How to get trading on the share market

How to get started on the stock market, how to build your wealth and the best way to react when billions of dollars are wiped off the market.

Last week nearly $80 billion was wiped off the Australian share market in two days as weak global growth and international recession fears spooked investors.

But what does that mean for you and what does that mean you should do if you have shares or want to have shares?

A lot of people will be panicked by such news into selling off whatever stocks they have or staying away from the market all together, but the basic principle of trading is to buy low and sell high.

RELATED: Aussie shares set to rebound after Wall Street losses

RELATED: How to get the best deal from smaller banks

RELATED: Treasurer implores Australians to ‘vote with their feet’

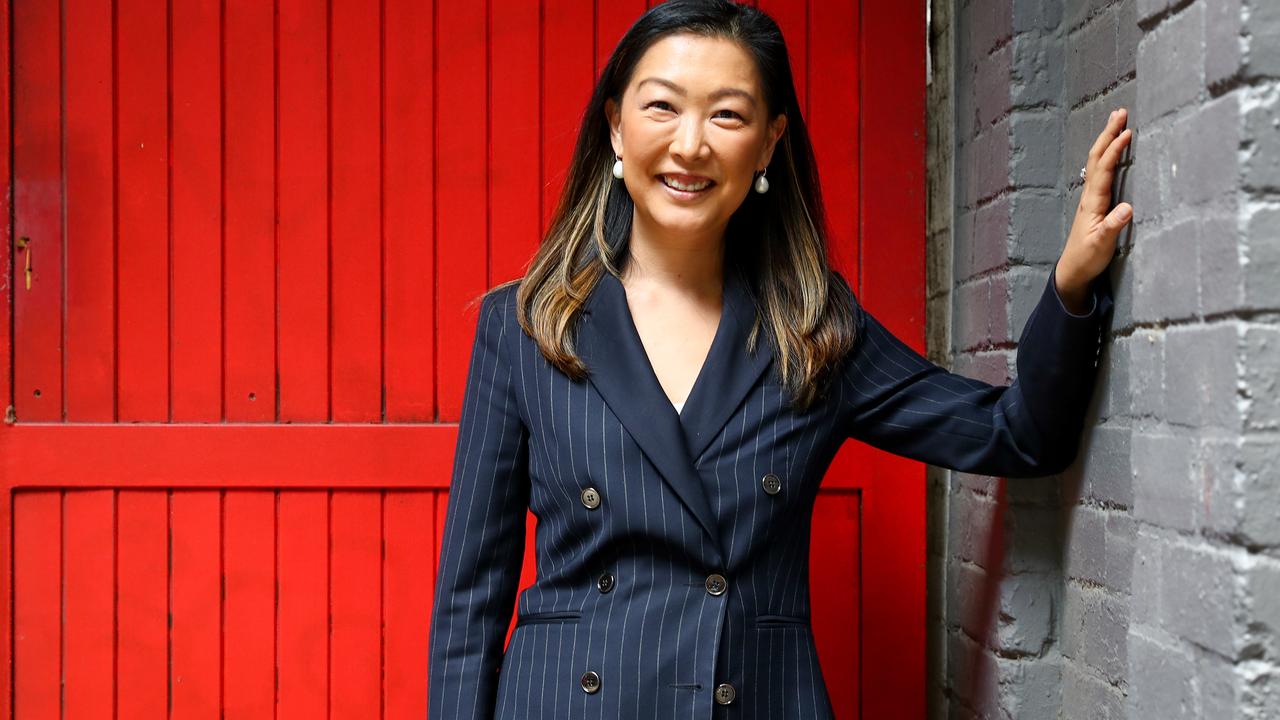

This means huge losses, such as those experienced last week, should be viewed as an opportunity, says Burman chief investment officer Julia Lee.

She said last week’s sell-off on the market reminds her of October last year which was the year’s worst performing month, losing more than 6 per cent.

But this was followed by a bumper four months through to the end of December where the ASX gained more than 20 per cent.

The expert admits there is a certain degree of volatility in investing the market, but if you pick the right shares then your money can grow over time.

Trading veteran and director at DNR Capital Jamie Nicol says investors should take a long term approach to fattening your wallet on the market.

“Investing small amounts each month, increasing those amounts when markets are weak and allowing the compounding of dividends and growth will build wealth steadily and impressively over time,” he told news.com.au.

HOW DO I GET STARTED

There are plenty of platforms that make buying and selling stocks simple to do from home, such as CMC Markets, Bell Direct and CommSec.

“The main thing I would say is when you’re starting out is just start low risk and then build with risk as you gain confidence,” Ms Lee told news.com.au.

“That might mean starting off with smaller sums of money until you feel more confident.

“And then taking over more and more of investing your money. Or that might mean just starting out with straight shares before getting into anything more complex or more risky.

Ms Lee said people usually want to make as much money as they can over a short term when beginning on the market, which tends to mean they’ll invest in the riskier stocks on the market.

“When you’re starting out, it’s really important to realise it takes a while to get your head around how shares behave and the lessons that you need to learn,” she said.

“So look at it as a process, it’s better to learn those lessons when you’re taking less risk and as you get more knowledgeable to build risk over time.”

VOLATILITY IS YOUR FRIEND

Mr Nicol said younger and more novice traders should capitalise when the market is volatile or soon after a dramatic sell-off such as last week.

