Tesla share price: Why stocks are rising despite fewer car sales

Tesla’s making fewer cars and earning less revenue, so why has the car company’s share price gone up five-fold during the pandemic?

Tesla’s share price has been doing extraordinary things in recent times. Since the start of the pandemic, it has gone up around five-fold. The total value of the electric car company is now bigger even than the value of Toyota. Even though Toyota makes and sells 9 million cars a year and Tesla sells about 4 per cent as many as that.

Today, Tesla released its financial results for the last three months. Like many people I was looking forward to them to see if they could explain the rapid quintupling of the company’s value.

I got up early and read through the numbers, then tuned into a phone call where Elon Musk answered calls from investors. There was … nothing much? The company sold fewer cars than the same period last year, and made less revenue than the same period last year. You expect that, because of the pandemic. It lost money on the sale of cars. But by selling $428 million of carbon credits and cutting costs savagely Tesla was able to squeak out a $104 million profit. That’s all.

RELATED: Why houses prices could actually go up

Of course, making profit in a pandemic is impressive, no matter how you do it. That profit is useful for Tesla’s share price. The company now has four small profits in a row, and four consecutive profits is a necessary condition to be admitted into the top US stocks index, the S&P 500. If it is admitted into the index, even more people will buy the stock.

But the profit was not nearly big enough to explain why investors think this company should be the world’s most valuable car company. A $104 million profit is puny for a company with a history of making $700 million losses.

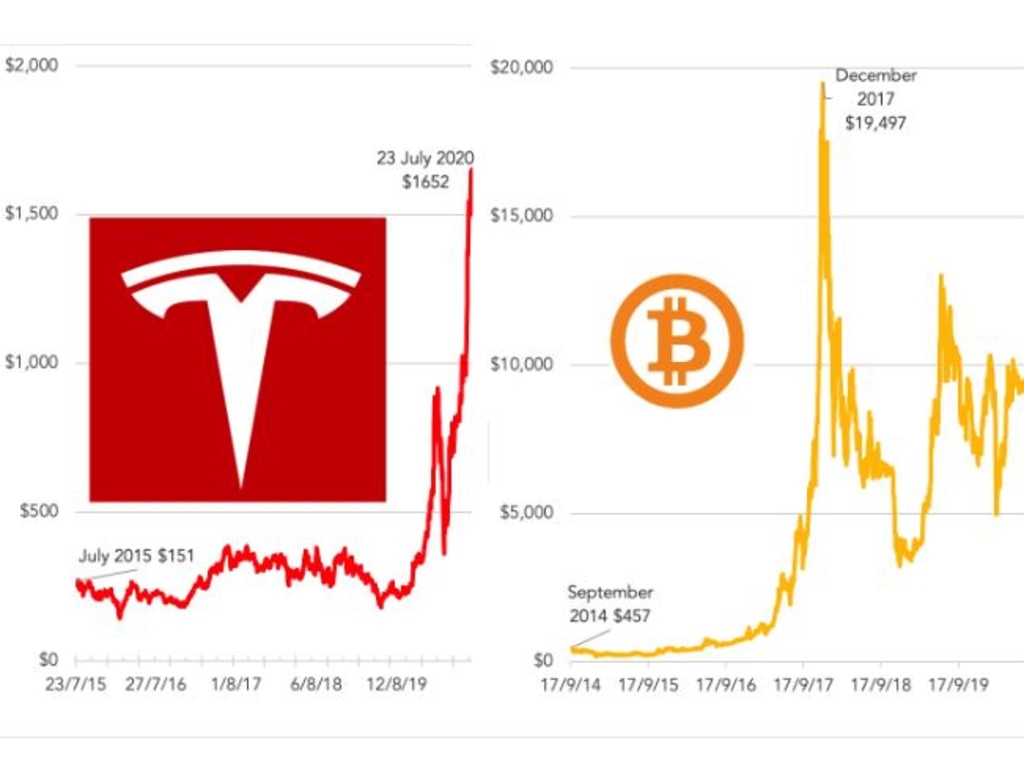

Tesla’s share price reminds me most of bitcoin. Because of investor excitement, it has suddenly gone vertical. But as the next graph suggests, going vertical is not always sustainable.

RELATED: ‘Crazy’: Australia’s pandemic payday

ELON’S PAY

Tesla CEO Elon Musk is very famous these days. Most recently he hit the news for naming his child X AE A-XII.

What gets less attention is his pay. Elon’s contract is written so that he gets paid big bonuses when the stock price of Tesla goes up. Most American CEOs get paid a lot. You sometimes see pay packets of up to $50 million a year. But Elon is in another league. He qualified for a $US700 million ($A980 million) bonus in May, and with the recent rise in the Tesla stock price he qualifies for another $US2100 million ($A2900 million) now. That’s $US2.1 billion ($A2.9 billion) extra, on top of the $US700 million ($A980 million).

That’s just his bonuses. Don’t forget – Elon owns around one-fifth of Tesla, which is now a $US300 billion ($A420 billion) company. When the stock price goes up his wealth goes up. That’s a lot of money he’s making out of Tesla’s green image.

THE ACTUAL BUSINESS

Away from the bizzarro world of the stock price, when we look at Tesla as a company, what do we see? Some good, some bad.

Start with the good. Tesla is building a new factory in Austin, with butterflies.

“We’re going to have a boardwalk, it’s going to be right on the Colorado River, It’s going to basically be an ecological paradise,” Mr Musk said. “Birds in the trees, butterflies, fish in the stream.”

Tesla is also building a factory in Germany in what used to be a forest.

These new factories will help Tesla produce more of their green cars, including the three-tonne Cybertruck, which will cost up to $103,000 in Australia.

It wasn’t all good news though. Progress of Tesla’s autonomous driving is still slow. Elon Musk previously promised a Tesla car would be able to drive itself “coast to coast” across America in 2017. Today he revealed how far short of that goal Tesla has fallen. He said his personal car – equipped with software that isn’t available to the general public – can drive to work without him touching the wheel. Almost.

“I personally test the latest alpha-build of full self-driving software when I drive,” he said. “It’s almost getting to the point where I can go from my house to my work with no interventions.”

To me, the story of full self-driving is like Tesla in a nutshell. We all want it to work, we are all very excited by it, and it’s tantalising. You see this hope expressed in the stock price. But the reality doesn’t quite match our dreams. Yet.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.