Why Australian house prices are still rising despite Covid

Instead of plummeting during Covid, the Australian property market boomed – and there’s one type of property in the most demand.

In Australia’s long history, booms and busts have been an integral part of life in our Great Southern Land.

From the gold rushes of the 1850s to a long list of commodity price booms, Australia has long enjoyed the joy that comes from a booming economy and the anguish that comes from the inevitable busts.

When gold was struck in regional NSW and Victoria in the 1850s, tiny little farming communities became booming mini-cities practically overnight. Australians and immigrants alike surged into these towns all looking to strike it rich, with some of their descendants remaining there to this day.

As a result of this rush into the regions, the cost of real estate and goods in these areas skyrocketed, as the surge in the number of prospectors and other new arrivals completely transformed the balance of supply and demand in these once quiet little towns.

Over the next 170 years this rush into the regions would be repeated over and over again, resulting in pretty much the same conditions as gold rush era regional Australia.

Fast forward to the present and it’s clear that Australia is once again gripped by another boom at least partially created by a large imbalance in supply and demand, this time in the nation’s property market.

When the pandemic first sent Australia into lockdown, it was expected that demand for property would drop off significantly, with the big four banks warning of an up to 32 per cent crash in housing prices at the time.

But that was not to be.

Australia’s pandemic property boom

Between a combination of record low interest rates, pandemic driven factors such as working from home and the desire for more space, and various government stimulus programs, demand for property actually skyrocketed to all-time highs.

As a result of these various factors, as well as the pandemic driving many homeowners to reconsider listing their property, the nation’s housing market is effectively in the midst of its own gold rush type atmosphere.

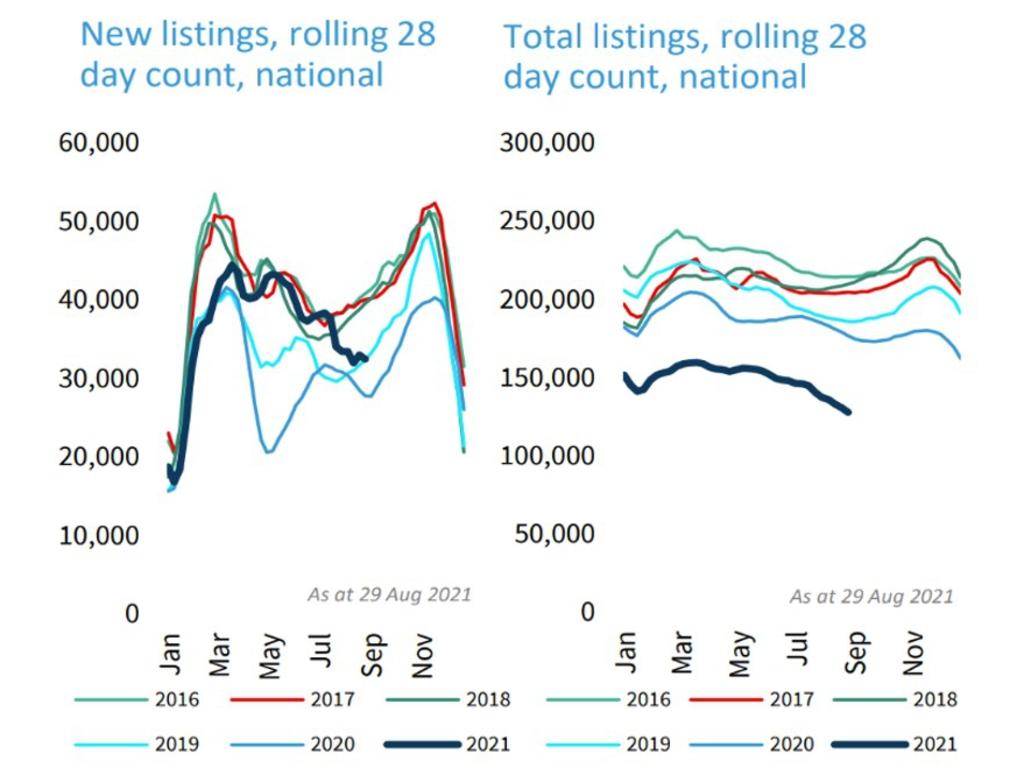

Nationally, new listing volumes were down significantly during 2020 and early 2021, driving the total number of properties on the market to well below the decade average since the pandemic began.

