Horror economic situation facing Anthony Albanese’s government

Things are looking more and more challenging for the Australia economy, with five key factors putting the nation under pressure.

When the Labor Party won the recent federal election, it marked the end of the better part of a decade in the political wilderness and affirmed that federal Labor could perform at the ballot box, after losing an election some claimed to be un-loseable in 2019.

Yet just a month after their historic victory, things are already starting to look more than a little bit challenging for the Albanese Government.

In some ways, Labor taking the keys of government for the first time in nine years is a lot like getting behind the wheel of a used car for its maiden drive. Everything looks OK at first, but then the car’s various issues start to become apparent and before long you might be wondering if you bought yourself a lemon.

Despite just a month passing since the election, it’s increasingly clear that Labor has inherited one of the most challenging positions for a newly minted government in decades.

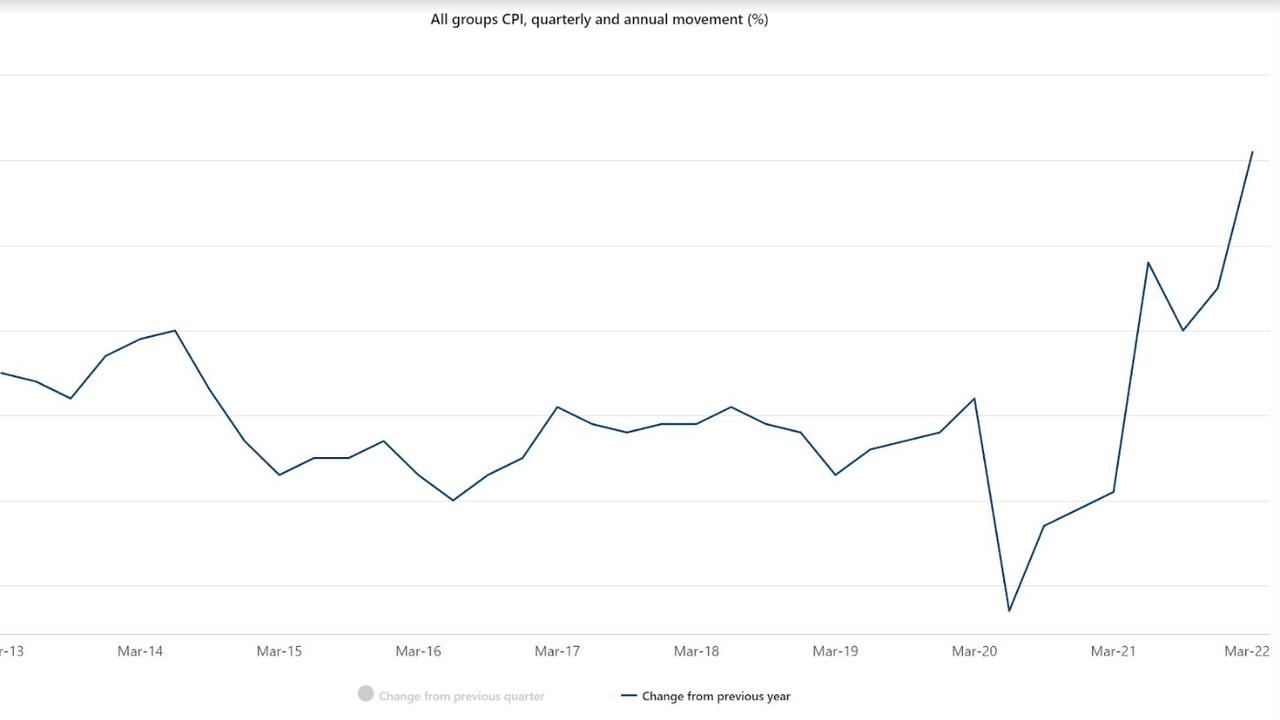

Inflation

Earlier this week Reserve Bank of Australia (RBA) Governor Philip Lowe was interviewed by the ABC and shared his prediction that inflation would hit 7 per cent in the December quarter, a significant acceleration from its current level of 5.1 per cent.

Data from the Melbourne Institute’s monthly inflation gauge pointed to an even more challenging path ahead for inflation, with it recently recording month on month inflation at a blistering 1.1 per cent, the highest ever reading in the history of the index.

Consumer confidence

Even prior to the election, consumer confidence was not in a good place. But with inflation continuing to accelerate and the RBA raising rates by 0.5 per cent for the first time over two decades, it has deteriorated even further.

According to ANZ’s consumer confidence index, excluding the initial pandemic shock, consumer confidence is now at its lowest level since 1991. While confidence is pretty dour across the board, the outlook of households for their finances over the next 12 months was particularly concerning, with that particular sub index sitting only a few points above where it was during the height of the initial pandemic shock.

Electricity/gas prices

On Wednesday, the Australian Energy Market Operator (AEMO) announced that it had suspended the national electricity spot market in NSW, Queensland, South Australia, Tasmania and Victoria in order to take over the national energy market to ensure supplies to households and businesses.

