Qantas axing jobs a sign ‘worst is yet to come’ for Australia’s economy

As well as aviation, COVID-19 means the writing’s on the wall for four more Aussie sectors.

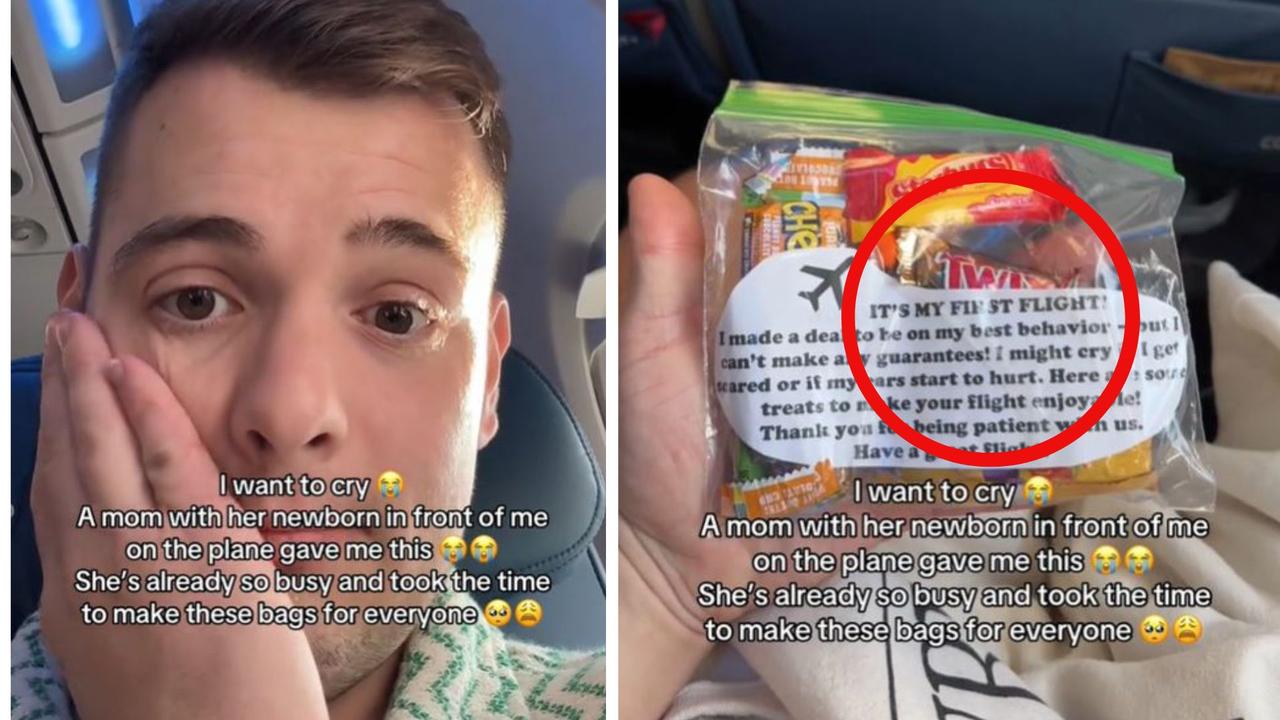

Qantas is laying off 6000 staff and immediately retiring all its 747s in a move that should shake the Australian economy to the core. The Flying Kangaroo has given us a glimpse of the future.

More jobs will be cut as businesses understand the new reality. Qantas’ lay-offs is a lot in one day, but across the rest of the economy, there will be worse to come.

On top of 6000 lay-offs, Qantas is standing down 15,000 staff. Half of them are stood down until international flights resume, which will mean years without work for some employees. They are permitted to work other jobs while stood down and will continue to accrue leave from Qantas. However, it would be crazy to assume these people will all remain with the company, so the loss of jobs could be even higher than 6000.

It takes time for a business to even recognise the extent of change needed. Qantas has actually acted quite fast. Eliminating a huge chunk of its workforce and raising nearly $2 billion dollars takes time. It’s a process requiring many lawyers, bankers, internal meetings and meetings of the board of directors.

One reason Qantas has been able to be so expeditious is that the impact on aviation is bright and clear. At time of writing, Qantas had just six planes in the air above Australia. Six. For a company with 29,000 staff.

RELATED: Economic ‘bloodbath’ coming in 100 days

RELATED: Ace card Australia holds over China

The size of the problem in aviation is obvious. That’s also why Virgin was so quick to go into administration. For other sectors, the medium-term issues are still slowly coming into focus. Commercial real estate, retail, public transport and hospitality all have their days of reckoning ahead. When the writing on the wall becomes legible, it will not contain happy tidings.