When this limited supply of property on the market was combined with enormous levels of pandemic-driven demand, the most rapid housing price growth since the 1980s resulted.

But this is only just one part of our story.

When you dive deeper into the data, the reasons for the current boom become clearer, as do the vulnerabilities the property market may face going into the future.

The national numbers

After Australia emerged from its first round of lockdowns last year, the desire for more space and a backyard suddenly became necessities for many households.

Things like working from home and space for the kids to play made many households’ current living arrangements in units or apartments untenable, as Australians adapted to the new pandemic-impacted world.

As a result, demand for free standing homes – particularly those with reasonably sized backyards – went through the roof and, as you would expect, the number of these homes on the market plummeted.

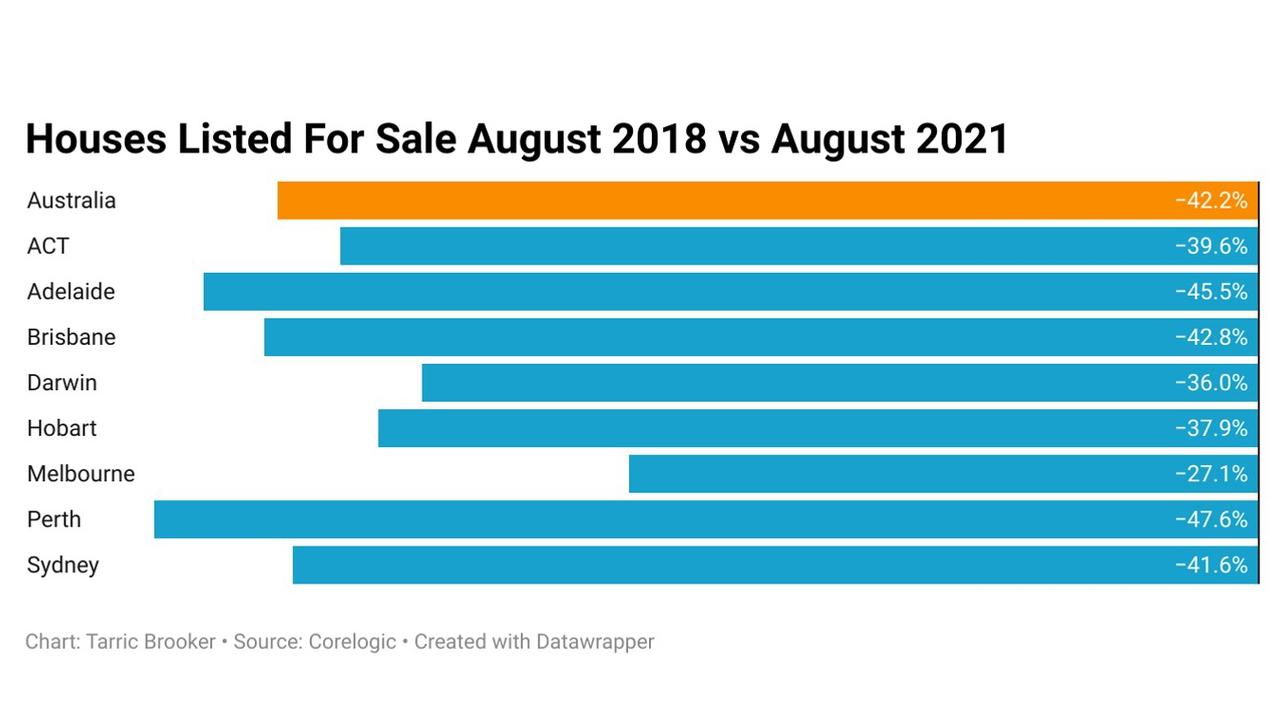

According to housing price data provider CoreLogic, in August 2018 there were 153,803 houses for sale nationally. As of late August this year, there are now just 88,872 houses, a drop of more than 42 per cent.

Some of you may be wondering why August 2018 was chosen rather than August 2019, this is due to the impact of the May 2019 federal election distorting the data.

