CBA slammed for record $5.2 billion profit despite ‘rampant understaffing’

Commonwealth Bank benefited from skyrocketing interest rates in its latest profits, but there is trouble looming for the nation’s biggest bank.

Soaring interest rates have helped the Commonwealth Bank report a record $5.15 billion in first half profits, but its been slammed for achieving the massive win on the back of “overworked” staff who need a “significant pay rise”.

The bank was also criticised for not passing rapid-fire interest rate rises on to savers, as its own profits rose by 9 per cent between June and December 2022.

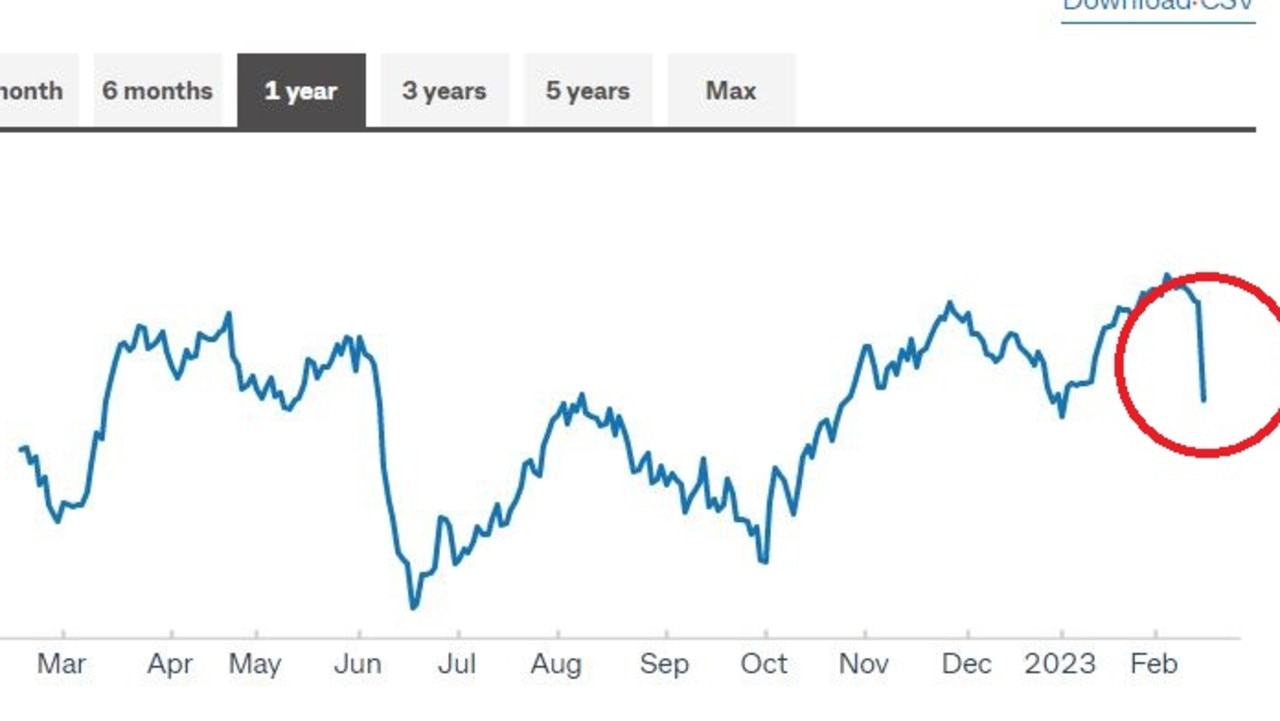

Despite huge profits the bank has seen its shares plummet on Wednesday. As of 1.30pm Sydney time shares are down a whopping 6.44 per cent.

Barrenjoey banks analyst Jon Mott said CBA’s commentary around margins suggested “more headwinds than tailwinds”.

“Of more concern to investors will be the monthly NIM chart on slide 23 of the presentation, which highlights that the NIM has peaked in Oct-22 and fell in Nov/Dec,” he said.

“If the margin has peaked, this would likely imply downgrades to consensus and Barrenjoey (earnings) estimates.”

Russel Chesler, head of investments and capital markets at VanEck added “storm clouds are gathering over the banks”.

“CBA in their results announcement specifically addressed concerns around the looming fixed rate cliff, deposit rates and cyber security risk. All the good news has already been priced in, we can’t see net interest margins expanding any further as rates continue to rise and the majority of fixed rates roll off later this year,” he said.

“The bank is increasing its capital buffer, a sign of caution as headwinds for the economy increase.

“CBAs loan impairment expense of $511 million for the six months leapt higher with the bank saying it reflected ongoing inflationary pressures, supply chain disruptions, rising rates and declines in house prices.”

Meanwhile, the Finance Sector Union (FSU) said while the CBA board and senior executives “slap each other on the back” for the record profit, it had been achieved off the back of an “understaffed workforce who are feeling the effects of cost of living pressures”.

Ahead of enterprise agreement negotiations with employees this year, early results from an FSU survey of Commonwealth Bank staff provided a “damning indictment” on the pursuit of profits at the expense of workers, said the union’s national secretary Julia Angrisano.

“CBA staff are doing more for less – dealing with increasing workload demands due to rampant understaffing while struggling with increasing cost of living pressures,” she said.

“Having insufficient staff means that staff are overworked and customers are having to wait longer to do their banking.

“It’s time for the CBA to recognise the contribution of the hardworking staff and provide them with a significant pay rise.”

Ms Angrisano added the Commonwealth Bank has serious morale problems with the FSU survey showing 53 per cent of staff having considered leaving their jobs in the past year and 67 per cent think staffing in their departments to be inadequate to meet workplace demands.

Another 47 per cent of CBA workers think they are worse off financially than they were a year ago.

“It is clear the CBA can afford to pay their staff more and fix serious staffing issues,” she said.

“This won’t break the bank but an exodus of workers responsible for the bank’s massive profits will.”

But a CBA spokesperson said its most recent people engagement survey results showed 90 per cent of workers had pride in the bank.

“Almost 90 per cent of respondents said they feel supported to work in a way that allows them to fulfil both work and personal commitments,” they said.

“We recognise and value the contributions of our people to CBA’s success and the outcomes we can deliver for our customers and communities.”

In the 2023 financial year, for the salaries directly regulated by the enterprise agreement, people received an annual base salary increase of 4.25 per cent and the 10.5 per cent super guarantee.

“Eligible employees are also rewarded through performance-related pay and our Employee Share Acquisition Plan,” they said.

Savers lose out amid bank’s record profits

But CBA was singled out as one of the big four banks ripping off customers when it comes to their returns from savings accounts, according to independent analysis from comparison website Canstar.

It found the rates the big banks were offering to savers had “fallen short” compared to the amount they are charging borrowers.

According to Canstar, customers with several types of savings accounts have been stung.

Base savings accounts have risen by an average of 1.83 per cent while bonus accounts with certain conditions have risen by a total of 2.77 per cent.

Promotional accounts that pay an introductory rate for a limited time have increased the most, up by 3.21 per cent since April last year. However, savers who have passed the introductory period have only seen a 1.35 per cent increase.

The CBA increased its GoalSaver bonus account to 0.75 per cent, while its Youthsaver bonus account rose by 0.5 per cent, bringing them both to a return of 4 per cent last week.

The bank defended their savings policies but did not acknowledge how some savers won’t get the full extent of the changes.