Graph points to ‘unprecedented’ Australian job collapse

Thousands of Aussies are out of work – now new data warns things are about to get much worse. And one group will suffer more than others.

Australia’s job market is in a precarious state. Now a new and terrifying graph is warning us we might be stuck with heavy unemployment for a long time.

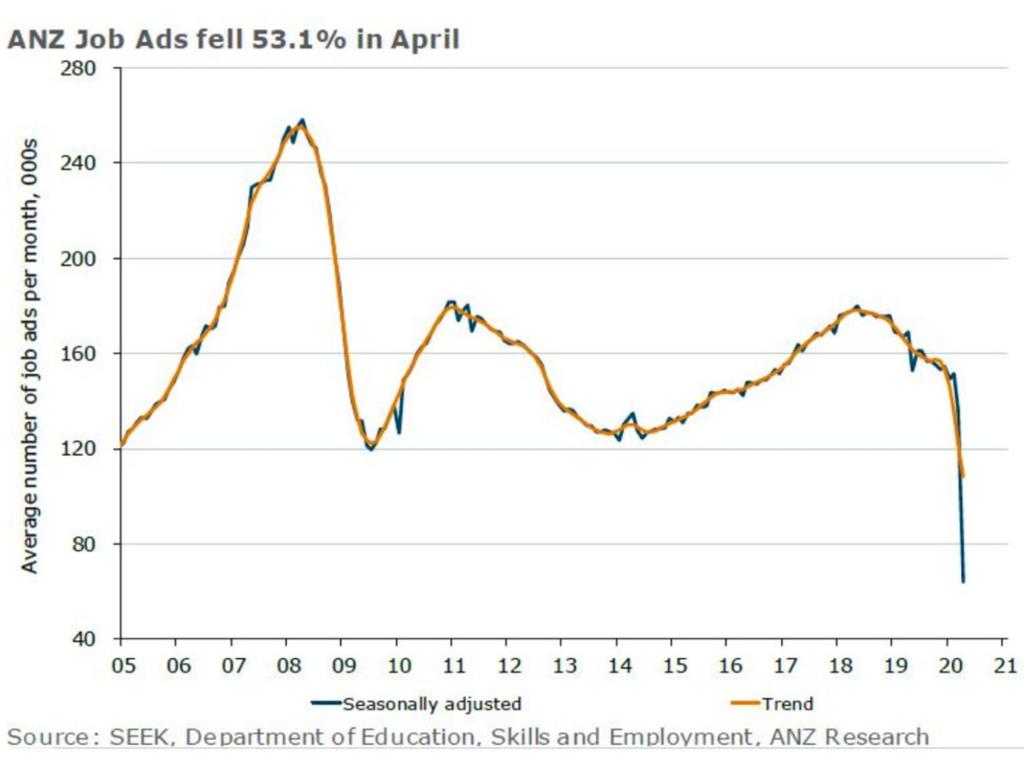

In April, the number of job ads did something unprecedented. They fell by more than half.

Every month, ANZ bank counts up the number of job advertisements. It’s a useful way of seeing how the job market will be in a few months’ time – unemployment data is backward-looking but job advertisements tell us something about how many people will be in work in the future.

ANZ had never seen job ads collapse like this. The previous biggest fall in the series was 11.3 per cent in one month, in January 2009, amid the Global Financial Crisis. This is almost five times bigger. April was obviously a time of high uncertainty, and we can expect some bounce-back when lockdowns begin to ease. But job ads certainly won’t come back all at once.

For the growing group of Australians looking for a job this is awful. They are searching for something that isn’t available. The government recently renamed the unemployment payment from Newstart to JobSeeker, and that’s cruelly accurate, because lots of people will be seeking a job without getting a new start.

RELATED: JobKeeper loophole means casual staff may not get $1500

RELATED: Tax Office reveals new working from home expenses rules

YOUNG PEOPLE

The lack of jobs hits everybody. But one group will suffer more than average.

“The young are going to be hardest hit by the COVIDâ€19 downturn,” wrote labour market expert Professor Jeff Borland in a new analysis of the effect of the pandemic.

Recessions usually hit young people. Finishing school and university at a time when jobs aren’t available is bad for their prospects. Instead of getting a full-time job, they might be forced to stick it out in a casual weekend job. And now, of course, a lot of those are unavailable.

“The young account for a disproportionate share of workers in industries being most affected by COVIDâ€19 shutdowns, such as hospitality and retail trade,” writes Professor Borland.

Because long periods of unemployment are so bad for your lifetime earnings, he recommends the government make it easier and cheaper to stick with education or training instead of going without a job.

