Controversial tech billionaire Elon Musk’s personal fortune ballooned $6.5 billion in one day

The surging value of a controversial tech billionaire’s company has been described as “insane” as punters try and figure out what’s going on.

Elon Musk’s wacky stunts often make it appear as though he’s auditioning as a Bond villain but his company’s recent surge in value may suggest there’s method behind the madness.

On Monday alone Tesla’s share price rocketed nearly 20 per cent, allowing its owner and chief executive to add more than $6.5 billion to his fortune through his 19 per cent stake.

And the rise didn’t stop there.

By Tuesday the electric car manufacturer and solar panel maker had gained more than 36 per cent in two days to about $1330, making it worth more than five times what it was in June when rumours of bankruptcy were circulating.

🔥🔥🔥

— Elon Musk (@elonmusk) February 3, 2020

In this time, the company has become the second most valuable car manufacturer in the world and is now worth more than institutional producers General Motors, Ford and Fiat Chrysler combined.

RELATED: Best and worst Aussie stocks of the decade

RELATED: How to get trading on the share market

Tesla, at $A237 billion, is now only eclipsed by Japanese giant Toyota at $A344 billion, despite producing a fraction of the stock and the high price tag of its vehicles, starting at $A60,000.

Tesla shares climb as much as 11% in pre-market trading https://t.co/n8kANlJx2g pic.twitter.com/QCacS1Bm2h

— Bloomberg (@business) February 4, 2020

Musk is no stranger to bizarre and expensive PR stunts.

Hurling one of his cars into space attached to a rocket ship, producing and selling flamethrowers, and the release of his futuristic Cybertruck are just a selection of the unorthodox.

Some are keen to brandish the South African a genius but many analysts suggest the company’s recent surge in value is the result of a number of investors who have gambled against the company — betting the stock will drop in value.

But as the share price rises, they’re losing money on their position so to limit their losses, they buy more.

This drives the company’s value higher towards a tentative position.

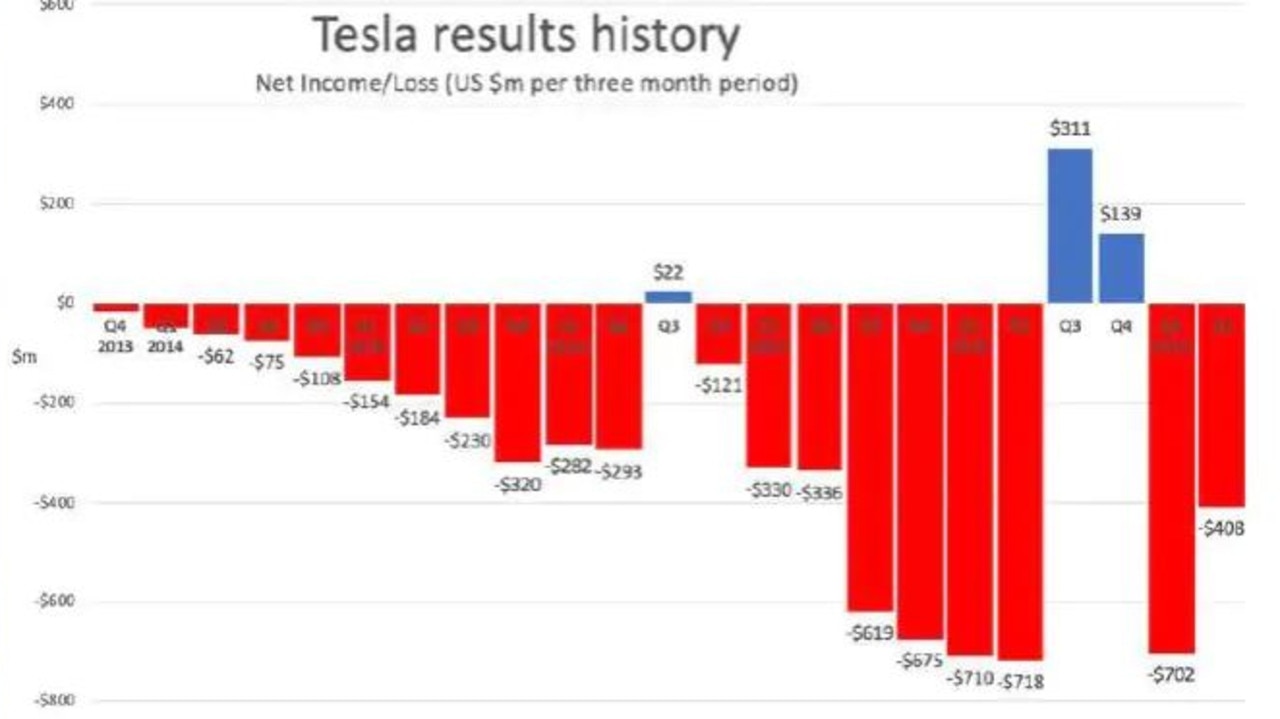

“It doesn’t seem to be closely attached to reality,” Gartner analyst Mike Ramsey told AP of the company that has never recorded a full year profit.

ROTH Capital Partners analyst Craig Irwin told CNBC the dramatic rise of Tesla’s “freaking” stock was “insane”.

Bronte Capital chief investment officer John Hempton has bet against Tesla, telling news.com.au the laundry list of warning signs was too much to ignore.

“I will take a short position on a stock with a lot of red flags,” he said.

I run >200 short positions. It works on average, but about once a year one costs me as much as $TSLA/$TSLAQ.

— John_Hempton (@John_Hempton) February 4, 2020

It is never pleasant. But for someone whose starting position is 10x mine it must be frightening.

The co-founder of the Sydney-based long and short fund manager says the recent surge is not explained by Tesla’s performance.

“The main driver by far in the stock is the behaviour of short sellers,” Mr Hempton said. “There may be some fundamentals but there is nothing in the fundamentals that explains this move.”

"I just can’t believe this freaking stock. It’s insane,†says $TSLA bear Craig Irwin. “I think this is largely #FOMO†pic.twitter.com/ef0bzIfJWQ

— Squawk Box (@SquawkCNBC) February 4, 2020

Tesla said in its recent result that “2019 was a turning point” for the company when it recorded profit of $386 million in the final three months of last year.

But economists say it’s important to note that although it has reported slight profits over the years, the losses have been far more significant.

SHOWDOWN WITH THE SEC

One of the company’s “red flags” was its boss’s confrontation with the financial regulatory agency in the US.

The Tesla boss regularly treads a fine line between brilliant and bizarre, and perhaps at no other time was the later as costly than when he was dragged over the coals by the Securities and Exchange Commission (SEC).

Musk had already been under pressure for his tweeting and its influence on the company’s share price but, in February last year, he posted a comment declaring it would make 500,000 Model 3 cars, up from 100,000 more than it did the year before.

Musk corrected himself four hours later, saying that Tesla would indeed produce about 400,000 cars this year: “Meant to say annualised production rate at end of 2019 probably around 500k.”

But that correction was not enough for a federal judge, who gave Musk two weeks to explain why he should be spared from being held in contempt for violating the agreement with the SEC.

To settle fraud charges stemming from the tweet, Musk had to resign as Tesla chairman, both he and the company had to pay a $20 million fine and the SEC demanded oversight of his social media use.

— with AP

What’s behind Tesla’s recent surge in value? Get in touch or comment below | @James_P_Hall | james.hall1@news.com.au