Cash payments predicted to disappear within a decade as tap and go takes over

STATISTICS show less and less of us are relying on cash these days. And according to experts, it will soon vanish altogether.

CASH could become a distant memory as soon as 2026, according to startling new predictions from experts.

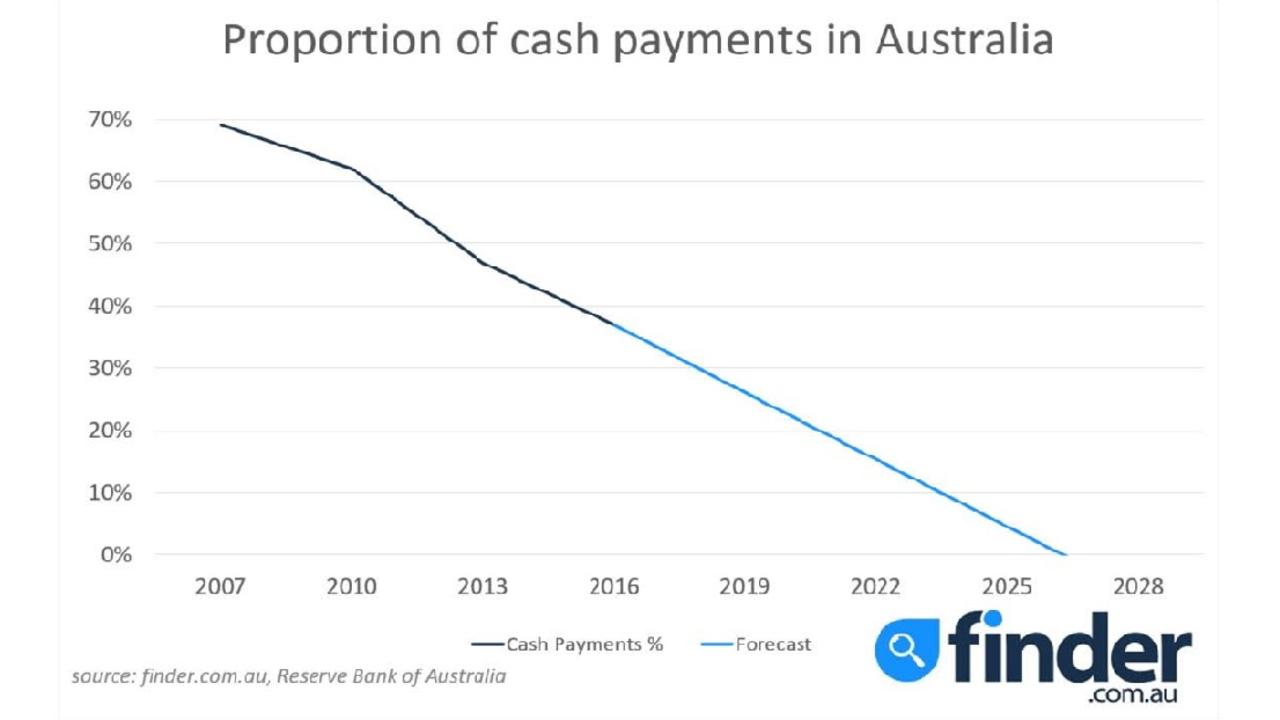

According to data from the Reserve Bank of Australia (RBA)’s ongoing Consumer Payment Methods survey, the percentage of cash payments in the country plummeted from 69 per cent in 2007 to just 37 per cent in 2016.

A projection of that data by comparison site finder.com.au has revealed that if the current trend continues, physical cash could vanish in Australia as soon as 2026.

It’s even earlier than the predicted expiry date of ATMs, with an analysis of RBA statistics by finder.com.au showing they could disappear from our streets by 2036.

• ‘Millionaire by 21’: Teen makes $1800 an hour

• Ex-porn star’s tweet divides US

• David Jones’ simple stroke of genius

Finder’s money expert Bessie Hassan said it seemed new technology was behind the death of cash.

“Many people simply tap-and-go with their debit or credit card nowadays. With the introduction of Apple Pay and Google Pay, even that’s a bit old-school for some,” Ms Hassan said.

“These new payment methods have led to less people carrying cash with them.

“In the past Aussies would come armed to group dinners with a wad of cash so they could pay for their portion of the bill.

“Nowadays it can all be done electronically thanks to mobile and online banking and new technologies such as PayID through the New Payments Platform (NPP), meaning Aussies don’t even need to bring their wallet with them when dining out with loved ones, just their mobile phone.

“There are also mobile apps such as HeyYou which allow you to order and pay for your morning coffee through your mobile phone.”

It’s a sentiment echoed by Aussie coffee baron Salvatore Malatesta, the owner of Melbourne’s St Ali Coffee Roasters, Bondi’s Sensory Lab and a host of other businesses.

“Ten to 15 years ago I would have said 90 per cent of customers used cash, but since then there’s been a slow decline and now only around 10 per cent of transactions are cash,” Mr Malatesta said.

