Housing market: House prices could go up

Everything is pointing towards house prices dropping because of the global pandemic. But that may not actually be the case.

There’s a huge question Australians want answered: What will happen next with house prices?

The majority view is prices will dive. Australia’s biggest bank forecasts house prices to fall 10 per cent in the next six months. The fall, say analysts from the Commonwealth Bank, will be “driven by weak sentiment, rising unemployment, social distancing measures and a

sharp slowdown in net overseas migration.”

For a lot of Australians the end of endlessly rising house prices would be very welcome. House prices are crazy high, especially in the capital cities. I include myself here. I don’t own a home, although I’d like to.

But in this tumultuous time, there’s a risk. A risk house prices don’t do what the economic forecasters expect. The risk is they keep going up. It wouldn’t be the first time Aussie house prices have defied expectations – and common sense – to get even more expensive.

WEALTH EFFECT

Two things have me wondering about rising house prices. First is the wealth effect. Plenty of Australians are, paradoxically, finding themselves better off in this crisis. The wealthy are those who usually spend most on restaurants, cafes and holidays. Now all that money is stuck in their pockets, building up and looking for an exit.

Sydney-based investor John Hempton put it like this on Twitter:

RELATED: ‘Crazy’: Australia’s pandemic payday

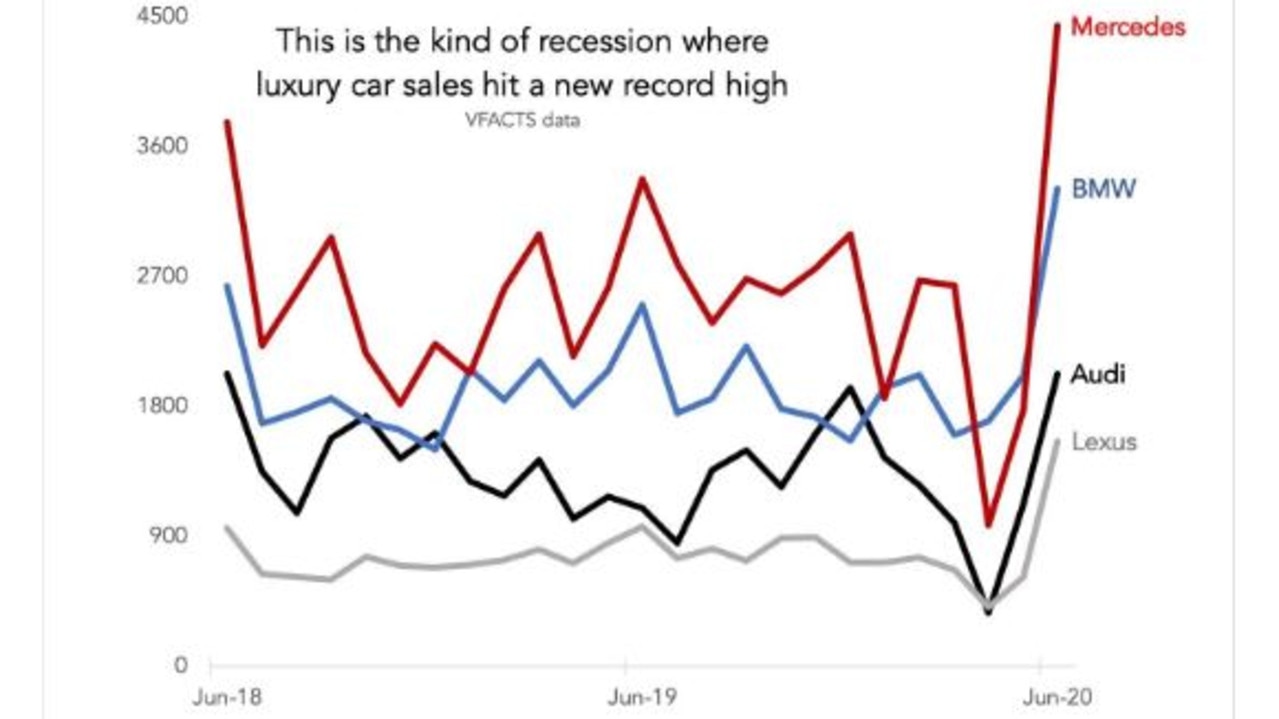

One thing the wealthy are spending up on is luxury cars. Sales of Mercedes Benz cars hit a record in June, as the next graph shows. BMW, Audi and Lexus too. Which is a weird thing to happen in a recession, if you think about it.

RELATED: Economic risk of Victoria’s ‘second wave’

Now, partly this is caused by the instant asset write off policy, which juiced up the usual end-of-financial-year surge. But if it was only about that policy, every kind of car would have set new records. Instead it was the Germany luxury brands that did. The explanation has to be that spare cash is sloshing around in the pockets of the wealthy.

The definition of a recession is falling incomes. But obviously some people find themselves with spare cash. You better expect they will spend more on houses. There couldn’t be anything more Australian.

OFFICIAL POLICY SUPPORT

The Government has come to the party too. The RBA sent interest rates to record lows of 0.25 per cent and they have pledged rates will stay low for a long time. Mortgage rates have never been cheaper. The government has also given us the HomeBuilder Grant. $25,000 for people to build a new homes. These policies give home buyers the capacity and confidence to keep buying.

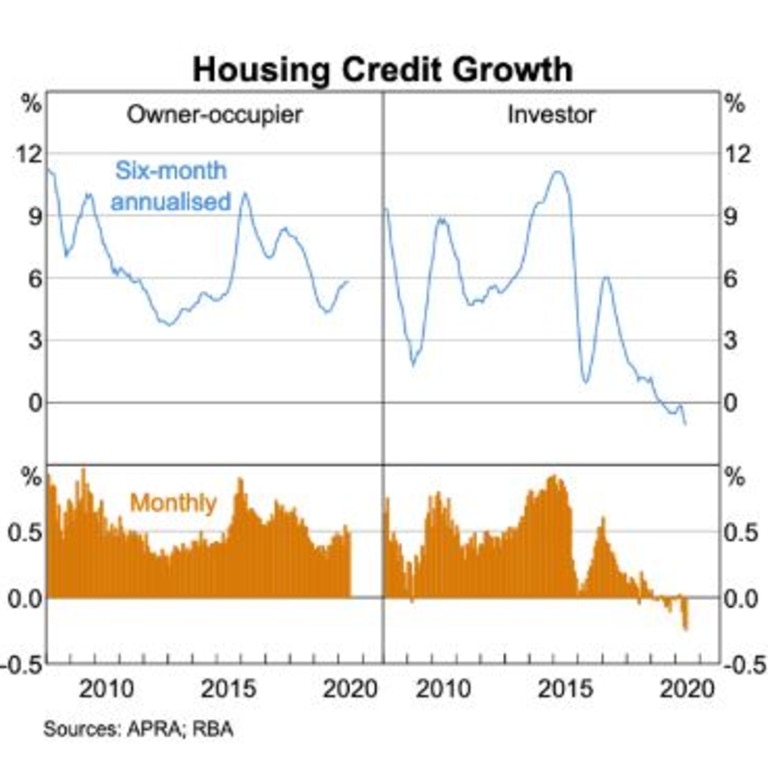

As the next graph shows, owner occupiers are still hitting auctions hard. Lending to owner occupiers is up 6 per cent, even though investor lending is actually falling.

REGION BY REGION

Now, I don’t think there’s a chance of rising house prices everywhere. In some parts of Australia the downward pressure is surely too much. I’m thinking especially of those areas that depend most strongly on foreign tourists, foreign students and new migrants.

Places like Melbourne’s CBD. In Melbourne’s CBD, investor sentiment matters, and rental prices have tumbled. I’d expect apartment prices to fall further with the latest restrictions in Melbourne.

That obviously spills outwards to some extent. Cheap city apartments are substitutes for inner city apartments, which substitute for inner city units, and they in turn substitute for inner city houses, etc. But this wave of discounting can only go so far before it breaks on a reef of cashed-up wealthy people competing for family homes in good suburbs.

Those suburbs are where house prices seem most likely to hold steady or go up. Suburbs with a lot of public sector employees (total jobs down just 0.9 per cent); finance and insurance employees (jobs up 0.9 per cent) or electricity and gas employees (jobs up 1.4 per cent).

The government has actually done a good job of propping up the economy in some places, JobKeeper has worked well and – so long as the Treasurer doesn’t slash it too much when he does his budget update next week – it should continue to keep the Australian economy from falling in a heap.

That is welcome news. It also means the house price easing that so many Aussies are waiting on might never materialise.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.