawals as savings appropriate to be used for a deposit for three months after the withdrawal was made.

With housing turnover still sitting near multi-decade lows, despite a recent uptick from a lockdown-impacted low base, it’s possible that the effect of these super withdrawal driven deposits may have been further amplified.

Recently, figures from housing price data provider CoreLogic revealed that the amount of housing stock listed for sale was 28.3 per cent below the five-year average and even lower than during the height of the pandemic last year.

RELATED: Suburb where house prices fell despite the boom

According to Martin North, the principal of research firm Digital Finance Analytics, the super withdrawals have had a significant impact on the property market.

“Quite a few (first homebuyers) saw this as a silver bullet to get into the property market. So it has definitely driven the first homebuyer market.

“Very significantly in Western Australia, very significantly in some of the urban fringes of Sydney and Melbourne. It has been a big factor,” Mr North said.

However, as you can see from the Australian Bureau of Statistics graph below, this isn’t the first time the first homebuyer market has been juiced by external factors toward record highs.

When the Rudd government introduced its first homeowner grant in October 2008, as part of its global financial crisis response, demand similarly skyrocketed.

In just five months, the number of first homebuyers making finance commitments to buy a home more than doubled.

But like most booms in activity driven by a temporary incentive, it was not to last. Less than 18 months later, the number of first homebuyers making finance commitments was lower than when the grants started.

According to data from Digital Finance Analytics, we may already be seeing signs of demand beginning to weaken.

“The forward demand from first homebuyers in my data is coming down, because they don’t have the same access to (government) incentives that they had previously and super withdrawals have come to an end,” Mr North said.

But it may not be the end for very long.

If a group of Liberal MPs led by Tim Wilson have their way, we may be seeing just the beginning of a housing market supported by super withdrawals for first homebuyers.

Under proposed plans, first homebuyers being able to withdraw part of their super to use as part of a deposit for a home would become a permanent fixture.

As it stands the proposal is just that, proposed legislation. It is yet to become government policy backed by the Coalition party room or Prime Minister Scott Morrison.

However, a sufficient number of cross bench senators have already voiced in principal support for it.

Where first homebuyer demand and property prices will head from here remains uncertain, as Australia and the world continue to come to grips with the pandemic.

But ultimately, if superannuation withdrawals become a normal part of a first homebuyer’s deposit, we may see history repeat itself as first homebuyer demand rockets to new record highs.

Have you used your super to buy a house? Email stories@news.com.au

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator