Coronavirus Australia: ABS data shows Aussie sectors ‘bleeding out’

Everyone knew April sales would be bad – but no one was prepared for a bloodbath of this magnitude, and the havoc that will follow.

Retail trade has fallen straight into hell. April’s result is an absolute shocker. We knew it would be bad, but this bad? Yikes.

The preliminary data on retail trade from the Australian Bureau of Statistics (ABS) shows it fell by 17 per cent in one month. That’s a record. I know we all have record fatigue by now – every new economic data point is a record these days. But this one matters.

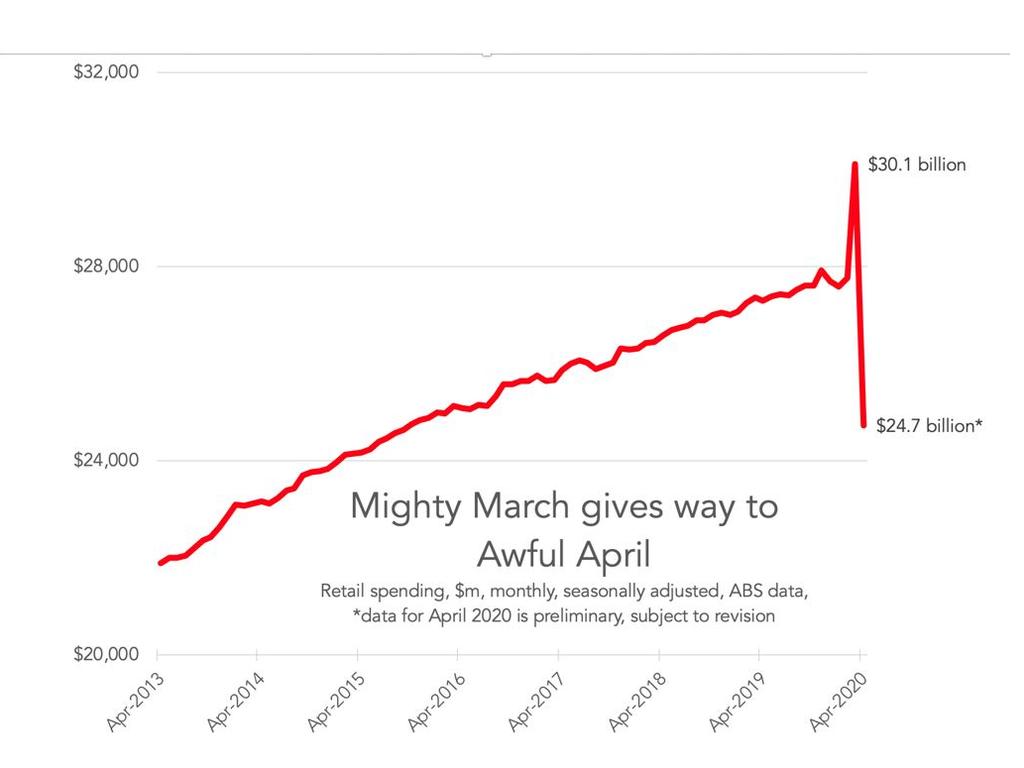

As the next chart shows, the level of Australian retail spending is usually pretty predictable. A small rise, or sometimes a small fall. But the last two months have been completely different. April’s retail trade numbers are crazy. They wipe out four years of growth. It’s like going back in time to 2016, a time when prices were lower, the population was smaller, and the economy weaker.

RELATED: RBA’s bleak prediction for Aussie jobs

RELATED: Aussies most screwed by pandemic

Nobody saw that coming. The people who forecast these things – and get paid a fortune to do so – expected much better numbers.

Commonwealth Bank forecast an 11 per cent fall in April, and NAB predicted a 5.3 per cent fall. Of course the ABS data is preliminary and it could be revised, but still, those are big misses. It shows the retail contraction is much worse than expected, and the impact on the economy will be much worse too.

The surprisingly low level of retail activity in April is devastating for businesses – and for jobs. I feel horrible for all those retail workers who are now not earning, and terrified for their futures. Many retailers won’t make it out of this pandemic intact.

But even amid the devastation of April, not all businesses were affected equally. Supermarkets? Still going pretty well. Food retailing cooled it from its crazy highs in March, when everyone was fighting over pasta, but it was still 5 per cent above its 2019 levels.

So where was the pain felt? All that home cooking means restaurant are suffering. Cafes and restaurants are bleeding out fast.

The idea we would buy enough takeaways to compensate for all those meals out? Not happening. Cafe and restaurant sales are 50 per cent lower than last year. Takeaway sales have doubled compared to last year, but it is just not enough.

Sadly clothing stores are down by half too. This is somewhat more concerning, because some clothing stores were open in April. Is it about need? We don’t need new threads because we’re not going outside? Or is it about opportunity – we didn’t buy clothes because we were cautious about going into a store to try them on?

Or is it about consumer sentiment? This would be the most concerning explanation, because consumer sentiment won’t heal straight away when the lockdowns end.

RELATED: What if our economy doesn’t bounce back?

RELATED: Graph points to unprecedented collapse

ONLINE SHOPPING

Over the last decade online shopping has grown very slowly in Australia. Despite a few companies that do online very well, it has never been a major part of our ecosystem.

This time last year online sales accounted for only 5.7 per cent of all retail trade. In the entire two decade history of the internet, it has managed to slowly accumulate just $57 out of every $1000 spent in Australia. The remaining $943 is spent in store.

But in April, that slow growth took a big leap. According to the ABS, in April online sales were nearly double the year before, up to 10 per cent of sales. That gels with what Australia Post is reporting – an 80 per cent increase in parcels.

That’s the sort of change that could wreak havoc on Australian retail if it doesn’t revert back. Online companies like Kogan and Amazon will run amok. Meanwhile sellers without strong online presence – including certain department stores and a German discount supermarket – will suffer. Jobs will be gained in delivery and logistics, but lost in stores. We could see a lot of empty shopfronts.

WHAT ABOUT MAY?

Anyway, that was April, and we are now in May. How will May look?

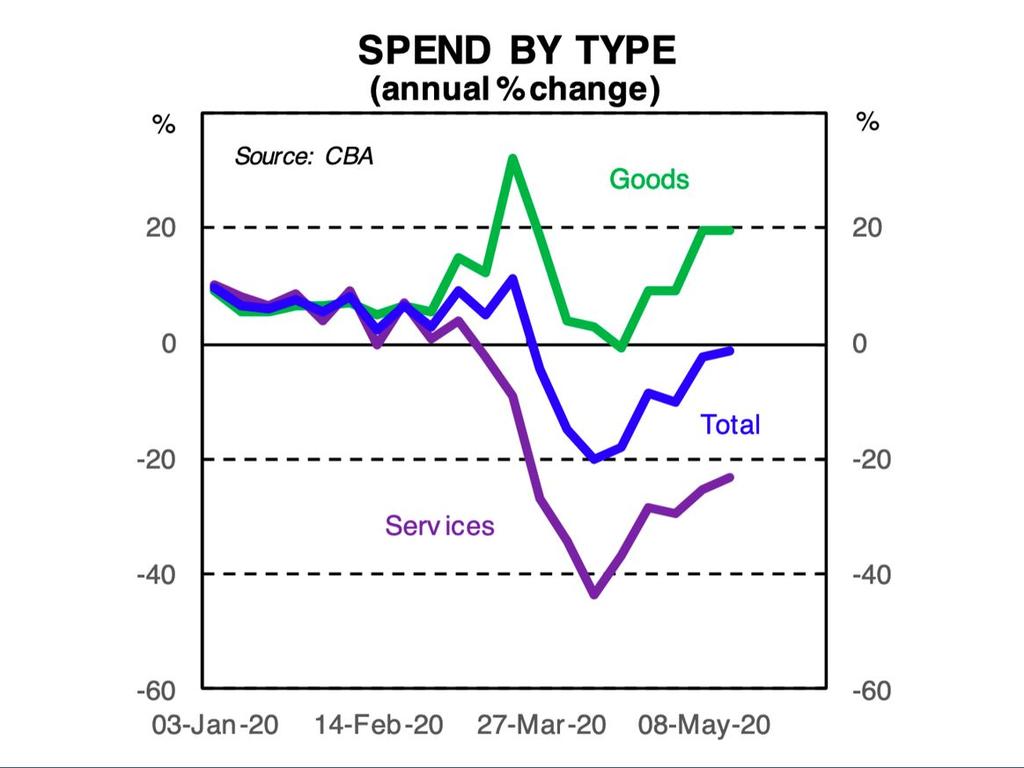

ABS data comes out only after the month is finished, but Commonwealth Bank has data on how much we are spending on our credit cards and debit cards. It comes out every week, and it shows that by May 8, we were starting to recover. Total spending was back to about the same level as a year earlier.

That’s got to be extremely welcome news for anyone who works in retail. If the recovery can continue and extend, their employer might not go broke, and they might yet keep their job.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.