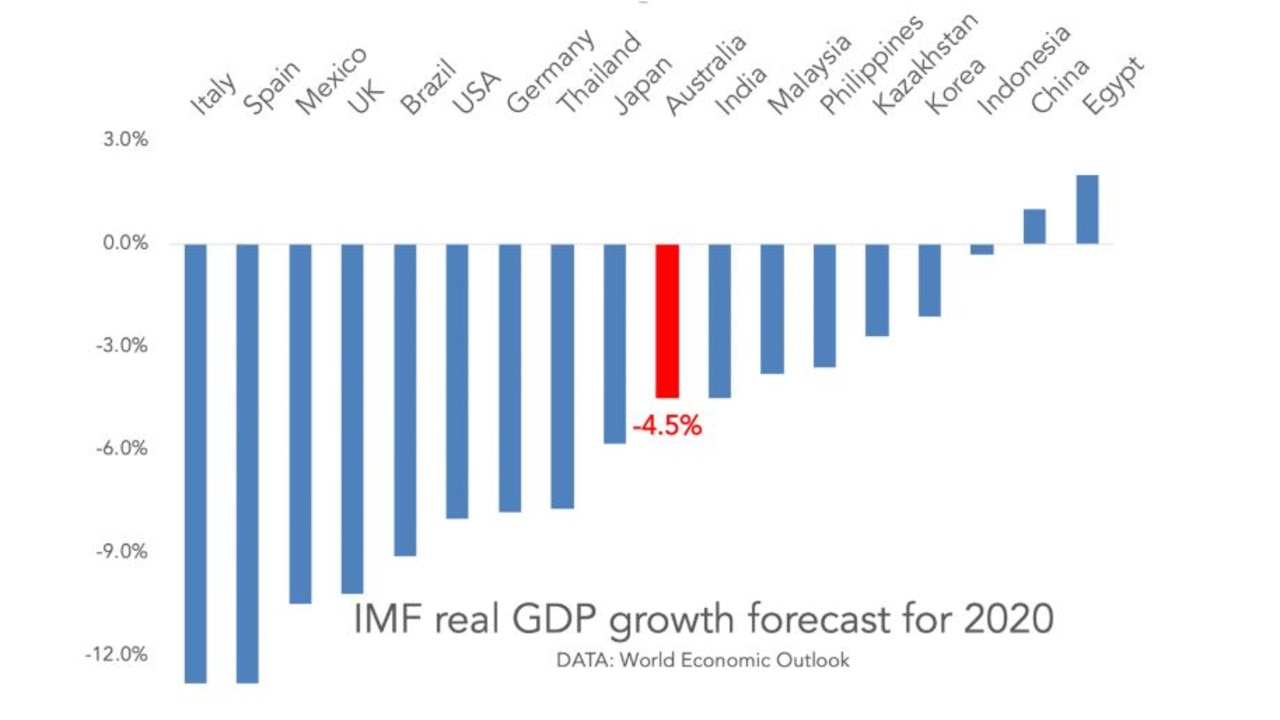

The IMF is now saying the pandemic hit global growth harder than expected, and that the expected bounce back is not going to plan.

“The recovery is projected to be more gradual than previously forecast,” the Fund wrote in its World Economic Outlook, released on Thursday.

All these percentages look neat on the page, but in real life they represent mess and despair. They mean jobs being lost, companies going broke, homes being sold into falling markets, mental health in decline and families falling apart. This is why the economy matters.

The frustrating truth is that Australian growth depends on global growth. We are a trading nation and we need the rest of the world to be in fighting shape to pull us through.

Instead, the rest of the world is sick. America in particular seems to be yielding to COVID-19. The virus is on an upward trajectory in that country, and there are few signs the US can get its act together in time to prevent a second peak in infections.

China, our long-time economic engine room, is growing, but very slowly by its standards. And it is having a second surge in infections in its capital, Beijing.

At home we are not out of the woods either. A small blip in cases in Victoria could turn into a second peak quite easily. A domestic second wave would really crush Qantas.

CEO Alan Joyce has basically given up on international flying – Qantas expects international flight numbers to be less than half of what they were all the way out to 2022. But the company still has hope for domestic flights.

“We’re planning to be back to 40 per cent of our pre-crisis domestic flying during July and hopefully more in the months that follow,” Mr Joyce said. But a rebound in domestic travel depends on properly beating the virus.

FREQUENT FLYERS

Qantas international will be a shell of its former self for some time. Qantas domestic might bounce back if they are lucky. What about Qantas Frequent Flyer?

The funny thing about Qantas in recent years is that it makes more profit from its loyalty program ($200 million in the first half of this financial year) than from international flying ($160 million).

Australians are obsessed with points programs in general and the Qantas Frequent Flyer scheme is dominant. Fully half of all Australians – more than 13 million of us – are part of the scheme.

So, if we’re not flying frequently, what happens to frequent flyer? Not that much, it turns out. Earnings for the scheme are expected to fall only 5 to 10 per cent compared to last financial year. This is one thing Qantas has going for it.

The strength of frequent flyer schemes is also an interesting footnote in the Virgin Australia story. The company had a scheme called Velocity, and it was so successful they were able to spin it off for $335 million. But then they got cold feet and just before they went broke, the company spent $700 million buying it back.

The signals from Qantas today are a bad sign for Virgin. Qantas is saying there’s not even room for one large airline in the market in the next few years. How can there be room for two competitors?

Virgin’s administrators are working on completing the sale of the airline as we speak. Let’s hope they succeed, or there might be even more jobs lost soon.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.