Coronavirus Australia: What if the economic recovery is not V-shaped?

Australia is predicted to see an economic bounce back in 2021 but what will happen if the V-shaped recovery decides to take the form of an L instead?

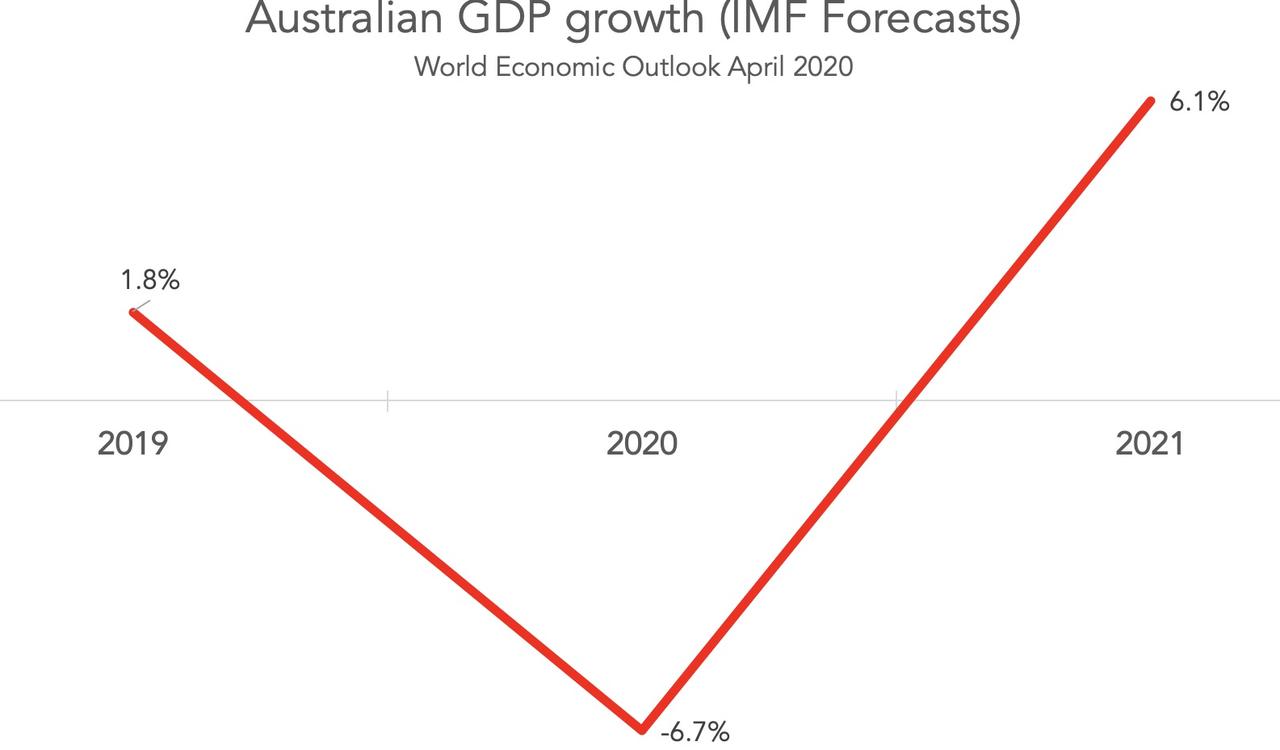

The International Monetary Fund says the world economy will have a V-shaped recovery.

It forecasts the Australian economy to plunge this year, then next year we shoot back up almost to where we were.

Growth is shown in the next graph. We shrink by 6.7 per cent, then grow by 6.1 per cent the year after.

This is a very bad recession. But at least it is quite short. The assumption the IMF makes is that the economy bounces back when the virus is defeated.

One question haunts me: What if they are wrong?

It’s worth thinking about, not because they are certain to be wrong – let’s hope they’re right – but because we need to be ready if this economic downturn turns into a stubborn, long-lasting one.

RELATED: Follow the latest coronavirus updates

RELATED: The big problem with 80c a litre petrol

The alternative to a V-shaped recession is an L-shaped one. We fall down and thereafter growth is flat.

Is that likely? The Commonwealth Bank thinks the economy will remain drab in 2021.

“We think that business investment and residential construction will be sluggish right through 2021,” wrote senior economist Belinda Allen in a note to clients on Friday.

“And we don’t think that the spending habits of households will fully recover to the level they were pre COVID-19.”

After they go through a grinding period of job losses and wealth destruction, people don’t go straight back to buying iPhone 10s and Ford Rangers.

We’re going to be frugal for a while.

We’ll be milking out the battery life on that old iPhone 8, and watching the kilometres click up and up on our current car. That hurts the economy, because one person’s spending is another person’s income.

Businesses will be the same – many are taking on debt to make it through this period, and once the recovery starts, their focus will be on paying down that debt instead of spending money to grow their business and hire more people.

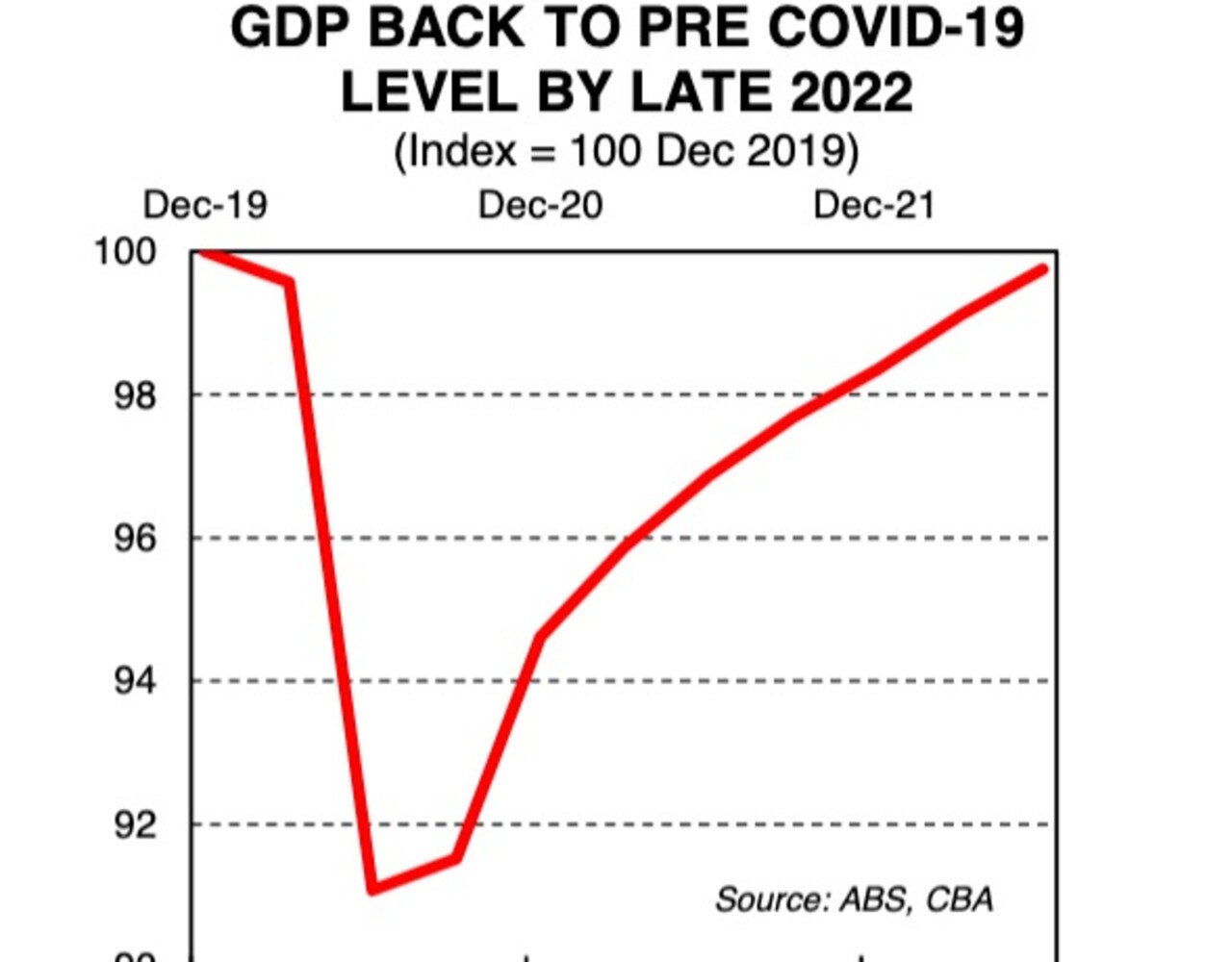

The Commonwealth Bank’s forecast of our economy has the level of GDP getting back to where it was in late 2022, as the next graph shows.

Note that this is a different graph to the first graph. This shows the level of GDP, the IMF graph earlier showed the growth rate.

There’s a funny thing about growth rates. If you shrink by 6 per cent then grow by 6 per cent, you end up smaller than you started.

Imagine we start at an arbitrary level 100; we fall by 6 to 94. But 6 per cent of 94 is only 5.64.

If we grow by 6 per cent we’re not back where we started. If growth falls to negative 6 per cent this year, we need to grow by more than that next year to get back to where we began.

GLOBAL GROWTH

The Australian economy depends, these days, on the rest of the world.

Even if we eradicate the virus and our domestic economy starts to fire up, our exporters – farmers, miners, education and tourism - need the rest of the world to provide their incomes.

And as the Grattan Institute observes, the rest of the world is suffering.

“A striking feature of COVID-19 is that it is hitting all major economies almost simultaneously,” wrote author Brendan Coates and colleagues in a recent analysis.

“The prospects for a rapid ‘V-shaped’ economic recovery are remote. The duration of the COVID-19 crisis is uncertain, but the direct economic effects on employment are likely to persist for some time.”

RELATED: Credit score impact of deferring mortgage repayments

UNEMPLOYMENT

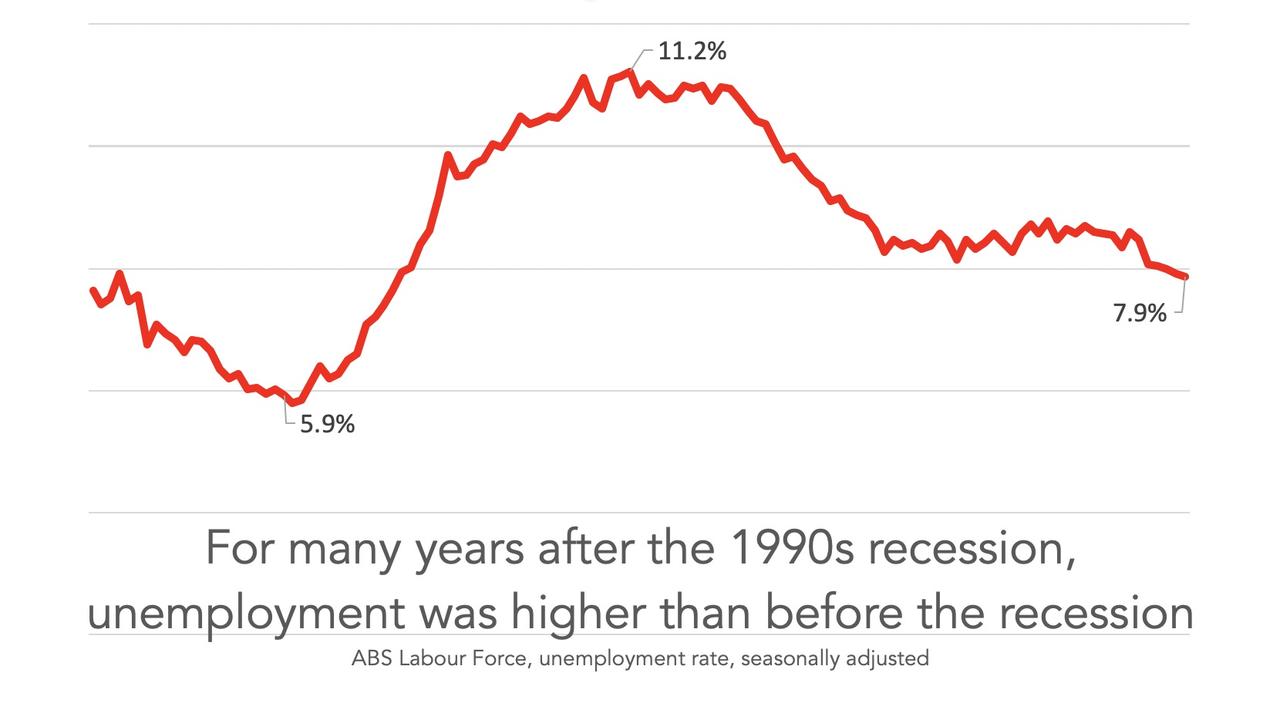

Unemployment sucks for many reasons. One is this: its gets worse fast and gets better slow.

Why doesn’t unemployment jump back to where it was? Partly because companies learn how to get by with fewer staff.

But also because unemployment hurts people. They call it “scarring.”

Australia’s top labour market economist is Professor Jeff Borland, and he says one group who will be scarred by this downturn is those leaving school.

Scarring occurs when longâ€term negative consequences for a worker follow from an adverse experience early in their work life,” he said in a recent note.

“It now seems certain that cohorts of students who are (or would have been) leaving school at the end of 2020 (and perhaps also 2021) will face a considerably more difficult time getting into employment.”

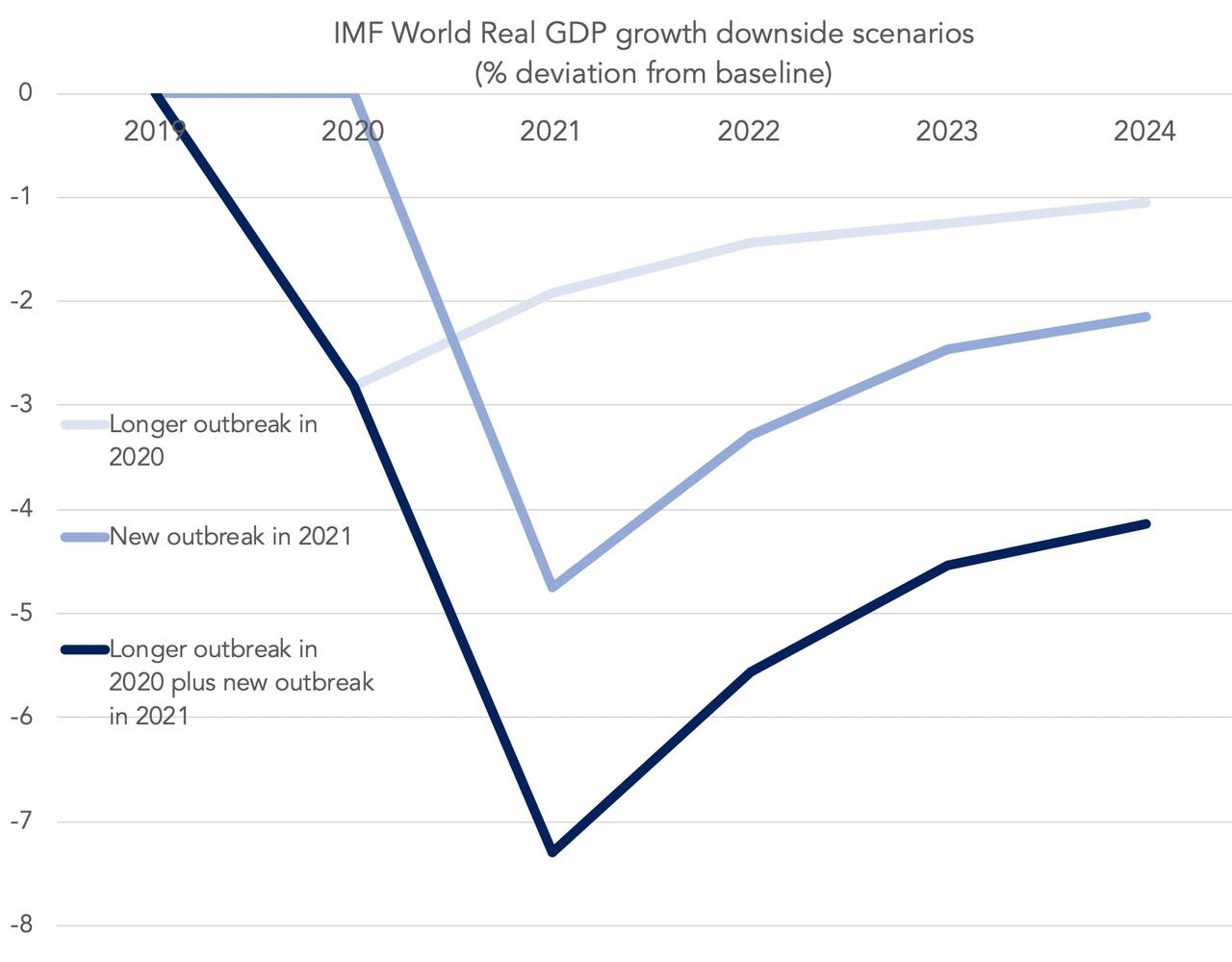

The future looks cloudy. And all this is without considering the chances of a devastating second wave of the virus.

If that happens, the IMF expects the world to be even worse off, as the next graph shows.

These long-run implications are not certain – nobody can see the future – but they are worth bearing in mind as we consider the choices we make right now, both individually, and as a nation.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.