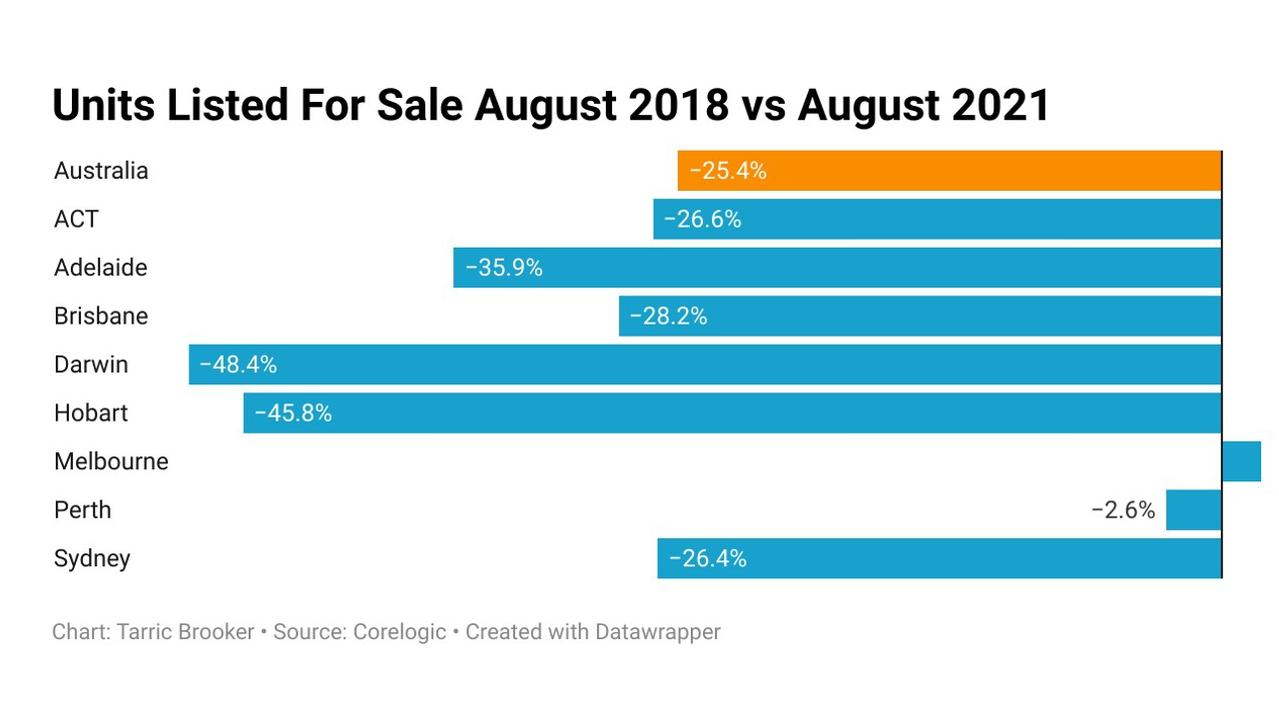

The number of units has also experienced a drop of a little over 25 per cent, but they haven’t seen anywhere near the same level of demand as houses.

However, based on what capital city you are looking at, the experience of their property market can be quite different – most notably that of Melbourne and Perth.

In Melbourne, the number of units on the market has bucked the national trend by rising 1.9 per cent versus this time in 2018, arguably as a result of the city’s protracted lockdown.

In Perth, unit numbers have only fallen by 2.6 per cent compared with a fall of 25.4 per cent nationally.

The gold rush boom and a gold rush bust?

As it stands, it appears likely the ongoing property boom will continue, particularly once lockdowns are inevitably lifted in NSW and Victoria.

Even as the number of first home buyers plummet due to increasingly finding themselves priced out of the market, the number of investors buying into the market continues to go from strength to strength.

But in the long term, this boom’s fate will be decided by the strength of demand once the current pandemic driven factors finally fade.

For some areas such as the NSW north coast where demand has arguably permanently shifted higher, the impact could be relatively muted.

But in other regional areas, the same boom and bust cycle that has defined Australia for more than 170 years may once again repeat.

As for the long term outlook for the capital cities, the metaphorical ‘Magic 8 Ball’ can currently only answer “Ask again later”.

With uncertainty likely to remain high for the foreseeable future, there are a multitude of possibilities on the table from across the spectrum.

There are a lot of predictions and theories, but if the last 18 months has taught us anything, you might have better luck with a piece of paper and a dart board.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator