Not our intention to sell ‘rubbish products’, life insurance firm claims

A LIFE insurance firm forced to refund $1.5 million to customers says if its products are deemed to be “rubbish”, it will stop.

A SENIOR executive of a life insurance firm accused of using unfair sales practices to target vulnerable consumers has told the Banking Royal Commission “as far as I know” the intention was “not to offer rubbish products to the market”.

ClearView chief actuary and risk officer Greg Martin was the first in the hot seat as the commission resumed for its sixth round of hearings today, this time focusing on dodgy insurance.

The company earlier this year refunded $1.5 million to 16,000 customers after the Australian Securities and Investments Commission raised concerns about high-pressure sales tactics.

Counsel Assisting Rowena Orr QC opened proceedings with a statement outlining a litany of admissions of wrongdoing in submissions by life insurance companies, including more than $6 billion in commissions paid to advisers in the past five years.

Mr Martin told the commission he disagreed with the characterisation that ClearView had targeted the “lowest” socio-economic groups. “I emphasise lower, not lowest,” he said. “It was meant to be customers who could afford the product and would keep the product. After all, there was no point selling (insurance) to customers who couldn’t afford it.”

He conceded that the high lapse rates showed that wasn’t the case. “We now know that is true,” he said. ClearView closed its direct sales business in December 2015 after 14 months due to the poor results.

According to ASIC, ClearView sales agents made “misleading statements about the cover, the premiums, and the effect of any of the consumer’s pre-existing medical conditions” and “did not clearly obtain consumer consent to purchase the cover before processing the premium payments”.

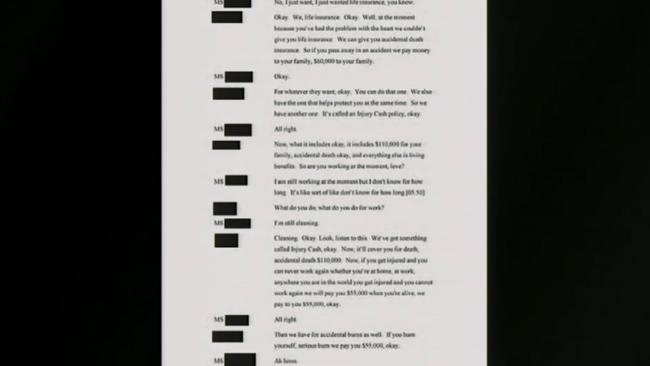

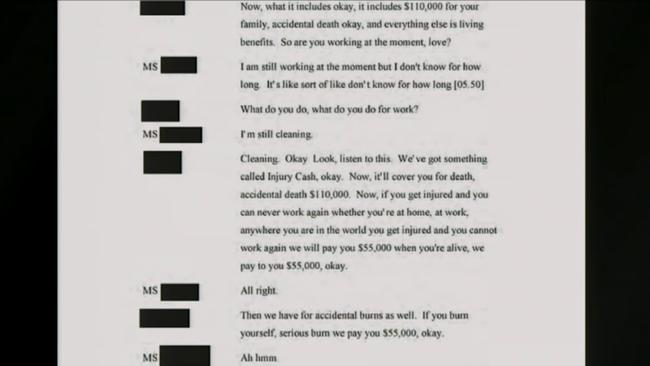

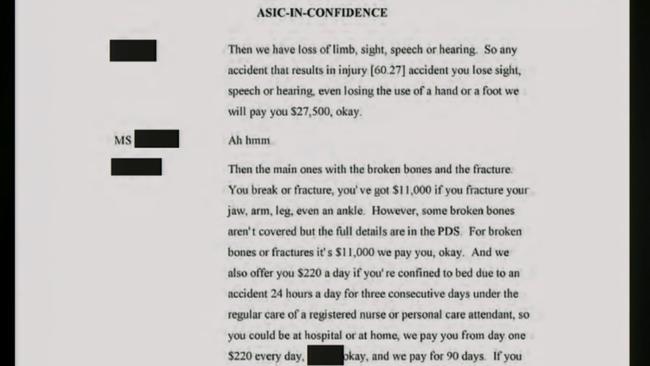

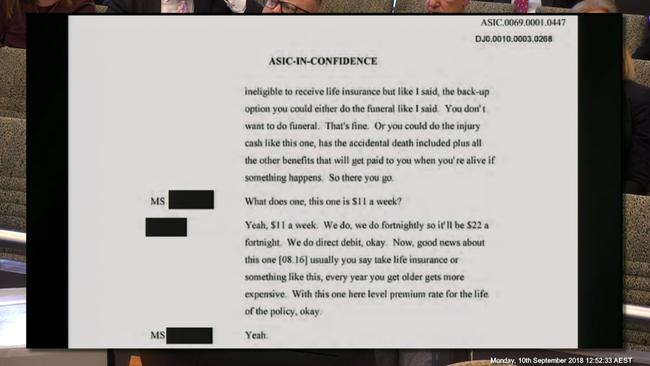

The commission heard from a recorded sales call in which an elderly cleaner is convinced to purchase accidental death insurance – a product highlighted by ASIC as providing “little benefit to consumers” in a recent review of the sector. “I just wanted life insurance, you know,” the woman says.

“At the moment because you’ve had the problem with the heart we couldn’t give you life insurance,” the sales agent says. “We can give you accidental death insurance, so if you pass away in an accident we pay $60,000 to your family. We also have another one called an Injury Cash policy … it includes $110,000 for your family. For all that it only costs you about $11 a week.”

Mr Martin said he was “aware of ASIC expressing (the) view” that accidental death policies were virtually worthless, but said he had only read the executive summary of the report. “Unfortunately I’ve been very busy preparing for today,” he said.

In its report, ASIC said it expected firms to cease selling accidental death insurance “except where they can demonstrate that it provides value and meets a genuine consumer need”.

Mr Martin said ClearView no longer sold “that version of the product” but couldn’t say whether it would stop selling it altogether. “We will have to review what ASIC has said about accidental death insurance,” he said.

“ClearView hasn’t made a decision on that at this stage. ClearView’s not trying to do something that society doesn’t want, so if ASIC and society want us to stop offering it, ClearView will stop offering it. As far as I know the intention of ClearView is not to offer rubbish products to the market, so if that’s what they’re deemed to be, we will stop.”

ASIC’s review of direct life insurance, which is sold directly to people rather than by advisers or through superannuation, found consumers were cancelling their policies in very high numbers.

The regulator plans to restrict the practice of cold calls pressuring people to buy life and funeral insurance they don’t want or can’t afford. The commission will examine the sale and design of life and general insurance products and the handling of claims, including following natural disasters.

The hearing will also look at the administration of life insurance by superannuation trustees, given about 12 million Australians hold insurance through their super. The regulatory regime will feature, with the peak bodies for the life and general insurance industries to give evidence.

Consumer advocates say many of the problems with insurance are due to gaps in laws, which mean unfair contract term protections do not apply to insurance contracts and ASIC lacks the power to regulate insurance claims handling.

— with AAP