China trade war: Why the car industry is Australia's ace card

China has boasted it could crush our economy – but there’s one key sector in which they need us much more than we need them.

What product is Australia leaning on China more and more for these days? Cars.

Chinese-made cars have become a serious part of our market all of a sudden. They’re not selling at Korean levels yet, but they are now much more than a niche choice.

This change comes at a surprising time. Overall, car sales in Australia are in the toilet. The number of cars sold here is down 24 per cent compared to last year, and the rot set in long before the pandemic. Car sales have been falling steadily for a couple of years now.

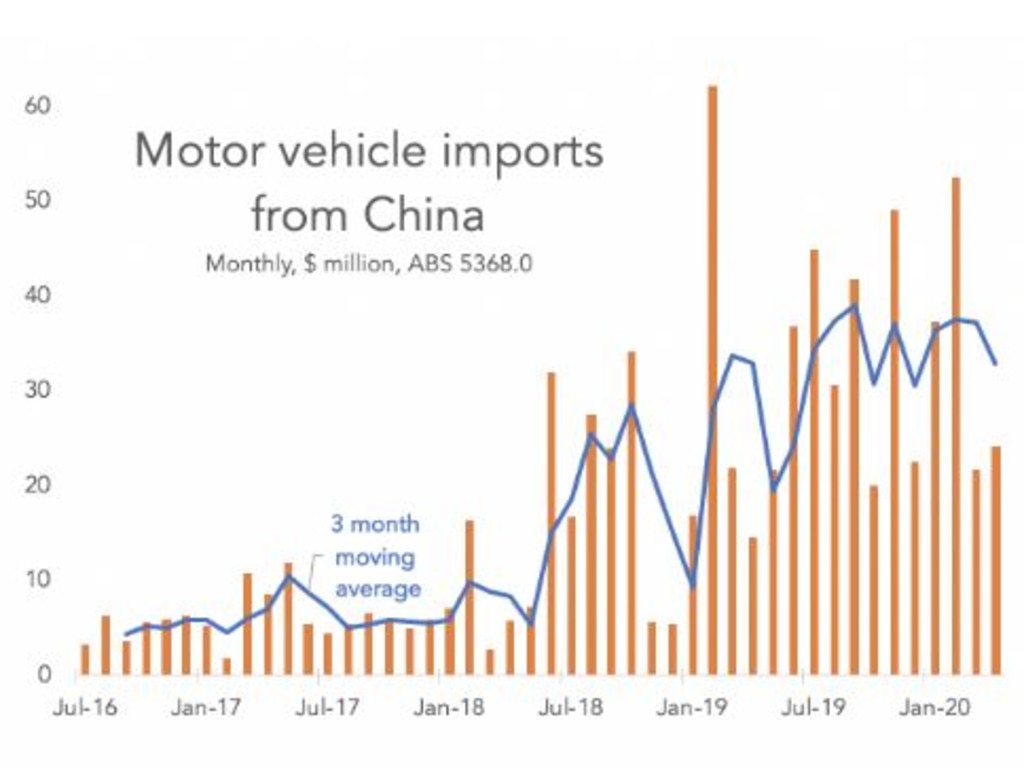

But as the market turns cold, Chinese cars have turned red hot. As this chart shows, we’re importing up to $60 million of Chinese cars each month, up from a piddly few million dollars worth in 2016.

RELATED: Huge cost of Australia’s financial success

RELATED: Economic ‘bloodbath’ coming in 100 days

The number of cars imported from China is up 36 per cent so far this year compared to the same period last year. This has happened even as Japanese imports are down 21 per cent, German imports are down 35.7 per cent and imports from Thailand (our second biggest source of cars) is down 27 per cent.

CHINESE CARS ARE NOW MUCH BETTER

After its early failures, China has learned a thing or two about the car industry. One clever trick is to not make the brand names sound too Chinese. Remember Geely and Chery and Great Wall? They didn’t sell well. Only Great Wall remains in the market. Nowadays Chinese brands operate a bit more covertly.

Did you know MG is Chinese? The company was once known as Morris Garages and based in Oxford, UK. It is now a subsidiary of SAIC Motor, a Chinese state-owned enterprise which makes cars in China.

LDV is another British brand stuck to the grille of a Chinese car-making operation. LDV has sold 2100 cars in Australia so far this year, mostly big muscly utes at bargain prices.

Even the most proudly Chinese-named car company – Great Wall Motors – has a sub-brand which you might not guess was Chinese: Haval SUVs.

It is the Haval brand which reveals the second thing the Chinese have learned about car-making. The Haval H2 – a city SUV priced in the low $20,000 range – has achieved what many thought impossible for a Chinese car: a five-star safety rating. Nice one Haval.

Of course, not all Chinese vehicles can claim this – the Great Wall utes still have a terrifying two-star rating. But the signs are there of quality improvement.

Just as the world saw when Japan and Korea started making cars, if you sell large volumes, it doesn’t take long to get better at it. And China sells large volumes. Millions of cars are sold each year domestically in China.

China’s car industry is enormous – estimated at around 10 per cent of China’s whole economy. Growing the car industry is a national priority for China, as it tries to develop beyond being a maker of plastic toys and cotton socks to become a hotbed of high technology and luxury goods.

But China has a problem. While Chinese people buy millions of Chinese cars, no Chinese brand has yet become like Toyota or Hyundai – trusted and reliable globally. To build that kind of brand, it needs to continue to explore foreign markets and test our preferences.

That puts Chinese car exports in an interesting place in any trade war. The share of the Australian market they hold is only moderate. If China cut off the supply of cars, we could certainly easily manage. There’s other brands. And in theory, they would not miss the exports.

What’s 15,000-20,000 cars a year when you’re selling 20 million at home? The real value of China’s car exports to Australia is in what they can learn about the global market.

That means, paradoxically, that even though we are a small market, and we don’t have a domestic car industry of our own, our increasing interest in Chinese cars is probably a strength in any trade dispute. China will want to keep selling cars here, keep experimenting and improving. They need us at least as much as we need them.

More Chinese cars will be launching in Australia in coming years. For example, the Glory E3, an electric car due next year, costing perhaps $50,000 to $60,000.

That is just one of the electric car brands under development in China, The Chinese government is supporting a lot of companies to make electric vehicles in the hope one of them will produce a hit – something to rival Tesla.

You can expect several of those brands to land in Australia. But will any of them go on to be popular? Given everything we’ve seen about how Chinese cars have improved so far, I wouldn’t be surprised if the answer was actually, eventually, yes.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.