“It’s a massive change that’s happened for a number of reasons, the number one being just the convenience — because [non-cash payments] are efficient and quick.

“I know I’m often guilty of leaving my wallet at home, so using your phone to pay is just bloody handy.”

He said cash payments are also more inconvenient for sellers.

“Moving cash around is really expensive, and it’s a risky thing for the operator. The cashless space is quite handy and it’s a great leveller,” he said.

“I wish we were completely cashless to be honest.”

Mr Malatesta said it was his belief the government supported to move towards a cashless society.

“I’m confident that it’s not speculation but strategy to eliminate cash altogether from a revenue perspective,” he said.

“It just happens to coincide nicely with the way humans are now interacting with technology, and I suspect we’ll be entirely cashless soon.

“I’m not brave enough to put a prediction on when ‘soon’ is, but I think we’ll be down to single digits within three to four years and it’ll be gone entirely within a decade.

“There’s no place for cash — it’s messy and clumsy and it doesn’t work anymore.”

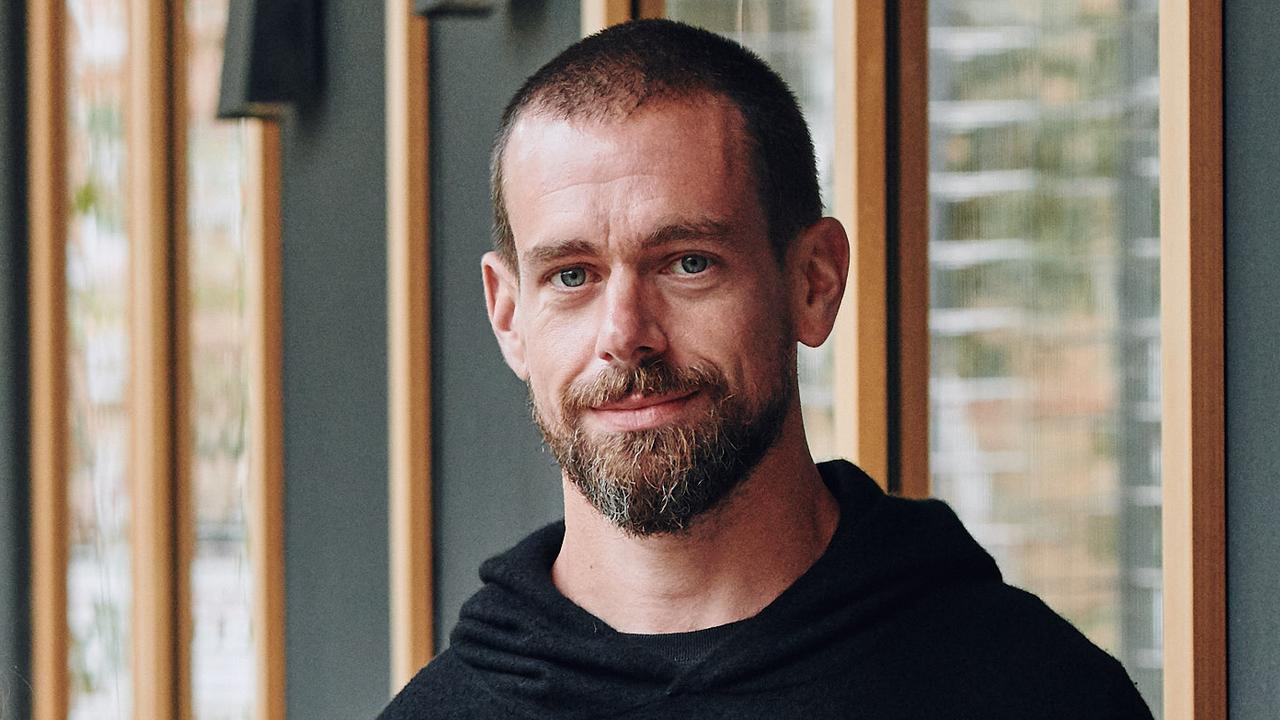

Jack Dorsey, the billionaire co-founder of social media platform Twitter and payment technology company Square, is one of the world’s cashless payment leaders.

Mr Dorsey was in Melbourne this week to announce the expansion of Square in Australia, including the launch of its first engineering hub outside of North America. He told news.com.au cash was becoming less and less popular with shoppers and sellers alike.

But he stopped short of predicting the death of cash altogether.

“I don’t think it will disappear entirely in future. Our philosophy is to help sellers accept any payment, whether it’s cash, bitcoin or tap, so they can focus on the sale and the customer,” he said.

“When it comes to what customers want, the trend is a lot more towards tap and go and digital — there’s a desire for more speed and convenience.”

Mr Dorsey said Australia was especially “tech-forward” and that Aussies had been early adopters of non-cash payments.

“Anyone can make a prediction and be wrong … but more and more people are using digital devices to pay, whether it’s with their phones or watches, and I do believe we’ll certainly see less cash and cheques, although I don’t think they’ll ever go away completely,” he said.