Low interest rates aren’t enough for first time buyers

Despite rates sitting at a record low, in the past year the “time to buy a dwelling” index has plummeted. Here’s why.

For more than half a century the ‘Great Australian Dream’ has been owning a home on a quarter acre block and pretty much the entire list of features included in the Burke’s Backyard theme song.

In most of that time, period rate cuts were welcomed by prospective home buyers, as the calculations surrounding the cost of mortgage repayments became that little bit more achievable.

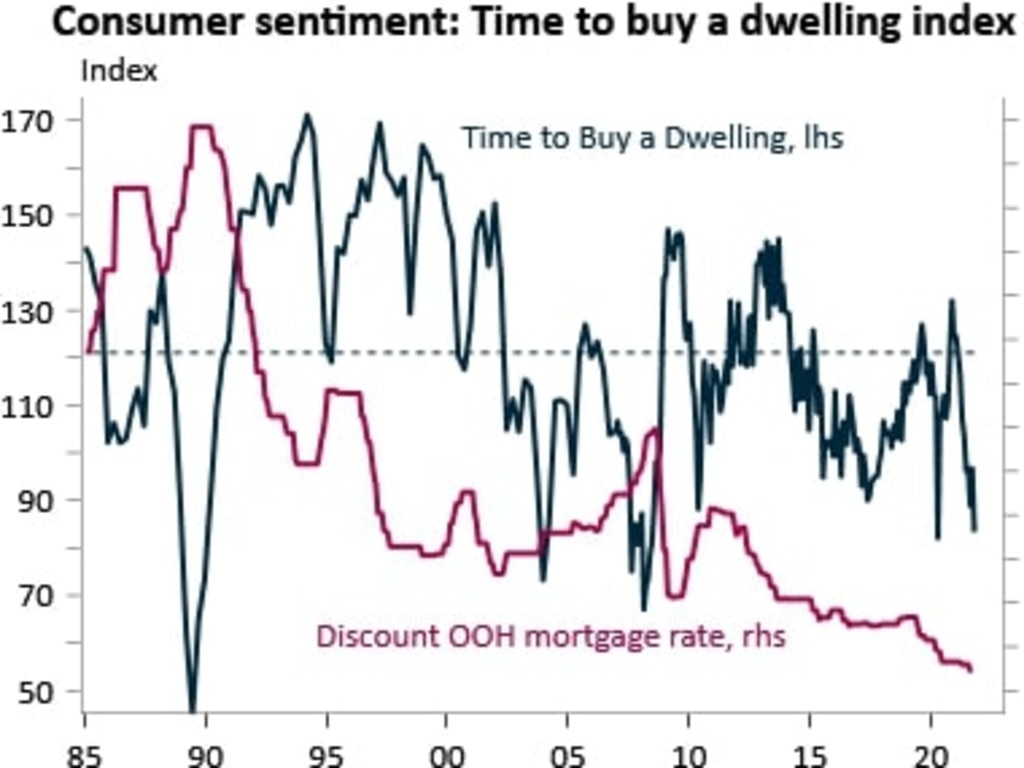

This is clear in Westpac’s ‘Time to buy a dwelling index’, which has now been running for 36 years.

When rates rise, the consumer perception that the present is the right time to buy a home deteriorates, in some cases immensely. Then when rates are cut, the opposite generally occurs as households become more optimistic about the potential for buying under the current circumstances.

That is until recently.

Despite the RBA cash rate sitting at a record low 0.1 per cent, in the past year the ‘Time to buy a dwelling index’ has plummeted to its lowest level since shortly before the financial crisis, excluding the sudden drop that occurred when Australia first went into lockdown.

This is arguably driven almost entirely by housing prices rocketing since late last year or early this year, depending on the market in question.

In the United States, it’s a similar story. In the University of Michigan’s consumer confidence survey, the percentage of respondents who say that now is a good time to buy a home is currently sitting at its lowest level since October 1982.

It seems like pretty much everywhere you look around the world housing prices are heading higher, pricing out potential buyers who may have been able to afford to buy prior to the pandemic.

