Bogus Facebook scam costs Sydney woman $8,000

Investing online can prove lucrative for some, but one Sydney woman was left seriously out of pocket after falling for a Facebook ad.

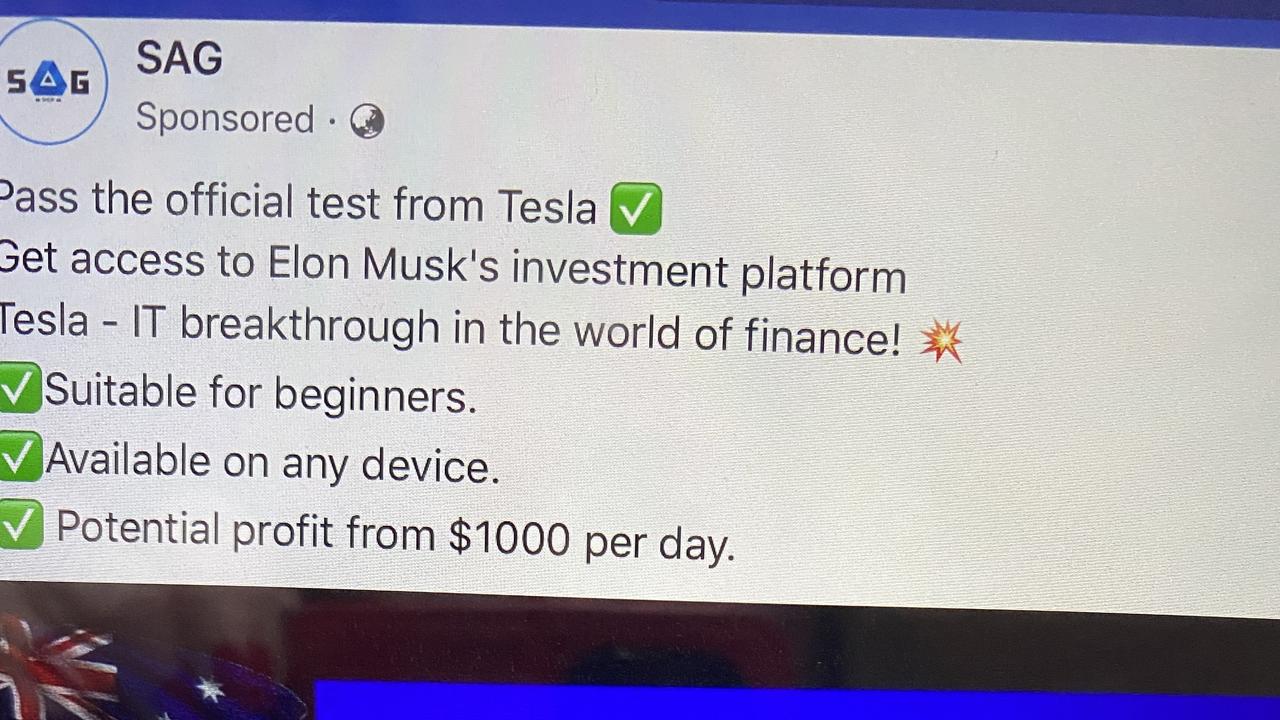

When Anna Rogers first spotted an ad on her Facebook feed promising “access to Elon Musk’s investment platform” she thought it was too good to be true.

But curiosity got the better of the Sydney woman and after being repeatedly targeted by the same ad she decided to investigate further on February 3.

“Pass the official test from Tesla,” the ad read.

“Get access to Elon Musk’s investment platform. Tesla – IT breakthrough in the world of finance! Suitable for beginners. Available on any device. Potential profit from 1000 per day.”

At the click of a button, she was led to a website that appeared to be a legitimate trading place for foreign exchange, cryptocurrency, stock and commodities.

“The website looked legitimate and professional, and I was keen to make some money to achieve some financial goals I had made,” Ms Rogers told news.com.au.

“So, I signed up and a ‘trader’ named Mark called me that same day.

“After hearing my accent, Mark asked me what country I was born in. When I said I was from Poland, he quickly informed me that he was from Slovakia. Yet when I asked him a question about Slovakia, he said that when he was young, his parents moved to Miami. I didn’t think anything of it at the time.”

During their conversation, Mark asked Ms Rogers if he could show her how to navigate the suspicious trading website.

“Within about ten minutes, Mark asked me to download the remote desktop Application ‘Any Desk’. After I downloaded the app, Mark took control of my computer so he could show me in real-time how the platform operated,” Ms Rogers told news.com.au.

