Is it possible for Australia to dodge another recession?

Australia has weathered its fair share of economic slowdowns in the past without going into recession – but will it be able to pull off a miracle again?

As concerns over potential recessions in Eurozone, Britain and the US continue to build, the possibility of the first truly synchronised global economic slowdown since the GFC, excluding the impact of the pandemic, looms on the horizon.

On the world stage, the US is a major engine for global economic growth. But we’ve already seen figures from the first quarter there that showed negative growth.

Now the Atlanta branch of the US Federal Reserve is predicting 0 per cent growth for the second quarter, with even the most minor surprise potentially sending America into a technical recession.

Throughout much of the developed world it’s a similar story: Growth is slowing down significantly, rising inflation is hitting households and recession looms as a very real possibility on the horizon.

Over in our generally quiet little corner of the South Pacific though, Australia is faring better than most of its developed world counterparts.

But how prepared is the Aussie economy for a recession?

The budget deficit

This one is a bit of a good news, bad news type of scenario.

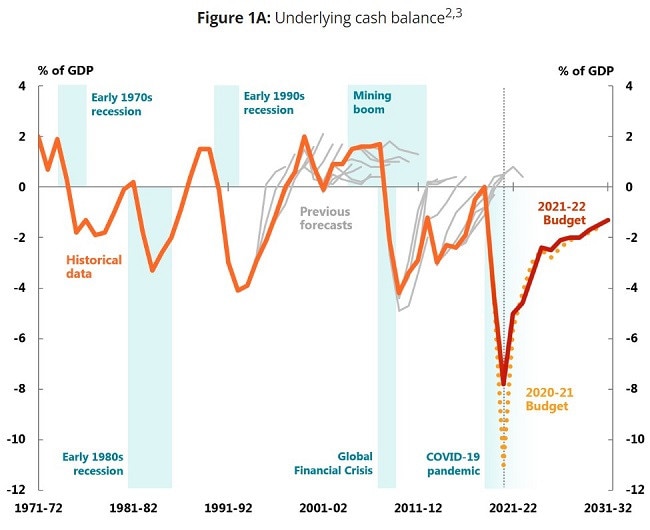

First, the good news: The budget deficit for 2022-2023 is expected to come in at 3.4 per cent of GDP, significantly lower than estimates of 4.4 per cent of GDP which were contained in last year’s mid-year economic outlook.

The bad news is that the budget deficit for 2022-2023 is expected to come in at 3.4 per cent. Excluding the impact of the pandemic and the years defined by stimulus following the global financial crisis, this is the largest deficit since the early 1990s.

Despite the improvement in the budget estimates, the deficit as a percentage of GDP is still roughly in the same ballpark as where it was during the height of the government response to the global financial crisis.

To what degree this could hamstring the response of the Government to a recession is entirely up to the Prime Minister Anthony Albanese and the Treasurer Jim Chalmers. But looking at the situation through the lens of historic norms, there is less scope for a big spending stimulus program without the deficit blowing out to near-record peacetime highs.

Unemployment rate

Out of all the categories on show today, this is by far the most positive. Through a combination of government stimulus measures, reversing levels of net overseas migration and strong domestic demand, Australia currently has the equal lowest unemployment rate in 48 years, coming in at just 3.9 per cent.

The recent employment figures have also proven encouraging. In May, the economy created over 60,000 full-time jobs and the underemployment rate (people employed wanting more hours) fell to just 5.7 per cent, compared with 8.6 per cent before the outbreak of the pandemic.

The labour market is currently a pillar of strength for the nation’s economy, with various job ad indices pointing to continued strong demand for labour in the immediate future.

Household confidence

According to the ANZ-Roy Morgan Consumer Confidence index, the outlook for households is only slightly above where it was during the 1990s recession, excluding the initial shock of the pandemic.

While other indices are painting a less dire picture of the confidence level of households, across the board confidence remains weak, which is remarkable and concerning in equal measure.

Despite unemployment at 48-year lows and GDP growth humming along at a strong rate of 3.3 per cent for the last 12 months, households remain highly concerned about their prospects in the future and the rising cost of living in the here and now.

This is an unenviable place for confidence levels to be sitting if a recession were to arrive on our shores while households remain so downbeat about the economy in the months and years ahead.

Interest rates

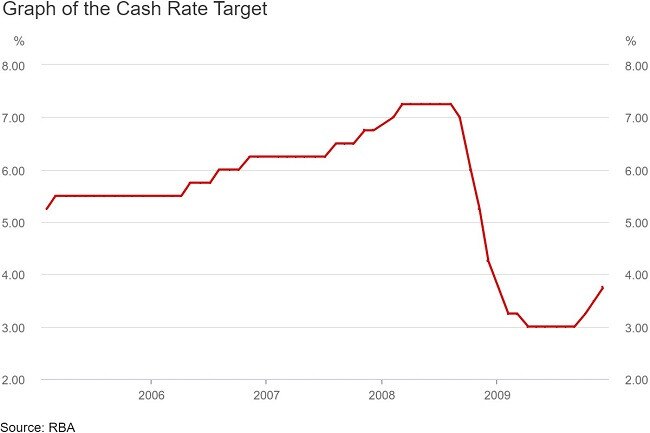

After raising interest rates for the first time in 11 years starting in May, the RBA cash rate now sits at 0.85 per cent. While this is higher than where it was immediately before the outbreak of the pandemic, the cash rate remains near historic lows.

When the global financial crisis arrived on Australia’s shores in 2008, the RBA was able to slash the cash rate from 7.25 per cent to 3 per cent, offering a large boost to the coffers of mortgage holding households.

As things currently stand, the scope the RBA has to boost household consumption is limited, with just 0.85 per cent worth of potential rate cuts on offer before hitting zero.

But that is set to change yet again in the months and years ahead.

As of Thursday, interest rate futures markets were pricing in a 3.32 per cent cash rate by December and a peak rate of 4.05 per cent by August next year.

This would provide the RBA with a GFC-era rivalling amount of ammunition with which to potentially boost household spending.

Report card

While there are many other factors influencing a nation’s preparedness for a potential recession, on these four categories Australia gets a mixed grade.

The strength of the labour market is historic and if job ads are an accurate barometer for the demand for labour, it may remain strong for longer than many expect even in the face of rapidly rising interest rates.

On the other hand, household confidence and a large budget deficit are both points of weakness one would not like to enter a recession with if it could be avoided.

Going forward, we are largely in uncharted waters. Inflation is expected to continue to rise for months to come, many major global stock indices are in bear markets and geopolitical instability is arguably at its highest level since the collapse of the Soviet Union.

More Coverage

Whether Australia will follow the United States and others into recession should that scenario come to pass remains an open question.

The Lucky Country has dodged recessions before. It’s possible it may yet again.

Tarric Brooker is a freelance journalist and social commentator. | @AvidCommentator