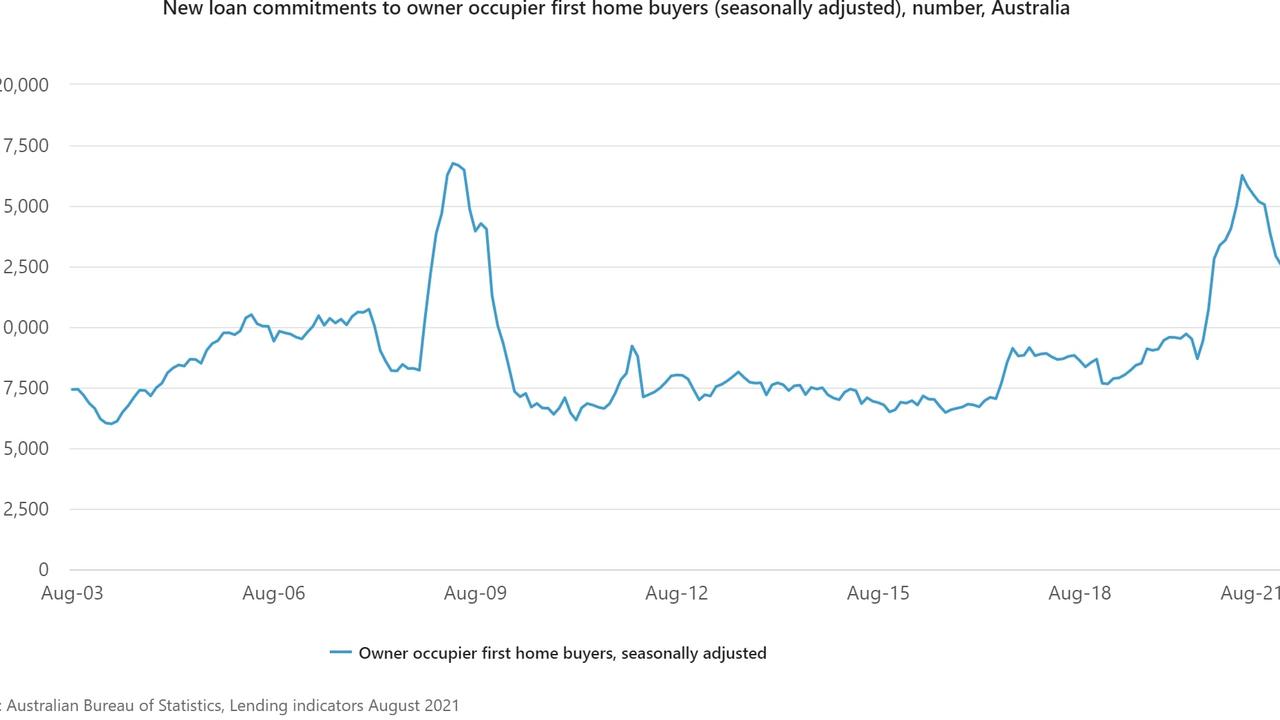

In Australia, the impact of rising prices on first home buyers has already become clear.

According to housing finance data from the Australian Bureau of Statistics (ABS), the number of new first homebuyer finance commitments has dropped by 22.8 per cent and appears set to continue to fall.