“For instance, he clicked on the screen which showed Bitcoin and I recall him saying ‘here you can purchase one bitcoin for AUD$29,000 but the next day you can sell it in the US market for $31,000 per coin’.”

In the same conversation, Mark urged Ms Rogers to transfer $10,000 to a “trading account” so she could start the money-making process.

Ms Rogers did not have $10,000 to invest at the time.

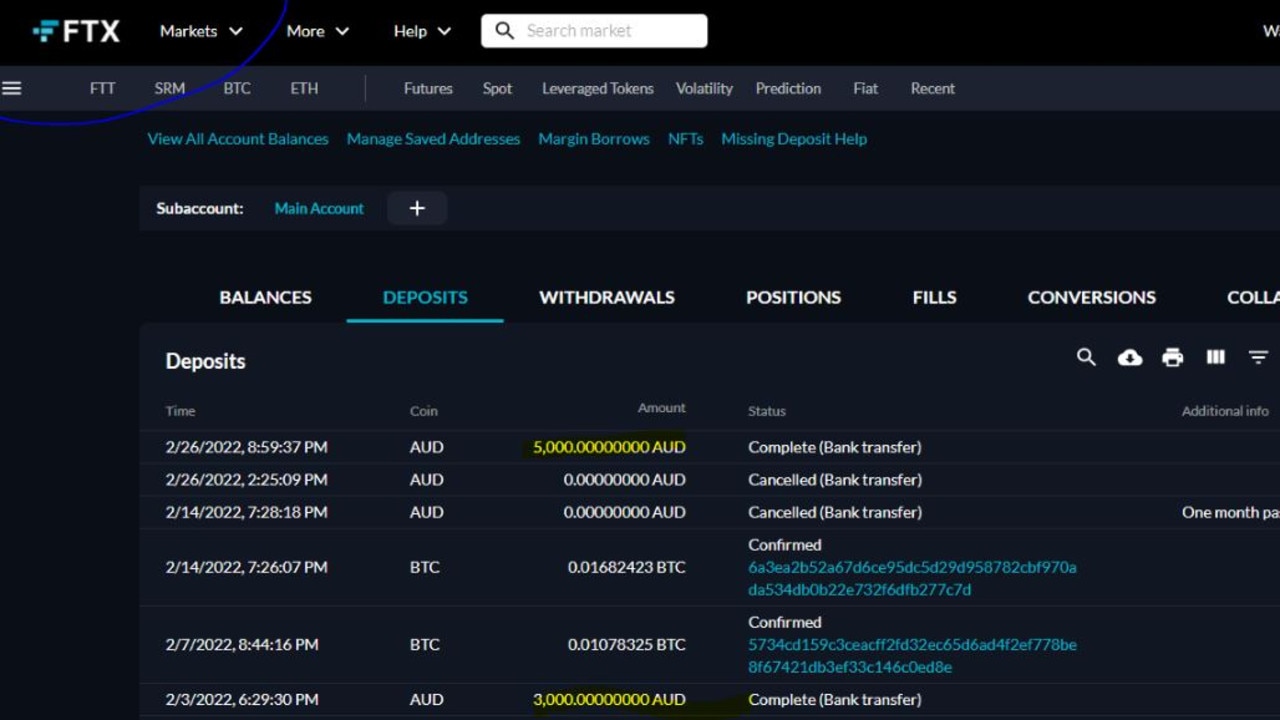

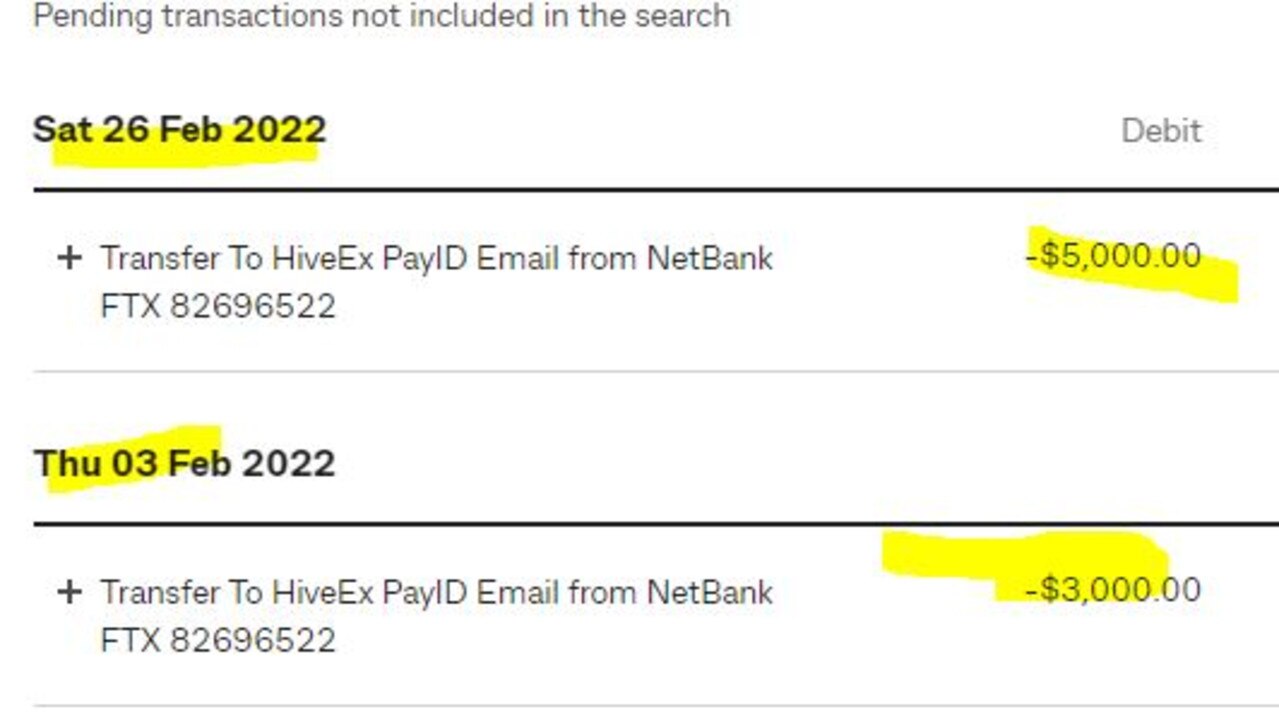

However as she believed the venture was legitimate, Ms Rogers decided to transfer $3,000 - all she could afford - from her Westpac account.

The bank transfer was rejected by Westpac.

“In hindsight, I should have seen this as a sign of something not being right,” Ms Rogers recalled. “I wish I had talked to someone about what I was doing.”

When Ms Rogers was called again the next day to follow up on the transfer, she naively decided to dip into savings from her Commonwealth Bank account instead.

“I then transferred $3,000 to the account and within a matter of days, I received a return on my investment of $2,000,” Ms Rogers explained. “I was thrilled.”

According to Ms Rogers, trader Mark would call her every three to four days to update her on her investment, send her screenshots to “prove” it was legitimate, and ask her to invest more money to unlock a “bigger return” for her.

“I had login details to the trading website so I could always check if what Mark was saying was accurate and it always was,” Ms Rogers said.

“Therefore, when he requested further funds from me, I said yes but that I was only able to invest a little bit more.”

On February 26, Ms Rogers made her second transfer of $5,000.

Two days later, Ms Rogers had not heard from Mark and knew that something wasn’t right.

When she tried calling him to discuss her investment the phone number was disconnected.

Terrified that she was a victim of a scam, Ms Rogers called Commonwealth Bank and reported the transfers as fraud.

The final confirmation she had been duped came a few weeks later when she received another suspicious phone call.

“A man called me and said that Mark had passed on my details as he thought I might be interested in purchasing gold and making a solid return,” Ms Rogers said.

“I politely told the man that I was not interested and hung up.”

In hindsight, Ms Rogers is “embarrassed” by her experience and wishes that she had paid more attention to the red flags associated with the transaction.

“Posting a fake advertisement on Facebook about granting me access to Elon Musk’s investment platform was too good to be true,” she admitted.

“Mark sending me a phony document about ‘arbitrage trading’, insisting on payment by bank transfer and not being reachable by phone at any time should have set off more alarm bells for me,” she said.

How to ensure that you are not the victim of a cryptocurrency scam

Ms Rogers has the following advice for other people who are thinking about investing their money:

• People running a scam try to look legitimate by posting fake advertisements on social media or having a professional website.

• If you are investing your money into something that appears too good to be true, trust your gut and proceed with caution. In particular, keep a look out for posters or sellers who say that you will make money and reference a “celebrity” in their posts to entice you.

• If scammers want you to pay immediately or via bank transfer, think twice. Try to purchase a product or pay for services through a solid URL with “https” at the front, or via a secure payment service like PayPal.

• If you have made a bank transfer and have not received a response or suspect that you have been scammed, contact your bank to stop the transfer as soon as you can.

• Report the scam to the Australian Competition & Consumer Commission through Scamwatch here. Please note that the ACCC cannot help with the recovery of funds money or tracking down a scammer.

If you or someone you know has been the victim of a scam, send an email to stefanie.costi@news.com.au.