Freedom Insurance cold caller signs up 26-year-old with Down syndrome in shocking phone calls

A SERIES of harrowing phone calls played at the banking royal commission show how bad the shocking behaviour really was.

THE banking royal commission has heard its most shocking case yet.

Despite months of damning revelations about the misconduct of Australia’s major financial institutions, a series of harrowing phone calls between Freedom Insurance, Baptist minister Grant Stewart and his 26-year-old Down syndrome son have blown them all out of the water.

Mr Stewart’s son, who receives a Disability Support Pension and has “difficulty understanding” abstract concepts, was talked into giving up his debit card number by a Freedom Insurance salesperson on a cold-call in June 2016.

The commission heard the initial two phone calls in which a call centre worker with a British accent callously walks through his sales script for more than 18 minutes, despite Mr Stewart’s son clearly struggling to understand what was happening.

It was then played Mr Stewart’s angry phone call to Freedom Insurance after finding the letter informing his son he had taken out a “Freedom Protection Plan” at a cost of $10.60 a fortnight — and finally, the call in which Mr Stewart was forced to coach his clearly distressed son into speaking the correct form of words to cancel the policy.

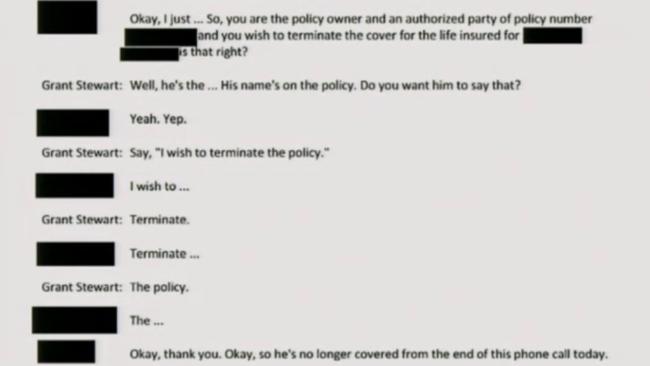

“So you are the policy owner and you wish to terminate the cover, is that right?” a Freedom Insurance representative asks.

“His name’s on the policy,” Mr Stewart says. “Do you want him to say that?”

“Yeah. Yep.”

Mr Stewart can be heard softly coaching his son, “Say, ‘I wish to terminate the policy.’”

“I wish to …” his son stammers.

“Terminate,” Mr Stewart says.

“Terminate …”

“The policy.”

“The …” his son struggles.

The customer service representative jumps in.

“Okay, thank you,” she says. “Okay, so he’s no longer covered from the end of this phone call today.”

Mr Stewart told the commission his son was “quite distressed” and didn’t understand what was happening during the call. “He found it difficult to articulate the words let alone understand what they meant,” he said.

He was “staggered” when he first received the letter. “We had no idea that this had happened,” Mr Stewart said. “I was flummoxed really. I questioned our son about how this could have taken place and that was when he remembered talking to someone on the phone.”

His son became “quite distressed about it, he thought he’d done something wrong and seemed embarrassed and perplexed about the whole thing”.

“I asked him about (giving his debit card) and he said yes but he didn’t know why he’d provided those details,” he said.

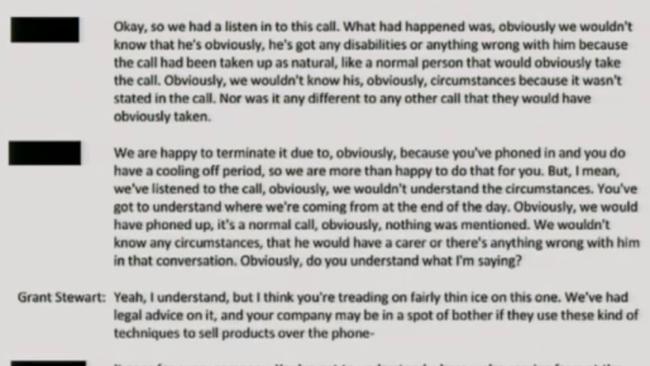

Despite calling Freedom Insurance and explaining what had happened, Mr Stewart was unable to immediately cancel the policy. The commission heard that phone call in which a customer service representative defended the behaviour.

“I mean, we’ve listened to the call, obviously we wouldn’t understand the circumstances,” she says.

“You’ve got to understand where we’re coming from at the end of the day. Obviously we would have phoned up, it’s a normal call, obviously nothing was mentioned. We wouldn’t know any circumstances, that he would have a carer or there’s anything wrong with him in that conversation. Obviously, do you understand what I’m saying?”

“Yeah I understand, but I think you’re treading on fairly thin ice on this one,” Mr Stewart says. “I would have thought it would be fairly obvious from the conversation that he had no understanding of what he was getting himself into.”

In the original phone call, Mr Stewart’s son gives brief answers as the sales agent spruiks a “very special offer for yourself”. “I’m gonna give it to you free for a whole year,” he says.

“You can choose between $4000 and $15,000 to leave behind for your loved ones just in case you died. So do you think $10,000 would be enough for you?”

“I don’t mind.”

“Do you think 10 would be enough to leave behind for them?”

“Yes.”

“Beautiful. You can go up to 15. Are you happy with the 10?”

“Happy with 10.”

Mr Stewart told the commission he was “disturbed” to listen to the call recordings “because I really didn’t think during the call that our son indicated any understanding of what he signed up for”.

“He was being polite and compliant but didn’t understand,” he said, adding he “would have thought” it was apparent to the call centre worker that his son had an intellectual disability.

“I just thought he had a script in front of him and he was asking the questions he needed to ask until he got the responses he wanted,” he said.

Mr Stewart, who only received an official apology from Freedom Insurance last month in the lead-up to the commission hearing, two years after the incident, said his son was now apprehensive about answering his phone.

He said his son knew he was appearing at the commission.

“He thinks it’s ‘about those calls I used to get’,” he said. Mr Stewart said he chose to give evidence because he “was disturbed at this process and was concerned that others would be targeted in similar situations”.

Giving evidence before the commission, Freedom Insurance chief operating officer Craig Orton said the company had made “enhancements to vulnerable customer training”.

Addressing Mr Stewart, he said, “To you and your son, I sincerely apologise that your son had to be put through that and from the bottom of my heart it should not have occurred.”

A recent review by the Australian Securities and Investments Commission of direct life insurance sector, which is sold directly to people rather than by advisers or through superannuation, highlighted accidental death insurance as of particular concern.

ASIC said the product provided “little benefit to consumers” and ordered firms to stop selling it altogether “except where they can demonstrate that it provides value and meets a genuine consumer need”.