“Making that education and training affordable (and not adding to the debt burden young people already face), and implementing largeâ€scale paid internship and work experience programs, are therefore priorities,” Professor Borland argues.

LONG TERM UNEMPLOYMENT

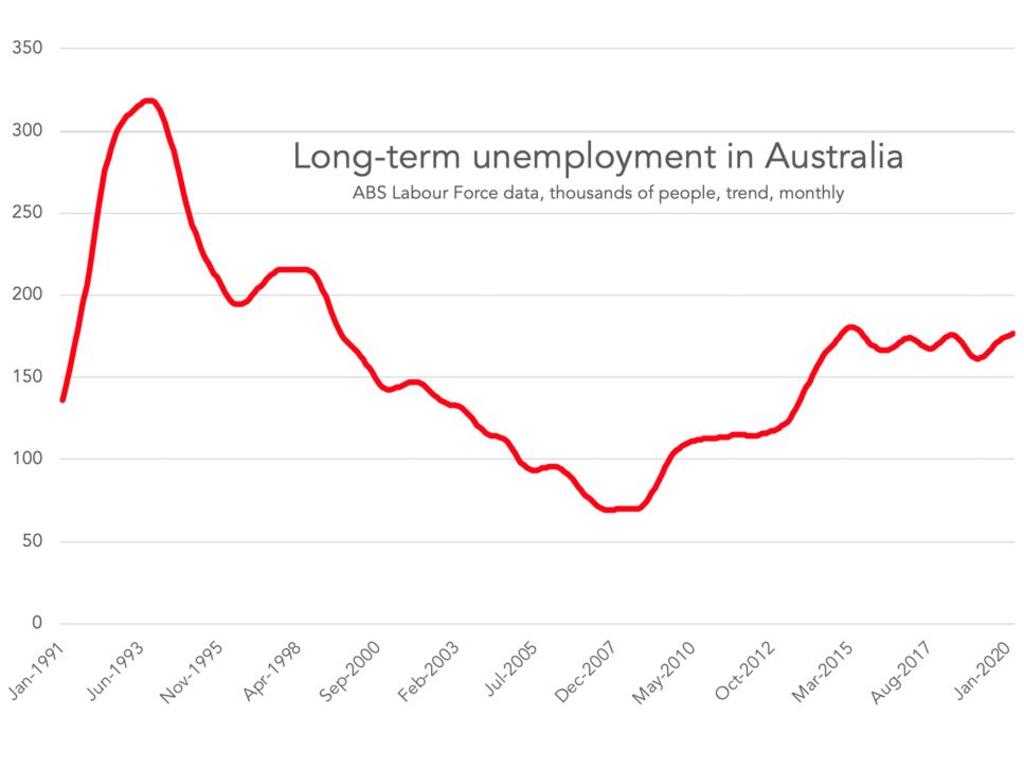

Long-term unemployment has not been a hot topic in Australia for years. After the 1990 recession it slowly fell away, and even though it has been creeping back up – as the next graph shows – it hasn’t been at the front of mind. That might be about to change.

RELATED: How to apply for the JobSeeker payment

RELATED: What deferring mortgage repayments means for your credit score

Long-term unemployment is defined as seeking a job for more than 12 months. With the likely lack of jobs out there, even the best labour market programs won’t save some Australians from slipping into long-term unemployment in the next couple of years. The red line in the graph above is going to shoot up.

Long-term unemployment is a major problem because it feeds on itself. The long-term unemployed find it harder to get work – employers are wary of gaps on the resume and their job skills wither away.

Long-term unemployment is also correlated with not having the tools you need to get a job – a car, professional clothes to wear to an interview, etc.

To save people from long periods of misery, avoiding long-term unemployment as much as possible must be a national priority.

REDUCING JOB SEEKER IN SEPTEMBER

In March, the government doubled the JobSeeker payment, adding a $550 supplement. That’s been very useful for those out of work and is helping prop up the economy during this difficult time.

But the payment is expected to snap back after six months. Come September, hundreds of thousands of Aussies who are depending on the payment for their income would have to make do with less.

Reducing the jobseeker payment in September will be very tempting for the government – it will be costing the budget enormously because so many people will be receiving it. But for the same reason, cutting the payment will be politically difficult. Loads of people who’d never been on the dole before will be on it, especially if the JobKeeper payment expires at the same time.

What’s more, cutting the payment will be macroeconomically dangerous. One person’s spending is another person’s income. Forcing so many Aussies to cut their spending at once might just slow the economy even more. And with that risk hanging over everyone’s heads, companies will not be keen to hire more people.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology