Aussie iron ore recovery could vanish overnight

The price of one of Australia’s biggest cash cows has gone up but the recovery might not be what it seems – and it could disappear overnight.

China is stimulating again and markets are buying iron ore. The price of Australia’s key export is up one-third from the lows. Time to pile investment into big miners!

Not so fast. We’ve seen it all before.

Despite this apparent turn in the iron ore cycle having some things in common with previous iterations, there are atypical forces at work this time to give investors significant pause – perhaps even to suspect that the rally is little more than bear market bounce.

The first point to make is that Chinese stimulus so far remains muted. This is particularly the case for the major construction sectors that drive iron ore demand.

About 40 per cent of that demand comes from property construction and it remains down 22 per cent year on year in the latest data (November 2021) and sales have not improved since.

Moreover, the cause of this sag, the campaign to deleverage property developers, is not over as defaults continue to pile up. Stressed balance sheets in the sector are also contributing greatly to an outright collapse in land sales for development, which are down 70 per cent year on year in January.

That may not seem to matter that much. But land sales make up about one-third of the local government revenue that supports the infrastructure spending that comprises another 30 per cent of Chinese iron ore construction demand.

Authorities are scrambling to backfill that hole with more debt, but it is a mighty large gap to fill. Infrastructure volumes are also likely to be down this year.

So, why is iron ore rallying? First, it’s the kind of market action we always see when China stimulates as speculators buy.

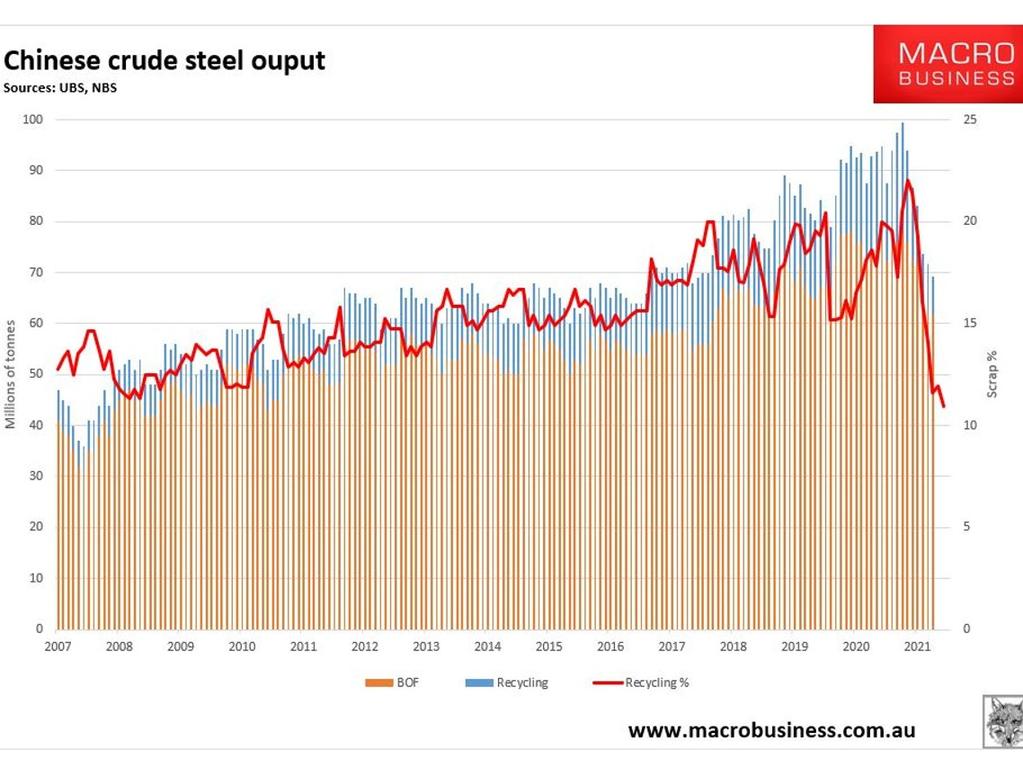

Second, and much more significantly, last year’s energy crisis in China is still playing a key role in supporting iron ore and coking prices. How? Because excessively high power prices derived from a runaway coal price led to huge shutdowns in steel recycling plants which use a lot of electricity.

The steel recycling sector directly competes with the blast furnaces that consume iron ore and coking coal. So, when recycling output falls, the demand for raw materials rises assuming all things are equal.

Right now, an unprecedented 120 million tonnes of recycling capacity is offline but will restart very soon as power prices normalise.

More Coverage

If it all comes back online before China properly stimulates its construction sectors again, some 200 million tonnes of iron ore and 100 million tonnes of coking coal demand will vanish overnight.

Market expectations are for a considerable lift in steel output and iron ore demand after the passage of the Beijing Winter Olympics in February. But there is considerable scope for disappointment if, instead, steel recycling booms back and crushes iron ore demand.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.