‘Bleeding money’: $408 million question Elon Musk can’t answer

Tesla sold a record number of cars last quarter — but the sales mask a bigger problem, and one that Elon Musk is running out of excuses to explain.

Tesla just had an amazing quarter. It sold a record number of cars worldwide: over 95,000 of them. Its factory is finally up and humming, making over 6000 cars a week, putting its long history of “production hell” behind it.

Eager customers in Europe received their electric Model 3s in the second quarter, many paying 70,000 euros for a car that can do zero to 100 in 3.4 seconds. Elon Musk’s famous “masterplan” to create an electric sedan at mass-market prices is basically complete (so long as you’re generous on what counts as a mass-market price).

Tesla’s cashflow was positive. It got more cash in the door than it sent out, perhaps in part because in Q2 it sold some cars it made in Q1. (The difference between the income result and the cash result is due to accounting rules that determine when costs must be recognised.)

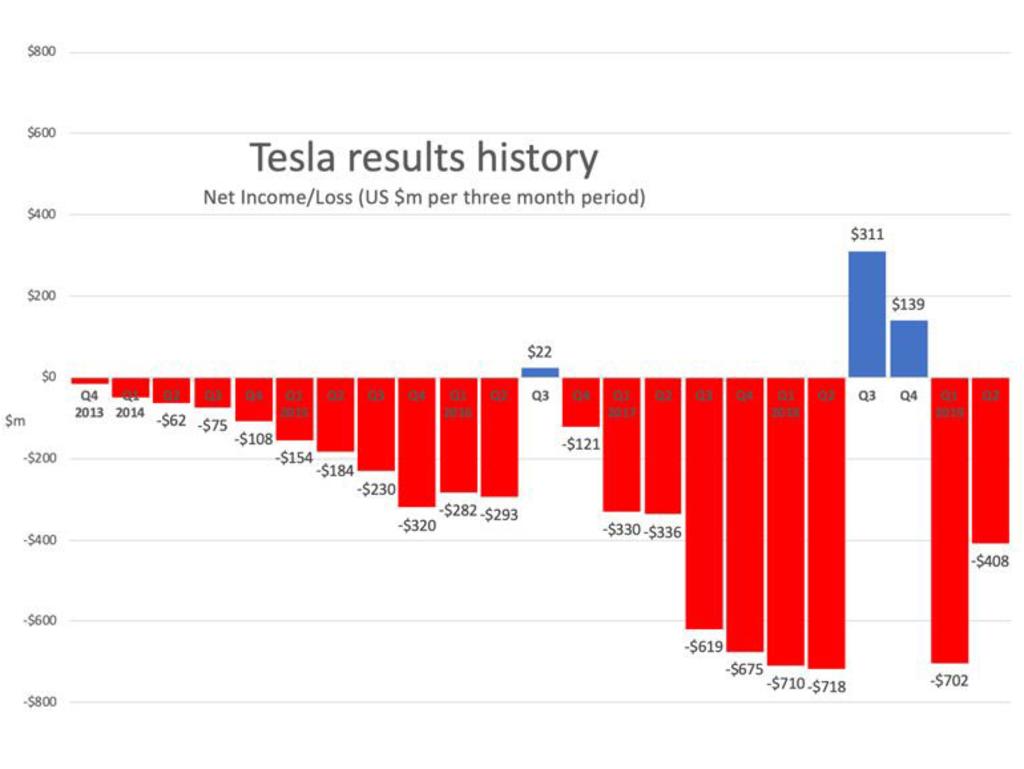

And yet. Despite this dizzying series of triumphs, Tesla lost money. Again. As the next graph shows, it lost $408 million in the most recent quarter. That’s not the most money Tesla has ever lost, but it’s the most it has ever lost without a good excuse.

In all those previous big losses, Tesla was able to say it was getting the Model 3 ready. It was building the factory, solving the manufacturing issues, ironing out the global logistics. There were two small profits late in 2018 that got people thinking that the worst was behind Tesla. Elon Musk said he expected to make profit in every quarter from then on.

But now? There’s not much that passes for a good explanation.

“(We) believe Model Y will be a more profitable product than the Model 3,” said chief executive and major stockholder Elon Musk in a letter to shareholders, referring to a vehicle the company has not begun to make yet.

While claiming that the future would be brighter, Tesla also slashed its planned investment in the future. Capital expenditure for 2019 was revised down to just $1.5 to $2 billion. That’s less than the depreciation on their current capital goods, suggesting the company was just scraping through.

Mr Musk has a history of engineering victories and financial losses. Unfortunately, companies aren’t engineered items. They live or die on the flow of money.

WHY DOES A COMPANY NEED TO MAKE PROFIT?

Without cash to spend, a company will go broke fast. It can get cash from two places — from running at a surplus, or from outside sources. So why would outside sources give money to a company? The answer is: to get returns.

Many Tesla investors are good-hearted people who simply want to help the environment. They genuinely don’t care if they make returns on their Tesla investment. But while these benevolent types are numerous, their collective ownership of the $US45 billion dollar company is small. A company is not a charity, after all. Pension funds own a large proportion of Tesla, and they have to get returns to fund people’s retirements.

Investors won’t fund a loss-making company forever. Faced with losses for a long time, big investors will sell the stock, and the stock price will fall. The further the stock falls, the less access to outside money the company will have, and the higher the chance of eventual bankruptcy.

BUT AMAZON LOST MONEY AND NOW LOOK AT IT

Not every company is Amazon. It should go without saying but losing lots of money is not enough to make you into the world’s biggest retail company.

Amazon did things differently to Tesla. It made losses overall, but that’s because they ploughed operating profits back into growth — building new facilities and hiring new staff.

Tesla has often made losses just to keep the doors open, and then also borrowed billions of dollars to grow. Operating expenses are regularly higher than its gross profit, and it has repeatedly gone to the market to borrow.

Tesla’s load of long term debt and finance leases is around $13 billion — equal to about half its annual revenue. Amazon’s debt load is equal to about 10 per cent of its annual revenue, and it is choosing not to pay that back, while regularly making multi-billion dollar profits.

Is Tesla just a few years behind Amazon? Arguably not. The company is not a start-up any more. It is 15 years old. It sells cars all over the world. In fact, Elon Musk’s master plan is complete. They achieved their goal of making a mass-market electric car. But the profits have not happened.

Tesla has a plan for a Model Y small SUV, which Elon Musk has said will come out in 2020. Do they get a pass because they are still developing new models? Nope. Other car companies develop new models too. If the only way a company can make profit now is by not investing in the future, it is doomed. It has to be able to invest in the future and return money to investors.

MASS MARKET?

One big problem Tesla faces is its Model 3 has been too successful. Sales of the more expensive, more profitable Model S and Model X have dropped substantially.

“There is some cannibalisation,” said Mr Musk.

That would not have been a problem if the Model 3 had been a hugely profitable car. The fact the company is still bleeding money even as it sells so many of them suggests they are not.

And that raises the question of whether the decision to make a mass market car was ever the right one for Tesla’s long-run survival.

Jason Murphy is an economist. He is the author of the new book Incentivology. Continue the conversation @jasemurphy