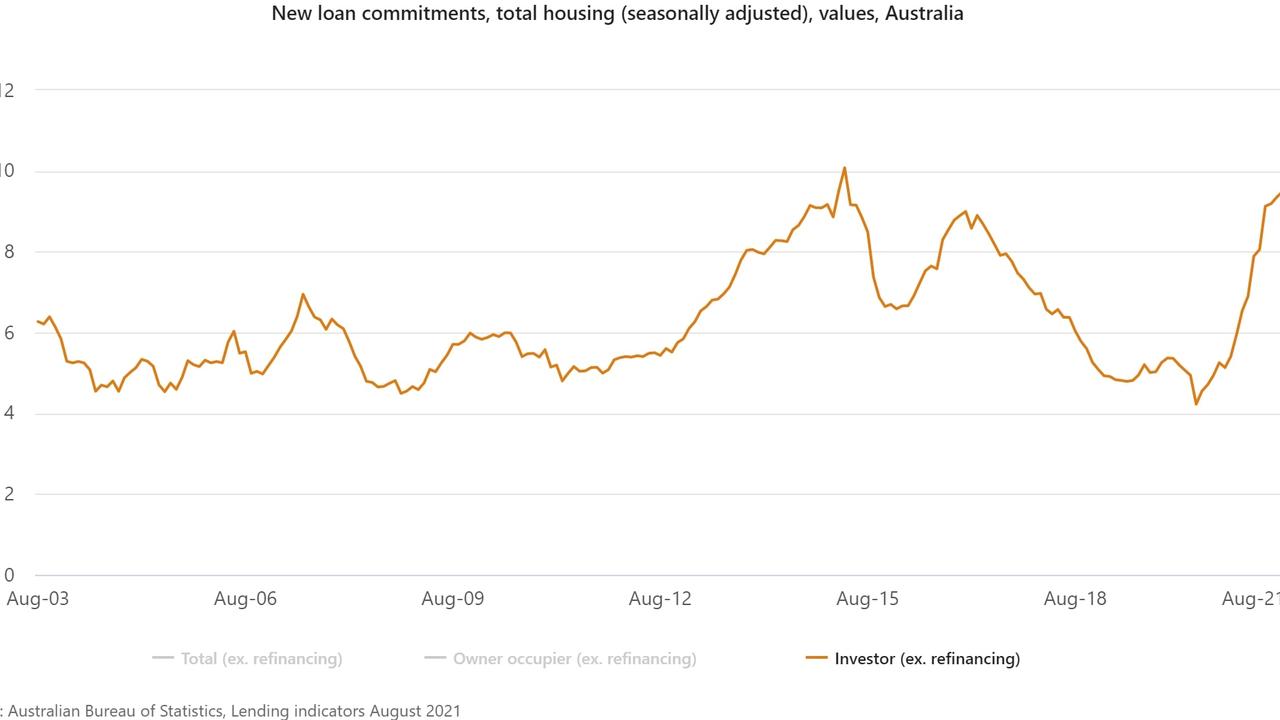

Yet despite the number of first home buyers falling significantly and many Australians seemingly seeing the present as a poor time to buy a home, transaction volumes continue to remain strong.

Part of this stems from investor activity in the market, which has picked up significantly since bottoming out shortly after Australia first went into lockdown last year. Since May 2020, the volume of borrowings by investors for properties has risen by 124.7 per cent.

According to housing price data provider CoreLogic, the number of homes sold across Australia in the 12 months ending August was almost 598,000. This marks the highest number of properties transacted in a rolling 12 month period since 2004.

So we are left with something of a paradox, a housing market where first home buyers are increasingly bowing out and people generally believe it is a poor time to buy a dwelling. Yet at the same time, housing turnover as a percentage of overall housing stock is trending up and sitting at roughly the long run average.

While divergences like this are not uncommon in the short term, one has to wonder if this has implications for the long term future.

Is this the beginning of a new status quo where more Australians are priced out of home ownership, where many households continue to see it as a poor time to buy a home in aggregate, due to high prices?

A new standard, where first home buyers increasingly lean on parental support and home ownership is increasingly concentrated in the hands of higher income households in some of Australia’s most expensive regions.

There is arguably some evidence that this is already taking place.

According to research firm Digital Finance Analytics, in September 58.8 per cent of first home buyers were receiving some form of parental assistance in order to buy a home. In that month, the average level of parental assistance rose to a record high of $94,784.

Or will Australians eventually come to terms with these higher prices and choose some form of alternative living arrangement in order to afford to be in their own home?

High levels of interstate migration from New South Wales and Victoria to Queensland suggests that may already be occurring, as the citizens of Sydney and Melbourne attempt to escape a median house price of over a million dollars.

There is also the rise of multi-generational households and the shift toward working from home in a rural or semi-rural area, which has seen hundreds of thousands of Australians pursue a different version of the traditional great Australian dream.

Where to from here?

For the immediate future, it appears there are more than enough investors, first home buyers with parental assistance and uptraders/downtraders to power the market forward.

But as prices continue to rise and more households are priced out of homeownership, while others are put off by the sticker shock of high transaction costs such as stamp duty and agent commissions, housing demand may begin to fall away in time.

Given the uncertainties that lay ahead as South Eastern Australia reopens and the global economy stumbles, it’s hard to know where housing demand will go in the long term.

More Coverage

Perhaps it all depends on how many Australians are willing to give up on the pursuit of the traditional version of the Great Australian Dream and instead choose a different path to home ownership.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator