Australian retailers facing meltdown as inflation rises and the stock market sinks

An ominous mix of inflation, higher interest rates and surging food and power costs is predicted to crush Australian retailers.

Despite the chaos caused by the pandemic over the past few years, many major retailers came out the other side of it faring pretty well.

Coming into this year, retailers were seeing record levels of turnover as Australians couldn’t stop spending.

However, a toxic mix of inflation, higher interest rates and surging food and power costs is predicted to crush this wave of positivity and spark a major meltdown.

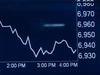

Amid the ongoing wipeout on the Australian stock exchange, some of the nation’s biggest brands including JB Hi-Fi and Harvey Norman have taken big hits to their share prices as investors are spooked by the thought of what’s to come.

On Tuesday, JB Hi-Fi shares fell 5.7 per cent for the session to $39.31, while Harvey Norman was 5.4 per cent lower to $3.86. Supermarket giant Wesfarmers also copped it in a struggling market, losing 3.8 per cent for the session.

With more pain tipped to come for the economy, Macquarie’s equities team placed downgrades on JB Hi-Fi, Harvey Norman and Wesfarmers, predicting “significant pressure on discretionary spending” in the coming months.

“A rise in inflation increases the cost of staples for consumers, leaving less leftover money to purchase discretionary items. We would expect rising inflation to lower relative demand for discretionary items relative to staple items,” Macquarie’s equities team said in a statement.

In a note to clients Barrenjoey consumer analyst Tom Kierath said retailers were facing some of the toughest conditions of the past 15 years, with consumers now battling a “cocktail” of higher interest rates, food and fuel costs.

“It’s easy to see why consumer confidence is back to GFC levels. Increasingly, we think [Financial Year] 23 will be as difficult as FY19, potentially worse in some categories,” he wrote.

‘Recession we had to have’

Mark Bouris, executive chairman of the Yellow Brick Road Home Loans, agreed that retailers would be one of the hardest hit if interest rates continue to rise as predicted.

He said that if rates keeping going up, it will “create a recession”.

“It’s totally counterintuitive,” he said on Today this morning. “Equally it’s counterintuitive that the people who probably spend the least amount of money to protect their mortgage will be the most affected, that is mortgage holders because they will put their interest rates up.

“Yes, we are worried about cost of living. Yes, we are worried about interest rates going up. But at the same time we’ve got to control inflation.

“So really what they’re saying is you have to take a lot of pain and if you go back many, many years ago, Paul Keating referred to this as ‘the recession we had to have’ to control inflation. And if Paul Keating was still the treasurer or maybe the prime minister today, he would say the same thing.”

He said retailers and small businesses will be among the worst affected by the coming economic pain.

More Coverage

“Probably you will see the unemployment number kick up but I don’t think we will see a recession,” he said. “Our Reserve Bank won’t let that happen. They are not going to put interest rates up and put us in recession. If recession looks imminent, the Reserve Bank will stop or put rates down.”

The ASX saw its most brutal day of trading since the start of the pandemic on Tuesday – as ordinary Australians saw their portfolios collapse and some of the nation’s biggest rich-listers lost $12 billion in a matter of hours.

Any hopes of a quick rebound have been dashed as the Aussie market opened even lower on Wednesday morning, dropping 0.7 per cent.