It will set administered wholesale power across these affected regions and will take control of power generation across all plants, using generator capacity to meet demand.

This comes amid the rocketing cost of gas and electricity, which recently saw gas prices in some markets hit roughly up to 100 times normal market prices.

While it is hoped this intervention by the AEMO will ensure the lights stay on, high energy prices will continue to be a thorn in the side of households and businesses for the foreseeable future.

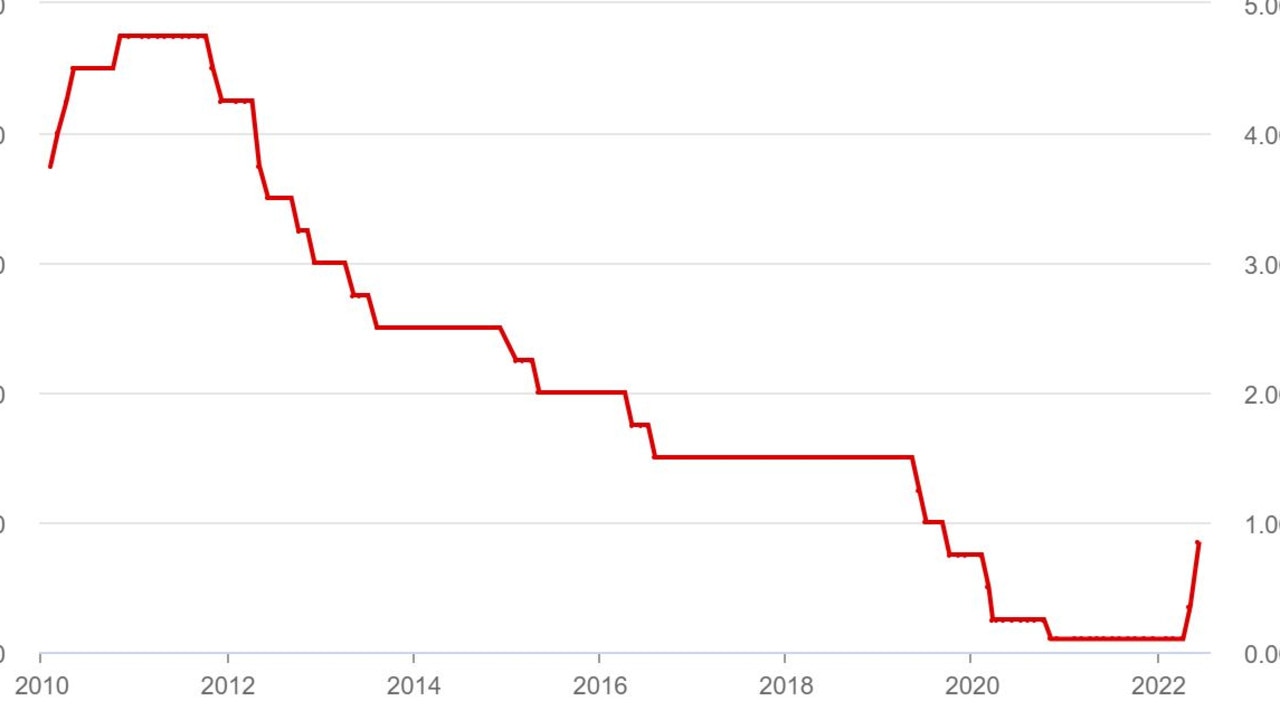

Interest rates

As inflation continues to rise, so too does the predicted peak for the RBA official cash rate. Just three months ago the market was pricing in a 1.36 per cent cash rate for December. As of the markets close on Thursday, the cash rate is now expected to be 3.71 per cent by the year’s end.

It is important to keep in mind that this is market pricing and far from set in stone – it is a snapshot of how the market sees the future playing out.

Fuel prices

While it certainly may not feel like it, as we pay near record prices at the pump, Australians have actually been enjoying several factors placing downward pressure on fuel prices.

Internationally, lockdowns in China and the release of one million barrels of oil per day from American strategic oil reserves have both been placing downward pressure on global oil prices. This is something we covered last weekend here at news.com.au in much greater detail.

Yet despite these factors helping to keep oil prices below their March peak, fuel prices in the US and around the world have been hitting record highs time and again in recent weeks.

In Australia, we have been somewhat insulated from rising fuel prices due to the former government’s cut to the federal fuel excise tax, which has reduced the tax on fuel prices by 22 cents per litre since late March.

But this measure supporting lower fuel prices will be coming to an end on September 28, leaving Australians paying far more for fuel if global prices continue to remain high.

Labor’s lemon

Political commentators and politicians will no doubt spend many hours in the coming months and years attributing where the fault lies for the mess Australia currently finds itself in, but how much that matters is in the eye of the beholder.

But in the here and now, Labor has inherited an absolute lemon of a set of political circumstances, facing both global and domestic issues that threaten to undermine its attempts to press its agenda in its pivotal first 100 days in government.

Prime Minister Anthony Albanese certainly has his work cut out for him and will be hoping to avoid the pitfalls that have left US President Joe Biden a deeply unpopular leader.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator