Experts predict economic ‘bloodbath’ when JobKeeper, JobSeeker ends

In April, the number of businesses going bust actually decreased. But in roughly 100 days, an economic bloodbath will commence.

This recession just got weirder: Despite hard times, companies are somehow not going broke. Everything is topsy-turvy. But are we just saving up pain for later?

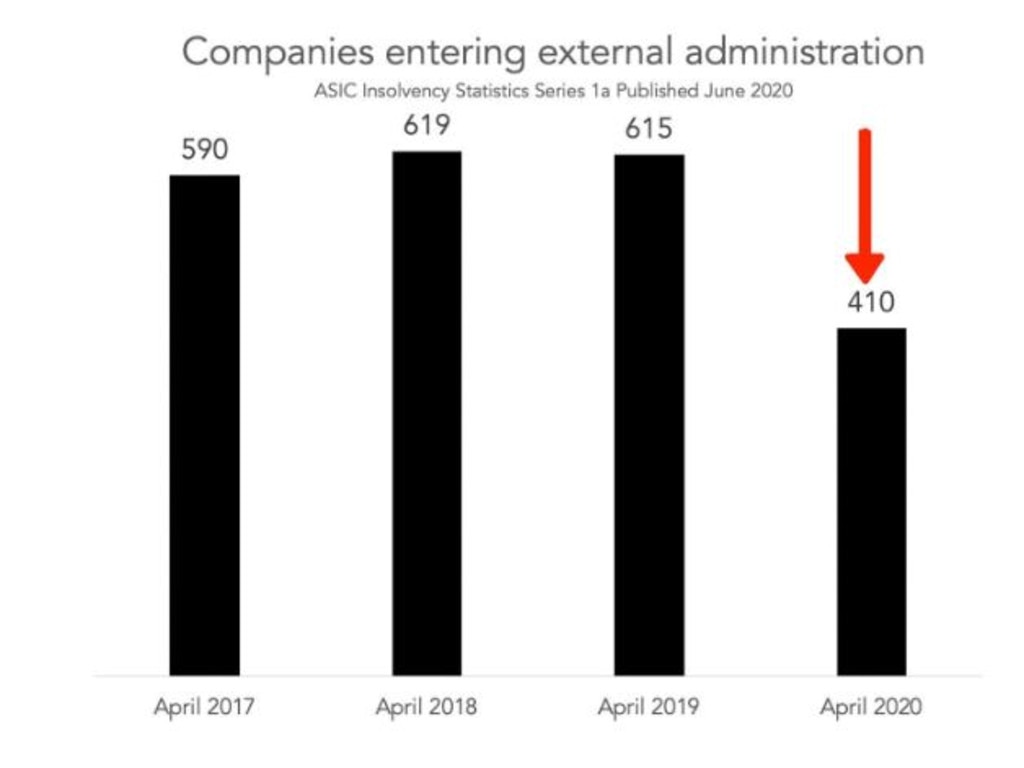

I keep an eye on the ASIC insolvency database, and when I opened it to check the April statistics, I couldn’t believe my eyes. April 2020 was a month of insane economic uncertainty and gross financial turbulence. But the number of businesses going broke went down. Not up. Down.

RELATED: Huge cost of Australia’s financial success

RELATED: ‘Total disaster’: Graph Aussies should fear

April was a record. Not only is it lower than April last year, it’s lower than each April before that back to 2013. In fact, the number of businesses going bust in April this year is the third lowest month in the whole database, which goes back to 2013.

We not only managed to prevent a bloodbath, we’ve kept more businesses alive than would usually go broke. The economy is in recession. Things are supposed to be going to hell in a hand basket. So how come businesses aren’t going broke?

JobKeeper is a big reason for the high survival rate. Instead of paying their employees, suffering businesses can get the government to pay, up to $1500 a fortnight. That dramatically relaxes their financial situation.

There are also new laws that specifically make it hard to send a business to the wall. Normally if a business owes you money you can apply to have it wrapped up. The administrators take over the business and try to get you what you are owed.

But the government changed the law for COVID-19. The minimum amount owing in order to start this process went up from $5000 to $20,000, and businesses who get a warning about a debt now have a leisurely six months to respond, instead of 21 days.

That probably explains a lot of what we are seeing. It’s not that business conditions are better than we thought. It’s that the law has turned from tiger mum to cool uncle. “No money?” it asks businesses. “Cool man, whatever. Have fun.”

Company directors are usually personally liable if their company trades while insolvent. You’re not allowed to keep operating if you know your business can’t pay its debts. But during COVID-19, the law has been changed so directors are not personally liable.

These temporary laws mean you can owe people a lot of money but not go broke. Ominously, the law is set to change back on September 25 this year.

WHO ISN’T GOING BROKE?

The biggest fall in insolvencies was among construction companies. Usually over 100 construction companies go bust each month. In April it was around 40.

Even retailers sailed through April. Only half as many retailers went bust in April compared to 2019. Cafes and restaurants were also more likely to survive this year than last year. The number of companies entering administration in the category Accommodation and Food Services was down 40 per cent.

There was only one category where more companies than usual were going bust: Transport, Postal and Warehousing. I suspect that’s a bunch of Uber drivers who were set up as a company, didn’t qualify for JobKeeper for various reasons, and instead got wound up.

WHAT DOES IT MEAN TO GO INTO ADMINISTRATION?

When a company enters administration, it owes more money than it can repay, i.e. it is insolvent. Administrators are special financial professionals who take over broke companies. They have a legally defined responsibility to work for the people who are owed money, and they try to either get the business functioning again, or sell whatever they can.

Whoever owned the business before now owns nothing – the people who are owed money are now the priority – e.g. employees, banks who gave the business loans, and anyone with an outstanding bill (e.g. tradies who did work for the company before it went broke).

In some cases the administrators can sell the whole business (e.g. Virgin Australia and Harris Scarfe – both of those went into administration but will come back out with new owners).

Sometimes, the administrators can sell the brand name (e.g. Dick Smith Electronics. It went into administration a few years ago and Kogan bought the name.) Sometimes the administrators can only sell the office chairs because the business is truly worth nothing. That’s a bad day for the people hoping to get some money back – they will only get a few cents for every dollar they were owed.

SUNSHINE AND RAINBOWS NOW, WHAT HAPPENS IN SEPTEMBER?

In September, around 100 days from now, all the policies that have been propping up the Aussie economy are due to be swept away. JobKeeper stops. The JobSeeker supplement goes away and the dole goes back down to bare bones. And the laws around insolvency revert back to being mean ones with sharp teeth. That could lead to a wave of collapses.

Australia has done a great job managing the early stage of this recession. The economic downturn will probably be “shallower than earlier expected,” the Reserve Bank said this week. That’s great news. But we also need to recover well and that means being careful as we try to get back to normal

The RBA has promised to keep low interest rates in place for years, which is very helpful. But the Treasurer is planning to remove a lot of support in September. Right now, the Australian economy is like a Jenga tower, and the bottom level of blocks are all due to be pulled out in September. If that happens, the clattering noise you hear will be thousands of Aussie businesses falling over at once.

J ason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.