“Many investors become nervous when markets fall and greedier when markets rise,” he said.

“The reality is you are better off investing more in weaker markets and so if you are trying to accumulate wealth you really should prefer markets to be soft while you are investing your money.”

AVOID THE REAR VIEW MIRROR

The DNR Capital founder and director recommends avoiding buying shares in companies which have already surged in value.

“The past might be a guide but you are looking for those companies that are going to do well in the future,” Mr Nicol said.

“Look around — what are your friends spending their money on? Where is the business in which you work seeking to expand? These can provide clues as to the types of businesses expected to grow into the future.”

WHAT ARE ETFS AND ARE THEY THE BEST OPTION?

An exchange traded fund is a collection of securities such as stocks that are lumped together in an underlying index. ETFs can be a great way for novice investors to accrue money over a long period of time because it’s diversified.

For instance, instead of investing in BHP you would invest in the energy sector or instead of committing to Westpac you would buy into the finance sector. This reduces risk because if a company goes rogue, your investment is generally more secured.

“The benefit of an exchange traded fund is obviously the low cost and the fees do add up over time, so the lower the fees the better you’re giving your investment a chance to flourish,” Ms Lee said.

“You do need to be aware you are just investing into an index usually.

“It’s a weighted index, which means the larger stocks will hold a bigger portion of your portfolio. So when the market’s going up it doesn’t really matter, but when the market’s going down you might see an impact.

“It’s not like you’re selecting companies on the basis on whether they’re a good business or not or their growth prospects, you’re really just buying the whole market.

“So there’s no real selection that’s happening except you’re buying more of the biggest companies and less of the smallest companies because those indices are weighted for size.”

WHAT ARE SOME DECENT STOCKS TO GET GOING?

Now you have access to a trading platform and you’re ready to start buying shares, Ms Lee said one of the first rules of investing is to diversify your investments to protect your money from the fluctuations of the market.

“If I was getting started today and I wanted a selection of shares, I’d choose a mix of shares that weren’t in the same industry,” she said.

The investment veteran suggests the following to get the ball rolling:

CSL (CSL): The biotechnology company falls under the health care sector and has been a darling of the Aussie market for the last couple of years. It’s currently worth more than $230 and is a strong growth stock.

Macquarie Group (MQG): The investment bank is Ms Lee’s tip of the finance sector, which is generally viewed as a more predictable stock than that of the big four banks — NAB, Westpac, ANZ and Commonwealth Bank.

Woolworths Group (WOW): Of the major supermarkets, Ms Lee is more keen on Woolies than Coles at the moment.

Santos (STO): The oil and gas provider is currently the investment expert’s tip for the energy sector.

“That gives me a bit of diversification in terms of the market and somewhere to start,” Ms Lee told news.com.au.

“Having said that, all the shares aren’t going to go up or down at the same time and that’s the benefits of diversification, you should see your risks spread out a little more over these investments.”

BUY GOOD BUSINESSES WHEN THEY ARE OUT OF FAVOUR

Much like sport or everyday life, the hype generated for some companies means the strong and reliable earners on the market can be forgotten, Mr Nicol said.

“The market falls out of love with good businesses from time to time,” he said.

“The company might be enduring a cyclical downturn, or the market might be focused on a hotter part of the market.

“A good business is one which has a strong likelihood of retaining its profits long into the future. Buying these types of businesses when they are out of favour should add value over the longer term.”

BE PATIENT

Ms Lee says the key to building wealth is to put your money in a place where it has a chance to grow but also make sure you do it on a regular basis.

“There’s a thing call the hot-cold gap and this is the difference between what people intend to do versus what they actually do,” she said.

Ms Lee says this is similar to having the discipline with a diet — it’s all well and good to say you’ll have a salad but when you get hungry at lunch, that hamburger and chips smells mighty fine.

“What you plan to do in a cold scenario as opposed to what you do when you’re surrounded by temptation — which is the hot scenario — is usually quite different and that’s because of people’s self control mechanism,” she said.

“And it’s a shame when it comes to building wealth, people usually intend to save a lot of money and not spend a lot of money as opposed to what they will do and put something on their credit card, there tends to be a gap.

“The easiest way to build wealth over time is to take your money out as soon as you get your pay in your account, put it into a separate investment where you can’t see it and do that on a regular basis.”

HOW TO REACT TO THE MARKET

A lot of naive investors see news reports of the market falling with hyperboles such as “bloodbath” and “wipe-out” and are spooked to thinking they should react in some way, but Ms Lee says to remember the basic principle: buy low and sell high.

“Which generally means buying shares when everybody else is selling shares or panicking,” she said.

“When it comes to investing, people who are starting out tend to move with the crowd so when they see those headlines ‘$43 billion sell-off in the market’, they panic and they sell.

“And usually they’re buying when everybody is talking about the sharemarket reaching record highs and how much money they’re making in the market which is probably when they should be looking when they should be looking at taking some money off the table.”

THE FINAL WORD

“Sometimes it’s important just to start,” says Ms Lee.

“If you’re scared, put in a little bit of money but just having that money in the market means that you’re constantly on the lookout and interested.

“Whereas just thinking about it all the time means you don’t end up doing anything.”

Have you had success investing or do you want to get into the market? Comment below. @James_P_Hall | james.hall1@news.com.au